Silver squeeze in 2021 was something. I made a 5x on some AG calls I cashed out, and with it, and an interesting roller coaster ride up and down in a day. Many of us calling for $50 silver were….early. I refuse to say “wrong” as I believe many of us just really had no idea how strong the “tamping” could be, especially when it starts to become clearer that invisible hands now direct the markets – and not necessarily the free markets. That’s another conversation for another day, but I wanted to talk about the roller coaster we may be seeing ahead.

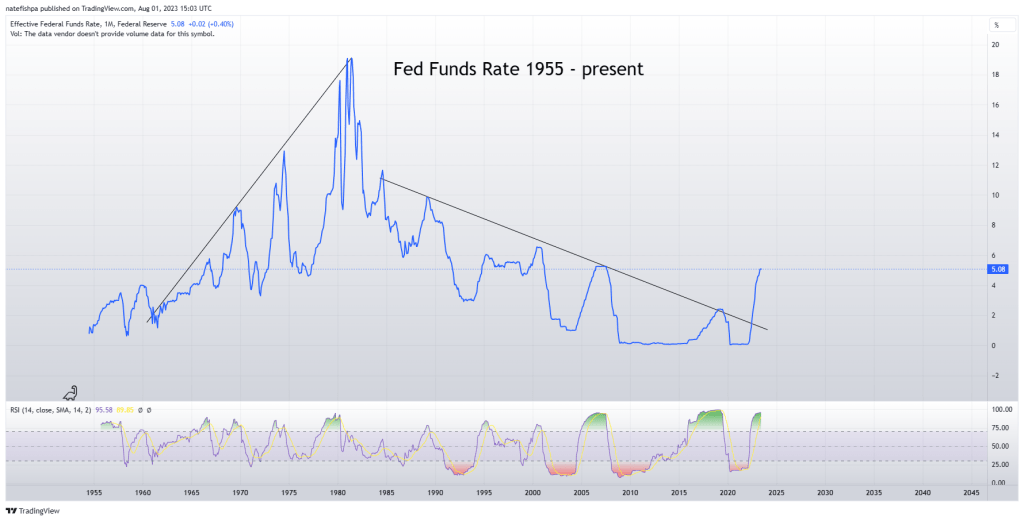

As the saying goes, “history doesn’t repeat, but it sure does rhyme” MIGHT be playing out right now with the 1970s. I am convinced that 40 years of rates being pushed down is over, and a big reason a lot of this happened was globalization. I think that history and economics books for many years to come will study this chart. Also below, think of these interest rate moves up and down as waves crashing into a beach. More on that later.

And how it looks like this

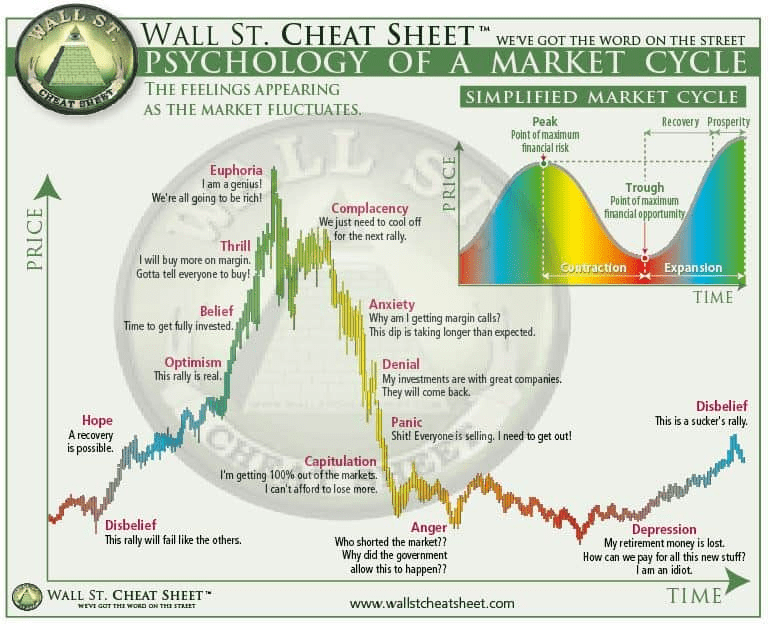

Which, if you think about it – is this when you put these things back to back.

