Summary: The OCC report does NOT contain gold, as Ted and Bix have claimed all along. Derivative contracts appear like they could be double counted if one of these 4 banks is the lessee and the other is the lessor. But the OCC report also doesn’t break it down by metals, either. In this, I review the data and do an analysis FOR and AGAINST Ted’s findings. I dig deep and play both sides to paint a picture of how the evidence can be both FOR and AGAINST his claims. Ultimately, my initial assertions of “not enough evidence to support the findings” are found to hold up, even though Ted makes a compelling case. Want to know how the shorting mechanism works? Let’s dig in.

All – a few days ago, I reviewed the OCC reports and could not find evidence of 800m oz of silver through the OCC report. Ted and others had claimed gold was not counted here, but I like to say, “trust, but verify”. I wanted clarification from the OCC on what “precious metals” were to wonder if gold was or wasn’t counted in this figure. They responded. I will first post my question, then the response below. I’ll then use this information to further discuss BoA and JPM derivatives of PMs of $18.2B and $27B, respectively…

My question to the OCC…

“

Hi – I am trying to understand the definition of “precious metals” on page 26 in Table 21. It is listed as “Precious metals”. Can you define “precious metals” for what is being reported here? I think of precious metals defined as: Silver, Gold, Platinum, and Palladium. Some consider copper and nickel as precious metals because they have been used as money. However, you see gold also mentioned with the FX area. Are precious metals on table 21 excluding gold? In Figure 18, we then also see the total notional amounts of precious metals – but does this also include the 4 precious metals I listed? Precious metals is not defined in the glossary to exclude gold. Is it possible to get a break down of what these precious metals are?”

Response from OCC – I put the items of interest in BOLD so you can skim.

“Mr. Fisher,

The information presented in the OCC’s Quarterly Derivatives Report is compiled from data reported by all banks who report derivative activity on their publicly available, quarterly Call Reports. Current Call Report Forms, Instructions, and related materials are located on the FDIC’s website. Attached to this email is the most recent Call Report form and instructions. In addition, through the FFIEC’s website, you can obtain individual Call Reports filed by FDIC-insured institutions.

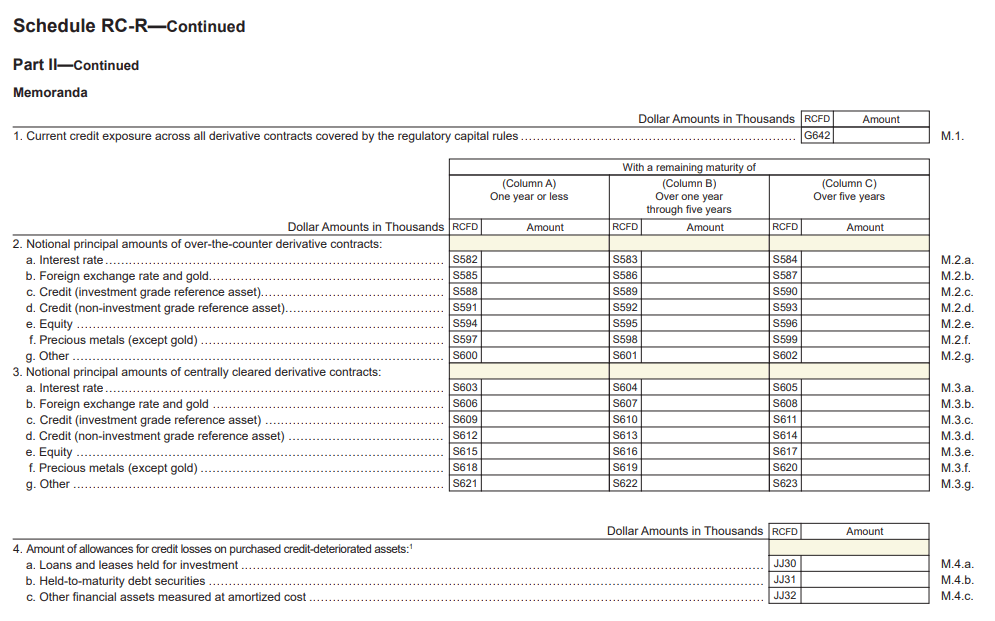

The information presented on precious metals in Tables 20 & 21 and Figures 17 & 18 in the OCC’s Quarterly Derivatives Report is based on the reporting requirements for precious metals as defined by the instructions to the banking agencies’ Call Report. Specifically, the information on precious metals is reported on page 82 of the Call Report (Schedule RC-R, Part II Risk-Weighted Assets, Memoranda, line items 2 and 3). Under the banking agencies’ regulatory capital rules, the risk-based capital requirements for derivative contracts is based on the type of derivative contract and the contract’s remaining maturity. For example, contracts based on foreign exchange rates and gold have a “conversion factor” or multiplier of 1%, 5% or 7.5% depending on maturity. Conversely, contracts based on precious metals (except gold) have a “conversion factor” or multiplier of 7%, 7% or 8%, depending on maturity (see page RC-R-150 in the attached Call Report instructions). This is the reason the information is reported in the format it is on line items 2 and 3 on Call Report page 82. The Call Report Instructions for reporting information on line item 2.f and 3.f, derivative contracts based on precious metals (except for gold), is as follows: Report the remaining maturities of other precious metals contracts that are subject to the regulatory capital rules. Report all silver, platinum, and palladium contracts.

