I have spent the last 5 years deeply entrenched in the financial system – and because of this, I did very well with some assets going through the roof and being able to take profits from some investments and then rolling them into repairs of another. All of this was under the understanding of continued inflation – perhaps leading to hyperinflation. My major investments in gold, silver, miners – and real estate, reflected my opinion of everything crashing higher.

I’m pivoting. I now believe a massive, massive, MASSIVE deflation is coming. While many may think of deflation and the Great Depression, this time around I believe it will be extremely GOOD for Americans, as well as the long term viability of our country.

Anecdotally, in 2019 or so, I was at Best Buy and saw some $2000 pink Mac. I’m looking around and saw $300 headphones. To me – this was the apex of “waste”. And, for most Americans, they just had no idea what was going on around them. This was sort of the new norm. I grew up and had the Walkman knock offs with the cheap headphones. To see headphones alone at $300, American children and teens had no idea of the lap of luxury and decadence they now live in. They. Have. No. Clue.

There is a major, major disconnect between how I grew up 40 years ago and life today. As a kid, my parents were pretty broke. The most my dad every made was $13k a year as a steelworker, and my mom spent the first 6 years of my life as a stay at home mom, mostly. Today – a video game system, with fancy controllers and games might be $700-$800. Insanity. And every kid is getting stuff like this, whether you are in the top 1% or on welfare – people are finding ways to pay for it. Maybe even maxing out credit cards.

Our culture is fat, bloated, and needs a reset.

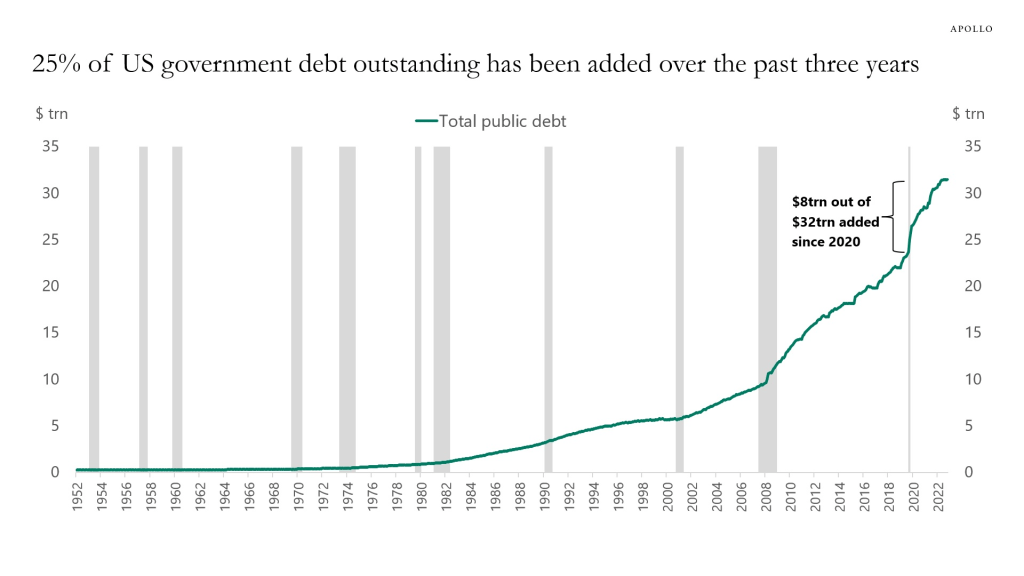

You had Yellen in front of Congress like a year ago, talking about the glide path to $50T. And, she was not concerned. Why? The MMT concept discusses a growth strategy out performing debt – so all is well. For example, imagine you have $1000 a month in credit card minimum payments on $35k in debt. While you may make $100k, the debt payment is sort of fixed. Yellen, in a sense, said that a monthly payment of $1500 won’t matter on $50k in debt, because our salary will go from $100k to $125k.

In a sense, debt doesn’t matter because of growth.

The problem is this. We have a bunch of Western countries playing this MMT money game, and the cultures that are thousands of years old are buying up gold and making their own playground with BRICS. Meaning – Yellen’s thoughts of $50T don’t have all of the world onboard with this. And, what this means, is that we would need to issue a LOT more debt – which if there are scant buyers – drives rates higher and higher and higher. However, there’s no real promise in wage growth. On the current trajectory – the only way to keep costs affordable for Americans is to import a virtual slave workforce and get everything we buy made by slave labor in SE Asia.