With the fed funds rates, it’s sort of the inverse thinking of it though. Lower rates make borrowing costs cheaper, allows for more free credit, and with this, inflates assets. This is your inflation, with money being borrowed into existence in some form. All of the same people who think inflation isn’t tied to currency, ask them this. What happens to prices if you remove 95% of the currency in existence? Also, what happens if you take all of the currency in existence, and print 20x of it in a week? These are extreme examples, but how you have to look at the mechanics of money creation and how it then works its way into the best and most efficient means of growing and protecting it. I believe the wealthy people you know of understand this far better than most people on earth. Which is why they are wealthy. Going to college or trade school teaches you how to work at someone’s company, not get rich. I believe rich people understand finance, risk, and leverage better than 99.9999% of people on earth. That is their special skills, and what many of us try to understand to be part of them. I feel a part of this is trying to build our a thesis of where the puck is logically going in years to come and be there first. While you may miss opportunity costs on other things – IF your thesis is correct, and if you are damn near first, this is how you get many 10x-100x items. So while the daily pain of gold and silver can be rough, I focus on the bigger hockey game being played and don’t focus on the daily nuance of price. What I see is long term VALUE. The price is just a graph point of that value at some point in time.

The same is inverse when markets get too hot – with respect to the charts above. When too much cash is chasing too few goods and services, you can get shortages in a lot of things, but mostly this can show up in labor. Think about everyone going to Home Depot or Target. At first, these retailers bank cash and appear profitable, but the raw materials have to come from somewhere and factories have to build things. This causes these operations to expand, and with it, labor becomes hard to find to satisfy the demand. This is what we saw all over the place, and now why we see trades people cleaning up with how much they can charge and someone is willing to pay – for now.

But if you look closely at the rates in the 1970s, they didn’t go one way up. IT was an oscillation. They tightened, they hurt economies with demand destruction, and with this, economies started to tank – which then led to rushes to lower rates. They lower the rates, and more waves of inflation happened, only to then lead to rate hikes. This happened all through the 1970s until the “voelker moment” where he raised rates so high – he “defeated” inflation. Or so the narrative goes. But what if that move – the decisive move – was to be the final death knell to inflation, whether it was 15% or 20%?

What I want to look at is what just recently happened. Obviously COVID happened and they threw $6T into the economy, which led to inflation. Duh. But there hadn’t been a recession since 2009, and with this, in the times of early 2020, many of us were calling for stock markets to significantly correct.

With these oscillations, economies expand during “good” times, and contract during tough times. In the bigger scope of things, lower rates happen to encourage borrowing and expansion. Companies race to then compete for these dollars, and then have a business model to maximize the return of those dollars. The companies in this cycle who have the strongest business models perform well – and those who don’t, start to go out of business when the rate hike cycle starts. What happened though on the back end of the global financial crisis was that they let rates stay too low, for too long, and never allowed for the natural pruning of the shitty business tree. This allowed things like SPACs to happen, and even crypto bros were part of this cheap, free money to lever up.

Wave 1

I started to think we were going to go Weimar when I learned about it a few years ago. However, there’s nuance in all of this. While they waited too long to raise rates, it blew the balloon up with more hydrogen – and with this, many hopped into this thinking we are at the new Renaissance. Yellen even said there would never be a recession again in our lifetimes – but she is 75, so perhaps she meant in the next few years. Little did we know they could simply change the definition of a recession to suit their desires.

But the rate hikes are indeed creating demand destruction. But many aren’t realizing the side effect of this expansion of everything – and what that really is, is assets are ballooned up, and with rates rising – the cost to own those assets is far higher than it was. While most of us were getting 1-3% raises, our costs over the last 3 years could have gone up as much as 25%. Everyone also knows the CPI doesn’t really measure things that matter most in daily lives – groceries and energy.

