I found myself once again last night as the angry old man on the lawn telling a guest about prepping. I’m sure I’m looked at a certain way, but I don’t really care. What I DO care about is people around me being safe. Many of you don’t spend five minutes thinking about bad times, as it hurts your soul or something. Here, I’m going to lay out the case as to WHY I am the way I am.

But before I do that, I need to speak on the concepts of risk. Many of you equivocate risk to things like getting on a roller coaster or eating a chip off the ground after the 5 second rule. Risk is a very broad spectrum of how the world around us works. You need to understand risk, and how to account for it.

Two examples of risk – my brother is moving to Florida for his job. He went to college there. He also knows there are hurricanes that hit Florida. The hurricane is a risk event. You then have to look at the likelihood of it hitting you, and the impact if it does. Those two give you scores to then decide what to do about it. If I was moving to Montana, a risk likelihood of a hurricane hitting me is near zero, and even if it does – somehow – the impact might just be some rain. However, moving to Florida then presents you with 4 items – AVOID, ACCEPT, TRANSFER, or MITIGATE. You can AVOID a hurricane by moving to North Dakota or leaving the state when one is coming. You can understand you are moving to a part of Florida not hit severely by hurricanes – which is to then ACCEPT it. You might buy hurricane insurance to TRANSFER the risk. Lastly, you can MITIGATE the issue by buying lots of water, candles, food, a generator, and boarding up your windows.

Another example of risk is something you do not see every day. It is the loss of purchasing power to your money.

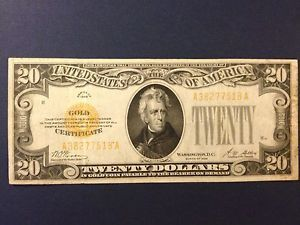

This $20 bill 100 years ago was the equivalent of an ounce of gold. Had you put both in a vault 100 years ago, they would have been equal. Open the vault up today, and the gold is worth over 100x the $20 bill. Did the gold get more valuable, or did the currency become more diluted and less valuable. If you answered door number 2, you are correct. This type of devastation happens usually at 2-4% per year, and they try to tell you it’s normal. Had you wanted to mitigate this issue, you would have put your cash into things that preserve the purchasing power, like gold. So if you have a pile of cash, it makes sense to put a portion of it in precious metals.

So now you have seen two risk events. What I want to do below is then give you the 50,000 ft view that is going on, and why I then bother with prepping. Each one of these alone may not move the needle, but taken together, you can see there is a form of storm brewing, and could hit tomorrow, next month, or next year.

Risk 1: The Fourth Turning

This is based on generational theory that every 4 generations or so, we as a society make the same mistakes, over and over again. This is primarily due to the elders dying off, and with them, their wisdom also dies off. My almost 97 year old grandmother grew up during the Great Depression. Farmed out, she lost her mother when she was 9 and her father was laid off by the coal mines and had to work on the construction of the new PA Turnpike. Her little sister Betty was adopted out – which left her and her remaining 5 siblings to live with relatives or friends of the family and exchange house work for a meal and a bed. But what I saw growing up was that they never got new furniture. They had a garden. My grandfather was a saver. They re-used wrapping paper. They never ate out, and had a stand up freezer for meats and other items they got from the farmer. My grandmother did a lot of canning, and her basement was always filled with tons of food.

The generational theory suggests that we are due. Perhaps the roaring 1920s was sort of like what we have experienced the last decade – where everyone you know talks about stocks and crypto. While the math isn’t precisely 80 years, the bigger idea is big events happen every 4 generations or so as people lose their history. For example – prior to WW2, you had the civil war, and before that was the Revolutionary War. But this goes further back than that.

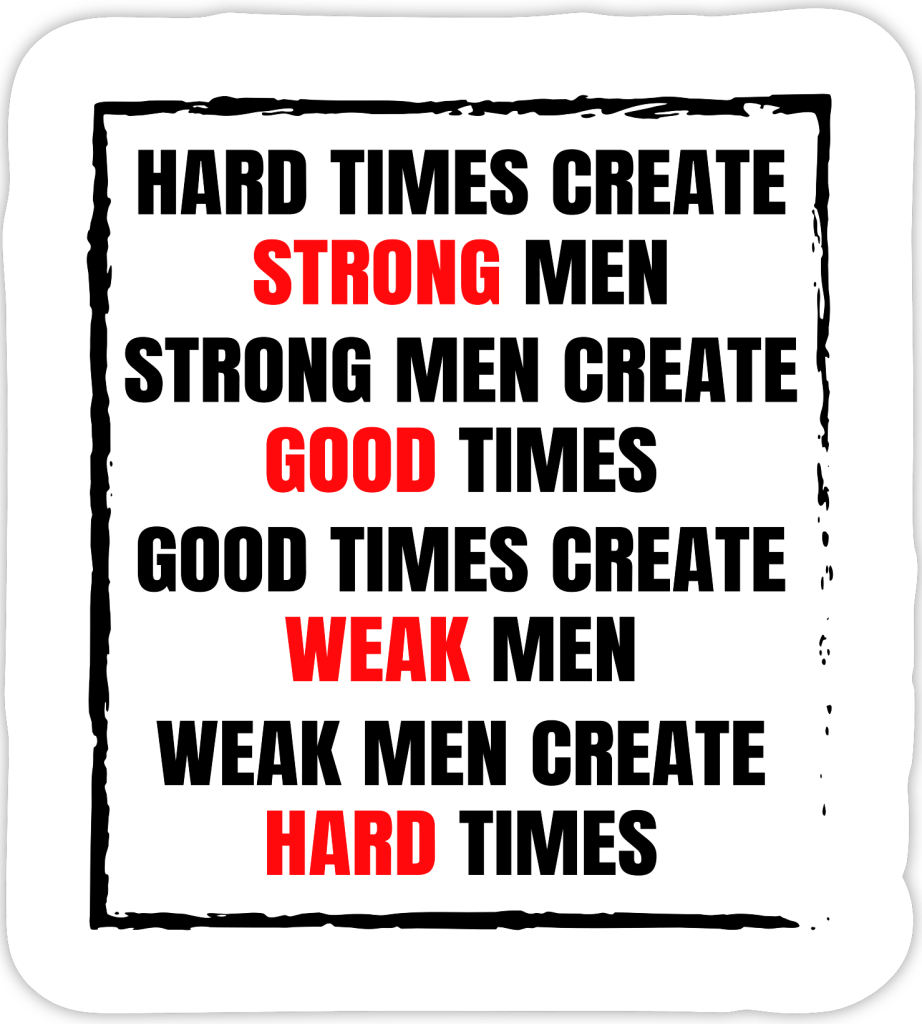

The fourth turning essentially leads to this…

Remember – our society has been bitching about everyone getting a trophy for 20 years. This is good times creating a soft generation. These kids are now entitled, there are 36 valedictorians, and college has been a joke for years due to lax grading. This is producing a generation of entitled assholes that come into the work force and are not productive, yet they want everything given to them. This is part of the whole woke mess – where these kids have terrorized the work place here. This has also led to the terms of “quiet quitting” where many of these young adults just bring zero value to a company.

The risk here is the weak men in this case then take over positions of power and can potentially wreck everything. Foreign policy, tax structures, spending, and the concepts of government frugality.

