I don’t know. No one does. But it doesn’t mean we can’t do something about it.

I started off writing this as a different piece, but figured I’d wind up on some list somewhere, so let’s just do this – take a look at the current currency wars, and from there – perhaps hedge our positions?

Many just look at gold or silver as “moon” – but have little context or understanding as to the “why”. I dug into the supply and demand over the years with silver and this led me to an “all in” position, mostly. I am a serious mining stock investor. Furthermore, most see the concept of buying silver at $25 and selling at $100 as a given – but don’t realize with that 4x, a loaf of bread then may cost you $16. However, some junior mining silver stock might to a 25x.

Here, I want to kind of take a look at how the US is a bit vulnerable with this. Recently, it has been reported that Mark Zuckerberg and others are building these doomsday shelters. Are they expecting civil war? Maybe not – what you start to see is a HEDGE against “what if”.

The 50,000 ft view

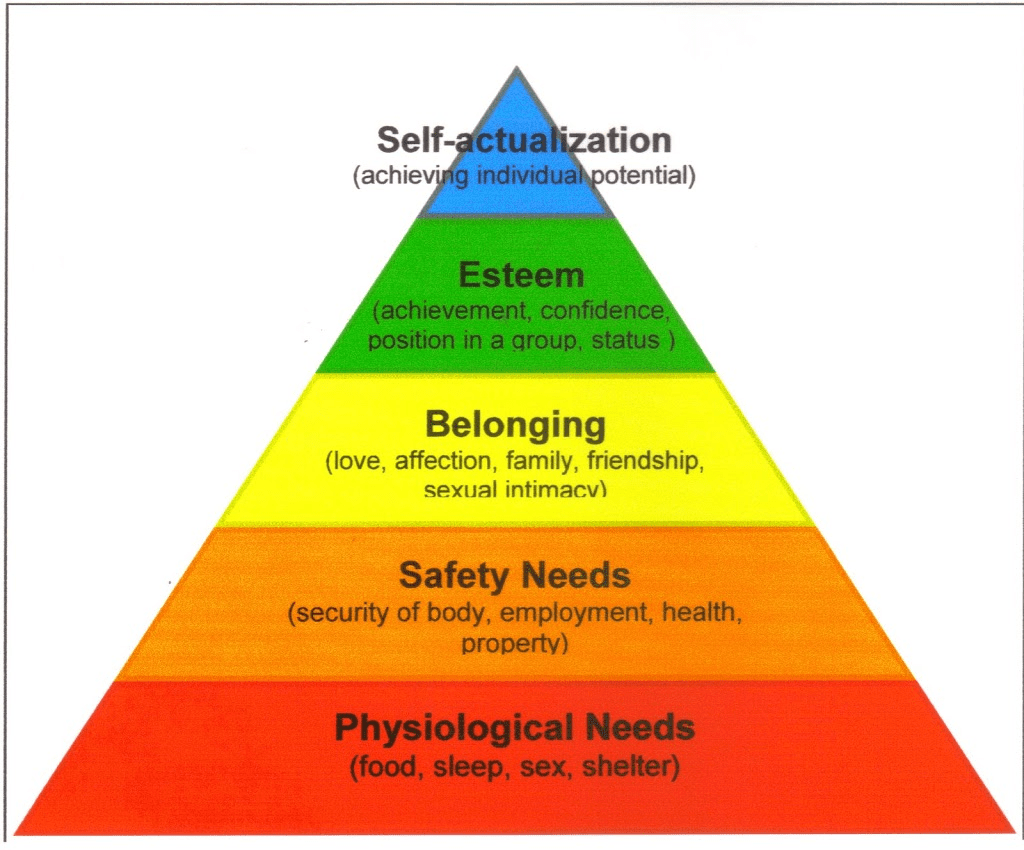

Most of us learned this in psych 101 as a freshman in college. To me, it stands the test of time today. However – there is one flaw with Maslow’s hierarchy of needs: it’s linear rather than iterative. Consider the Zucks or the Musks of the world, and you can easily start to see people who are on the path to self actualization. You have the Gates of the world creating billion dollar funds to give away money.