Therefore, Table 21 and Figure 18 in the OCC’s Derivatives Report include information only from Call Report line items 2.f and 3.f, which would only include derivative contracts based on precious metals including silver, platinum, and palladium contracts. Derivative contracts based on FX and gold are reported on a separate Call Report line item and are shown in Table 20 and Figure 17. This information is not disaggregated any further.”

Gold is NOT part of the PMs in the OCC report

So – my assertion that some or many of these contracts could be gold was incorrect. I wish I had this email address weeks ago, but wanted to get the best information out there as possible, when I got it. However, it doesn’t say this is all silver either. With platinum a heavily managed market at $1000 per ounce today and palladium breaking out to $2,400 after it was heavily managed for years, it doesn’t take a stupid high amount of these metals to make up $18b. Or does it? I was a little suprised.

I wanted to then further look into the chart above, and go back in time. Some have suggested that perhaps the JPM lease TO BoA is counted twice. The $18.2B would therefore show up on both balance sheets but JPM has more on top of that. I cannot tell you how this is reported – IF one company is reporting as the lessor and the other company is reporting as the lessee – and they combine this. I don’t know, but I wanted to get some data over time. Therefore, I will focus on the last 19 reports or so with the top 4 – which appear to be JPM, Goldman, Citi, and BoA. Yes, I manually did this.

The form shows that a bank is to report the notional amount of the derivative – so in a sense, they could be the lessor or lessee – and if they are leasing to each other, I could very well see this as double counted in total.

You can get access to all of the reports here:

Here is what all of the PM derivatives look like going back a long way…

I was able to then go back to 2016 or so to determine how the big 4 banks were broken down by who is doing what. Here’s what that looks like.

Numbers below in millions. So total derivatives in PMs were $56B. This is the report I manually put together from 19 quarterly reports. What’s interesting here is you can see JPM as always active, but this game only really started up in 2005 or so. Then you can see BoA getting involved in 2020. Citi has been more of a presence than thought, and Goldman ONLY got involved this past quarter.

Prior to 2016, you can see the total notional amounts in this chart, but they didn’t break it down by PMs before then.

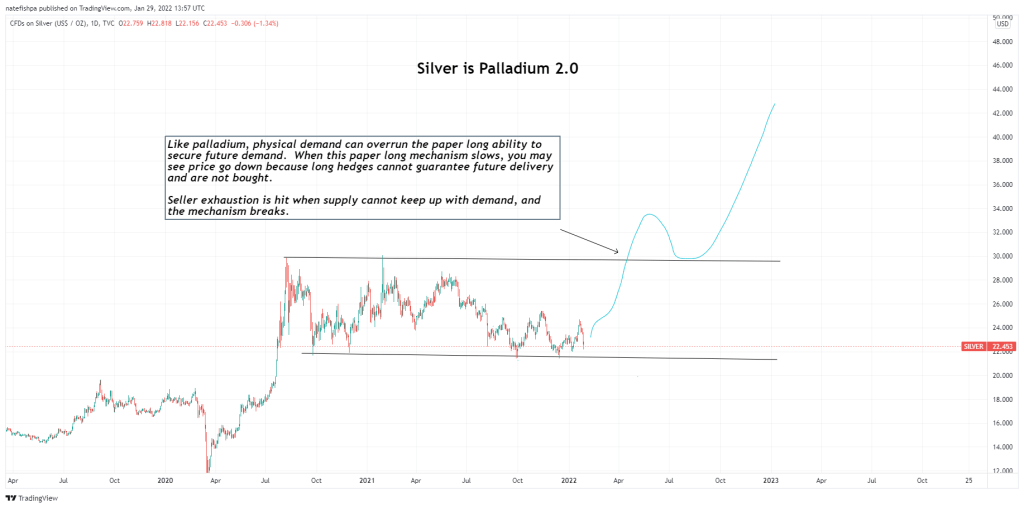

This whole game seems to be dormant until 2005 looking at the yellow bars on the chart above. Before then, you are looking at $5B in notional derivatives in PMs. You can sort of see how when PMs started going up in price, so did the derivatives. It seemed like a way to then manage the price. I believe Palladium broke out of this when the physical demand just overrun the whole thing.

IF BoA’s leased pile is exhausted, they too could then yield to a Palladium-like move, but I feel the pile wasn’t 800m oz and I felt they may have hedged most of what they sold – I have only seen COMEX, but I don’t have access to the OTC hedging. How do EFPs play into this?

With the above data, it’s focusing on the 4 biggest banks. Why? Take a look…

If you can read the smaller print, it’s saying the big 4 banks are responsible for most of the derivatives – which total a mind numbing $184 TRILLION dollars (with a T).