The reality is, if we had continued on this path, debt would have continued to climb much higher – and because rates would continue higher anticipating inflation, this curtails growth because taxes need to increase to pay the nut. Any possible wage growth is offset by higher taxes. Furthermore, the Biden/Harris admin was against oil exploration and with this – higher energy costs are also inflationary. Higher prices are thus needed to support the diesel getting the raw materials, the diesel to ship, the energy needed to run the plants, and the energy needed to ship finished goods to stores.

This meant, the only way out of an accelerated “crash up” inflationary scenario would be to cut spending.

If higher government spending and energy prices were inflationary, lower government spending and lower energy prices are deflationary.

Deflation vs. disinflation

For the last year or so, Biden’s team was flaunting success at bringing inflation down to make things more affordable for families. This was gaslighting people into a reality that didn’t exist. Most people do not understand what inflation measures. It measures the year over year price increases or decreases. If prices rose 2.5% last year, that’s 2.5% inflation. But the year before was 4% inflation. The rate of inflation went down from 4 to 2.5. This is called DISINFLATION. That is, the rate of INCREASE slowed. This is different from DEFLATION where prices go down.

Assume for a minute that most of Biden’s presidency around me saw about $3.80 gas prices on average. Your region of the country varies, but mine was over $4 for a lot of this. If Trump signs the Keystone Pipeline back into the plans, and allows for more permits and exploration, and reduces regulations to make things happen faster, it’s very possible we can see $1.90 gas again. Now, maybe I’m overshooting a bit, but I wanted some simple math. That means that the price of gas is 50% LESS. This is DEFLATION.

Likewise, the left wanted to tell you all about price controls, and “greedy” people. That’s not how capitalism works, in reality. Assume for a minute that you have a lumber company. A 2×4 might cost $5. This cost again is in fuel needed for equipment to saw trees, transport them, mill them, and transport them to the store. If your fuel costs go down 50%, and this is 40% of the cost of your production costs, it means in the SHORT TERM lots of more profits. However, because this is a competitive system, saw mills may start to lower prices to capture more market share. The short term profits are great, but these start to head back to normal after a few months.

At the store, I may now see the 2×4 at $4 instead of $5. This is a DEFLATION in cost, simply because energy prices were much lower. However, now take into account that the saw mills may have less regulations, to further drive down their costs another 10-20%. Maybe some level of safety is given up here, but the price of the 2×4 may then come down to $3.50.

This is the result of lower energy costs and regulations. This DEFLATION is good. You can buy MORE with the dollars you have, which is the reverse of inflation. Those who may have been on the sidelines about building a deck – now see prices for supplies perhaps 40% lower and want to build a deck. This starts to pick up sales and economic activity.

Likewise, we now may be in a situation where borrowing to do things can be reduced, as well. Imagine you wanted to borrow $40k to do a deck, but rates were 10%. Now, the cost of the deck is $30k and the rates are 4%. This is now a great time to borrow money to build a deck!!

So – Trump’s agenda is meant to be deflationary with energy and regulations.

Deportation

We now have an idea that there’s maybe 20-25 million people here, illegally. No one on the right has looked at this group of people and said, “you know, they are all bad people and need to be in cages and arrested”. Rather, what we HAVE wanted, is increased LEGAL immigration, where people that are coming in can be properly vetted. Reports now have that 13,000 of the ILLEGAL immigrants in this country today have been found guilty of murder. Another 16,000 were guilty of sexual assault. When people come here, they then have children, and those children are now US citizens by birthright.

Our system is broken. Those on the far left are trying to tell you laughably, that “all of them are safe and good people, trust me bro”. On the far right, they want to convince you that every single one of them is a gang member ready to murder you. In reality, many of us are cognizant that probably 80-90% of them are trying to escape drug cartel life in Mexico. We have seen many of these people doing landscaping work off the books for years when it’s 105 degrees out. No one is saying these are bad people. But they skipped the line, and came here illegally. Should someone who has been here and done nothing but work hard and send money home to their family be deported next week? Maybe not. Maybe that’s the former liberal coming out in me, but how business really operates is with a Pareto chart.