The main issue here with Maslow is this. WHEN are you in time? WHERE are you in time? Maslow’s needs need to be addressed almost daily, depending on what your political situation is. Meaning – one day you are considering retirement and the smoking jacket with the pipe in your study, and the next day you can have riots happening outside of your house. I don’t think many have taken into account the risks that are internal to our country today.

The issue is – I believe – that with their extraordinary wealth and status, people are whispering in their ears about revisiting 1 and 2 in Maslow. Why? Are they betting on doom? Not necessarily. What they may be doing is assessing – “hey, there’s a 5% risk of this event. We have $80 billion dollars. Perhaps we spend a few million of this hedging against that downside risk”?

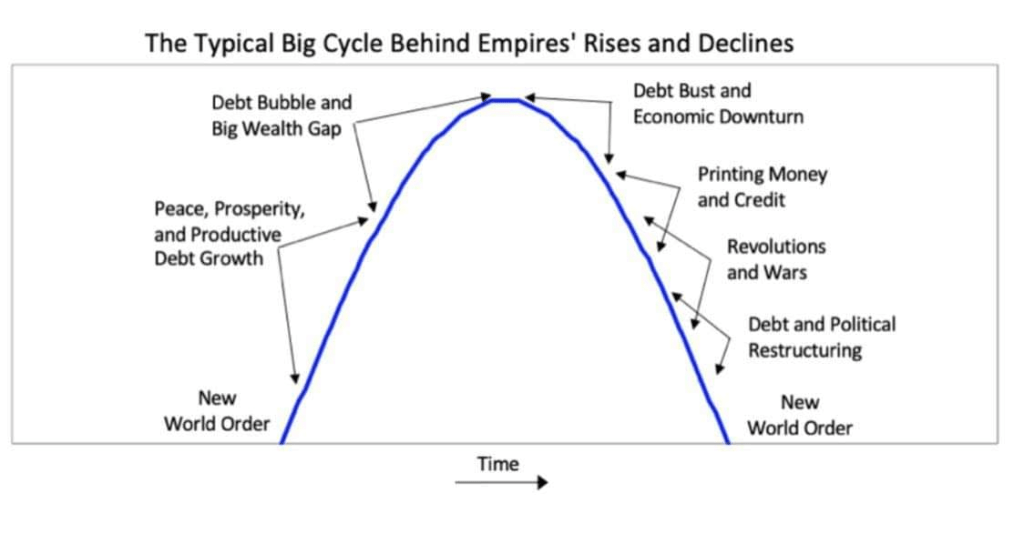

You need to understand where you are within your empire cycle. Think about France, 1789. We all know what happened then. Consider you strike it rich in France in 1788. What happens when they come for you in 1790? What if…..what if the US is France in 1786? What if 99.9% of people just aren’t aware we are in France in 1786? What if – many countries are France in 1786 right now?

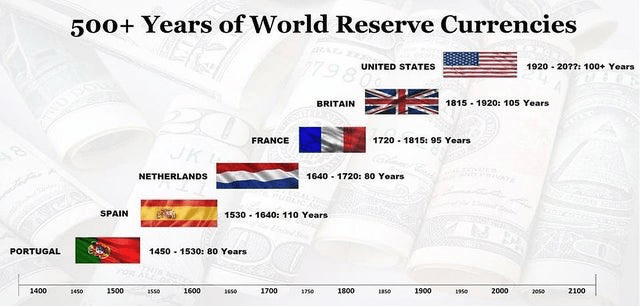

What if….what if these cycles also had something to do with their currency? Look at France below.

Furthermore – what if the 4th turning theory also has some sort of correspondence with the timing of this?

What is happening to a nation or empire over this time???

Before I go further with this, I have enjoyed sparring at times with Mr. Milkshake. I find his thesis compelling. So far, a lot of data points have supported it. However – if you had listened to enough of his interviews, he was very much using gold as an end game. Many of you just saw DXY 130 or 150 and got angry. But if you listen closely, he does advocate for a gold end game. This is lost on most people sparring with him.