Risk 2 – government spending

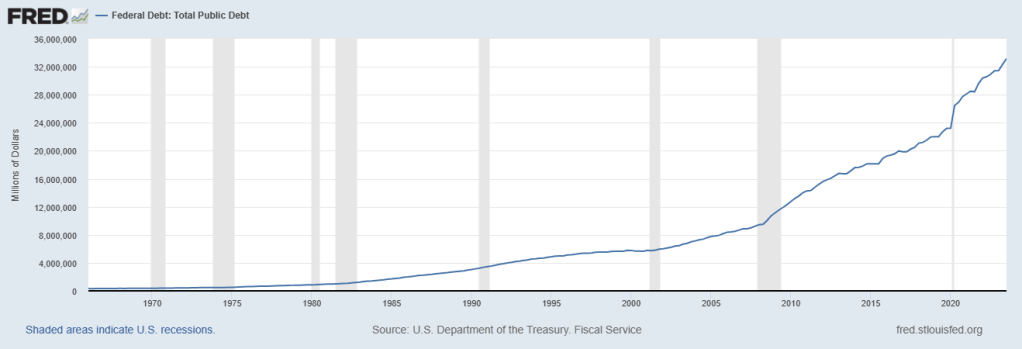

Our government spending is out of control. No one can get elected today based on frugality. We have spent sooooo much money, that it has then devalued our existing currency – for many generations ahead.

Think about this really quickly.

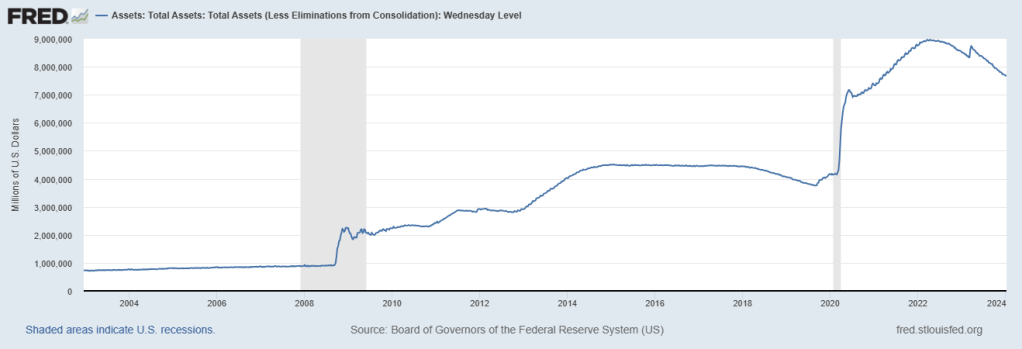

The federal debt, through 200 years of existence, accumulated to about $5T in 1990-2000. Since then, it has gone up SEVEN TIMES the debt. This is due to the endless wars, the global financial crisis, etc. But you can really see how it takes off after the GFC. Many say that the GFC is when everything broke, and we have just been putting on band aids since.

SEVEN TIMES THE DEBT, in just the last 20 years. This is going exponentially higher.

Risk 3 – debasement of currency

I spoke above about the gold and how it seemed to appreciate in value over 100 years. This is what you are all conditioned to believe about your house value. It is a massive investment, and in 20-30 years, it’s going to be worth twice as much as now!! Well, that is your currency being debased. What this means in reality is that you need more currency units to buy things. So if you save cash, over a period of time, you will lose a significant amount of that purchasing power. Imagine being someone who took a $20 bill and an oz of gold and put it in the vault 100 years ago. You go to take it out, and you see the value of the $20 bill can now get you a McDonald’s value meal.

When all of this debt is created, they are essentially borrowing money into existence. This money didn’t exist, now the Treasury issues debt, and voila! Money is then generated into existence, and from that – the government spends that money. All of this money they have created in the past 20 years has downstream effects of dilution of spending power. It might not be today, tomorrow, but could be next week. Gold was $250 in the year 2000 and is now over $2000. As much as me and my kind bitch that gold and silver are going up, this is a mathematical certainty given the currency creation. Silver has lagged, a lot, which is why many of us silver bugs are waiting for the catch up to happen. It will be glorious, but these things happen as they happen.

One can see how the Dow went up 5x from 2008-2021 and the Nasdaq went up 16x. Meaning – all of this currency created finds home in asset classes. You can perhaps make an argument that no matter how overvalued real estate is, that it has lagged from the other asset classes. All of this is to say that no one really is tracking how this debt creation then has an effect of the eventuality of crashes up in markets. This is essentially what happens during hyper inflation.

