So my life became more complicated a few months ago and a lot of my free time has been disappeared into nothingness. It’s ok, I’m not missing a ton anyhow, except a daily drubbing on my trading account. Lots less writing here, less videos – but I have had to realign some things in the personal life, I was getting burned out. Between this, the job, the family, I was probably burning 18-19 hours a day. Feel a bit more refreshed these days and clear headed.

Anyway….here’s a daily thing you are used to seeing…

Gold, down $2. Silver down $.06. Trading account down 9%. Seems legit.

I can tell you that it feels like a low, but the truth is there is no human on the planet that can PREDICT these things. It is reasonable to ASSUME we might have 5-10% down yet, but we are pretty much at or near where the last prediction of 10% down yet should have hit.

We use a combination of risk management, hedging, and probability to create our desired portfolios. You occasionally see gurus nailing things, but more often than not, it was a star alignment of probability and timing. Then, we listen to everything they say, and they miss the next 10 calls. Then, you get angry at them.

I want you to take a step back for a second. I want you to see this investment through MY eyes. I am down 42% on my trading account, which is nothing but miners. I’m ok with this. I sleep like a baby. Mostly.

I got into this after the repo market blew up, and me and maybe 1,000 people on the planet knew what it meant. Maybe 5,000. But we all had different ways of viewing it, for their personal investments. For ME, I had no 401k. No stocks. I had 3 rental units and my home, with a pretty decent salary at age 45. Meaning, I could take risk with cash on hand, and make it up in a few years.

I re-watched “The Big Short” – the movie about the housing collapse in 2008 and Dr. Michael Burry’s shorting of the housing market. I decided I wanted to short something. Perhaps the system we are in. Perhaps the USD. How could I do that?

Well, first – you have to look at Dr. Burry’s execution here. He bought CDS in 2005, and waited 3-4 years before his investments launched into orbit. One thing in the movie you notice was that ratings were supposed to drop, but weren’t, and everything Burry knew about the fundamentals was being wiped out be a system that refused to acknowledge the truth. Until they could not lie anymore.

So when you, me, and many others got involved in gold and silver – for ME, it was “shorting the USD system”. Not that I wanted the world to implode, but if things in the system went south, then to me, it made perfect sense that gold, and by proxy silver, would have a great awakening.

So I got involved in December 2019 with physical metals, and Feb/March 2020 with miners. I got in around March 2020 lows, and made a killing for months. I think my portfolio was up 40-50% in those few months. I then sold half of it because in July 2020 I felt there was going to be another crash imminent. Instead, QE to infinity was announced, and it pushed the snooze button on the eventual crash. Which might be going on as we speak. I made MASSIVE banked profits in 2020.

I then rolled them into fixing up one of the rental units. Which is about to rent now, after not being rented for 8 years. I put a lot of money into it. But the bigger picture was that I took profits and rolled them into another category. I was LUCKY it all worked out that like. Why?

Since July 2020, my account has been bludgeoned. At times, I looked like a genius where my AG calls were all sold for between 3-5x. Made SERIOUS cash on that. But I also bought calls on breakouts of charts, and got smashed with that. So I’m down on the trading account…but….

My rental units skyrocketed in value, and dwarf my trading account. So when I bought the metals and miners, it was potentially as insurance if the rental property and housing I live in went down. On paper, I have roughly a 50% increase in the value of all of my real estate holdings in 2 years. But, I didn’t sell. Likewise, I’m crushed by a lot of my miners, but I’m not selling – so all of these at the moment are massive paper gains offset by smaller paper losses. I’m still way ahead, by a lot, if I had to liquidate today.

But I bought this stuff thinking the world was going to end. I was early. So were you.

If you listen to Rick Rule enough, you hear his stories of uranium. You hear how the lowest junior uranium miner he had was a 22x. But if you listen to enough of his interviews, you hear that he was perhaps 5 years early. His investment thesis was clear: either the price goes up, or the lights go out.

So we have Burry and Rule who are famous investors perhaps 4-5 years EARLY on their biggest scores. Where does that leave you? Perhaps impatient?

Today, I don’t spend nearly as much time on social media. I have my investments set, and now it’s just a matter of waiting. I had bought a lot on margin, and was VERY good about leaving a massive, massive buffer. But – one lesson I learned – is that when you trade margin, and prices go down, the house has a way of making your life miserable. What I think I’ve been seeing the last 2-3 months is a lot – I mean a LOT of margin/leverage being unwound in all markets.