So let’s take a look at BoA’s $18.2B. Ted assumes this is all silver.

The case FOR Ted

First, he’s been looking at this stuff probably longer than I’ve been alive. My biggest problem here was – WHAT is this metal? Who was sitting on 800m oz to lease from?? We now KNOW gold is not counted, as I confirmed this with the OCC. OK, so what else could it be? I just figured, “hell, it’s a mix of other metals, too”. Well, the problem with that is that $18.2B is a LOT of metal. I had once heard something like $70B is the physical silver market, and I was mostly assuming that was all investment grade silver, bars, coins, etc – and that was perhaps 5 billion ounces at $16 an ounce then to take us to about an $80B physical market. Well, at $30 silver you are perhaps looking at a $150B market. OK…but look above and that’s where he gets his 800m silver oz, but my guess is it’s a combination of the three, and a combination of leasing out and being leased to. I have to admit, with gold off the table, silver is the next likely candidate for a lion’s share of this.

The assumptions here by Ted are three items:

- This was 800m oz of silver leased from JPM.

- It was all sold short into the markets

- That for every $1 silver goes up, BoA is losing $800m

If you look back in time, Bix had mentioned BoA is a newcomer to the short game. If you look at the BOA column, they only really started getting going with leasing metal in Q2 2020. That’s when we had the melt up in silver price and it might be nice to sell into the market at those high prices. You can see they started with $2.7B and ended Q3 with $3.3B. Now, that massive move up? IF I was leasing this dirt cheap and physically selling into this market to make stupid high cash, I am also then putting a buy hedge on the COMEX/OTC somehow. This could have been a massive push up in the COMEX price we all saw.

Q4 you start to see $5B more in silver in Oct-Dec 2020. There was a VERY nice move up in Dec 2020. This also could have been an opportunity to sell physical into the market and then possibly hedge long on the COMEX, which pushes up prices.

The big one then is a $10B chunk added in Q3 2021. Q3 was brutal selling, which has evidence of prices getting pushed down for months into the abyss. I had remarked many times when I was looking at the COMEX deliveries, that I was wondering about all of this EFP. More on that in a second. In the most recent episode of “Live from the vault“, Andrew Maguire points the BoA short towards the SLV. He also mentioned like me – he doesn’t know how much of the position is hedged in the OTC markets (I discussed COMEX). If it is not, then it would confirm that if silver went up $1, then BoA would lose $800m for every dollar. Andrew suggests BoA may have some sort of bailout agreement with the government if they get trapped in this – which would also support many who feel physical was shorted into the market to push price down. No evidence of this either, but a supposition.