Risk 4 – Gold standard removal of 1971

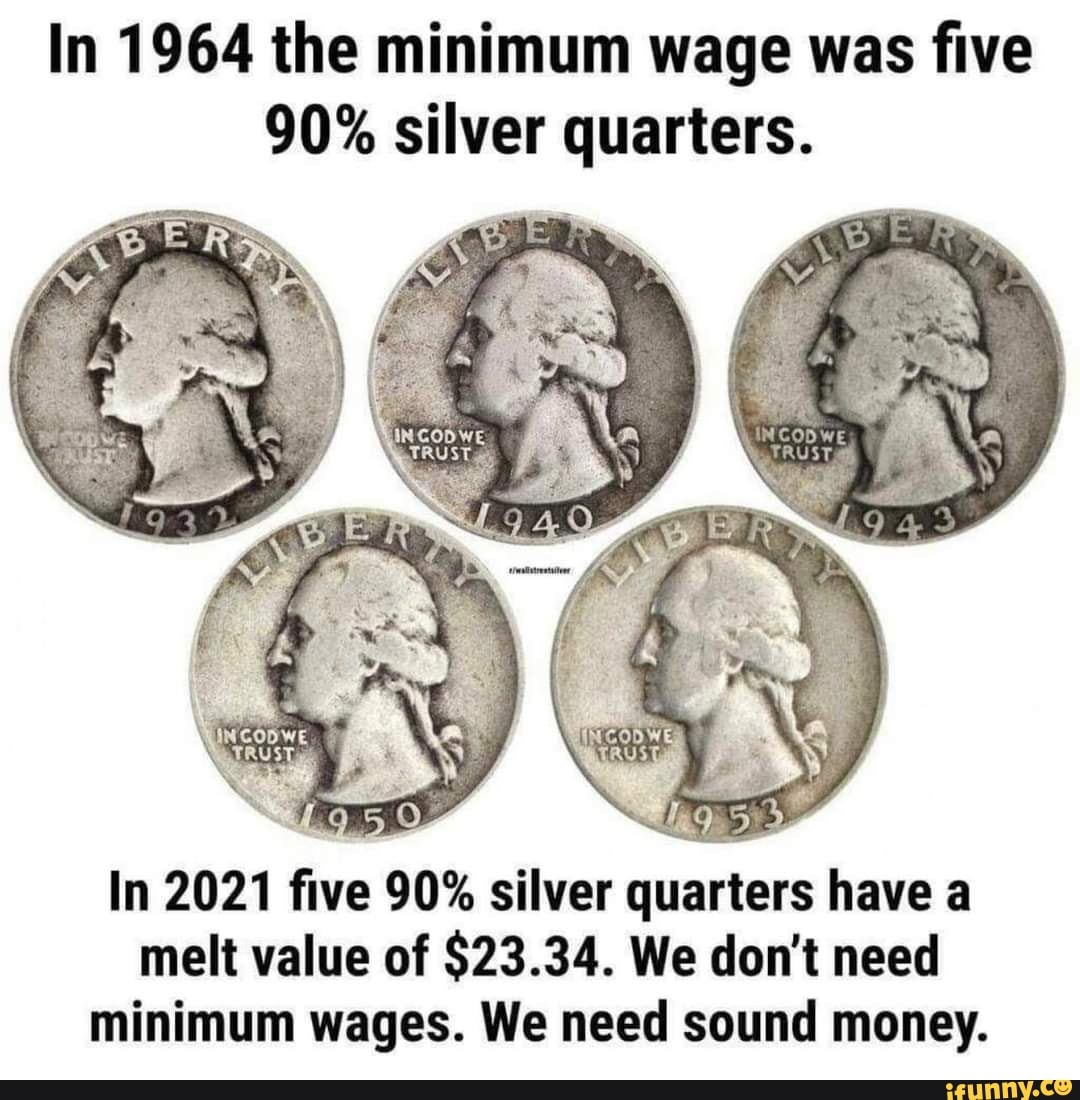

We all know how Nixon “temporarily” removed us from the gold standard in 1971. But with that, you can see gold, silver, oil – everything exploding higher in the 1970s now that the dollar had no tether to reality.

A few years prior to this, silver was removed from our money because it was costing more to make our money than the value of it. 1964 was the last year of silver in our money (with exceptions of the JFK exceptions) and with this – wages lagged behind. While wages are tremendously higher than in 1971, the problem is – that due to globalization, wages have not kept up here with the money creation. This has led to a hollowing out of our middle class. Don’t believe me? How many of you are calling for $15 minimum wage?

This is with silver severely lagging the gold move. Who knows, maybe $30 silver is where we are suppsed to be at. If silver was $4 in 2000 and 7x that is $28, maybe “the move” in silver is to get us near $30. That would perhaps put minimum wage today at $25-$26 per hour.

Risk 5 – Globalization

Many of you do not understand the nature of how globalization worked with our currency as the world’s reserve currency. What happened is we got a lot of perks with it. Our strong currency allowed us to buy cheap avocados from Mexico. We’d then send dollars to Japan for electronics. China was able to produce just about everything for us, for dirt cheap. Walmarts sprung up everywhere, selling cheaper goods. This was a 40 year direct result of opening up a lot of these markets to trade in. Thede countries would devalue their currency against ours – and in return, jobs would be shipped there. My dad was a steelworker in the 1980s, and those jobs eventually all went to Japan, for the most part.

We are now at a point with globalization in that a lot of jobs we have now today, since COVID, can be remote. Think about that for a second!! You worked in NYC and made $300k. Your job becomes remote, so you move to PA and with this, experience a major cost of living change and live like a king! Well, layoffs are coming for 2024, and many people are now being driven to go back into the office. However, many others may find that since their job can be done 100% remote, it can also be done in Bangladesh for 1/10th the cost.

The end result of globalization here is that we will inevitably have higher unemployment here. Period.

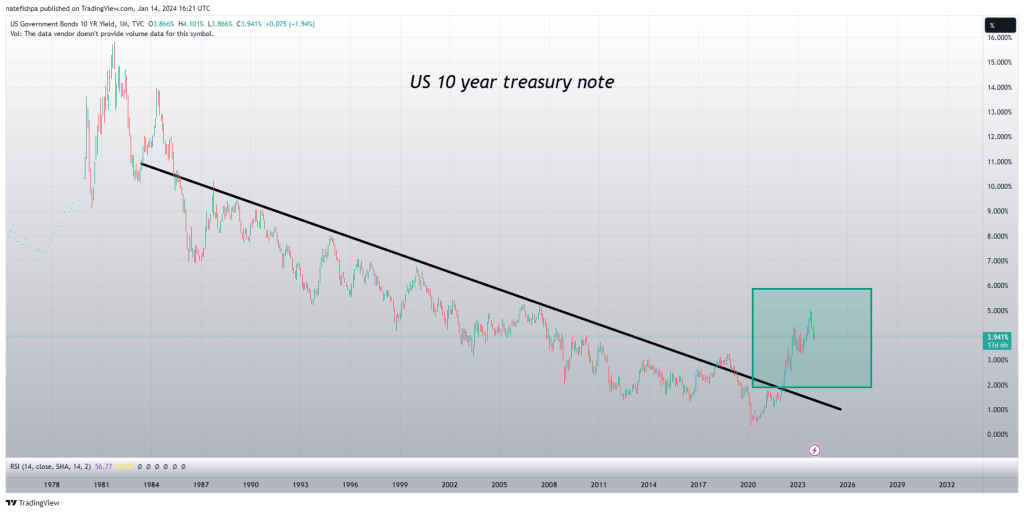

Risk 6 – Treasuries and new debt

The game was this – you buy our debt, and with this, we will then buy your shit. China has drawn back their purchases of debt, a lot. So has Japan in defending the Yen. But what you saw this past few years was the Fed essentially told banks to buy our treasuries. They bought at 1%, and got their asses handed to them. Why? They used cash to buy these, and when people wanted money out, banks had to sell these and “mark to market” the losses as the treasuries went to 4-5%. This led to yet another government program last year called BTFD that was put in place to rescue banks. Much of that short term band aid is due in March, and the treasuries are still north of 4%. Meaning, they will have to kick the can down the road yet again with more stealth QE unless they decide to let banks die. It is a possibility if indeed they want to use this to roll out CBDCs.

Risk 7 – CBDCs – Central Bank Digital Currency

This is the brainchild of government authority. Big picture is this – unlike cash, that is printed and they lose control of it, with the CBDCs, they can use smart contracts to ensure they control the money. For example, imagine you didn’t get the clot shot and they wanted you do it, for public safety, of course. With this, they can turn off your wallet until you comply and provide your bank proof of vaccination. This – is coming – and many feel this is the tool they will use to try and “rescue us” from doom. Unemployment at 15%? OK – you can get unemployment benefits, but they will be given to you in CBDCs. And, with this, they can determine your carbon footprint with how you spend that money, so you are only allowed 4 oz of beef per person, per week, in the household.

People feel here that the government is actually architecting the destruction, slowly, so they can rebuild with CBDCs and control us. For anyone that has heard the rhetoric of “global warming” which was migrated to “climate change” you understand that these people will do anything in the name of the state. If you see how this is coming, you need to understand that an engineered disaster needs to take place for people to actually adopt this.

Risk 8 – Nation of debtors vs savers

Where my grandfather taught me to save as a kid, and I had a 5% interest bearing savings account, the last 40 years of globalization was about changing the entire mindset of the country from saving cash (low velocity of currency spending) to a nation of using debt to buy literally everything – which then jukes the GDP numbers higher. From Ben Bernanke to Janet Yellen – our central bankers are very much now in line with a concept of MMT, or “Modern Monetary Theory” which is our country’s ability to create

“money” indefinitely, as long as it is controlled on the way up and taxes then are collected to account for some of the spending. The problem is this – with an MMT concept, this allows the US to indefinitely spend on tanks, guns, proxy wars, and be involved with foreign policy all over the world.

What most Americans are clueless to is that they don’t want us meddling anywhere. You cannot defeat the American Abrams tank. Or our fighter jets. What you can do, ultimately, is fight us at the money level. China, Russia, India – these countries have hundreds and thousands of years of using gold as money, and all of them have now called foul on our use of MMT – which seems to have been adopted by Canada and many of the G7 countries.