80% of the problems are from 20% of the causes. This same rationale is used within law enforcement. Maybe you have someone with a mile long rap sheet who just robbed a house. There’s probably 50-100 other crimes the guy did he was never caught for. By putting THIS GUY away, you then prevent a lot of other crimes this guy would have done. Arguably, someone who is here illegally and has done nothing wrong since being here may not be in the top 7 million they want to deport. And, Tom Homan knows this. It doesn’t mean they should NOT be deported, it’s just that’s not where you are focusing your dollars at this point.

What Homan needs to do is to use a big stick and limited resources to first target the worst of the worst. Get rid of the MS13. The Venezuelan gangs. Those 13,000 people who were murderers. 16,000 SA offenders. Get them out. Anyone part of smuggling people or drugs. Get them out. Have you committed a violent crime since you’ve been here? Gone.

Next, you need to really dis-incentivize people coming here.

- get rid of the free food and hotels. This will put a lot of people on the street. Those in the hotels, today, need to go. This prevents a lot of future homelessness and crime here, and it sends a signal to those coming that there’s no free food and housing for them

- write into law that if you came here illegally, you are banned from ever being a citizen. This is splitting the difference here. They can never vote, ever, in federal elections. However, it doesn’t mean they cannot apply to become a permanent resident. This allows for the integration of many law abiding citizens into our country – but also does not reward them with citizenship, social programs, or social security.

- Special forces start to take out the drug cartels in Mexico. They need the approval of the president of Mexico. If the top people there are being decapitated, week in and week out, this then can start to drive them underground and remove a lot of their power. Disrupt their operations. If we know who the bad guys are, and where they live, drone strikes in an hour next week could take out the top 50 drug bosses in Mexico. If you have drug cartels getting dismantled, there are less people that need to come to our borders. To fix this problem long term is not to have an open border, it’s to pressure Mexico into allowing us to help.

My guess though is over the course of 4 years, border crossings may drop to near zero. At the same time, I can see 1 million or so deported that are real criminals.

This is 1 million less people living in apartments. 1 million less people working somewhere. Whether it is being a mechanic, a day laborer, a landscaper, a cook – there’s potentially a lot more vacancies in apartments.

We are told always there’s a “housing shortage”. Well, when you have 10 million illegals crossing in 4 years, what did you think was going to happen? They soaked up a lot of the rental units – and citizens, green card holders, and temporary workers then cannot afford to live places because it bid up the rents.

I do not think there’s a GOP person out there who thinks Homan can deport 22 million people in 4 years. The left wants to talk about how they contribute $100b in tax revenue, but are missing that they are estimated to cost us $200b in services. But even deporting perhaps 1 million people and closing the border stops our flow in – and can cause lower rent costs and reduced costs of police and jails – and essentially making our streets safer from gangs. When streets are cleaned up, investment can be made. No one wants to invest in a high crime area.

But those jobs!!

I’m seeing how people like to say, “well, if we deport them, who are doing all of these jobs that Americans don’t want to do”. I think this is about the biggest crock of shit out there they have fed you. When you bring illegal aliens over – and they are sleeping 5-10 in an apartment, they live pretty cheaply and with this – they are the people who will work for cheap. Growing up, maybe as a kid you walked the neighborhood and tried to get someone to pay you $5 to mow their grass. As an adult, we all just mow our own grass. However, commutes became longer. Hours at the office became more. We all needed to go to grad school to keep our jobs – so we then found ways to outsource cleaning or lawncare to a company who promised to do it on the cheap.

If you pay $30 now for a lawn service to mow your grass, and they are illegals who are doing it – the lawncare company is in violation of the law. I have heard of landscaping companies having a terrible time finding workers, even with 22 million illegals here now. Why? Because perhaps the cost of labor is higher, because it costs more to rent and eat. That landscaper may need to raise his prices to $40 for a cut in order to pay people more to work for him. In reality, maybe people then stop paying a service to cut their lawn and decide to do it themselves.

Maybe if we deport 1 million of these, it then creates problems finding cheap labor. If someone offered you $300,000 a year to mow lawns, would you do it? Of course you would. But maybe you wouldn’t do it for $10,000 a year. Illegals would.

If you deport them, would costs go up for things like this? Yes. However, we have another thing brewing.

