I’m writing this today for anyone out there who isn’t particularly savvy about investing, and wants an idea of a philosophy of investing. You should work with your financial advisor on what is right for you, but the problem is, none of them were alive during inflation in the 1970s – so be careful about what you determine is right for YOU.

I fight with my wife about money, a lot. My parents fought about money. I’m sure it’s probably no different in your households. No matter how much money you make, there’s always a want/desire to spend it. On what?

- Bigger house

- Re-do your house

- Cars

- Furniture

- Clothing

- Trips

- Vacations

Most of what people spend their cash on is pissing in the wind. It gets put into something that has value, for a short time, and then the value dissipates. Meaning, your money “value” went to money heaven. That nice new hutch to store plates to display for $3000? In 10 years, you’d be lucky to get $400 for it on Craig’s list. This isn’t the furniture made to last from 100 years ago. Everything you buy today is cheap shit meant to break, so you buy more of it a few years from now.

I believe what everyone spends it on is unique to their situation. None of this is investment advice, just how I believe a model is out there that exists for all of us to review. I wanted to share my philosophy here.

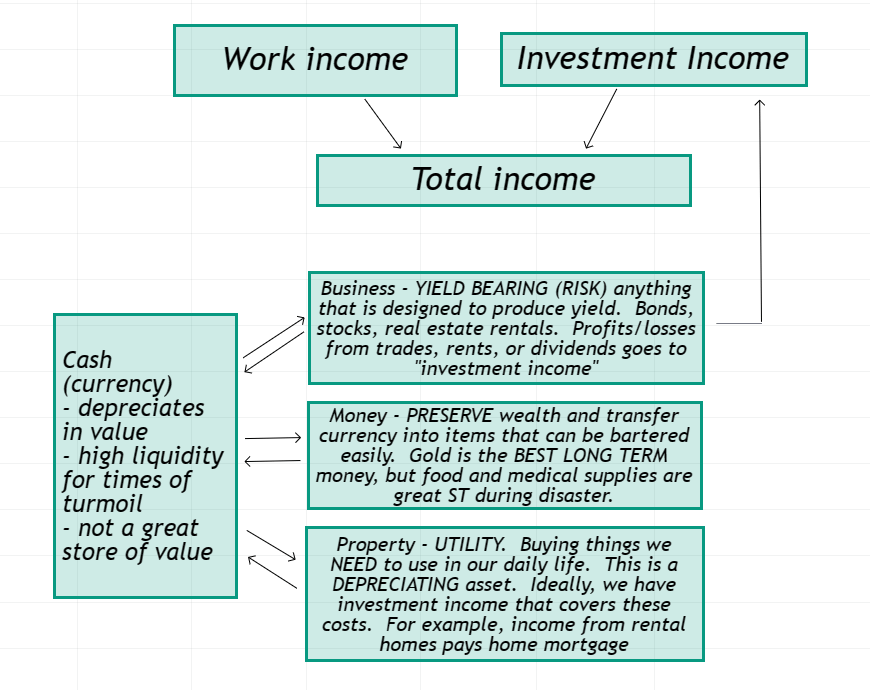

The three amigos

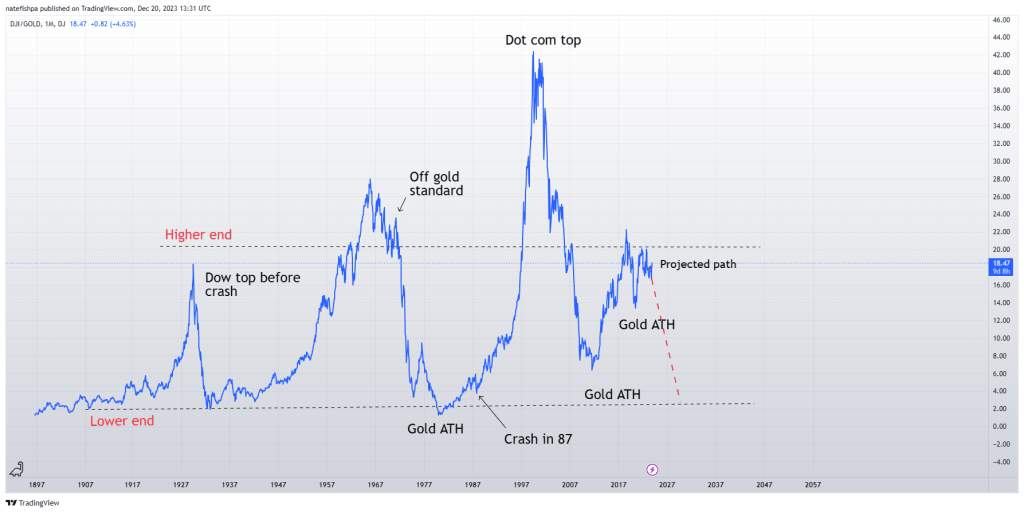

My asset classes are derived from Mike Maloney’s in his “Wealth Cycles” video, but I expanded on what is in each of these. He uses “stocks, housing, and gold”. I use “business, property, and money”. Many of you reading this are gold and silver bugs, and know that I’m a huge advocate for them. But there is a time and a place to own them, and a time to sell some or all of it.

Money – to me, gold is money. Silver is money. But they are also commodities. So are sugar, timber, and a million other raw materials. My belief is that a good portion of commodities are money, and I’d also throw food and emergency supplies into this category. There is a spectrum as well – the longer duration money is best stored in gold as it never oxidizes. But shorter term, imagine a SHTF scenario – water, food, and medical supplies are items that function as money. Early on in hurricane scenarios, you see people selling bottles of water for $20. Cash is the first to go – but they know the situation is temporary. Imagine a scenario like “Leave the World Behind” where the USD is rather worthless – water and food ARE your money, and cash is worthless. Even in a scenario where you invest in a farm with fruit trees, berries, eggs, animals, honey – this is MONEY. Consider a lot of people during the Great Depression were farmers – what decimated many was “The dust bowl”. In 1952, my grandparents lost their chicken farm due to the “Avian flu” in birds – and had to kill $4,000 in birds. That was $4,000 in money then, and my grandparents bought the house my grandmom lives in today for $2500 – which is worth $225,000 now. Meaning – farming has super high risks, but it’s a way to make money from the land. You might consider a “farm” a business below, but just the act of having food available to you from a small garden behind your house is MONEY. Whether you avoid buying tomatoes because you grow your own, or whether you sell berries to neighbors, this is MONEY. A few times I was part of a farm share, where you give cash to farmers, and each week you pick up your share of the crops/eggs. This is taking cash and getting MONEY back.

Business – this is ANYTHING that is yield bearing. The yield is in lieu of risk. When you are younger, you can invest in things that are far more risky, because if you lose it all, you have 40 years to make it back. This could be CDs, treasuries, stocks, digital yield tokens, and real estate rentals. It can even be partnership in a pizza joint or law firm. Every dollar you put into this, you have a payback period as well as ROI measurements. My wife and I fought over the $50,000 I put into rehabbing a rental, but the payback period was 2.25 years and the yearly ROI when fully rented was close to 48%. On paper, this was a no brainer to me. To my wife, this was money in the short term that could go to a deck or pool for our house. The difference here was I chose this cash to go into something that has YIELD. From those profits, I could potentially save up for 2 years and then buy the deck/roof, and the pool 2 years later – without affecting this thing printing cash for the next 40 years. I put stocks in here – I’m big on the PM stocks, but all of this is cyclical. I feel a July 2020 move is coming with metals stocks. Others are dumping cash into the SPY. Others may like biotech. Others want REITs. Others may just like their 3% dividend stocks.

Property – Maloney called this housing. But it’s a lot more than this. In this category, these are items that you have utility with. The home is the most well known of this, but consider a car. It allows you to drive back and forth to work to earn money. A baseball glove allows you to play baseball. Things you own, all depreciate in value, for the most part. I can put things like art and baseball card collections in here, but most items here lose value – unless you pay to maintain them. Art may be cyclical. Baseball cards were a fad that died out. Legos can actually be used on the black market as currency. But generally speaking – cash you put into this category should give you UTILITY. However, cash put into this category is generally a depreciating asset. Consider furniture. You buy it new for $5,000 in your living room. 5 years later, you struggle to give it away on Craig’s list. A house, without maintenance, would break down and be relatively worthless in 25 years due to leaky roof, mold, water in the basement, etc.