Risk 9 – World Reserve Currency

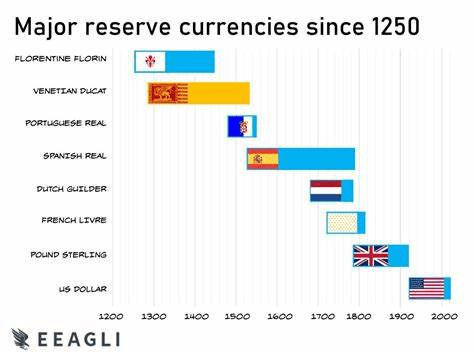

We have had the privilege of being the world’s reserve currency for over 100 years. But anyone who has seen that chart understands that this is a period of time in history.

You can see here that these things are cyclical. No one can doubt in today’s financial world that the US dollar is king. No doubt. But you have to skate to where the puck is going.

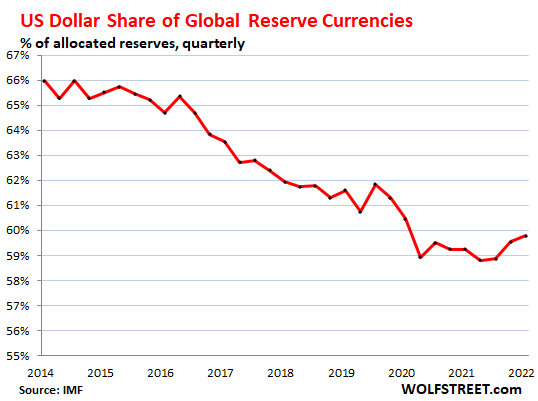

This doesn’t seem like much – but this is a trend. I had heard recently this is now down below 50%. But the US is not doing itself any favors – with weaponizing the dollar and seizing assets of countries like Russia. Never before has a world reserve currency been abused like this. But our bureaucrats are so dense and so idiotic that they then use their positions of power to try and isolate the likes of Russia. This has led to central banks everywhere buying the hell out of gold and re-patriating it from us.

Risk 10 – BRICS+

While some sneer about this, the big picture is that from the other side of the GFC, countries loosely banded together to try and challenge our hegemony. 4 just were added, but you have perhaps 50 countries today loosely associated with this. Is it going to be a gold-backed currency? A currency of local currencies that challenge the dollar?

Now assume there’s the bloc of nations that agree they all want to use USD less. Maybe bilateral money exchanges. Maybe they use gold as a settlement tool with the blockchain. No idea. But these countries are actively trying to unseat the dollar as THE world’s reserve currency. Look – 20 years from now, it might be 25% of holdings, so this isn’t evaporating tomorrow.

But I want you to then think about what happens with these nations? They stop buying US debt, and dollars they do have, they start to get rid of over time. Perhaps they buy US companies on the NYSE. Maybe they take delivery of our gold. Maybe they buy real estate up.

But make no mistake, that in the coming 20-30 years, there will be supreme challenges against the dollar. Meaning, all of these dollars coming to our shores will create another massive wave of inflation These dollars will compete against our local dollars to bid up everything. All of that debt we printed? Those come up at maturity, and we have to pay dollars out to holders of this 10 year debt. The cash goes to them, and then where?

Risk 11 – End of Petro Dollar

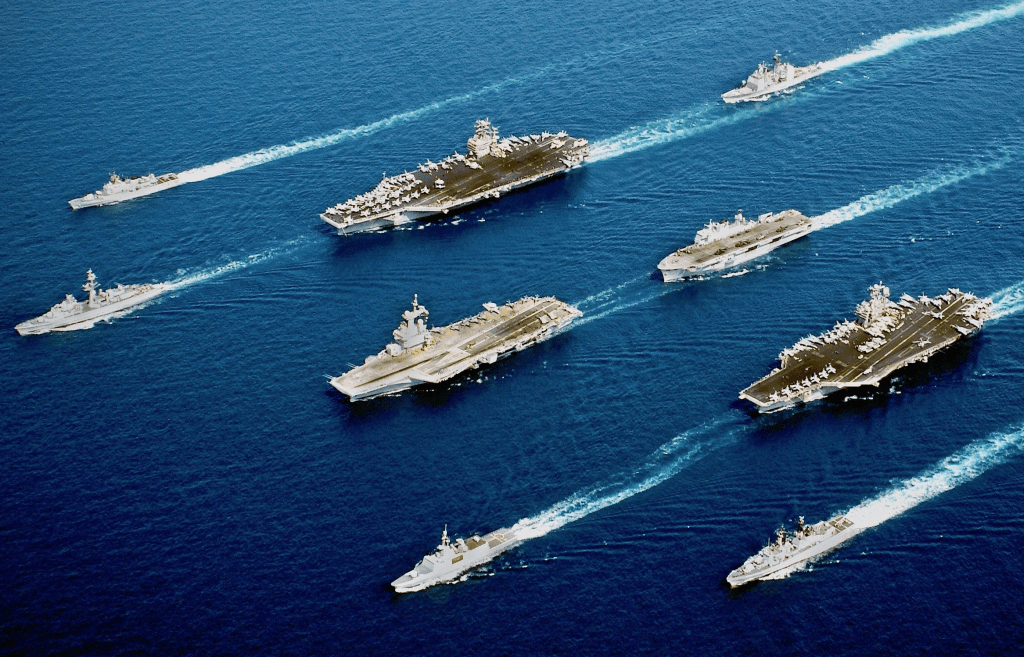

What sort of followed the gold backing of 1971 was us buying oil in USD and in return, they buy our debt and we protect them militarily. Essentially, today, this is what backs the dollar.

No country in the world can defeat this head on. How do you defeat this? Kill our funding. If we can not afford to buy more and repair this – they can win a war against us without firing a shot. We are spending ourselves into oblivion. All countries need energy, and the middle east agreed to accept ONLY dollars for oil. Every country needed oil – and with this, it ensured that there was always a massive demand for USD.

Today, China has undermined this and has started doing deals for oil in Yuan. Other countries are now trying to do the same thing. Again – if the demand for USD is down, this then reduces the value of the USD, and those holding it overseas are wanting to get out of it. I believe they are doing this slowly, as to not bid up everything overnight.

Risk 12 – Govt data

I believe we are now at a point where not a ton of people are believing the government data anymore. MY first real exposure to this a few years ago was the measurement of inflation and the CPI. You learned that twice they changed the formula. Now, they report 3% inflation, but in reality, using the formula from 1980, we could be experiencing 8% inflation.

You also see with the jobs numbers. Every month there is a “beat” on jobs data. You then look a few days later, and the previous month’s data was revised down. This jukes the headlines, which then has machine-based algos investing in things and moving the stock markets higher.

Risk 13 – Breakdown of laws

You can see by the “mostly peaceful” demonstrations of fire and brimstone that our media is now 100% corrupt. Everyone SEES the violence around us. The people shitting on the streets in San Francisco. The drug addicts in Philly just existing. Our country is decaying, and people who do violence are then not prosecuted. Without fear of prosecution, people are now just brazenly stealing from stores in the inner city to the point where either everything is locked up behind glass, or stores are now moving out.

We also have seen how tyrants then took over in the name of public safety during COVID and ordered some businesses to close, and others to stay in business. This then also led to people inventing rules of voting during the last election, which led to a lack of confidence in the results. While many are “orange man bad”, they also do not understand that was a product of the media machine – and with it, any result of a Biden win, no matter under what circumstances – does not matter because the ends justify the means. This led to all kinds of censorship on social media, so only the victor was allowed to write history.