DOGE

I believe Elon and Vivek are about to take a weed whacker to government. Those entrenched in Washington are of course, going to fight. Dems are fighting this. But I can see inside of 6 months that many agencies are either disbanded, shrunk in size, or moved. Let’s review…

- disbanded. Maybe you have an agency like the department of education that has been controlling culture of schools for decades, and not in a good way. All states have their own department of education. My local schools are funded by the tax money I pay in school taxes. My local school district doesn’t really NEED the department of education.

- Shrunk in size. Maybe Elon finds that much of what NASA does can be done 10x cheaper by companies like his. Maybe funding is cut in half. Maybe the DHS is shrunk by 75%. This will then shed a lot of employees.

- Relocated. I worked in federal government as a contractor for 15 years, and with this, you learn about the GS pay scales and location adjustments. For example, maybe a GS 13 paid $105,000. However, each different location in the country then adds to that base, based on locality costs. The DC area had the highest adjustment, and maybe that GS 13 there makes $140,000. Assume you then take 2,000 people who work at the USDA and relocate the department to Oklahoma around a lot of farmers. Maybe of those 2,000 people, 500 are offered relocation packages and 500 new jobs are added in Oklahoma. The building costs less and the labor costs are less. Maybe relocating an agency with shrinking its size saves the taxpayers 50%. Overall, as a lot of these agencies are relocated, it starts to cause massive deflation in the DC region. Rents/houses start to go down in value as people leave to move to OK and perhaps many who lost their jobs need to sell their homes.

With DOGE, you can see how this is deflationary to taxpayers – which allow for lower taxes to do the same tasks.

But what also may happen is millions of people will lose their jobs. This is very scary for the swamp. The swamp fought back against Trump in 2016, and this time he’s coming with a 12 gauge and a team of people to completely disassemble them.

This is going to be very deflationary for the DC region. Many may then sell their homes and move somewhere completely due to the cost of living there and no jobs now.

With perhaps 1-2 million deportations, it’s also possible that many of these jobs are now open. Maybe if you were a GS15 you aren’t wanting to cut someone’s grass next week – but jobs will be out there for people to take. If you own lawncare companies and cannot find workers for low wages, the wages need to increase or you go out of business. So some of these people might get unemployment, and then work off the books 40-50 hours a week with landscaping. Not glorious, but can put food on their table until things stabilize.

This may then also have a lot of these people selling stocks. Maybe that GS15 isn’t mowing lawns, because he or she has $250k in stocks. They start to sell stocks to get by. They can’t afford their new $130k SUV with a $1500 per month payment.

College

Trump has talked about putting together an online university for the US called the American Academy. I wrote EXACTLY about something like this in July 2020. I had brick and mortar colleges as well as online colleges, and can tell you that the university system is ripping people off today with the brick and mortar costs. Online is much more cost friendly.

But he’s offering this – for free – where people can get bachelor’s degrees that are recognized by the US government and US government contractors for work. The cost of this to the taxpayers is negligible. A rounding error. What this WILL do, is start to suck the kids out of the brick and mortar schools first that are charging $70k per year for a gender studies degree.

A major cost in colleges that have gone up had been with administration. Many schools have a lot of DEI now, and it’s quite possible many of them are out of work inside of a year or two, as colleges will need to bring their costs down if they want to compete.

The current system now has the US government paying the colleges money for the students to borrow – then the kids have this debt probably for the rest of their lives they have to pay. Those who do not graduate, are out $20k, 60k, maybe even $100k without a diploma and are buried in debt. That money was borrowed into existence and paid to a school. This “American Academy” also allows people who partially finished college to go back, get credits for what they did complete – and finish their bachelors at no cost.

This is good for ANY parent with teenagers and wondering how the hell you are going to pay for college. Now imagine you are an inner city child – and college was never possible due to cost. You can now take this, get a bachelor’s degree, and get a “good job”.

But in the process, I believe this is going to be highly deflationary for the traditional collegiate system. I believe the bigger colleges that might have 100 DEI admins of sorts – all may be out of a job soon.

This is HIGHLY disruptive to the existing college system. And – he talks about a new accreditation system that gets wokeness and politics out of colleges.

Overall, higher education costs are about to collapse and I can see a lot of colleges going under.

This is very, very good for the consumer.

Housing/rents

I believe that places like DC may collapse in housing costs and rents, as jobs leave the beltway. Likewise, smaller areas like a minor city in OK that gets the USDA (example) may see an uptick in housing values, commerce, and rents. What most do not have a clue about is how hollowed out most of rural America is, and relocating a lot of these 450 government agencies all over the country can have a significant effect on more rural areas getting jobs and increasing home values.