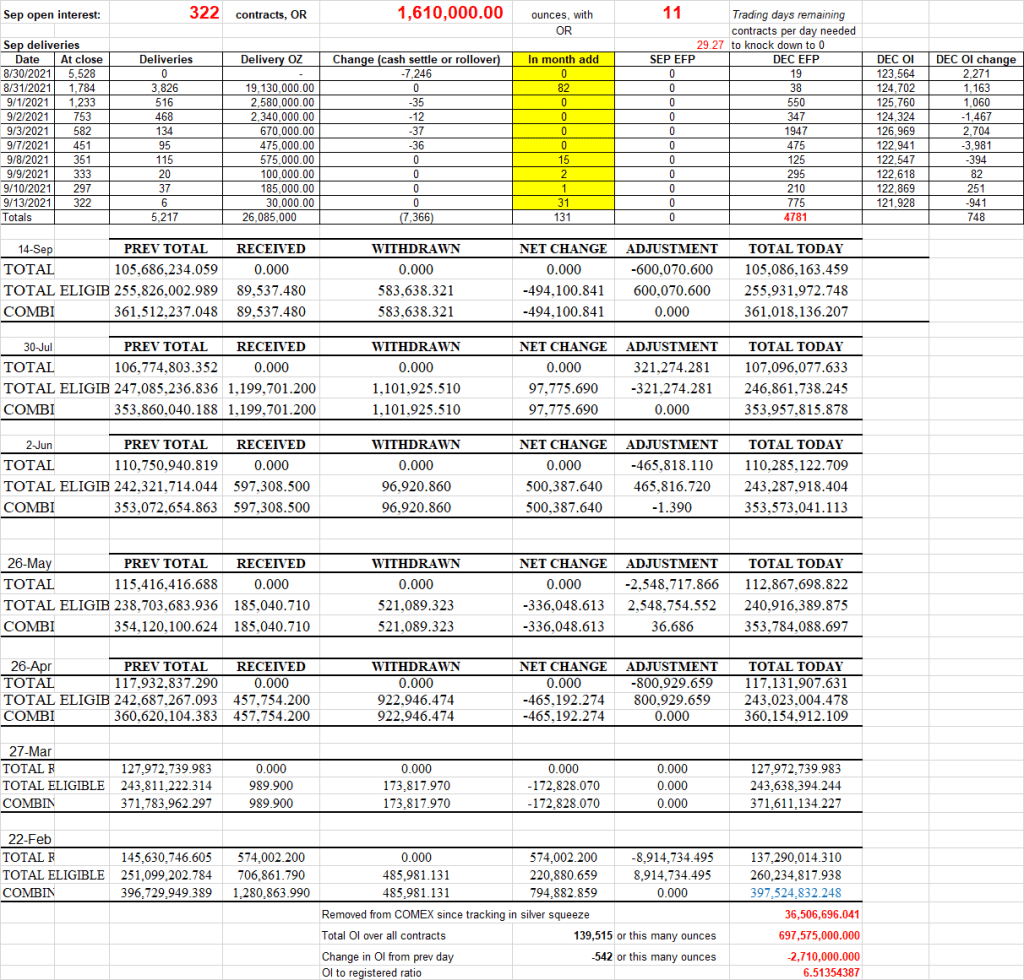

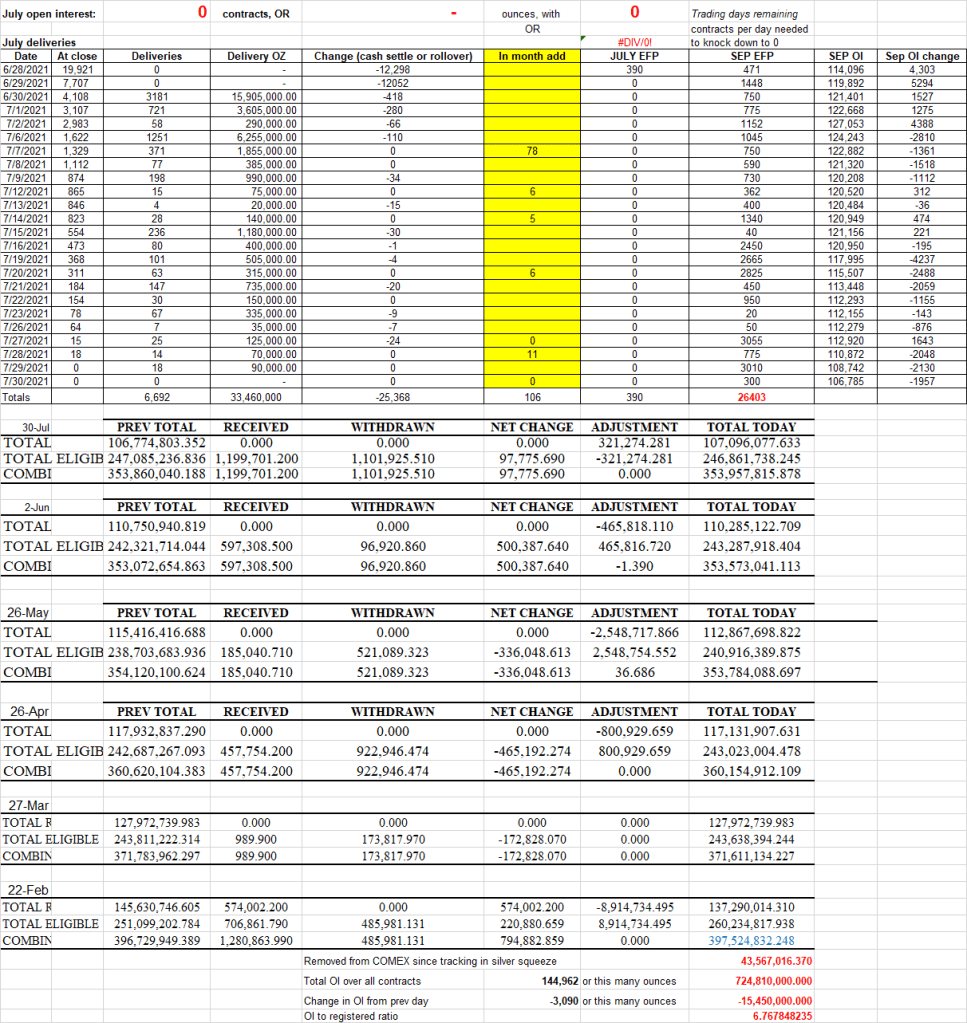

Where is it being sold? Well, one problem I was running into I mentioned above, was all of these COMEX items that wanted metals were being pushed off to LBMA EFP (exchange for physical). That then settles the COMEX and they are done with it. See below, how a few months back I was tracking 24m was being sent by mid-September for the Dec EFP. I stopped tracking – but this was in Q3, massive selling seemed to be not taking anything from the COMEX, but just pushed off to EFP. Notice below the 4781 contracts that went EFP in just half a month.

Now, the question is – is BoA delivering these EFPs through the LBMA? This is 25m oz in HALF A MONTH. Now, look at my records for the end of July – 26,000 contracts sent to EFP??? That is 130m oz in interest that hit the COMEX that was then sent to EFP. In ONE MONTH.

Can anyone tell me what the hell happens once this disappears from COMEX and goes EFP? I can’t. I just don’t know. But in a month and a half of tracking, in Q3 2021, I have shown 150m oz sold. At a price then of about $26, that is $3.25B in silver sold in half a quarter.