Risk 14 – Censorship

This is piggybacking on the last one, but right now, special interests in this country own politicians. These special interests also then control the media, as they are advertising and paying the bills. Social media had promise of the platform to have public debate, but “misinformation” and “disinformation” was then put in place so the status quo state-based message could not be challenged. There was proof that Twitter colluded with government entities for who to censor and what messages to promote and what to block. Think of the Hunter laptop right before the election. Proof that our future president’s son was potentially compromised by China and Ukraine dealings – and what then happened? We fight a proxy war in Ukraine. This laptop was deemed to be Russian disinformation by 55 intelligence experts. It took 18 months for a single mainstream media reporter to be able to confirm it was legitimate.

Meaning – HALF the people in this country who voted for someone not named Biden had the government censor and block critical information that would have been crucial to the election results. Because – “the ends justify the means”.

Censorship is just beginning. Imagine a day when a CBDC would be instituted, and I would write something like this on social media – my social credit scores would be low, and with it, I could be restricted from spending my money on whatever I wanted to.

Risk 15 – Capital controls

Anyone go to a bank and try to take out $20k of YOUR money? You have to fill out forms and they grill you on what you want to use YOUR money for. Why?

Think about what happened with the bank runs last year, and how banks failed. Now, imagine a period where bank runs like that happen this year, and with it, banks start to say you cannot use more than $300 of your money, per day. Why? Because they can.

There’s also something called “Bank Bail ins” none of you are tracking from after the GFC. Meaning – when banks failed in 2008, the government BAILED THEM OUT. Now, banks are to be BAILED IN with the depositor money they have on their books. While your account of less than $250k is insured by FDIC, assuming you have $3m in the bank you may have inherited or got when you sold your pizza business – you could be stripped of all of your money if the bank fails.

Risk 16 – Illegal immigration

To what end is this going? As a dem in 2006, I was for the wall, as was everyone. The dem position then was that all of the illegal people coming over were stealing American jobs – think construction jobs, meat packing jobs – and back in the day there were tons of scandals with Republicans using illegal nannies.

But Texas has been dealing with this for 20 years. Finally, the last year or two they wised up and decided to ship illegal immigrants to “sanctuary cities”. They are starting to crack, and want to turn away the buses. Here’s the deal – it’s ok for them to agree to the policy, as long as they don’t have to pay for it. But now, hundreds of thousands of illegal migrants are now in NYC, Chicago, etc. While many of you fell for the narrative of “good people” coming across, the truth is there are people from all over the world entering the US via Mexico. And – we have tons of cartel issues with fentanyl, as well as all kinds of human trafficking going on.

This is going to break. And soon. How long until the overrun cities just take buses of illegal migrants and dump them in the “rich suburbs” and crime goes vertical with people just trying to get money for food?

Risk 17 – Hollowing of middle class

You cannot see this on a daily basis, but the middle class has been hollowed out over 40 years. You have the richest 10%, that perhaps have master’s degrees, professional degrees, and live in nice neighborhoods. You have perhaps the bottom 10-20%, that live in inner city slums, Appalachia, and the deepest rural America. Then you have perhaps 70% in the middle that are paycheck to paycheck. They make too much for government assistance, but don’t make enough to make ends meet. Your wages go up 2%, but your health insurance goes up 8%, your taxes (or rent) goes up. Food is up 15%, yet government wants to do a victory lap and tell you inflation is back to 3%. This is silliness. Imagine you gained weight at 3 pounds per year, and in 2022 you gained 9 pounds instead of 3. With inflation going down to 3%, you didn’t go back to prices from before. You simply went back to gaining weight.

Americans during that period had minimum wage growth, and in fact, the Fed talked in a sense about waging war against it. Why? If your costs go up 10%, and you want to have your union fight to get you a 10% raise, these higher costs are then passed on to the consumer. Essentially, it is a spiral higher of inflation that won’t stop.

In the 1970s, there was several waves of inflation. I believe we can expect something like that – with the second wave of inflation I believe to be a combination of higher wages along with dollars starting to come here. I believe the third wave of inflation will be ALL the remaining dollars coming here from overseas as US people also decide to get out of USD.

Risk 18 – Natural disaster and/or cyberwar

Much of what is written above is political, but what if the Yellowstone super volcano erupts? What about a Carrington event, which is an electrical storm every 500 years or so that could take out our entire power grid? What about floods, hurricanes? I’m not even talking about nuclear war here – but the event is there are issues so damaging that you need to leave where you are. While a Carrington event may have a 1% chance of occurring, you also have to understand that we are now in a world where a cyber war could erupt where our enemies take down our entire power grid. While it sounds silly to some, consider how we were responsible for the Stuxnet virus in 2009 or 2010 which ended up deceiving Iran using SW to spin centrifuges too fast and burn them out. The Siemens SW looked fine to them, but they kept blowing out centrifuges. The same type of thing could take out our entire power grid. Who would do that? Imagine we do seize $300b in Russian gold and treasuries. What is a measured response? Kinetic war? No – maybe they take out the NYC power grid where it could take months to repair. Or the entire northeast of the US? We are in a different era of warfare today. While we do not associate cyber ware with kinetic war, there’s a fine line there of loss of life. What types of acts that we do to others might come back to us with a cyber war. The capabilities are there. Today – there’s global conflict erupting everywhere. Ukraine, Israel, the Houthis – maybe Iran to join. Maybe Taiwan up soon? Things are gettng worse, and with this, statistically speaking, this is not a non-zero risk.

Risks and how things are going

What I painted to you above were a lot of conditions that have been occurring over the last 10-20 years. None of this means that next weekend, the banks will close and a CBDC will be there and you are all screwed. Rather, you have to look at the risks above through the prism of likelihood and impact. If you live un an urban area, right now, you have a much higher risk of violence than in the rural areas. But make no mistake, the hollowing of the middle class also then potentially has 1789 France vibes to it.

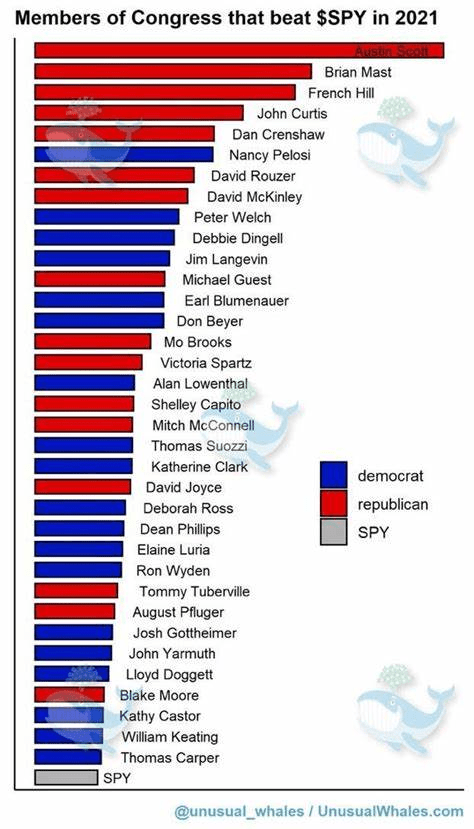

This also manifests in anyone going into federal government service today making $189,000 a year as a representative may leave several years later a millionaire due to special interests and stock trading of insider info. Nancy Pelosi and her husband are now worth several hundred million dollars – and she made $220k a year as speaker of the House.