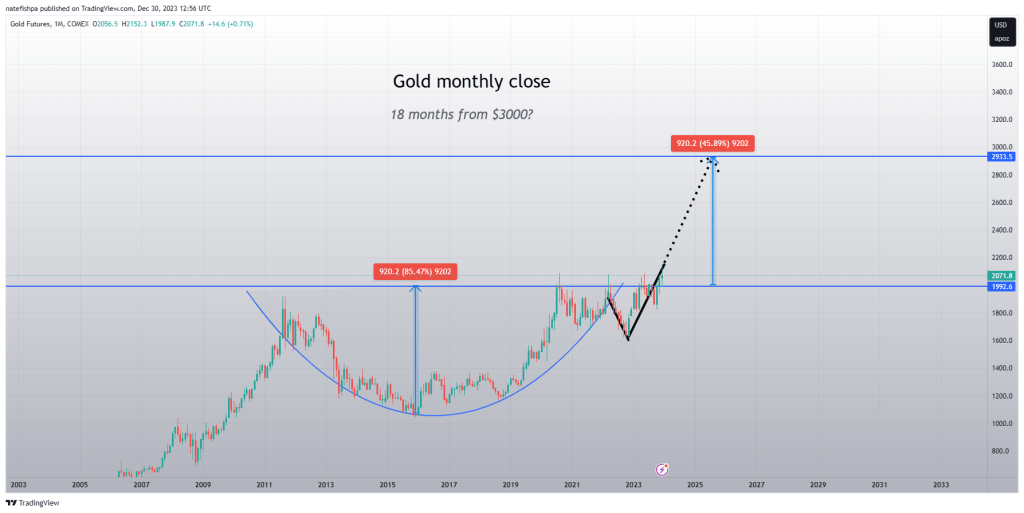

So there essentially are two major camps within the gold sector – “dollar is dying” and with this, gold (and everything else) must go up. Camp two is also talked about with the Dents of the world – where there is a move much higher in the dollar first (due to a deflationary event) – and THEN you have gold as the end game.

Both camps just simply fight over how long the dollar has or when gold is going to take over.

Schiff got into a 2 hour debate with Dent once and sort of mopped the floor with him. He more or less asked – “if you agree with me that gold is the end game, why are you getting cute trying to predict the dollar going up first”? The idea, I believe, is to max your gains. But Schiff was like “what if your scenario never happens, and mine does”? Essentially, he was saying that if all parties agree gold is the end game, you are adding unnecessary risk to bet the other way first.

We can also see how since the GFC, nations at the central bank level have been hoarding gold.

Two dimes

I bring this up in all of my writings, but I wanted to tie this to something tangible, and then demonstrate how this relates to the hollowing of the middle class. I showed my step father a few days ago two silver dimes. I told him, “back in 1964, these bought a gallon of gas. You take them to a coin shop now, you get the silver converted to fiat, and you can buy a gallon of gas”. This analogy I have used over and over, but this is where it starts to make more sense.

The issue here has been the complete and utter debasement of currency. And, what has happened – is that the richest people have continued to acquire more of the newly made dollars than the poorest. This has led to a “hollowing out” of the middle class here in the US.

It’s hard for people to grasp this….but let’s play with some math here. Let’s assume wages go up 2% per year, and assume inflation is 3%. We know the CPI is rigged, and the inflation is actually much higher.

If you look at prices over the span of 40 years, you see that the wages don’t keep up with the most important spending we have. Year over year, you might see a 2% raise in your paycheck and are happy!! Then you see your taxes went up on your home, your health insurance went up, and the cars you were looking at are more expensive.

This is the HOLLOWING OUT of the middle class. What I mean by this is that over a good amount of time – IF you just kept working the same job for 40 years, you would be able to afford far less than when you started your career. Meaning, the dollars you get for your productivity do not keep up with the dollars to sustain your life.

If you go to graduate school, invent something important, strike it big with crypto, strike it big with stocks – many of those people do not feel what the middle class does.

But all one has to do here is simple math. Take the wage, and divide it by the item, by year. For example, your wage in 1980 of $20,000 divided by the avg home cost of $47,200 was 42%. Now if we do the same exercise 40 years later, we get 18.22%.

Before you throw a flag on the play, I know why this is. We have been in a deflationary period in this country. Wait. What?

You see interest rates going down. But all of the costs of things….went up? That’s inflationary!!! Wait…the M2 supply has gone up as well. By definition, that is inflationary!!

Now we tie a lot of this together….ready?

You can borrow more money at cheaper rates. This incentives people to buy shit. New homes!! Suddenly, the demand goes up for new homes. The cheap availability of money has then allowed for it to compete with scarce resources. Materials and labor. In 1980, the materials are made in factories here, and we have union employees.