Wave 1 in this cycle’s inflation inflated assets. It drove unemployment lower due to needing more factory workers, trade people, etc as the money flowed. The correction to wave 1 now with rate hikes will drop asset prices, somewhat – but the higher costs to borrow stop expansion and those “zombie” companies out there will get a double tap. Banks are now failing due to buying treasuries that lost value in 2022 and when they were forced to sell, had billions in losses. It was the worst year in 100 years for a 60/40 portfolio.

Wave 1 is seeing inflation rates coming down, but this is often conflated with prices “returning to normal”. No, prices are just accelerating at a slower rate. Meaning, if you gained 10 pounds last year and 5 pounds this year, your rate of weight gain is slower, but you did not lose weight, you gained. This is where most of the public is intentionally misled.

How wave 1 ends?

- Asset price deflation eventually hits

- Unemployment starts to rise

- Rates pause, and then start to decline

Wave 2

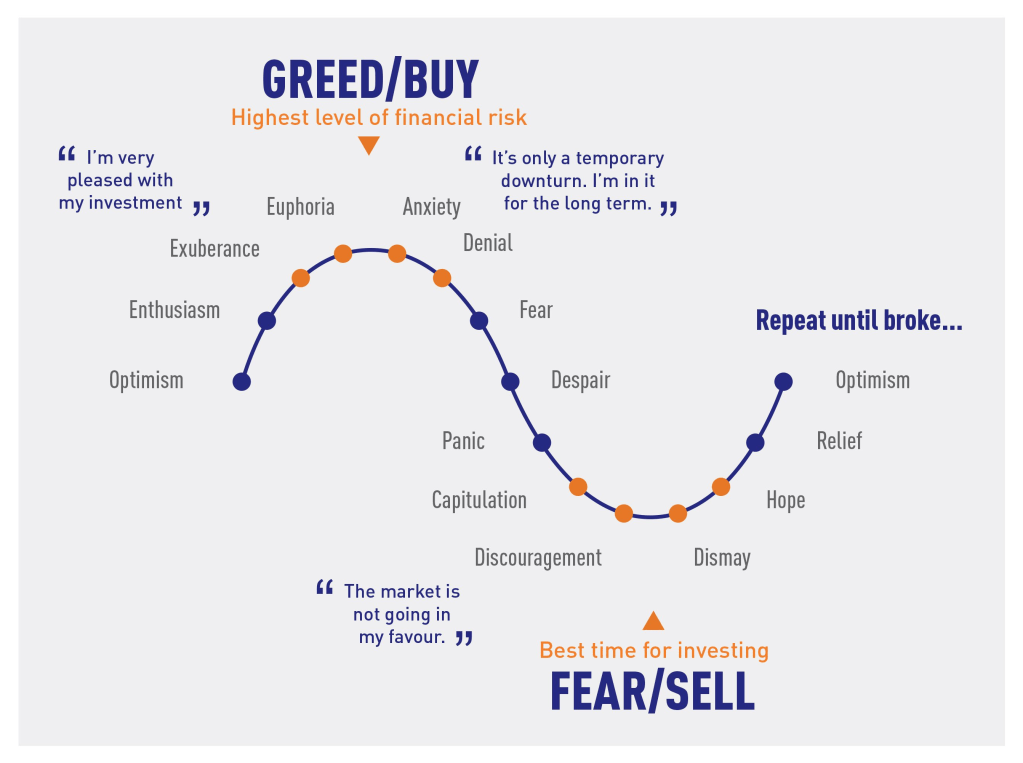

Like standing at the brink of the ocean, you can see the waves coming in – one is crashing in now, at the end of wave 1. But behind it, you can reasonably see other waves forming that are coming in. Some end up big and massive, and others tend to be smaller. We cannot predict at this point how severe they are, but looking at geopolitics today, we can potentially see where wave 2 is coming in from.

Assume that at some point late 2023 or 2024 rates start to come back down. Most don’t realize these things may have a 1 year or so fuse, so all of trhe bankruptcies you are seeing now are essentially from when we hit 2% fed funds rates, with perhaps another 3-3.5% about to work its way through the system. How this can be bullish for stonks, is beyond me. But it stands to reason that wave 1 will result in asset bubbles being deflated. Whether it is 5% more or 25% more, I can’t tell you. But I think unemployment rising is what is ultimately stops the rise.