For example, I was very heavy towards FSM in my portfolio. I still am, but I was at like 70%. One day, I woke up to a margin call. I had 25% backing on it, according to their rules. Now, they wanted 40% backing. I had to sell things to free up, at a loss. Whew! A few days later, I was then given a MASSIVE margin call because they changed my FSM requirements to 75%. So I had to sell a ton of that for a loss. Meaning – I was very responsible with margin, and played by their rules – but THEY changed the rules, and with this, caused me to have to sell when I did not want to. I banked the losses. To me, I was ok with this because the second half of the year I think I’ll do pretty well and if I take some profits, I am most definitely not paying taxes on shit this year.

With this, one can see the stock market clearly going down. This caused a run up in the dollar. At 8-9% inflation, it was easy to see no one wanted 2% treasuries, so they sold off and rates went higher. The MBS went no bid, and we have seen the housing rates double in just a few months.

And…this is all on the THREAT of running down the Fed balance sheet, along with rate hikes – into a recession. They still have not sold off any real amount of debt yet. And all of the markets are down like 20%+. Crypto was the first to get hammered. Then stocks.

The bright side

I take great comfort with Burry and Rule being wrong for so very long, then smashing it out of the park. You can say the same for me, or thousands of other precious metals investors – that we were wrong. Or, I’d say to me, the metals did exactly what they were supposed to do. I bought insurance on my houses. My houses went way up, and my metals went way down. The hedge worked. In a way I had not intended, but 2.5 years into this, my net worth is drastically higher, only hampered by 42% unrealized loss in my trading account.

But, can it get worse? Sure. But I don’t think much more so. What I see happening is the bifurcation at some point. Many may think it’s metals smelling a reversal in Fed policy, but to me, it is what Don Durrette refers to as the fear play. As fear starts to set in of stocks cascading lower, many may FEAR what is to happen. Right now, the algos are trading paper gold and silver along with anticipation of inflation. It’s as if the Fed is trying to cause a deflationary bomb to save the dollar by curbing inflation. This is how you would do it if you wanted to put us into a global depression.

But – they are missing bigger points with this. While they may try and crush consumer spending, housing, and deflate leverage in the system, we are now in a situation where our supply chains are supremely disrupted. Rates went down for 40 years based on globalism. And, I can tell you, the reverse is happening as we speak. This will lead to constant inflation for a decade with things like staples, foods, and energy. They MAY be able to bring down a lot of the other things.

But to me, when they see a 5.x in front of inflation, that is when they call it a day. Food and energy may be 20%, but they can potentially bring most other things down. At 5.x, they can inflate out of debt and call a mini-victory, but then blame Russia on the higher inflation (which isn’t entirely untrue) and call it a day…then begin to reduce rates perhaps sub 1% again.

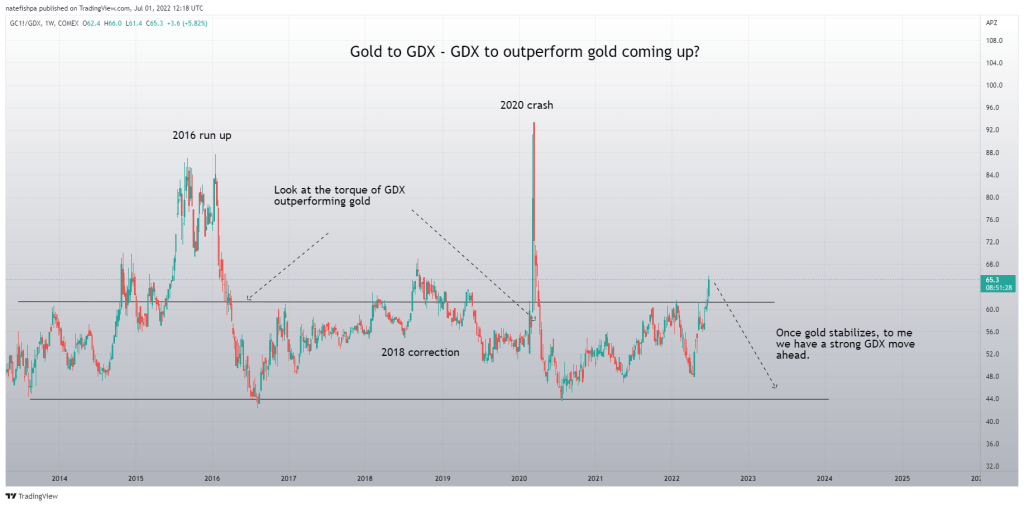

Where I have hope is that when you look at charts, you can see these miners trading like gold is at $1400 and silver at $17. Meaning, the miners had sniffed in advance these lower prices. So if gold quadruple bottoms at $1776 and silver has a hard floor at $19, you might then see a recovery with miners.

My thesis is, and has been, when big money rolls out of stocks with a 350 P/e ratio like Tesla, they want to find not only a risk off safe haven, like gold, to hold during times of fear – but perhaps invest in a company that makes these items. I believe many of us poured into these in 2020, and when QE happened, that hit the snooze button for Risk On to keep going.