However, I do see millions of people losing their jobs ahead. No way around that. The hope is that many of these people can pick up jobs in other private sector industries. If you were a GS 13 accountant for OSHA, you could be an accountant at Bob’s Tires in a more rural area.

Tariffs are something I’m very much looking forward to. Things like avocados that we really don’t produce here much (maybe in CA we do, I don’t know) – we would not tariff. But people talk about how Europe and Japan may have tariffs on our Ford and GM, but we do not have tariffs on their Mercedes or Toyota. It makes sense to simply defend our brands. Period. If you are looking at a Toyota or a RAM for a truck, maybe the Toyota is $5,000 less. Well, put a $6,000 tariff on the Toyota. This forces them to buy the RAM if they are being price sensitive. And, perhaps we can have lower rates for American-bought products. So maybe a car loan today is 6%, but if you buy the RAM there’s a special 1% rate. Essentially, this has the effect of buying the more expensive American car, with the monthly price payment of the lower priced Toyota.

What can happen then is the tariffs boost sales of American products. These companies want to start expanding and need people. Now, a great accounting job is open at RAM in Detroit, and the former GS13 accountant who took a job at Bob’s tires now is making $35k more a year working for RAM.

This has a net effect of promoting US companies and taking workers from the federal sector and making them available to the private sector. However, taxes are lower. Gas prices are lower. Rents are lower. House prices are lower – due to a lot of the unemployment.

Remember, we also deported about 1-2 million people, so there’s a lot of rental vacancy.