What you see above is the list of congress people who out did the S&P index. Now, I’m not saying they are all insider trading – but it is LEGAL within congress to do so. And, with this, you get your 1789 vibes unless this is changed.

Now with this, you do not need to build a bomb shelter in the desert.

This movie had a prepper in it – which is synonymous with the current prepper of today. Lots of guns, tons of food, and anti-government conspiracies to make them all cuckoo for coco puffs.

You can read this post and see a reasonable likelihood that some negative event happens in the next 5-20 years. No, it doesn’t mean WW3. It doesn’t mean Robespierre and 1789 beheadings. But we have seen a lot more urban violence. We have seen global conflict pick up with Russia and future proxy wars. We HAVE seen debt spiral out of control. We have seen our government reps get silly rich on their service. We have seen all kinds of voter irregularities. WE have seen endless streams of illegal migrants coming into this country. We have seen debauching of the currency. We have seen a BRICS entity come to be that is challenging the dollar. We have seen government tyrants shut down private business in the name of safety. We have seen people lose their jobs for not complying to government shot policy. We have seen the government work with social media companies to censor us and try to tell us the “official government narrative”.

What to do about these risks???

Therefore – doesn’t it make sense, that with the likelihood of some negative event NOT being zero, with a potentially HIGH impact to you, that you do more than ACCEPT the risks? What could you do to perhaps mitigate some of this? You have to look at your vulnerabilities, but here are some easy things to do….

- Get food. I bought a lot from the webstaurant store. 50 pound bag of oats, rice, beans – in airtight containers, a lot of this can last for years. Imagine waking up and the price of food goes 3x in a week? You can then potentially feed your family. I spent perhaps $400 and usually have about years of food here. Those “survival” food containers are just pastas and cheap carbs.

- Get camping equipment. I grew up camping a lot as a kid and had 5 years of scouts. It doesn’t hurt to have a family tent, sleeping bags, and camping equipment. If you run into a situation where

“mostly peaceful” protests hit your neighborhood, it makes sense to get the hell out of there for a few days. - Have 72 hour food supplies in a go bag. While this sounds silly, we have seen how violent protestors are not only not prosecuted, but somewhat encouraged to forage on their own. It’s just a matter of time until many neighborhoods have this type of thing happen to them.

- Store SOME of your cash in precious metals. While a hyper-inflation scenario with a world reserve currency is not likely, but it doesn’t mean it cannot happen. Buying an ounce of silver at $25 is the equivalent of perhaps 6 loaves of bread today. In a scenario where silver is $100 per ounce, a load of bread could be $16. So you are PRESERVING your spending power with precious metals. In Venezuela during their hyper inflation, apparently 1 oz of silver fed a family of 4 for a week. Would it not make sense to have 100 oz or so at home to provide food for your family for TWO YEARS??

- Learn how to fire a gun and buy one. If there’s a mob of 3,000 people coming to your doorstep, a shotgun with 2 shots isn’t going to do much and police aren’t coming anytime soon. However, if you have a proper defensive weapon, you may be able to get out of your neighborhood with your family intact.

- Bug IN or bug OUT – in some situations where the power goes out for days, you may be just fine at home until order is restored. In my case, I have solar panels and batteries. However, if this is something that is sustained in time, you may consider packing up the car and bugging OUT. For this, you might want to consider alternate locations. Maybe your uncle has a cabin in the woods, your close friend has a big house in a very rural area, or you have land somewhere.

- Get an RV – I looked into this last year. Brand new a lot of these are like $25k-$35k, but you can get 5 year old used ones for half that. Maybe a $150 a month payment. If you DO have to bug out, you can use your RV on remote tracts of land to be safe and secure. $150 a month for this – perhaps even $100, is not excessive if you are currently spending $5000-$10000 a year on family vacations. $1200-$1800 a year for an RV provides you not only a family vacation on wheels, but serves the dual purpose of an emergency shelter.

- Buy some books and practice – things like herbal remedies, identifying plants to eat, basic medicine, etc. While I had a lot of time in scouts, I forgot most of what I learned. Some basic knots are easy enough. But there’s also tons of resources out there for “bush craft” types of things.

- Go camping. While I talk about a tent/RV above, many of you high end people put a $5000 cruise on a credit card and get great pics with the family to brag on Facebook. I would go camping with my parents for $7 a night as a kid, 15 mins from the house. This gets you practice of setting up tents, getting mobile shelter, starting fires, and having this as a routine to do rather than some thing you are fumbling about doing. For about $1000 – you can buy state of the art camping gear and with this, practice being in nature in the event something does happen. You can teach your kids valuable skills – and the upside here is cheap vacations virtually anywhere.

- Learn to fish – I fished a ton as a kid. I don’t like eating fish, but I have a few times that were really good (I had fresh Mahi Mahi in Aruba for my honeymoon). If there’s a situation where you are out in the middle of nowhere with your family, you need to be able to fish/hunt beyond your 72 hour go bag food supply.

- Learn to hunt – I have yet to do this, but I want to be able to hunt and clean animals. My father in law may be taking me pheasant hunting this coming year. I have shot a shotgun a LOT in the last few years with sporting clays. This is a more complex system then skeet – which is the stationary “pull” station. Sporting clays have you go all over 15-20 stations where the “birds” come out of nowhere and go at different speeds, heights. I feel my skills are now such that I can kill anything with a shotgun, but I don’t know what to do after it. I have a 30-06 and .308 with a scope, and I have a very high confidence in me hitting animals perhaps 400-500 yards out. Again – what do I do if I hit a deer? Those of you idiots who don’t know anything about an AR, it isn’t powerful enough for deer hunting. It’s a pretty damn good defensive weapon from 25-150 yards out with not a lot of kick, but great stopping power. IT is NOT a weapon used for hunting – you would just mame a deer and not kill it.

- Plant a garden – I have a garden the last 5 years or so with raspberries, cherry tomatoes, and zucchini. I grow weeds better than anyone. Point is, you should be able to have a small garden to understand the concept of growing food. I had grown some potatoes before as well. I love raspberries and they are a good source of calories.

- Live more frugal. Learn the lessons of my grandparents. Eat most meals at home. There’s no need to upgrade furniture every few years. Don’t put this shit on credit card. Save up to buy things you need. Excess savings – put into things like 401k, precious metals, real estate. Do NOT over-extend yourself.

- Understand the world of credit. If you just tried to save cash to buy a house, you will be saving most of your adult life. Some things – in this new world – you need credit for. You need to learn finance and how to budget. Some big expenses you borrow – but only if it’s low rates. My finance professor once said, “if someone gives you a free loan, take it”. My house is at 2.75%, and solar panels/batteries are at 2%

- Save 6 months of bills. Another nugget from my finance professor said to always have 6 months liquid of bills. If this is too much to save, then you also have to understand you are living well beyond your means. His reasoning was – if someone at work directs you to do something unethical, you walk. But in today’s age of unemployment, etc – it makes sense to have this liquid.

- Actively invest. While none of you are Warren Buffet – it makes sense to have conversations with your financial advisor to take your excess cash and put in different asset classes. Some in tech stocks, some in dividend stocks, some in bonds, some in real estate, and some in precious metals. Maybe you have 3% in precious metals? Depending on your age and risk appetite, you have to balance growth of your pile of money as opposed to preservation of it.