I believe the Risk Off is now here, and it’s going to take weeks/months for all of the algos to change and people to adjust to a new norm.

The way ahead

Hemke and Brady have been pretty good with their walk throughs of what might happen. Michael Oliver NAILED the “arm wrestling” move down, as opposed to a 2020 cliff drop. I believe Hunter WAS right and the melt up already happened – he just kept extending his forecast too far, and the 65% bust is in the making perhaps now. Most crypto already down 50-95%. When Tether goes (it’s actively being shorted now), that can be all she wrote for a lot of the crypto. You had Kranzler telling us (his subscribers) he’s worried about a stock market accident and holding off on a lot – going back to December 2021 as I was buying things hand over fist – Dave was correct.

You cannot underestimate the whole thing with the Ruble and the Dollar. Sure, the DXY has gone up, but that is measured against the Euro, JPY, and GBP. It’s not measured against the Ruble. So compared to people that continue to print, our tightening has made our bonds somewhat attractive for foreign buying. However, there is a BRICS+ union that is really catching fire and I believe this rivalry will challenge the dollar hegemony, and is now. So while the DXY may be “strong”, when you start to see “things that make things” getting harder to find for the west, as the east is starting to buy it up – you then have things like oil and gold that cost more US dollar units to buy. This is NOT the COST of things going up, it’s the dollar relative to the WORLD currencies going DOWN. We saw this with the ruble/gold/oil thing that lasted a few weeks. Any currency who even hints at a sniff of a gold association with their currency is rewarded immediately.

So I still feel the dollar is in trouble, and with that, it will cost more dollar units to buy “stuff”. This will have gold costing more in USD. Stagflation is real. We have perhaps years of costs rising – but wages being stagnant along with having stagnant growth.

We have the West doing silly things to their energy policies. This will destroy their economies, IF more pragmatic people aren’t elected to have a phase-in green approach as opposed to a switch over. The East has embraced nuclear energy as a way to get off of coal. This can aid their economies as they will continue to be able to produce goods cheaper – and with this cheaper energy – provide a higher standard of living for their residents, while tree huggers in the west suffer rolling blackouts, high production costs of goods due to energy costs for factories and transportation, and continued problems with sourcing future energy.

In any green future, the roles of copper, nickel, and silver are clearly required. I firmly believe all of the central banks buying gold will have this as some form of nation-state backing someday.

Remember what I said about in 2005-2008 the system sort of lied, until it could not anymore? When that happens, you have the Lehman moments. With 2 qtr earnings coming in July and August, I’m expecting a bloodbath. This can drive the markets further down. But when you have Newmont able to pay dividends at $1200 gold – they will be still showing strong profits.

IF gold can hold serve the next few weeks and rally – perhaps nation states are paper buyers here – I firmly believe we may see miners rally hard, as if the light switch was flipped with algos one day. We just need to get to that point.

If we continue to slide through $1700…to $1600…to $1500 most of the miners had already priced in $1500 gold, so I’m not sure how much further down they can go – short of margin call liquidations – and feel these may be due for a rally soon.

Maybe we are looking at a full GDX capitulation coming, to send this candle into a parabola up.

The next few weeks could tell us a lot. I am of the belief there will be a bifurcation in equity markets and PMs very soon, and when that happens, miners will be THE only thing going up.

Lehman?

The question then is – IF there are Lehman moments, what could they be in?

- Companies that are shorted to oblivion. Think of Teslas who are one gamma squeeze after the next with 300+ P/E ratios.

- Banks that have massive derivative exposure. We saw what happened with Nickel – can we see the same with the COMEX? We are seeing massive metals being pulled from the COMEX and ETFs as we speak. A LOT of people think they have gold and silver, and instead only have paper exposure to it. What happens when they all try to take their metals at once? Or, 5% of them try? Rick Rule says we don’t need historic numbers, we just need a “reversion to the mean” of percentages of portfolios. And – I think with the 60/40 model dying, gold will be getting re-added soon enough.

- Entities that short commodities that go into structural shortages – copper, silver, oil – I think anyone who shorted these items, soon, may be caught and have to buy back. You want to know a catalyst for PM bifurcation? As fear takes hold more, I think you may see stories of banks with no metals that did the fractional reserve schemes – and this leads to buying and a run – which then leads to a mother of all short squeezes. This is your bifurcation moment.