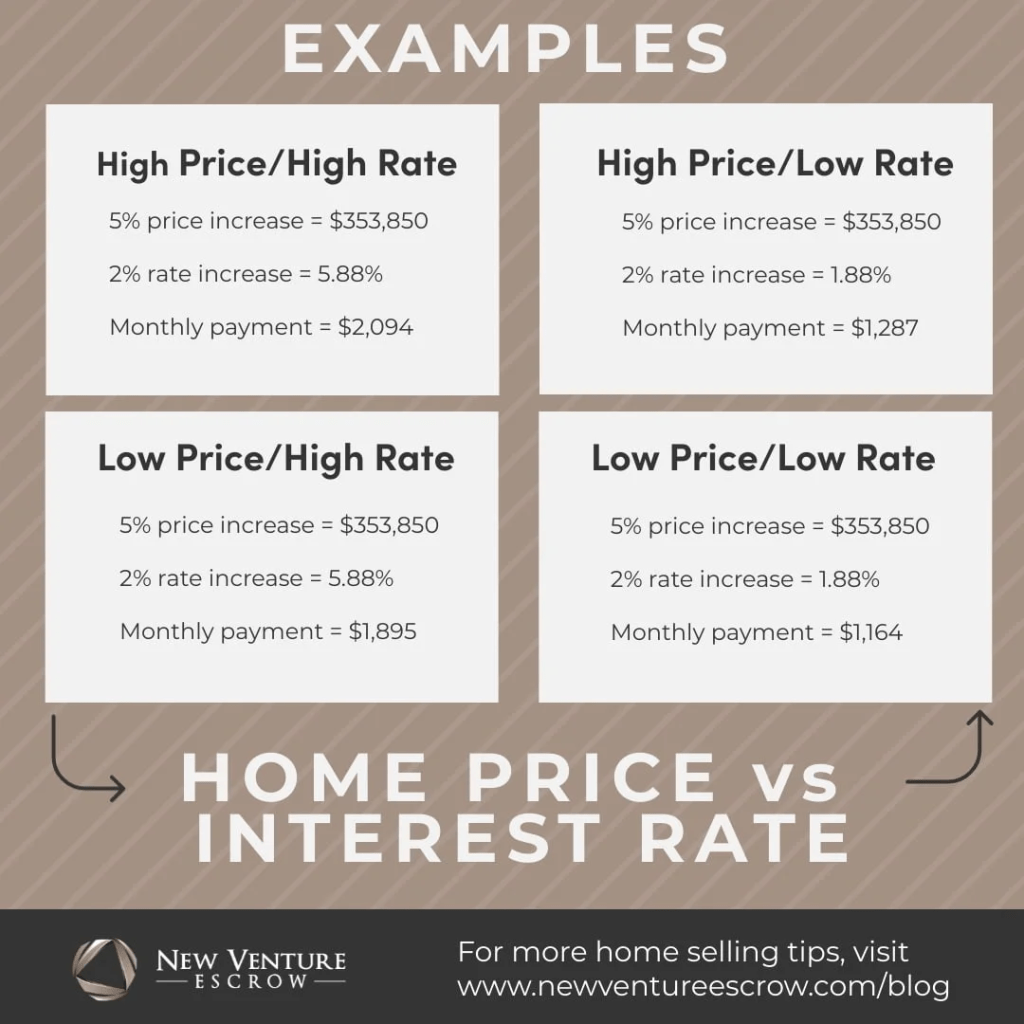

What I can see – easily – is home prices get smashed as unemployment goes higher. Then, rates start to fall and this is deflationary with respect to the monthly cost of housing.

Gold/silver

I heavily invested in these – and rotated out of most of my miners and some of my physical silver. This was my inflation hedge, and made money. Now, if there’s a massive deflation ahead, these assets may be sold. Maybe there’s unemployment going up and they need to sell to pay mortgage payments. Maybe they sell because the house down the road is 50% off and they want to buy it at a discount.

As much as I felt this is a great bet with inflation ahead – IF indeed DOGE does what it says, and shrinks our government and costs, deflation is probably in the near term – by a lot. This may have people who bought gold at $400-$600 sell for $2700 USD and hold the cash to then bargain shop for things during this deflation.

I will always hold silver, but a good part of me now is extremely excited about a bargain buying opportunity 6-12 months from now.

This is predicated on IF deflation happens. While gold does decent during inflation, it has run so hot, so fast, at the very least a correction to $2000-$2200 is entirely possible. Silver? I think structurally silver is going to explode, but in a near term – you could see people who lost jobs selling their silver, or traders who get smoked to get out of their silver longs.

Stocks

Near term right now, you obviously see people happy Trump won for business. Less taxes. Lower energy costs. It means more profits. But the problem here is that I do expect to see in the next 12 months, millions deported and fired.

This means less sales, of just about everything. People still need toilet paper, but you could see how less illegal immigrants could mean less rents. Less sales at the grocery stores. Less sales at Walmart and Target. Unemployed people pinch pennies. Stop buying houses and cars.

At the end of 2019, I was with many others warning of a crash coming. While COVID hit, there was a crash coming anyhow. The “recovery” from COVID is what led to “money printing” and massive inflation. Much of this was then tucked into stocks, and all of the sales all over the country made companies cash rich – which then had them do stock buybacks and make people more wealthy in their 401ks and stock trading accounts.

If you look closely at that, we are now at a peak of 38.16, and we are far past the 1929 thing. The greatest two financial events of my adult life were the dotcom bust, then the global financial crisis. Pretty much no one under 38 has seen a real recession in their lives – and with the Yellens of the world talking about $50T in debt – they legit tried to never have a recession.

Which led to pink Mac books and $300 headphones. And, runaway inflation. Costs have been impossible to keep up with.