Cash

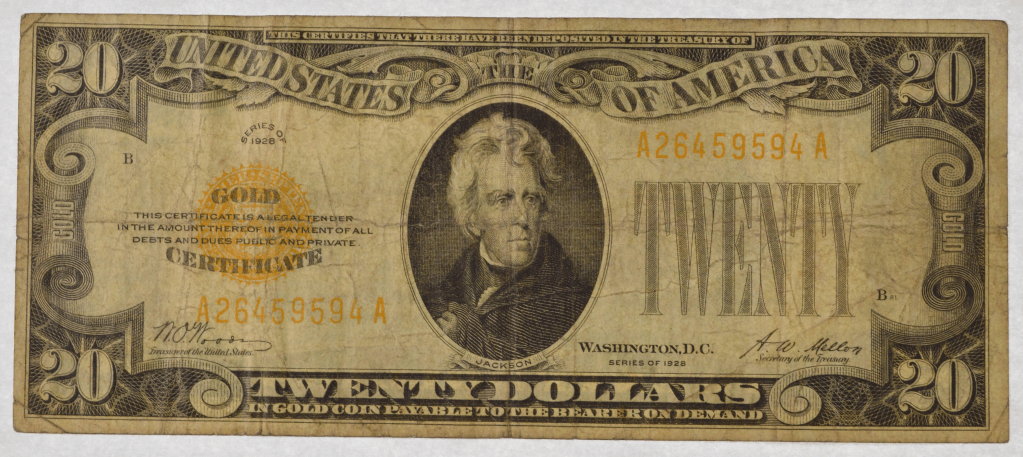

I’m trying to address this for the noobs out there. Cash is currency. It is not MONEY. For hundreds of years, cash was a receipt for the money at the bank (gold). Since 1971, they have convinced you gold is no longer needed – that your receipt IS money. This has led to a lot of debt explosion around the world. And, we have seen 40 years of declining interest rates, which has lubed up the system to borrow cash into existence, cheaply.

This has led to debt explosion…

Some red circles to note

1971 – we had a few hundred billion in debt from the 200 years our country had existed. This was the time we went off of the gold standard. The gold standard was meant to curtail spending. Without this guide rail, governments were free to spend. And, they did.

2008 – by the time we got to the global financial crisis in 2008, we were now at $10 trillion in debt.

2020 – at beginning of COVID, just 12 years later, we were at $24 T in debt. In 12 years, we TRIPLED the debt.

2023 – we are now at $33T in debt, $9T up in just THREE YEARS. Yellen talks about not blinking an eye to $50T in debt.

Most people have no understanding of the train wreck going on, as we speak. This cash is currency getting pumped into our system, and bidding up our goods and services.

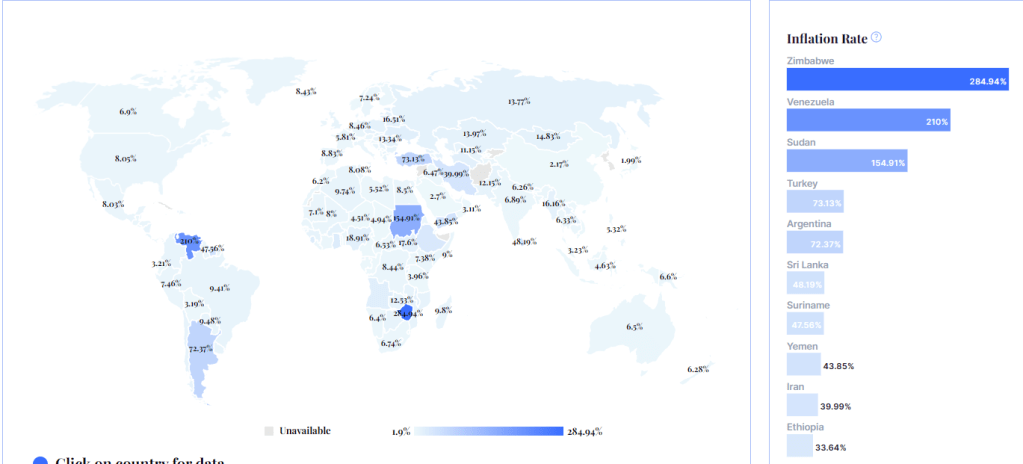

Super inflation and hyper inflation and stagflation?

Also – most of your friends have never heard of the Weimar hyper inflation. They have no idea about a Zimbabwe $100 Trillion bill. They don’t know about the collapse of Venezuela. Or Argentina’s currency problems. They don’t know much about the collapse of the Soviet Union and the worthless currency. They don’t know about Lebanon today.