- Anything crypto-related that is unbacked. I told everyone I’m a buyer of bitcoin at $3,000. Pisses them all off, especially when it was $69,000. Most who invested in this were not adults during the dotcom bubble. Or the real estate bubble. But this is a mother of all bubbles. Many really smart MIT-educated people talked about things like “value proposition” and had no idea what the hell they were talking about. Many of these talked about supply-side only, without use cases for demand. It’s as if a ponzi scheme met the wild west, with the amplification of the dotcom bubble on steroids – with the lack of regulation like which led to the housing bubble bust. They literally don’t know what they don’t know, and I spent a lot of time trying to educate them on “sound investment” versus “high speculative assets” which would do nothing but anger them. I am aware my miners are risky assets. But they are a business producing cash flows, dividends, and I own a tangible part of a company. Cryptos can get blipped to zero, and we have seen this now countless times.

Stay safe all. I hope no matter what you put your money in, that you can retire a rich person and stick it to the man. I just happen to feel my particular horse in this race is the equivalent of the Burry CDS buys in 2005 and the Rule uranium buying of 2002. I’ll be wrong every single day, until I’m right. And then someone may want to make a movie about some of us. Until then, stack the shiny, and be greedy with lower prices, and be very careful with margin, as they seem to make the rules up as they go.

July 1, 2022 at 3:42 pm

Nate, this is brilliant and therapeutic. I really needed to read something like this.

LikeLike

July 1, 2022 at 7:48 pm

Thank you for this article. Its been hard these past 2 months watching my porfolio go further and further into the red. Appreciate hearing your thoughts and perspective.

LikeLike

July 2, 2022 at 8:17 am

Agree, Agree and agree..

LikeLike

July 2, 2022 at 10:52 pm

Hey Nate,

Your articles are always very well thought out, and well worth reflection and serious consideration. I’ve really enjoyed reading them over the past year or so. As for myself, I’ve spent a lifetime in I.T (going on 30 years) and share a deep interest in investing/finance. And I love “the shiny”–were I depart from you concerning the shiny is in holding it, and I own zero miners. While in theory I concur with you that miners will very likely outperform physical holdings (initially anyway), I foresee a more apocolyptic future than you, in that I believe a bird in the hand is worth two in the bush, and I do not trust any electronic holdings. As you well say, they change their rules to suit them, and I have serious reservations that when SHTF hits, that they will payout on the many x-times profits. Look at what they did in nickel just a couple of months ago–what a shitshow of sudden rule changes, and nickel investors lost out on incredible profits.

Thanks again for your articles.

Respectfully,

Glenn

LikeLike

July 2, 2022 at 11:05 pm

Glenn – I have 27 years in IT :).

I can see your apocalyptic scenario as well – but I see these things happening more like a waterfall over several dams over many miles and not a Niagara Falls strait down. I could very well be wrong, which is why I have some shiny but I also am concerned about storing much at home. So I trade the miners with the idea of a massive move up scenario where I can take the poker chips off of the table. You are right in that there is a scenario where the trading accounts just blip to zero someday. But to me, that is the 3rd or 4th waterfall and not the first – which I HOPE allows me time to exit a lot of this. Once this stuff moves up a lot I plan on branching out to more things like battery metals, uranium, energy – but for now PMs to me have an explosion coming. Any shiny I do have in that scenario I probably wouldn’t want to swap for cash. But – I might be able to cash out miners that went 3-10x and pay off a mortgage. No one has a crystal ball and your scenario is absolutely possible.

LikeLike

July 2, 2022 at 11:57 pm

Hey Nate,

For sure, none of us has a crystal ball into the future. Its a matter of probabilities–which I personally base on history in that human nature being what it is, we can take some good speculations as to how things are now going to progress with global fiat currencies collapsing–and more specifically for us the US dollar. “There is nothing new under the sun”, as it says in Ecclesiastes. I agree with you that It’s likely that there will be a period (albeit probably short) in the coming economic collapse where profits from miners etc can be cashed out. The key will be to do so before its too late–my problem is in that knowing myself I would hold out to sell at the top lol..so its best for me personally to stay away from miners and all stocks in general, because I doubt I’d get out in time. Reading through your site I’ve found I have much of the same perspectives vis-a vis preps (the importance of guns, food and other hard assets etc), for the coming economic crash\fiat collapse and fortunately for me my wife is on board. Been prepping hard core since 2016. I’m heavy on food storage and prepping equipment/supplies. I lack a bug out location, so my family and I are probably going to have to live through it here in the burbs of CT. Worse case scenario, I have a big Ford van and could grab and go, but that would be last resort. Will most likely live it out here in our current home her in the burbs. Shit is going down pretty fast now Nate. God help all of us. I have a 27 year old son named Nate (Nathan) by the way…7 children total. We call him “Nate the great” lol…oh, and as for shiny, I’m much heavier silver than gold. To each his own. I just think the silver story is way more compelling for future use/need, being the common mans money if there’s an economic collapse, and if not then the increasing industrial uses in a all is well global situation. Godspeed to you and your loved ones Nate, and to all your readers here!

LikeLike