To me, it tells me someone at the LBMA was providing silver liquidity in a tight OTC market. Remember, at this time, I was tracking that 1,000 oz bars had high premiums. To me, it is clear those who could not get silver, decided to try and pull from the COMEX, and rather than draining the registered show room, it appears as if it went to EFP, where it is POSSIBLE a giant pile was being sold short.

You then see, precisely at the end of Q3, silver moves up for what appears to be 45 days straight. As if someone sold physical at $26 into the market, then bought long hedges on the COMEX at $21.44 to move price up. You are selling a pile at $26, and buying back from the COMEX essentially at a $4.50 haircut when you hedge.

IF they sold short, which looks like it is possible, it looks as if they sold to ETFs and EFPs. I did see in my conversation with Chris Marcus in our presentation that 25m was sold by BoA in December, then just last week they put a hedge on for 10m oz which you could clearly see how it pushed the price up last Tuesday when they did hedge. Sold in December physical at $23, price goes down, and in January you see COMEX go up with BoA hedging long.

800m oz? with liquidity issues, it is quite possible there’s 400-800m leased and I showed with EFPs there was a lot sent to the LBMA. Furthermore, the SLV and other ETFs during Silversqueeze may have been able to buy hundreds of millions of ounces from BoA. If they didn’t hedge anything, then they will lose $800m for every $1 silver goes up.

The case AGAINST Ted

First, I don’t know how much of that $18.2B is leased from others, and how much of that they could be leasing to someone else. As I pointed out above, the forms you submit asks for notional value of derivatives, not if you are the lessee or lessor. It could be they had the $8B from JPM but turned around and leased others platinum and palladium.

When doing the numbers, I tried to compare it to yearly mine supply. Given that gold was not on it, it does seem likely this pile of $18.2 is at least 300-400m oz. So taking the leap to 800m isn’t that drastic, but the evidence we have doesn’t break down these leases.

Remember – it is possible a lot of what they did was to hedge long. It is POSSIBLE when they hedged long, they were then able to settle EFP and collect metals. Meaning, they sold at $26 and bought at $21. They got the metal back. What do you do with it? Maybe I’ll lease it to a mint. So I leased $8B from JPM – about 300m oz, then it’s possible over time I sold that 300m, bought it back cheaper, then leased that 300m for $10B. The NOTIONAL value of those two items, combined are $18B. But this is 300m oz leased FROM JPM and 300m oz leased OUT to perhaps ETFs, industry, mints, or other banks that aren’t in the top 4. This means they OWE JPM 300m oz, but are OWED 300m oz in return. Some form or mix of these numbers could make sense – to lessen the 800m down to 300m.

Claim 1 – 800m oz were leased and sold short. NO CONCLUSIVE EVIDENCE

I can tell with the shorting that it is clear to me with evidence from December that BoA sold 25m oz on the COMEX. That report Chris Marcus brought up. We then saw a few weeks later when price cratered, they went long 10m on the COMEX, which seemed to be a long hedge buy back after they sold short. I have evidence of 25m sold short, not 800m.

I do wonder a lot about the EFPs. I don’t want to get into the nitty gritty of 240 pages of banking documents. I didn’t go to law school because I hated contract law and reading massive documents with legal stuff. Hurt my skull. But I have shown there were massive amounts of COMEX items sent to EFP over the 45 days I was tracking it. I had an open question to everyone several times on Twitter about the EFPs.

Additionally, the whole SilverSqueeze thing with SLV supposedly getting 100m oz delivered in a week. Well, that could have been some squirrely shit, and why the accounting didn’t work out. If JPM has a pile of silver in the LBMA vaults and leased it to BoA – the metal is sitting in the same damn vaults that SLV was in charge of. BoA could then sell that metal, which possibly never left the vault, but changed title But if JPM leased that to BoA, then SilverSqueeze happened, BoA could have sold that to SLV short. The metal is sitting in JPM vaults as JPM as the custodian. But also the owner. The OWNER on the bar was JPM. The lessee was BoA. They sold it to….Blackrock, who then wanted it delivered to….JPM vaults. So a bar that had a JPM ownership on it then ALSO had an SLV owner tag on it. This potential double counting of 100m oz is a legit reason HOW the LBMA was off by 100m oz, and could explain how 100m oz could have been delivered to the JPM vaults…it was already there.

There is evidence of short selling, but is all 800m sold short? With all of the production delays everywhere and how hard it was to find silver for industry, one has to wonder who was servicing all of the EFPs and supplying ETFs with MASSIVE liquidity.

Claim 2 – 800m oz sold short. There is evidence of a lot of metals sold in the background to keep this stuff going, yes. No direct evidence of 800m sold short, but I did paint a picture between December, EFPs, and SLV, that accounted for 275m oz that came out of thin air to help liquidity. Note that BoA delivered 25m oz in December, but the registered did not go down 25m oz. Could be a registered pile at the LBMA that changed title.