The concept is simple. Inflation is a marker of the increase in money supply. Now there are economists out there and MMT people who will try and wave a wand at you and tell you that there is no correlation between the increase in money supply and inflation. The problem is, this is the definition of inflation. They point to 2009, when they “contained” a trillion in the banking system and with this, prevented inflation. Well, they did the opposite with COVID, and essentially handed out trillions like tic tacs. This led to 9% inflation – but the worst part of it is this measure is stupidly low, and meant to be low.

So there are still trillions of dollars floating around, waiting to bid up these asset classes.

Super inflation may be a very high rate of inflation, sustained.

Hyper inflation professor Steve Hanke talks about as 50% per MONTH or higher. Stagflation is something like Japan, where they use Yield Curve Control to keep their rates from going higher, while having something like 300% debt to GDP.

Of interest then, is IF we are looking at a currency crisis in inflation coming up – at some point – you then have a different way of looking at savings and investing.

Your grandparents saved money over 50 years. When I was a kid, I had a 5% savings account. This, is yield bearing. They bank would use your money, with fractional reserve banking, and get a return on it and reward you for providing them liquidity. With 40 years of declining interest rates, 0% savings accounts are pretty much the norm. A few years back, CDs were at 2%. With inflation at 9%, what this means is that if you are holding cash, you lost a LOT of purchasing power with that over the course of the last year.

Let’s do the time capsule experiment to show you how this works. In 1910, a $20 bill had an orange seal on it, and it was a receipt for an ounce of gold at the bank.

I want you to put a $20 bill and an ounce of gold in a vault, in 1910, then open it up today. At the time of putting them in the vault, they were of equal value.

You take them out today, and the gold is now worth 100x more than the $20 bill. Did the gold somehow appreciate in value? No, the printing and dilution of the money over the last 100 years slowly required 100x more monetary units to buy the gold. The gold is a stand in here for houses, cars, etc – everything is about 100x more expensive than 1910. But these things all go in cycles up.

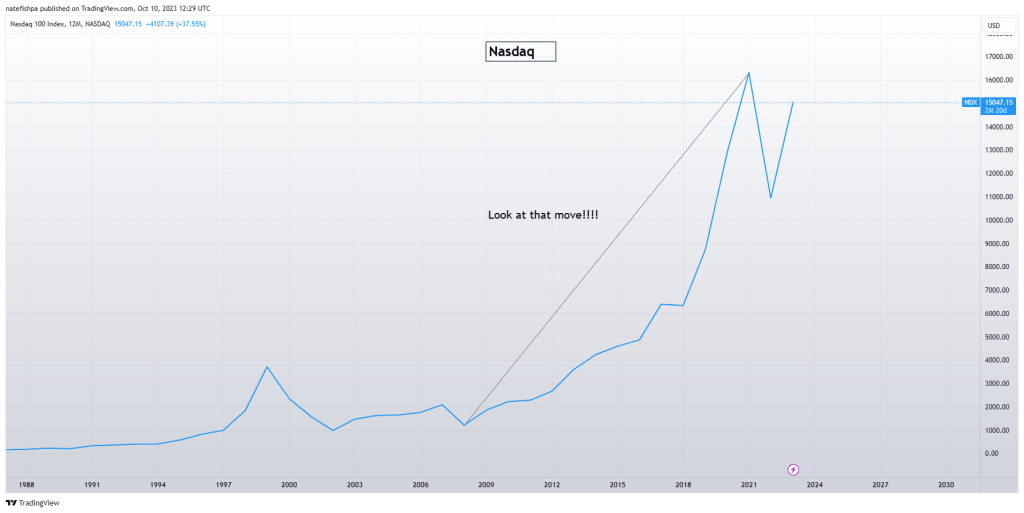

From 2000-2020, gold was the best investment class. However, take a look at the Nasdaq from 2009-2021. It went up something like 16x in 14 years.

So the point here is that cash today is a very, very poor store of financial energy. Houses are near an all time high. Stocks are at an all time high. Gold is at an all time high. So what do you do with your cash?

Do you….

- buy a deck/patio to add to your house – only getting perhaps $.30 on the dollar of this investment back?

- Hold cash, knowing it depreciates in value rapidly?

- Buy an investment property – knowing rates are super high and houses are near all time highs?

- Buy gold – near all time highs?

- Buy stocks – near all time highs?

- Buy furniture – a depreciating asset?

- Put stuff on your credit card – at all time high rates?

- Pay off debt?

