I’m going to take a very unpopular stance here and defend pretty much any bullion dealer right now. I have seen many people beat up on bullion dealers, and I’m going to take the position of analyzing this industry for a hot minute. Read the whole damn thing before you sling the hate.

And at the end, you will see how Apple Resources will give you the low premiums you want. It just might cost you a lot more at spot. A LOT more.

Why am I writing this? It started with the article about the price controls.

It continued as I went to look at a car with my wife. More on that below. And then I just saw this from WallStreetSilver and wanted to connect the dots for everyone.

WallStreetSilver wrote the below:

It then continued with Dave Kranzler joking about Musk mining Lithium in 2 years.

So how does Weber’s price controls tie in with me looking for a car and WallStreetSilver’s tweet combined with Musk and Lithium?

Fundamentals

Let’s first take a minute to understand price controls. I took economics in grad school, and as much as this pains me to say, not enough people have taken economics, and those who have taken it – apparently forgot it or wrote some PhD thesis where they sprinkle magic fairy dust on it and it doesn’t work how it’s supposed to.

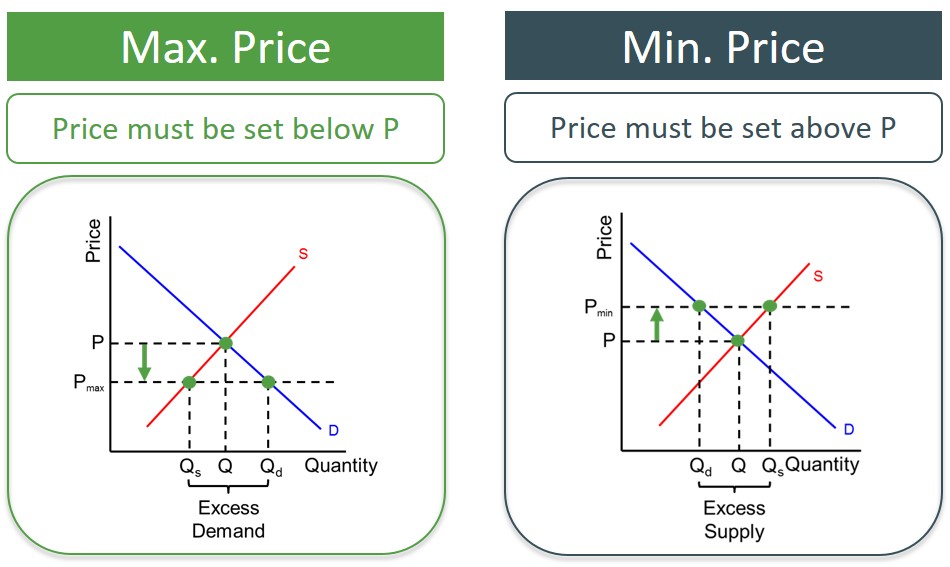

So let’s understand the below concepts:

- price ceilings create shortages

- price floors create surpluses

Why?

If you have a price CEILING on something, it means you are ARTIFICIALLY suppressing the price of something. If I am a manufacturer and it costs me $25 to make a widget, and the government says I cannot charge more than $24 to make a widget, I lose $1 by producing these widgets. At the start of this, perhaps we can lay off some people to cut costs, maybe shrink the size of the package from 1 pound to 15 oz. There are ways to cheat death here.

But what if the price control was $20? You have to stop producing. You WERE charging $30 and someone called you greedy and decided you cannot charge more than $20. It puts you out of business. Let’s assume you have a small producer who has a cost of $25 who was charging $30 and a large producer who has a cost of $20 and was charging $30. When you cap the price at $20, perhaps you are then forcing the small producer out of business. This also has a net effect of increasing the market share for the large producer.

However, there were 1 million of these widgets sold. The large producers only made 600,000 of them. They cannot produce more without spending millions in CapEx to increase their plant sizes. Production is thus capped at 600,000. The DEMAND was 1 million. Now, there is less product on the shelves. In a natural free market system, the price would increase to meet demand and thus keep the shelves stocked. But with less produced and artificially low prices, you have no hope of keeping the shelves stocked.

That is, if your price cap was actually profitable for the large manufacturer. Otherwise, this could be complete bare shelves as if it is not profitable to produce, companies will not produce it.

With price FLOORS, the reverse is true. If you have a floor of $5 for milk, but it costs you $3 to make, all diary farmers would crank up their production of milk to put on shelves. The lower price of $4 may have been found by supply/demand. By having a higher than normal price, it entices more and more people to produce milk. However, there isn’t enough demand at $5 and the shelves have too much product.

This is what it looks like on the charts.

Those who set controls may THINK they are doing the right thing. Consider a situation where it MIGHT be warranted. What about right after a hurricane in a ravaged area. You see someone selling bottles of water for $50 each. Is that price gauging? Yes. It’s kind of hard to argue with that. But the idea is to prevent something like that.

In reality, if you are producing widgets for a $25 cost, and inflation is rampant – your input costs go up. Raw materials to make stuff, energy costs, and eventually, labor costs. To make your product, it now costs you $30. You are in business to make money, so you pass on your additional costs to the consumer. Price caps essentially could put this company out of business by an ill-informed politician – or worse yet, as demonstrated above, pick winners and losers while creating shortages.

There’s your crash course in price controls.