I can see a lot of silver sold that the Silver Institute is not accounting for with their supply and demand figures. There is evidence here of a LOT more sold than reported. Additionally, with all supply chain delays since COVID happened, I have not heard one person, other than mints, complain they had no metal for production. In fact, it appears as if mints were cut off intentionally to drive up premiums to disincentivize investors to buying investment silver.

NO CONCLUSIVE EVIDENCE, but PARTIAL CIRCUMSTANTIAL EVIDENCE

Claim 3 – that for every $1 silver goes up, BoA loses $800m. To me, it appears that BoA was selling physical into higher prices, then hedging long COMEX at lower prices later. It appears, at times, they may have been flying a little naked. However, if they sold a millions of ounces at $26 and hedged long on the OTC and COMEX, then they would be covered. If it’s properly hedged, then BoA would not lose $800m every time silver went up $1. Andrew is sure that in a paper-to-paper market, there is a “technical hedge” on it.

PARTIALLY TRUE – I feel that we can’t know:

- how much they leased

- how much they sold short

- what hedging mechanisms they are and are not doing

Because I saw clear evidence of BoA buying 10m in COMEX last week, a few weeks after they delivered 25m oz, it appears to me they are putting long hedges on at opportune times of low prices. Likewise, if price starts to get too high, they are able to physically sell into the market to drive prices down, to then buy paper contracts cheaper to hedge.

Conclusion

Ted has been doing this for 40 years, and he’s obviously on to something. And, the OCC report showed a massive jump from $8b by BoA to $18.2B by BoA. But there were too many assumptions about what that metal was, what was done with it, and too much speculation on a bank not hedging selling short 800m oz. I spent a lot of time researching this, and people like me learn a ton from the likes of Ted. I had NO idea what the OCC was before 2 weeks ago. I didn’t know much about the leasing/shorting mechanisms, and that world sort of opened up to me.

What is likely? There’s a BIG pile they leased from someone, sell physical into the market for liquidity, then hedge long by buying it back AFTER they drove the price down. The hedging mechanism allows them to buy the metals back cheaper and perhaps then turn around and lease THOSE metals out. For example, if you leased 100m oz at $20 and sold at $40, then hedged a buy order at $20 after you drove price down, you can buy double the metal, turn around and hand in the metal you leased, then lease your metal out to others. Point is, no one really knows what the OCC report is with the reported derivatives.

Finally, one has to really step back and look at the numbers here. These 4 banks have $184 TRILLION in derivatives, and the PMs are about $56B right now. That is, about what – .3%? I hate decimals, but I think that’s about right. The gold/FX market seemed to be like $12T. So that is about 240x the size of the PM derivatives.

Overall, I don’t think BoA is going down based on silver moving up a few dollars. They are playing an interesting game. They borrowed someone else’s shiny object. Sold it into a market to bring down price, then when price was low, they hedged by buying contracts long pocketing a nice profit per ounce. My guess is you can do this indefinitely, until the market you are hedging long with runs out of metal.

Lastly, someone needs to look at what the hell all of the JPM derivatives are. I put the JPM% on that because I thought it might be interesting to consider that JPM could be leasing everything to others, but if they are 70-80% of the derivatives, who is the counterparty not declaring it here? Given this isn’t gold, you are now looking at about $60B in PM derivatives. Do the math, and that’s an awful lot of leasing and short selling, then buying back.

I think I just kinda figured out how this whole crooked thing works, so I appreciate Ted pointing us to the right places to look.

Post Edit on 1/29

I wanted to add here about the “commercial shorts”. I know Ted has talked about the “criminal banks” with the top 8 shorts being short as much as 400m oz, with the top 4 at 300m. I think this is about 30% or so lower today than when he had brought this up. Then, it had been mentioned JPM was no longer short. How does this look?

Let’s say you buy 100m oz of silver as a bank. That’s a BIG pile. What do you do with it? Unlike you or me, when the banks buy a large pile of metal, it’s not really to YOLO on silver. The first thing I might do IF I were to buy this pile might be to hedge it short on the COMEX or OTC. Meaning, if the price is $25 when I bought it, if I bought a COMEX short and the price goes down $1, I made $100m on the short position on the COMEX and lost $100m on the price of metal. Meaning – a COMEX short on a long physical position hedges that value.

Now let’s assume I’m a JPM and had accumulated a large pile over the years. To preserve this value, I add shorts. This had a tendency to drive down price. Every month you simply rollover your short position. Some months you made money, some months you lost money – but the game is preserving the value of that hoard to net even. Now, there’s costs to vault that stuff, and potentially, you can lease this out to make money.

Let’s assume the price is $25, and I have 100m I wanted to lease out to someone like BoA. As I hand the metal over, the value of this is preserved in the lease agreement. As long as BoA has this metal, they would owe JPM $25 for the metal. Meaning, JPM can stop shorting every month because there’s no longer downside risk. The revenues from the leasing make some money which covers vaulting. If, at the end of that lease, metals are $50, perhaps JPM demands the metals back. They had a 2x upside with no downside risk, right?