Debt and leverage

This is going to be controversial. But when things are everywhere at all time highs, you have to consider that a deflationary event can occur in some or all of those asset classes. Assume for a minute that you have $200,000 in cash. An average house costs $400,000. Next month, the house market absolutely crashes as unemployment goes up and supply floods the market. It is possible that $200,000 in cash could buy you a house. In this case, your cash essentially doubled in value during a deflationary event.

Meaning, over the course of 100 years, we clearly see a trend where cash depreciates in value, during inflation. But there are times where DEFLATION happens, and with this, cash increases in value. Consider the stock market when COVID happened. If you sold off everything right before the collapse and had $100,000 in cash, during the collapse, you may have bought back everything for $50,000, then watched it inflate several times over.

This is why you want cash, or something of highly liquid value – to buy things during a deflation. There were times during the Great Depression where homes were bulldozed by property owners because they could not pay the property taxes, and taking it to a bare lot was the only thing they could do. With all of the banks closing in 1933, by 1936 cash was still hard to come by.

If everything is at an all time high, perhaps hoarding cash anticipating a draw back in not a terrible idea? What about paying down debt?

My finance professor once said, “if someone wants to give you a free loan, take it every day of the month”. He was also someone who advocated everyone have an “FU fund” so if an employer ever asks you to do something unethical, you have 6 months of bills in savings and can walk. The concept of “cheap debt” is something that many don’t understand, and is strategic to hold. Many of us re-financed our homes under 3%, while inflation was 9%. It makes zero sense for any of us, ever, to sell that home to buy a home at 7%. Ever.

But if you think about it, why would you take cash that you could get a 10% ROI on, and pay down debt at 2.75%? It makes sense to invest that at 10%, and pay off the note with the proceeds and pocket the 7.5% difference.

My mortgage/taxes/insurance were at $2000 a month. Taxes went up a bit during inflation, and I’m at $2093 a month. That’s $25,116. If you take that $25,116 and invest it, you would have $27,627 at the end of the year, and that is $2,500 in the black by doing this.

Consider a discover card at 27% interest on $10,000 owed. That will cost you $2700 a year just in interest and barely pay any of the principal. This is something I would pay off rather than invest.

So what do you do?

I’m very happy with my “money” position. I can sell PMs if need be. But I also have like 2 years of food, emergency supplies, and means of defending my home with the base metal of lead. I am very happy with my PM stocks, and feel they are about to rise, substantially. I have rentals, and am very happy with that income. I have no revolving debt – just “cheap” long term debt.

The wife still wants to buy the deck. I’m really in a situation here because I understand the concepts of finance. IF I was able to finance that at 3-4%, maybe I do it. My guess is it will be between 9-20%. So financing it is out of the question – for me. I can take a home equity loan on a rental, perhaps at 6%, but that is a 10 year note, and the ROI in it is abysmal. But what about cash? I can buy another rental, and get cash flows from that rental – and perhaps those cash flows pay off the note? Interesting. You have a YIELDING investment that pays off the note or purchase of property. So when the note is paid off, you perhaps have another 30 years of yield from that investment.

Cash right now is of interest to me. Why? Because if you want to buy a rental, you need to have 20% down for an investment property, but only 10% down if it’s a second home. The rates are about 7.75% for these things, even with an 800 credit score. Then, you are looking at 6% closing costs. Additionally, a lot of rentals today are at extreme pricing, and with this, you aren’t making any money off of rents until prices come down. So maybe time to look for another type of rental?

This past year, I spent $6,000 on a Disney Cruise. Still makes me ill to my stomach. We aren’t a vacationing family, but if I was to perhaps assume a budget each year of $6,000 – that’s $500 a month. It is quite possible I can buy a second home with a mortgage/utilities at $1500 a month – I had put a bid in on one and got outbid. I can rent it out 2-3 weeks a month at $500-600 each to family and friends. Even at $1000 a month avg rents, that puts me at $500 towards this property. I would get to potentially use it 180+ days a year, rather than 4 days for the Disney cruise.

The thing is there are a lot of homes in limbo right now. No real ability for a family to move in there for one reason or another. A lot of AirBNB homes are starting to hit the market, but they are trying to brag about their cash flows (that no longer exist) and with this – I am seeing lots of price reductions everywhere. Maybe a shorter term type of rental is in the cards? Not to “make money” but perhaps to “break even” at a loss of $500 per month. Remember, ST rentals are crashing in bookings, and in value. If this storm lasts a few years, perhaps 4-5 years from now this stuff picks back up? In that short term, you eat $500 a month, use it as your vacation home, and rent out to close people to you just to make the nut?