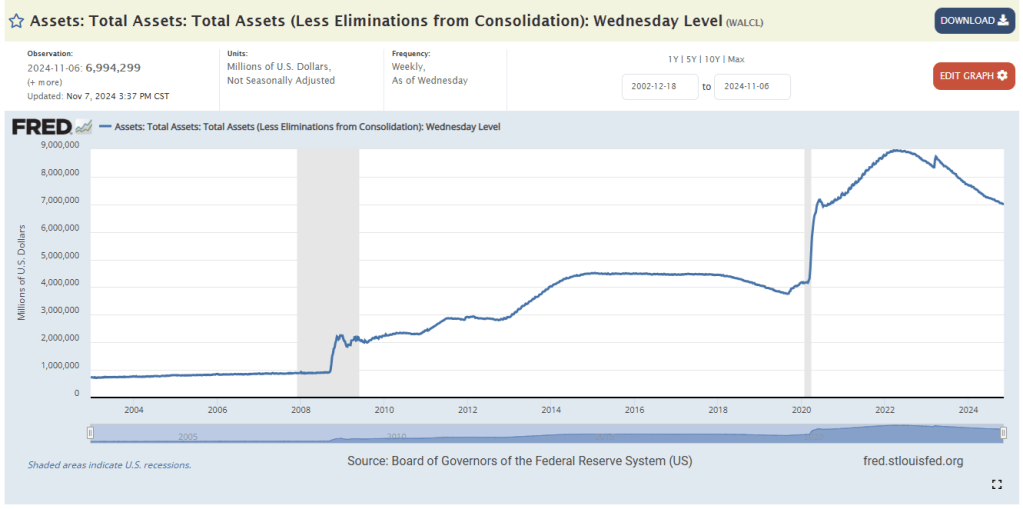

Above – a lot of that inflation was driven by energy costs going up – but it was also near zero interest rates along with the fed buying treasuries and mortgage-backed securities (MBS). Given that the relationship between rates and value are inverse, less people wanting to buy a 10 year at 2% would make rates go higher. If the mortgage rates for homes are about 300 basis points higher than the 10 year rate, you saw how buying debt and MBS could keep mortgage rates ARTIFICIALLY LOW to then stimulate the housing market.

But the Fed hit peak insanity at approximately $9T in 2022. Since then, they stopped buying and have been selling into strength.

IF – increasing Fed balance sheet, high energy prices, and near zero rates were highly inflationary………

Bringing DOWN the Fed balance sheet, reducing energy prices, and having high rates is……deflationary. There is a fuse to this, and literally any day a bad jobs number can make the stock market shit the bed.

To recap,

- stocks at all time highs

- precious metals at all time highs

- real estate at all time highs

- Liquidity is being sucked from the systems

This is a grenade pin that was pulled a long time ago.

We also have Warren Buffett now at $325 billion in cash. Why? If “cash is trash”, then why would America’s most savvy investor have that kind of cash horde? Could he have seen how overvalued everything is? Could he have seen that government will have to stop spending money? Has he seen how the Fed and reverse repo is sucking liquidity out of everything?

You can see how a lot of these banks who were told to buy debt in 2020 at stupid low rates have been killed with unrealized losses. How many of these banks might go under? Would it not make sense to let many of these fail?

I have also written about the commercial real estate tactical nuke about to hit us. I was early on that – also in July 2020. It made a lot of sense to me back then, that if all of these people could work from home, why would businesses pay for expensive offices? We have seen now with Pfizer, Amazon, and other companies “directing employees back to work” that they seem to be trying to utilize their office space. In reality, it seems like these are also tactics companies are doing to make people quit so they do not have to pay them severance. You can see, however, many of these office buildings are about to take a major haircut in value.

Regional banks tend to hold a lot of these notes, and may be the most affected. Owners will just throw the keys at the bank, and the bank then may have a $700m building that is only worth $125m. Those types of write offs may start to happen, and sink a lot of banks.

This is deflationary for office space rents.

We also have corporate debt below – so a company maybe for 30 years kept rolling their debt over with lower rates. Many might have the cash now to just pay them off – but I had read at one point a few years ago that 38% of the S&P 500 are “zombie” companies. You have seen a lot of companies declaring bankruptcy lately. One I had seen was TGIFridays. In 2025, many companies will have these notes due and become dead, overnight, in a sense. Mass layoffs to come in 2025.

Conclusion

2025 appears to be a year of a lot of pain. But for those people who have seen 30% more at the grocery store, and no more in their paychecks – it is reasonable to start seeing prices actually come down. It is possible that with mass government layoffs that we see home prices come down. Deporting millions of illegal immigrants may decrease rents. For those who wanted to buy in on stocks or hold or bitcoin and felt they missed the move, 2025 may bring a world of hurt for you to buy in. Maybe you wanted to buy a motorcycle. A boat. A tractor. Toys and gadgets may start to flood the market as people scramble to pay their mortgages.

Pain is 2025. It’s going to hit a lot of people, everywhere.

The good news is that it looks like this is going to bring prices back down to normal. The bad news, is we might see 6-8% unemployment.

But, consider – you were worried about being able to send your 2 children to college. They could go to the american academy for no cost and get a bachelor’s degree. Not only are you not incurring debt, but your kids now can get a college degree and have no debt. That is deflationary.

Consider if you do have savings in stocks, or precious metals – you may want to get to cash, because as a deflation hits, the cash you have starts to buy a LOT more for your dollar.

Overall – this can be scary. But on the good side of this, our country will fix our debt issue, finally – and with this, people will see much lower prices and have a lot more cash in their pockets.

Leave a comment