Well, if you are BoA, how do you make money on leased metal? Remember, silver is a pretty small market. If I have a 100m oz hoard, I’d like to sell strategically at higher prices. Remember, I leased it when it was $25 and owe the metal OR perhaps the agreement has a buyout of $30 in it. Like when you lease a car there’s a buyout? I hope someone from the interwebs could tell me how this particular leasing arrangement was worded.

Now, perhaps I’m JPM and have another 100m oz pile. I deposit this into SLV. To hedge my value on this, I take out shorts. They do not deposit into SLV for kindness. SLV then takes care of the vaulting fees. I have hedged the value. At some point I may withdraw my shares from SLV and remove my short hedges. This is where Jeff Currie said, “the shorts are the ETFs”. If you see these big depositors like JPM, Citi, etc – they have hedged short to protect the value of this silver. While it is in SLV, they preserve the value.

Let’s now assume price rises to $35. BoA from the above example takes some of the pile they leased and sells it into the physical market at $35. Because they are dumping millions into the market, those who are buying then….hedge short on the COMEX or OTC and these short buy hedges drive the price down. Once price is driven down far enough, a BoA can then put a long hedge on the metal they just sold short. We just saw evidence of this from December 2021 where they sold 25m over COMEX, then a few weeks later went long on the COMEX 10m oz. They sold at like $23.50, and bought at like $21.50. That $2 spread over perhaps 25m oz is a cool $50m they just made by selling someone else’s metal. Below is a screenshot of my interview with Chris at Arcadia which shows this.

By hedging long on the COMEX, they can then hold that as long as they want, OR closer to the time of the lease expiration, IF there is no buyout and IF they need to hand metals back, they simply take metals from the COMEX/OTC long hedges they have.

Someone like JPM who is out of the “shorting” business as Ted reports, is probably out of the shorting IF they handed their pile over to others to lease out. Meaning, they have no reason to short hedge this because if the metals are leased out, the value is protected. This may be what they refer to as “passing the short position”.

How this ends

It is clear that the CFTC is doing nothing about it, because this is beyond their scope, it seems. They have position limits, but they make exceptions for legitimate hedges. If you have a 100m oz pile, and hedge this short, then you are legitimately hedging the value of this. Likewise, if you sold short 100m oz, going long as much as you can is also a legitimate hedge.

Now, as long as there are sources of this metal in the registered COMEX or on the OTC to hedge long, where you feel confident you can hand that metal back to JPM, all is well. But I ask you this, with the registered now at 82m oz down from 150m the year prior, are we confident there will be registered even in there a year from now?

I can see Jim Hunter screaming at me through his keyboard now trying to point at the 272m in eligible. And this is where I have disagreements with Jim. Love the guy, but that 272m is NOT for sale. IT COULD go for sale. But it NOT for sale. It’s like, “hey, you know, if this price moves up perhaps $10 or $20, perhaps I can then slide this in to registered to sell immediately”. It also doesn’t mean it is NOT for sale, if BoA had 100m of their leased hoard among this, they can sell that behind the scenes and the bars get the tag moved and nothing ever had to move from the eligible to the registered. I also get that people can take OFF the eligible, which may be sales to mints, industrial, etc.

My point is this, IF there was a run tomorrow, you COULD go to the COMEX, buy long contracts and take within a few days from that registered pile. That is your ‘show room floor’. David Morgan says he had seen this as low as 35m oz before – but this was not in the same environment we are today, where the COMEX is a deliverable mechanism. Why is the COMEX being attacked so hard? Well, to me, it is a source of deficit sourcing.

We continue to see the silver institute put out these reports that those IN the industries question. What I am seeing, clearly, is that there is and has been a shadow pile of metals accumulated by a JPM, and this pile is then leased, and this leased pile is then sold into the markets when price goes up to control price – or, is it to ensure liquidity of a strategic metal? Most think this is relatively nefarious, as the government is pushing down silver prices. Truth is, I don’t think THEY care about silver. To me, gold is what they care about. If you are a seller of PMs to industry, AND the markets get tight, wouldn’t it be nice to be able to source emergency supplies from someone?

Now, the question is, can these emergency supplies get re-stocked from the COMEX and OTC long hedges? Remember – if they sell that 100m oz over a period of time, drive the price down, they hedge long paper contracts to potentially collect that metal later. This game is up when these deficits overtake the ability to re-stock that long hedge.

To me, the overflow in demand has been, and will always be, the investment demand. I feel the WallStreetSilver movement, with PSLV, taking 1,000 oz bars off the market, and heavily investing in physical metals (which then require 1,000 oz bars to be drained to re-stock mint supplies) are very effective at a long term plan of draining the ability to re-stock the long hedges.

Now, here’s where I mostly differ from Ted. IF you have a BoA who at one point realizes they can no longer re-stock if they sell, they slow the sales of the metal or stop completely. Why? They cannot replenish that stock. OR – they sell without a hedge, and THEN you get blown out $1 for every $1 price moves up. I would think of they can’t hedge, OR if the paper hedge allows them to settle with JPM for like $30, that metal can get disappeared over the next year.