If things go well with this rental, maybe I have $1800 per month in, and $1500 costs and still get to use it 90 days a year. That $300 is about what I would spend on a home equity loan to do a patio/deck – and I’m not out $500. Meaning, I could have a vacation home to use, use rents to pay down the principal on that, and use rents to pay the note on the patio/deck. In 10 years, I have the patio/deck/pool, and the vacation house – which might be renting out at top dollar on AirBnB 35 weeks a year. And, the most I would be out would be perhaps $6,000 per year for 10 years at $60k. Which, is the approximate costs of the patio/deck, but in this scenario I had 10 years of vacations (for free) and a lot of equity built in the house from appreciation and paying down the principal.

I’m looking to “be the bank”. The wife just wants a deck.

So – for ME – I’m hoarding cash. YOU might think you need to stock up on food. Maybe YOU need to move and buy a home. Maybe YOU need to buy a new car. Maybe YOU may want to invest in tech stocks.

Everyone is different – but I wanted to write this piece to show how I think about funding things in the PROPERTY asset class. Additionally, over time, the more investments and yield you have, the less you need to be dependent on your salary from a job. At some point, perhaps you are able to remove yourself from the work environment altogether? I’m 48 now, and would LOVE to be retired before 60.

Who knows? But I think everyone owes it to themselves to come up with their own investment thesis. Again – not financial advice, but how I see to invest for myself.

The Great Rotation

What many of us have done reading this is buy PMs and PM stocks. Many of you also grumble about how shitty it’s been for the last 3 years. I made a double in 4 months, sold half, and funded a rehab on a rental. The last 3 years have sucked, and I’ve been buying all the way down and accumulating shares in companies.

The purpose for me buying PMs was insurance against currency devaluation. Remember the safe above? Assuming I lived to be 100 years old. Imagine I put $2,000 in the safe 100 years ago, and opened it up today? That $2,000 can’t even buy a shitty used car. Back then, it could have bought a house. However, imagine I had 50 oz of gold I put in that safe. Opened it up today and had $200,000. That could buy a decent house around me. Remember, the gold didn’t appreciate, the dollars depreciated.

With this, I hope the PMs are able to stand the test of time in 10, 20, 30 years when I need them. But the PM mining stocks – THESE are what I’m playing the move on. Imagine I had $50,000 in a mix of juniors, mid-tiers, etc with gold miners. Imagine then a move for gold to $3,000 and silver to perhaps $100. It’s not crazy, given all of the money printing you have seen above, and PMs would simply be “catching up”. I’m not PREDICTING this, I’m saying that the catch up move would be very much overdue. Stocks and real estate, relative to PMs, are overvalued – give another nudge to PMs.

Lastly, the PM mining stocks, relative to PMs, are severely undervalued.

It stands to reason there is a “catch up” phase coming. With that, it is entirely possible to have that $50,000 in stocks turn in to $500,000-$1m. Why not? The Nasdaq I showed above went up 16x in 14 years. Why couldn’t PM miners go up 10x in 5 years? You can see in the chart above, PM miners eventually catch up and outperform the metals, by a lot. This assumes that the miners are super profitable with higher metals prices, and a rotation from tech or the like starts flowing into these.

What you CAN then do is rotate the profits from this to your FIXED COST DEBTs. First, investment properties with higher rates. Then, any home equity loans. Then, your home. For $50,000 – you could essentially pay off hundreds of thousands in long term debt notes. Having no debt, at all, you can live comfortably off of some rentals. What standard of living you want, is up to you with how long you work and how much yield-bearing assets you need to buy.

Assuming we run into a super inflation scenario, it might make sense NOT to pay off the home you are living in with 2.75% and take that profit from the PM miners and put it into another asset that can preserve the value with rates going up? If you still owe $300k on your house, investing this in unloved rentals could get you $30,000 profit per year, and you owe $25,000. That extra $5,000 can go against your note. Maybe pay off the house in 10 years.

There’s a LOT you can do with your money. There’s no right or wrong. There’s perspective of risk – and no one can tell you if we are headed for inflation, deflation, hyper inflation, or stagflation. You have to make yourself resilient in any situation.

This “great rotation” is potentially a way for you to then capitalize on one asset going vertical, and rotate it towards debt or another underperforming asset.

Best wishes!

Leave a comment