Capitalism, for better or worse, is about efficiency. Now you have 10 home builders getting all of this work. Their materials costs skyrocket. The availability of labor is non-existent. What they happens is other markets are then opened up to compete for bidding. Maybe you can get wood cheaper from South America shipped here? Maybe the drywall can be made cheaper in Mexico? Maybe the light fixtures can be made cheaper in China? And who needs union labor when you can get cheap day labor?

The availability of CHEAP MONEY then DRIVES DEMANDS for SCARCE RESOURCES. This then drives production of materials to the cheapest places it can be found, and then also finds the least expensive labor to get the job done.

By opening up trade to everywhere, we then allowed all of these countries to compete to make products cheaper than us. Our manufacturing base left our shores perhaps 30-40 years ago.

Cheap money did this. Not only did a lot of jobs leave – but cheaper workers were introduced into this country. It’s efficient, and this allows the corporation to continue to exist.

We send dollars all over the world, and they send us goods. We keep borrowing money into existence, and this continues to create a situation where scarce resources are bid up. With MMT, this is a never-ending orgy of deficit spending. The problem is about to come crashing down. Why????

Because we have hit the wall of people buying that new debt. According to Business Insider, nearly $8 trillion in debt matures in 2024.

In addition to that, you figure another $2 trillion or so deficit will occur. I first saw some of these numbers awhile back, but I was reminded of them a few days ago with Dave Kranzler’s Mining Stock Journal.

What you see are the Yellens of the world not blink an eye at $50T in debt – the MMT way of thinking is taking capitalism beyond what it was meant to be. We try to continue to offer cheap cash, and with this – those who are closest to the creation of the dollar benefit the most.

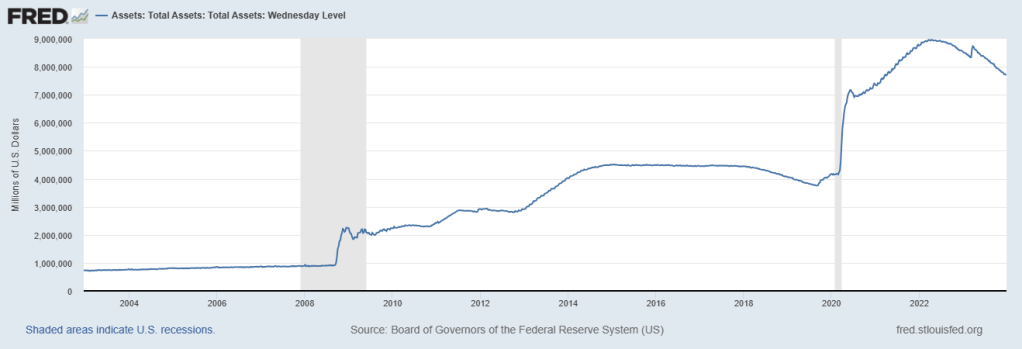

But what if in 2024, less and less countries want to buy treasuries? Would that not insinuate that rates would go significantly higher? Yes – only if the Fed doesn’t intervene. Remember, banks are underwater, a lot, on the notes they bought. The Fed had to bail out banks by essentially giving them a warm blanket of reassurance. Yellen keeps plotting on, and Powell is then left to clean up the mess. Powell has said many times, he doesn’t plan on buying more debt. In fact, he wants to take the balance of the Fed down, a lot.

With the Fed, it’s all be about liquidity. Here is the reverse repo sheet which has kept liquidity in the system.

Many speculate this is then being used to buy treasuries, and once this runs down, there will be no buyer. The speculation is perhaps by March this could be drained.

The question then is – who is buying this debt? Could we see 6-7-8% rates needed to entice foreign buyers? What about all of the dollars that are overseas? Could we possibly see a lot of those dollars coming here – not to buy treasuries, but to perhaps buy gold, real estate, and stocks? Are we already seeing Shanghai offer higher prices for gold and silver to drain our stocks and give us dollars for it? Think about this – you buy silver in USD from all around the world. You take delivery of this silver, then sell it to Shanghai for a nice arb!! Wow!!