Furthermore, if you are JPM and leased this out at $25, you may have a buyout at $30 and get paid 20% profit for this. OR, perhaps BoA hands the metals back when it is too risky to hedge long – but at this point you are looking at $40-$50 silver and then JPM would get the metals back – at this point, industrial lines of production STOP, or they are selling into this at $50. This would grease the wheels for maybe 6-12 months, but to me it would be at THAT moment the emergency reserves are gone, and the lease massive piles to sell short game is over.

This is what I see unfolding within five years. Our true deficits of supply and demand will be recognized, and this is when all hell breaks loose. Now, could we be at that point now? No, but I think we are on a collision path. With two years of investors buying silver hard, with no end in sight, and millennials now understanding inflation and monetary policy – I believe the investment in precious metals hasn’t even begun to start.

Remember how the palladium game was broken. Physical demand overwhelmed the ability to paper it over. If the BoA shorting can not be replenished with COMEX or OTC long hedging, that’s game over. I am not giving two shits about COMEX eligible. Those owners might be waiting for $50 silver. If they wanted to sell, now, it would be on eligible. I’m wondering how much of those piles are front runners knowing $50-$100 silver is imminent and just laying in wait.

What I’m seeing with silver is similar. I believe the next time we cross $30, it is the “palladium breakout”. It may run to $35-$40, back test $30, and THEN it gets really interesting.

How does this end?

- Short sellers slow their long hedging, as future supply may not actually be able to physically deliver on reuqest for metal. This drives prices down – perhaps like we saw in Palladium in 2016.

- Physical demand is real and paper shorts then slow down. We can see lots of less OI on the COMEX. Paper spec shorts start to see seller exhaustion and realize they could get steamrolled.

- Commercial shorts on owned metal may start to take these off as they sell physical into an increasing price OR risk industrial contracts being defaulted on. I believe this is how the price rise in Palladium then started in 2016. With commercial shorts being taken off, there’s less selling pressure on the metals. Those who buy the metals consume it, and have no need to short to preserve value.

- Leasing activity decreases. Shorts who leased need to replenish what they leased and take delivery of metals to hand back over. Once owner takes possession, owner of metals starts to then sell into a much higher priced market. Leasing is a way to make money in a sideways market.

- Most exchanges then have a tough time finding sellers as hoards are depleted and supply/demand realities hit the markets.

- Prices rise drastically to entice more supply from miners.

- Price eventually stabilizes at an equilibrium when new price discovery zone found.

- Efficiencies eventually found and price consolidates over a long period of time before cycle begins again.

What we can postulate is there are similarities to silver today as there were in Palladium in 2016.

Here are the questions I’d want to know as a silver investor:

- How are the lease agreements written? Does BoA have a buyout price for the leased metals at end of lease or do they have to hand metals back? This is important to me, because I believe JPM was told by CFTC they needed to get out of their hoard. Rather than selling 300m or 500m oz at once and crashing the markets – it is POSSIBLE they were permitted to lease this metal out with an agreed buyout price. I am wildly speculating here – but the timing of the BoA lease coincides with JPM being fined $920m for all kinds of bad manipulation. So IF BoA was allowed to lease this perhaps with a buyout price of $20, BoA could be selling into rises with physical, and then going long paper at troughs to replenish as long as we are in a trading range. If metals then continue to rise past $30, they may just sell out of the hoard 100% and write a check to JPM for $20 per ounce for all they sold. This would have the net effect of freezing JPM from winning or losing on the pile of silver and getting market value of $20 at the end of these leases. JPM would no longer need to short the COMEX on this hoard. BOA would not need to short as they had the metal they could hand over and ONLY would sell on price rises into it.

- How much of the hoard does BoA have left?

- If this was an 800m oz hoard sold over 2 years sold out, that would be about, on avg, 400m per year or 33m oz deficit in supply/demand they have plugged. This is somewhat in the ballpark of the ETP numbers the silver institute reported for 2020. Now, the question is, is BoA replenishing the hoard to continue this or are they performing a legit service to sell JPMs hoard over years at a nice profit to them and no risk.

- Are we at Palladium in 2016? If so, what would the signs be? Perhaps diminished COMEX reserves? Perhaps tighter OTC markets (Andrew Maguire mentioned problems until mid-2022 getting supply from the OTC). Perhaps reduced OI? Last year this time, we were at 900m oz of OI, we now have about 750m oz of OI.

- Could we see big banks pull out of SLV to sell to plug holes? We saw lots of SLV withdraws over the last year. When these banks withdraw and sell, they remove their sort hedges.

I feel that we are at a time where these questions should be considered in your investment thesis in silver. My contention is, and always has been, that supply/demand fundamentals are really out of whack, and as David Morgan has said, the price of silver is “at the margins” – and with significant investor demand, and reserve piles are being reduced to rubble.

Our time is coming. Trying to understand these shadow games and wars is unfortunately necessary in order to know if our investment on a supply/demand principle in correct or not.

1 Pingback