So we now look to wave 2 causes for inflation. Remember, 12 month lag. You are now seeing unions strong arming companies for higher wages. While we will have SOME asset deflation, Americans are realizing now how the wave of inflation made them poorer, and they need to exploit leverage to make wages go higher.

I believe this is the root cause of the next wave of inflation. Why? Costs need to get passed on to the consumer. They are behind in wage growth, and with this, they demand more money.

At the same time, the wages for trades that exploded higher will remain higher. While demand destruction happened, a LOT of the wealthiest weren’t really damaged in wave 1 – and with this, all of them are still buying new kitchens, getting new HVAC systems, and getting plumbing to their houses. Due to the sheer lack of supply of this labor force, these wages will continue to be higher.

At the same time, the geopolitics of BRICS is fracturing the global supply chains. This, ultimately, means our ability to source the cheapest goods with USD will be impinged. Whether it is trade blocs, tariffs, or countries refusing our business, it stands to reason that the cost of raw materials is going higher. Wave 1 had significant stress on the supply chains, and commodities prices for the most part did not rise nearly as much as they should have. Inflation killed margins for a lot of miners, and with this, the lack of investment in this sector in wave 1 is about to change. As Wave 2 of inflation hits, the raw materials they need simply won’t be there. I believe this may have commodities prices going vertical.

So in wave 2, you have:

- Wage inflation starting

- De-globalization pressures sending cost of goods higher

- Scarcity of commodities drives underlying raw materials prices higher

I believe in this wave, rates start to increase, but the main problem you have is the cost of materials goes moon – and between the high costs and shortages, this is a violent rip higher that drops quickly as the demand is killed. Substitutes are found for a lot.

Wave 3 – currency wars

I think by the end of wave 2, many now see the effects of how the debasement of currency effect the world. I believe that the 2020s will be a slow drip of the BRICS faction accumulating gold by selling USD. They will further get out of dollars by selling treasuries down more. Those USD will go towards gold and investment in commodities/energy. The West is hyper focused on ESG, control, and lecturing. The East is quietly focusing on building hoards of gold and energy reserves and building trade partners with Africa. Most have no clue how valuable Africa will be over the next 50 years. Many of us in the West and think of coups and violence. Cannot invest there. However, there are pockets of places that are very much of interest to invest, and population centers like Lagos that need to be modernized. The vast space and resources available in Africa are stunning. And while the US focuses on trying to lecture us into eating grasshoppers and driving electric cars charged by coal plants, the East is doing the hard work of establishing a business framework for the next 50 years.

Our ties to the WEF and ESG – along with the lack of borders, lack of enforcing laws, and woke ideologies are marking the end of the faith in the USD. The true believers truly believe that all of the actions they are taking are saving the planet, and don’t have the capacity to understand how they are a pawn in someone’s chess game. They are lost. And with this, so is our currency. They just don’t know it yet.

Wave 3 inflation is the act of abandonment of USD for gold. I believe the world has seen how the US has mistreated the reserve currency. I love my country, but no one can dispute the level of corruption and power games at the top levels now have created a cancer in our country where no one can ever be elected again based on cutting costs. Meaning, no matter what candidate is elected, there’s a version of how much currency is going to be debauched. One side may increase the one form of spending, the other side promotes another – both paths lead to more deficits and debt.

By this time, our deficits are now spiraling out of control. Nation states stop buying our debt and with this, rates continue higher for our sovereign debt. At this stage, perhaps 8% 10yr starts to have many people rolling out of risky items and into safety, but the problem is – at this stage – retail cannot quench the thirst for new debt. Without more buyers, deficits continue higher and higher.

Wave 3 is 1980 with gold and silver – and even oil. While wave 2 is fantastic for commodities, the root issue with wave 3 is the end of our US dollar currency as we know it. At this point, Maloney’s vision is becoming true. This is where the bombers are coming out. More trillion dollar packages to “lower inflation”. Anyone thaty has dollars are trying to get out of them the second they get them.