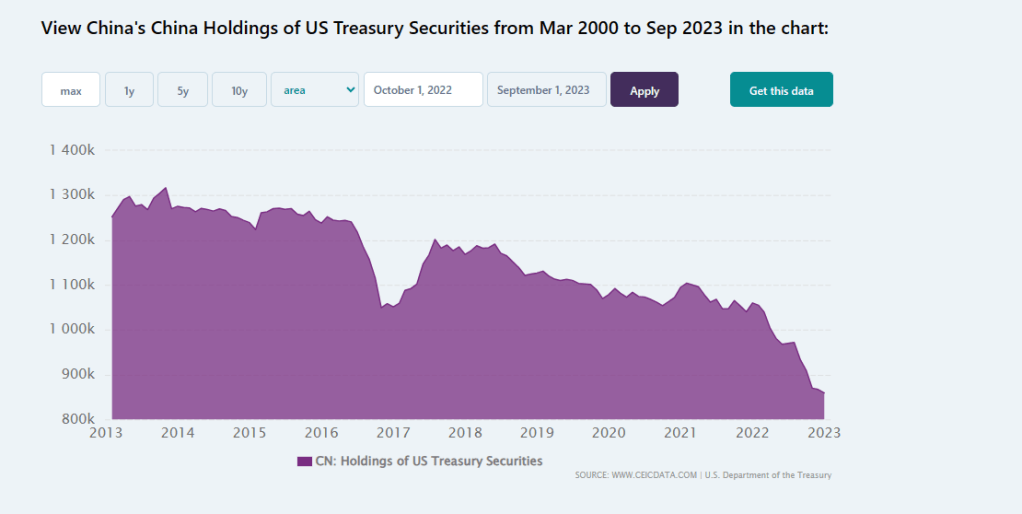

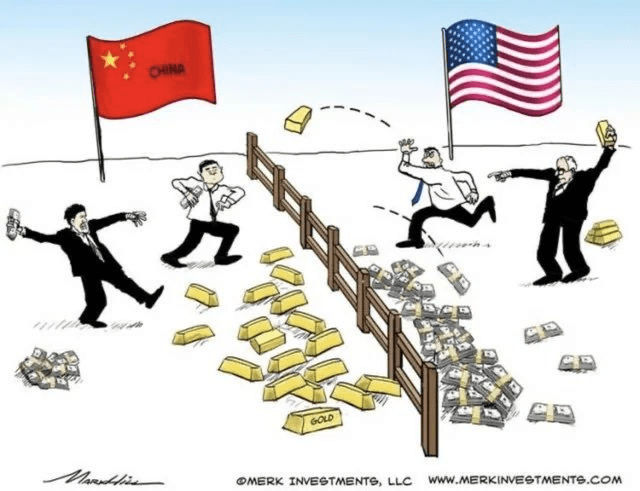

So China – who is using perhaps dollars they want to get out of, are offering higher prices for precious metals to then, over time, in the darkness of night, exchange fiat for PMs. Furthermore – this could be constant liquidation of US treasuries to fund this effort.

Meaning – you can see our once biggest holder of Treasuries slowly getting away from this.

We have heard recently about the problems with Japan – then needing to sell Treasuries to get dollars to buy yen to defend the yen. So these guys might have a problem buying a lot more Treasuries.

However, foreign owned debt isn’t the biggest owners of debt.

You can see now with the Fed balance sheet, they are a massive holder of the debt. Now, let’s do some fun math here….

- The largest FOREIGN holders of debt appear to be selling our debt, or perhaps letting them mature and not buying new.

- The largest domestic holder, the Fed, appears to not want to buy more, but actually unwind a lot of this. While it may not be an active seller, it may let items go to maturity and then not buy new.

If these two entities account for maybe 55% of all of the debt held, and THEY are not looking to buy a lot of the $10 T that may be issued this year, who the hell is buying it?

I have to keep bringing this up….if you are a dividend stock holder, and you are getting a steady 3-4% each year, and the treasuries are giving 7%, would you not sell that stock to buy the Treasuries?

If foreign countries are indeed looking to slowly de-dollarize, would it not make sense to avoid buying more debt? IF they see the value of what they have about to collapse, would they not want to unload it?

It tells me a few things may happen in 2024:

- Treasury rates will have to go higher, which may break the stock market with people rotating out of many stocks, UNLESS

- The Fed becomes the buyer of “last resort” AFTER something breaks, as a form of QE.