- Buy land – while this is beyond the means for some, having an acre or 10 remote from civilization can provide you a safe place to go. You can also vacation there, but most importantly – you can also plant things like raspberries there to have calories when you return. Maybe a stream is on the property you can fish in and have access to fresh water/bathing.

- Buy a pickup truck – you don’t need to go out and get a $75,000 new Ford F150, but a pickup truck is something I never thought I’d buy, and will never be without again. There’s so much utility with it, that I will never go back. I finished up my basement here, and needed it to haul dry wall. It was great for dirt/mulch.

- Make a fire pit – I got firewood from a friend of mine, but I bought a fire pit out back. Not only do I love fires, but the type of firepit I have also has cooking abilities on it. This not only serves as an emergency cooking area, but you can practice making fires.

- Buy a second property – I got outbid for the one I wanted to buy, unfortunately. This might also be beyond the ability for most of you. However, for a SECOND HOME – you only need 10% down. While you can rent it out when you are not using it, you have to occupy it like 10% of the time. No biggie. I planned on doing it. If it was an INVESTMENT vacation home, you need 20% down, at least. The house I was looking at wasn’t very expensive. So the idea was I could rent it out perhaps 50% of the time which may have paid for it. The second property can be a vacation place for you and the family, but can also be where you store excess preps. While the idea of camping in the woods with bear around might be a tough pill to swallow – if you have some means, you might be able to have a cheaper cabin retreat.

- Learn handy skills – I will be the first to admit I spent 10 years in college and didn’t know how to swing a hammer. That changed perhaps a decade ago when I actively made efforts to learn a lot more. I’m still terrible at certain things, but I learned how to build/frame walls, do drywall, paint, mud, do drop ceilings, do sub floors, flooring, etc. I also built my gym power rack from 4x4s for about $200 with a video I saw on YouTube.

- Buy some basics – I’ve been late to this game, but I just recently got a leatherman multi tool. Things like knives, tarps, paracord, gorilla tape, hatchets, shovels, coolers – while all of that could make you look like a serial killer, all of these things are necessary items if you find yourself with the family in the woods.

- Get a relationship with a local farmer – this is interesting to buy quarter cows, half pigs. If you get on their lists, and are a repeat buyer, you may reap the rewards of being able to get meats if the stores run barren.

- Keep your gas tanks filled. My wife has a terrible habit of running her gas tanks super low. IF you run into a situation where you have to get out, in a hurry, you should have a full tank of gas to get where you need to go.

- Keep cash in the house. While I’m not a big proponent of having cash, it makes sense to have perhaps $100-$250 per person in the house. Imagine a situation where a hurricane hits those in Florida, and there’s no drinking water. You will have people selling water for $20 a bottle. While this is gross, in situations like this it does make sense to have cash. At least some.

- Store barter stuff – While it’s of interest to talk about a 50 pound bag of oats and rice/beans, I also had gotten a 25 pound bag of sugar. I am mostly low carb/keto and rarely use sugar, but it never goes bad and is something great to barter with. Canned goods don’t really go bad, the taste just decreases over time. Things like honey never go bad either. It makes sense to have a pantry to store a lot of staples like this that never go bad, so in the event of something terrible happening, maybe you can barter 20 pounds of sugar for antibiotics for your kid.

- Get a med kit – While I don’t plan on dodging bullets when things get sketchy, it makes sense to have a med kit to treat wounds/injuries.

- Have tons of booze – I have a lot of booze here, but I only drink less than a handful of times a year. It’s great for barter, but also good for a disinfectant.

- Get a good cooler – imagine you do have to bug out, it also makes sense to take some frozen foods with you to eat first. If you have a really good cooler, your food may last quite some time. While I would plan to grab the tubs of dry food I have to throw in the pickup, none of that is a great protein source. So a good cooler might help you take some meats with you.

- Watch a lot of zombie apocalypse stuff. I have been fascinated by dystopian future movies since I’ve been a kid. I think the first dose of it was “Red Dawn” from 1984, perhaps around the same time as “The Day After” – after a nuke attack on us. It makes sense to watch a lot of these movies. How society might break down. How psychology might work in these situations. How to be prepared. How to form alliances.

- Lose weight and get in shape. If there are problems with the world, you need to be able to run, lift, and work with your hands. You need to seriously be able to do manual labor for food and shelter.

- Learn how to defend yourself. I am lucky to have been a heavyweight wrestler for a lot of years in HS, took karate, jiu jitsu, and tae kwon do, and got into some fights in college to learn how to handle myself. The best fights are those you never get into, but understanding how to defend yourself is a key skill.

If you critically look at the items above, none of this is tin foil hat stuff. If you think about it, a lot of this is just practical advice on how to live. Think about it. Planting a garden is tin foil bug out? Having extra food in case of emergency is crazy? Storing SOME wealth in precious metals is insane?

I believe many of you are living in some sort of parallel universe with “recency bias”. Yesterday was fine, so tomorrow will be fine as well.

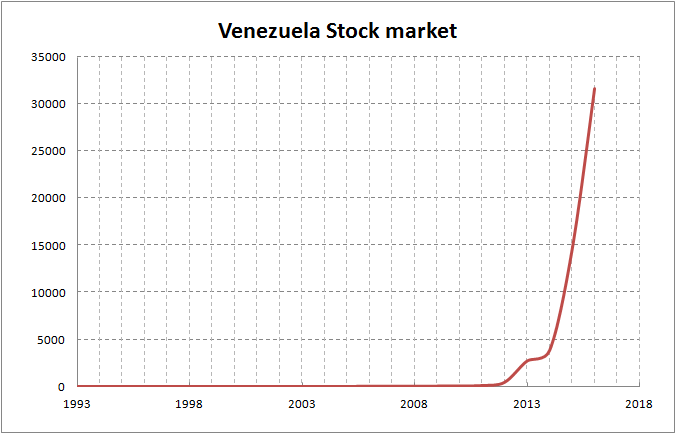

Venezuela was one of the richest nations on earth – until they embraced the socialist dogma. Guns were forced to be turned in, and then shortly thereafter the government confiscated private industry. Foreign investment fled the country. And what you see above is the government printing money, as governments do. If you owned stocks, you think you got rich. But again, your $4 loaf of bread might end up being $500 tomorrow.