This, is the currency reset. I believe those holding gold and silver at this moment are kings of the world that have seen a 10-30x. And those who own miners who went 50-300x are gods of those kings. It could take 7-12 years for all of this to play out. So all I am doing is accumulating when I can, sell portions into rises, rinse and repeat. Think of the people who went all in on Microsoft, Amazon, or Apple. They were able to understand the VALUE of the item far before the PRICE caught up. I believe for 2030, those who can understands the VALUE in items, will have the best PRICE returns.

I believe the waves ahead have some flavor of this. As one crashes in, another is forming off the shore. The water comes up to your ankles, and recedes. These are the ebbs and flows. And this is what real markets do. I believe they are doing all they can to save the currency at the moment. The problem is this. Since no one can ever cut costs, ever again, runaway debt is a certainty.

I believe the ONLY way to stop this is to cut costs, and by a lot. IT won’t happen until 2030. When we can no longer borrow more money into existence and we default. THAT is the time the US activates its gold. Until then, expect 100% defense of fiat. By all means necessary.

Gold

At this point, many of you want to crowd into $27 silver to wait until it hits $50 and get out. That is amateur hour. It makes sense when you get a double in something, to take half off the table and sell it. This essentially gives you that asset for free.

But if you can save in gold and silver, and stack, if my 2030 vision comes true, this is rhyming with 1980. This is where you can see your $10,000 gold and $300 silver. My “predictions” here of the price in USD are irrelevant – to an extent. Assume you have a $300,000 loan on your house, today. You buy 1000 of silver for $23 at a cost of $23,000. What this model can do – IF the 2030 prediction is true, allows you to store purchasing power today that may go parabolic. In the 1970s, silver went up 29x from its low and gold went up 24x. If we can assume the $11.75 or so in 2020 might be THE cycle low, perhaps we see $300 silver then. Meaning, in 7 years, that stack of 1,000 oz could be worth $300,000. You take the stack you paid $23,000 for, and pay off your house. You refinanced at 2.75%, so making monthly low payments rather than paying off your house sooner – allows you to prepare for 2030 by stacking PMs now. While I wouldn’t do 100% in this, you can see why it makes sense to even have 5-10% allocated towards this.

If gold had a cycle low of 1400 or so during 2020, you are looking at perhaps $30,000 gold in 2030. Again – these are silly wild numbers, but if the waves play out like 1970s, this is HOW you COULD get there.

I believe in my heart that a trade currency in gold is going to be established, and I’ve written about these ideas here for 18 months, did some interviews on them, and detailed out how it could come to be. These nation state solutions would be where perhaps Ghana and the Saudis exchange gold for oil on a blockchain. The vaults could be everywhere. But with this, I then believe there will be private companies that lead the charge on this for the private sector. Meaning, you could then have Americans buying Chinese goods on Amazon in gold grams. French companies paying for energy in gold grams to Russian suppliers. Chinese companies buying copper from Chilean mines in gold.

This also indicates that private companies that do this are the next iteration of Mastercard/Visa. These companies are the future, and with this, the best and brightest talent will want to work with these companies as many traditional companies are on their 13th round of layoffs in 7 years. Those who today invest in commodities companies will be tomorrow’s barons of fortunes. While many were smart to hitch to tech, a great rotation is coming to commodities that are historically undervalued.

Why do we need all kinds of FX exchanges in the future IF gold is the language of money? If a barrel of oil is worth a gram of gold, that is the price. HOW YOU GET your gold is a YOU problem in local currency.

How much gold do you have? Answer: Not enough.

Discussion

When I write these, I try to also have counterpoints. Where am I wrong? What am I missing?

- How can I be wrong with the lag effect of rate hikes. Could the $6T printed still have a LOT of legs in it?

- IF inflation comes back, are the stockpiles of commodities and wells/mines enough to meet demand?

- Are shortages likely in wave two, perhaps by 2025-2026?

- What are the economic realities of the West-based ESG compared to the economic policies of the East?

- In what realities could gold decrease by 2030?

- Could substitutes for silver be created and thus reduce the industrial demand for it?

- How could nation states promoting gold work with private companies who are doing this now?

- How could gold-based markets work? Like my model or am I missing something huge?

Leave a comment