- This never ending debt creation has to hit a wall – and with it, the first thing that needs to happen is slashing government spending, eventually.

If indeed there is a print of $10T, that would weaken the dollar, by a lot. This is potentially good for gold. However, at the same time, you would be seeing higher rates giving yield – which can have stocks being sold, providing temporary demand for the dollar and holding the line. This cash may rotate into treasuries. Gold does not provide yield, however, it may be apparent we are in the end game as rates that high also indicate auto loans, real estate mortgages, and business debt may all carry very high rates and put a deep freeze in all of these industries.

This deep freeze is where the Fed has to come in, again. This should, in theory, tick unemployment up to 5%. Many people will be forced to sell their homes and eventually, their AirBnBs as vacationing and discretionary spending slows. The Fed will intervene ONLY when things break, not before. Remember, the Fed already bailed out a lot of banks who bought the Treasuries at 1% and they lost a ton on the mark to market at 4%. The ideal potentially was by 2024 the rates may come back down and the banks would have much less losses. However – if rates are about to go to 6-7-8%, the unending number amount of bank failures in early to mid 2024 can be staggering. The Fed will need to extend this program and expand it in order to keep the banking industry alive – OR they let a lot of these fail with the concept of the CBDC to eventually rescue institutions.

2024 gonna be lit

I figure that everyone focused on the pivot, drank the kool aid, but people just aren’t grasping what the pivot may mean. It may mean the data they are seeing is fire and brimstone and the pivot may happen later in the year after a lot has broken. So the markets are front running eventual Fed Funds rates dropping – but I do not think they are accounting for treasuries and other debt to start going much higher in rates. I believe the Fed sees this, and is talking about the pivot in response to the fire and brimstone coming 1H 2024.

If we start seeing banking problems, along with money printing – this is the catalyst for what we see below.

Perhaps the punch bowl took us to a double top with the S&P? Do we have fuel to keep this running? If not, here’s the future.

Now the question is this – can they somehow continue to brainwash everyone that all is ok and with this, continue higher? Or – is retail being set up to be massive bag holders as institutions need to exit to preserve cash?

Who is winning?

This picture is what I feel everyone needs to understand in the world of de-dollarization, BRICS, and treasuries. NO ONE can beat the US in a kinetic war. What they can do is assist us in eroding our currency, by allowing us to keep spending ridiculous amounts of money in spending orgies on everything. Once the debt can no longer be funded, the only source to fund it, ever again, will be the Fed. And if they refuse, good luck. They could refuse in order to save the country. Powell has warned many times that spending is out of control and Congress needs to do something. But they will just put in an MMT puppet, and with that, our currency goes Zimbabwe.

If you think about the gaddafis of the world, the Saddams of the world – who tried to bring back gold, bad things happened to them. I feel that the BRICS union is gaining momentum essentially as an anti-dollar trading group. Maybe they go to gold, maybe not. There is no doubt these countries are hoarding gold and silver, and no doubt now with Shanghai that they are exchanging dollars for metals – and willing to pay a premium.

With the BRICS – you may have a union here that does eventually challenge the dollar, and with it, together, they are strong enough to take down the currency. But the currency is what pays for our military. So…..maybe there’s a war with Russia and Ukraine that we fund, and Ukraine takes out Putin. Good way to blame them. I believe conflicts breaking out are smoke screens for taking out the BRICS union. Pit them against each other. Wait for some leaders to die off, try to assassinate others by the hand of third parties.

Most people think of wars as tanks, planes, and soldiers. But most don’t understand that the currency war is THE WAR. Currency allows for everything we do as an empire, and without it, we cannot fund our military.

Many of you I don’t think are grasping the significance of what countries are doing to move away from the dollar. In some cases, it’s being openly mocked. I will tell you this. The cannot defeat our F35s. Our Abrams. So they need to defeat our currency to then defund the tanks and planes. I believe there is a massive effort to destroy our currency, and this is a war that is being fought in the shadows that no one is really tracking. After the cold war – came the currency wars. We saw what happened to the ruble in the 1990s. Russia spent themselves into oblivion. Now, it may be our turn.

The question then is – what is next?