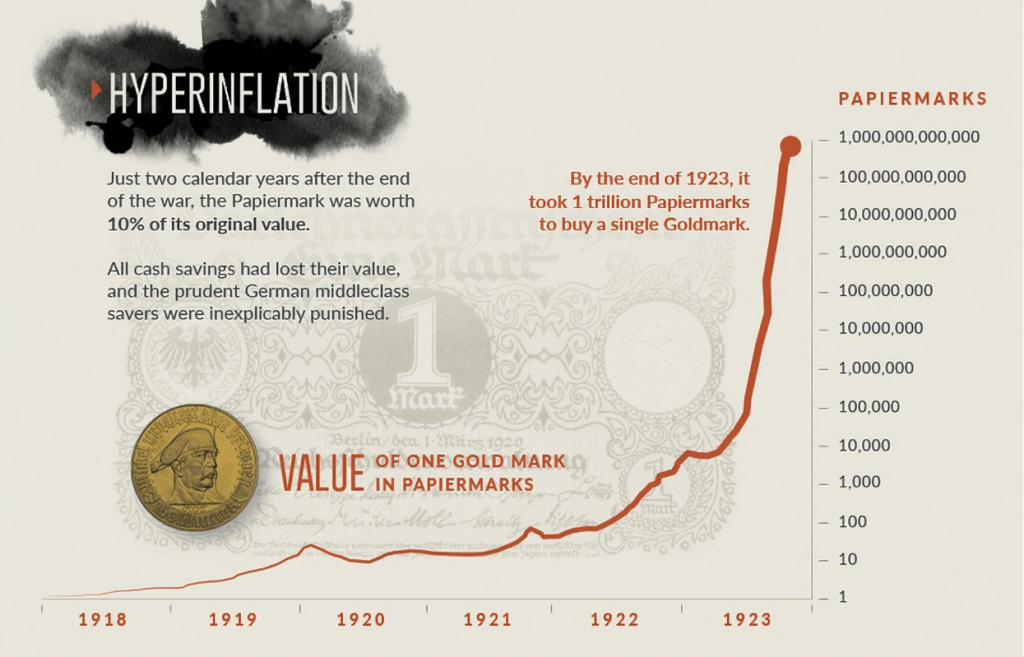

This is the Weimar hyper inflation in the 1920s

Look at the value of gold rising!! Wow – you will be RICH if you owned gold!!

No – this is the amount of cash you needed to pay for things.

Where it HELPED people is those with FIXED RATE DEBT. Imagine owning a house today with a 7% mortgage, and with this, you store all cash in gold. Gold then goes up 5x, and the $50,000 you put in gold goes to $250,000 and you can pay down your note. Now imagine gold at 50x. You can see how having cash stored in other things can help you inflate your way out of debt.

This is essentially what our government is doing now.

Why? In the history of humanity, all fiat currencies fail. Why? You cannot trust government NOT to spend too much.

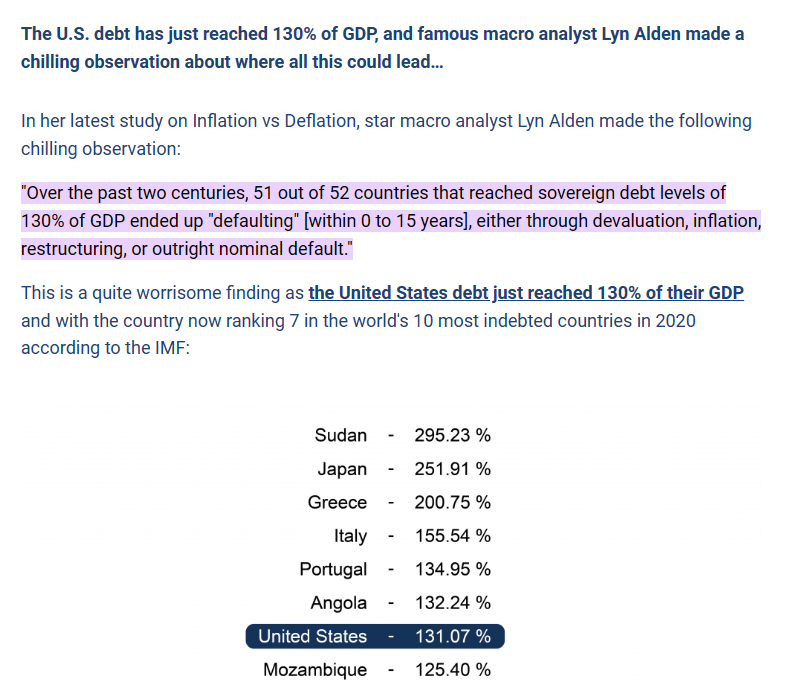

With looking at this – you can see we are on a path of default. Currently, when a treasury note matures, we simply borrow more money to pay that back. Sort of like a ponzi scheme.

What has happened though, is not as many people want to buy our debt. This has an effect of forcing the rates higher, which has a lower value to the notes. This also now has an effect of costing us over $1T a year in interest JUST TO SERVICE THE DEBT.

So we cannot really default on paying our debt in the traditional sense, unless no one buys the debt. In that case, the buyers of last resort are the Fed.

Above, you can see how during COVID, the Fed was the buyer of last resort and bought treasuries and mortgage backed securities to keep our housing market from imploding. Now, the Fed wants to unwind this balance sheet. You can see how this has happened with a form of QT, with higher fed funds rates. This has unwound about $1T or so, and everything is breaking.

The OTHER way of defaulting is “inflating us out of debt” which has a way then of debauching the currency. This is the most likely path, and with this, I’d start to fully expect that with the BRICS+ and the challenges to our currency, along with all of the central bank gold buying, and the US seizing foreign reserves – it is very likely that inside of 10 years a lot of US dollars come back to our shores driving up costs and creating a form of super or hyper inflationary event.

Conclusion

The 30+ or so items I told you to do above aren’t tin foil hat. In reality, most of that is practical advice that someone who lived in the Great Depression would probably give you. None of this is tin foil hat stuff like the guy in Tremors. It’s not crazy to learn how to shoot a gun. Get in shape.

Everything I talked about above has a probability of happening. You then add all of them combined, and you might have a 5-25% of something really bad happening inside of 5-10 years. What do you do? You need to at least understand the risks. Maybe you choose to accept everything, and the chips fall where they may. However, maybe you do a little from the list to plan – to be proactive to then try and do something to protect you and your family.

While people in my inner circle may think of me a bit as a doomsday guy, I’m very much NOT that as a person. I am VERY cognizant of the struggles my grandparents went through, and am very much in tune with the political global realities of today. I don’t walk around hoping ANY of it will happen. However, due to my awareness of the heightened risks around us, I choose to MITIGATE a lot of these risks with very sensible ideas. If you look at my ideas – they are good ideas of how to live in GOOD times, let alone how you might need to live in tough times.

January 14, 2024 at 7:08 pm

Someday–probably soon–“NORMALCY BIAS”–that being the presumption that things will be the same tommorow as they are today (and were yesterday) is going to smack the heck out of Americans when this all goes down–and it WILL be going down, because economic realitiies will eventually come to bear, and the USA and the West will become a lot like our 3rd world neighbors.

LikeLiked by 1 person

January 22, 2024 at 1:04 am

doh! Normalcy bias, it is 🙂 Thanks!!

LikeLike

January 14, 2024 at 7:37 pm

Great info. A couple of good annual meetups include PrepperCamp and Heritage Life Skills events. Most folks just drift through life with normalcy bias, but being a prepper has an intentionality that feels right.

LikeLiked by 1 person

January 15, 2024 at 12:45 pm

you talk about stocking up………then talk about leaving your home for a few days…….are you just hoping your home wont be looted while you are gone camping……….stocking up is great…….but if you can’t keep it……it ain’t yours

LikeLike

January 16, 2024 at 7:48 pm

One thing I would add to your list is to not be a target. If things are getting ‘tasty’ don’t ponce about with your watches and expensive clothes (jackets etc). Same goes for your home. If you’ve got a an expensive car – hide it. Let the front garden go a bit. Obscure security cameras and lights etc. Don’t let a passer by look at your house and think there’s stuff in there that might be worth stealing. Other than that – great article

LikeLike

January 16, 2024 at 7:59 pm

Love it – I am pretty much someone who goes out of his way to look homeless in front of others lol. I don’t want anyone ever thinking I have 2 nickels to rub together.

LikeLike