If you are China or a country like that, and you can sell treasuries slowly, or get out of these dollars by buying gold and silver, they will do this as many years as it takes, and do it as long as they can. This doesn’t mean 2024 the US loses the currency wars. No. Not at all. But each year, you can see our debt continue much higher, with less and less countries willing to buy our debt. You can see the reverse repo running out. You can see the Fed trying to reduce their balance sheet. All of this is saying to expect higher yields in 2024 as debt matures and new debt needs to be printed to pay off the maturities.

I do not think most people understand what these higher rates, for longer, actually means. It means a deep freeze of a lot of things, with a lot more stress on our banks. You can also see business bond debt maturing, and with that, they cannot rollover cheap debt. They will either have to pay back the debt in cash – which may be done – which also means less growth and more layoffs as costs are cut.

Can this go on another 10 or 20 years? Perhaps, but it would just be further degradation of the middle class. More continuous wealth transfers to the elites. The socialists want to solve this problem by seizing wealth, like they have done all through history – leading to chaos and death – but the solution is not to seize wealth. It’s to reduce the size and power of the government.

Only way out?

To me, it seems the only way out of this for the US is to stop spending. This means severe reductions in spending and services. However, we have gone almost full blown socialist in that everything is now funded. Whether you pull the lever for the R or D doesn’t matter much, it’s just more spending.

What you have seen over 40 years is the hollowing out of the middle class. Most manufacturing jobs have left. Labor is too expensive to actually mine anything here – as we use the futures markets to then find the lowest cost places in the world to source minerals.

The only real way out of this for the US is to curb spending to such drastic ends that it causes a major recession or depression here. Vivek – love him or hate him, has the solution. He will never get elected because of it, but he is right – it’s the only way to save the country. However, he is incorrect that the President doesn’t have the authority to reduce the federal work force by 75% on day 1.

No elected official wants to be blamed for causing this recession or depression. IF you are Vivek – you could create staggering unemployment numbers overnight, but in return, you bring down government spending and with it, taxes. PAIN could happen, for awhile. However, it’s the only way out of Weimar. You have to essentially chop off your toe to save the rest of you. The Fed could be activated at 7% or 8% unemployment. Draw back the military 75% – it could happen, but most likely will never happen due to the special interests and lobbyists in Washington funding the war machine. I left a job in the DoD as a contractor because I felt the only real way out of our country’s death spiral was a massive reduction in spending – and with it – my job would have been gone.

The problem then is death by either a massive inflationary wave that continues to devalue our currency, or a near-death massive deflationary wave that reduces costs here to be competitive with the world and get jobs back.

While no one WANTS a depression, it seems to me that cutting costs, and severely, are the only way to win the currency war long term. Until then – the 400 PhDs at the Fed basically run around inventing programs to rescue our spending, work on gaslighting techniques and phrases to not alarm the masses, and keep the full faith and credit in the dollar – until they cannot.

Whether you are Dent or Schiff or Johnson – all of them see gold as the end game. I feel 2024 is another move up to another stair step level. Shanghai may accelerate this move. Banks are getting increasingly short, perhaps anticipating buyer exhaustion. However, if the Shanghai arb is indeed a money maker, this would indicate a LOT of buyers and taking of delivery from the COMEX to then sell to Shanghai. Until this arb is closed, it presents a potential short squeeze situation where banks can be seriously injured. They will close the shorts, step aside, and the arb will either be closed, or Shanghai will continue to raise prices to further damage the West’s currency and exchange fiat for precious metals.

2024 is going to be a very, very interesting year. No one is going to get it all right. But trouble is brewing. Can we hit 6,000 with the S&P? No idea. Could we get back to 4,000 quickly? Possibly. But the currency war is what most of you are not tracking, and that doesn’t give a shit about your S&P predictions short term.

December 30, 2023 at 9:49 pm

Gold, and to a lesser extent silver, is the end game, because when confidence in the dollar is lost, gold is the default standard–“as good as gold” or “the gold standard” as the sayings go No one will trust CBDC’s, which the governments will likely try to implement, nor will they trust cryptocurrentcies or any other electronic assets, for a “bird in the hand, is worth two in the bush”. Hard assets, specifically gold and silver, will be the foundation, and then real estate and other hard assets will be also be significantly valued.

LikeLike