Car shopping

My wife’s car came off of lease and we bought it out for $24,000 and the trade in value for it on Kelly Blue Book is $35,000. Great! Let’s go lease another car and trade this in! What you are seeing is dealers trying to significantly low ball the KBB value – by a LOT. Furthermore, there legit is no real inventory on lots in my region. We need an AWD car, and we looked at 3 makes and models within 50 miles. No dice. We showed up on some lots and got laughed at.

Much of this is the chip problem, but some of this also is production capacity issues. These dealers’ lots are BARE. And, if they buy my wife’s car, it gets sent up somewhere else so it doesn’t sit on their lot to make money from. If you are a car salesman, and there’s virtually no cars on the lot, how do you pay your monthly bills? First, cars that do come on the lot cannot stay on the lot. So there’s no negotiation down in price, at all. Why would they? Second, any used cars that come in, they have to low ball to make some money. KBB says $35,500 and a guy offered me $31,000 the other day. When I pushed back, he went back and got “authorization” for $32,500. Clearly – these guys are missing where KBB has $35,500 for TRADE IN value? No. They are selling that car whether you trade yours in or not due to the demand.

But this also has parallels now to the silver bullion market

Bullion market issues

If you run XYZ mint, maybe you have the capacity to make 4m rounds a year. This is with full shifts and staff running 24/7. Some years you make 2m, some 3m, and in rare cases, 4m. In 2020-2021, you were ramped up as much as possible, but you had problems with people calling off, a warehouse getting sick, supply chain bottlenecks getting you silver on time, and while you had a capacity for 4m, you maybe produced 3m.

Sad thing was, demand was off the charts! All of these bullion dealers wanted to buy from you.

Now, if I’m a bullion dealer, I know I can get 1m rounds from XYZ mint. In most years, I might get 1m in rounds sold back to me. Most years, the demand may be 2m rounds. So we have a supply/demand balance.

This past year, things changed. Demand went up to 3m but my normal 1m from XYZ was cut to 750,000. And, none of you assholes are selling rounds back to ABC bullion. Where ABC bullion THOUGHT they would have 2m rounds of supply and 2m rounds of demand – and this gives them a fixed premium to then keep the lights on, pay the staff, and run the website, a funny thing happened….

Those 2m rounds of supply are only 1m. So if they charged the EXACT same premium, they would sell out of product quickly AND only have half of the revenue. With lower supply and higher demand, what NEEDS to happen is premiums double to just make ends meet due to the supply restrictions. With demand so high, you can go for awhile with keeping premiums high.

Eventually, one of two things happen:

- The supply situation is resolved and normal supplies come back in and you can reduce premiums to make ends meet.

- The supply chain is NOT resolved and premiums have to stay very high, perhaps driving down sales and putting the company out of business.

Where many see high premiums right now as gouging, I see as an industry that is struggling right now. Sure, when they sell this ASE, they make bank. But at these prices, how many people are seeking alternatives?

I tell people to layer their silver investments. Get your physical, but I also talk about PSLV, OneGold, vaulting, and Kinesis. At times when you see high premiums like the above, look to other sources. Perhaps a local coin shop and 90% constitutional?

Chris confirms issues with bullion dealer supplies, and then Jeff then writes back…

I’m not going to comment on the nuances of the bullion dealers here – but I can see clearly like anyone that the whole damn system is falling down around them and they are trying to keep the lights on and provide you a service. Fiat currency in exchange for a rare piece of precious metal that may become extremely rare in the coming decade. They aren’t in business to lose money, and unfortunately, those who can pay, are. Luckily for you – you still do have PSLV and Kinesis as alternatives.

Where this is going

I have written a few articles the last 2 weeks on silver supply/demand issues. Currently, there’s 82m oz sitting in the COMEX warehouses. Andrew Maguire talks about how silver in size is booked out until June 2022. But anyone, really, can go to the COMEX today and take off millions of ounces.

Furthermore, if you are a Samsung and want silver, all you really have to do is work with one of the authorized participants – buy in 10m shares of SLV, then withdraw the silver working through the AP. There’s 550m oz there.

At most issue is that the stackers are not selling back and couple that with mints that cannot keep up with demand and have fixed production capabilities. If you are XYZ mint and are asked to take blanks and make 1 million WSS rounds, you may not have the lines available for months to run it.

Where this is going, to me, is that a few things are about to happen….

- The guys buying 1,000 oz bars and slicing/stamping will partner with major bullion dealers and they are about to move a LOT of product. These guys also have only so much capacity. But, they have low overhead and can potentially move a lot of product.

- Mints like XYZ mint may start to expand production capacity seeing that this has been in high demand for 20 months and it is not letting up.

- Bullion dealers like ABC will have continued high premiums until their shortages are resolved. Some of the bigger bullion dealers will pay well over spot in order to get inventory.

Buying a mine?

Lastly, I wanted to write about the thinking of an Elon Musk or the like buying a silver mine in order to get supply. At this point, it is kind of funny to think about. What the hell does Elon know about mining? Nothing. Right now, IF Elon wanted to, he could buy up at position limits every month in the COMEX and take delivery. Or, he could buy every single silver primary producer on the planet with 10% of his net worth. He could also buy into SLV/PSLV and drain these. To me, this is where I feel the deficits will be sourced for the near future. I was stunned by the COMEX being dropped from 93m to 82m oz in a week. I made mention I thought this was a big deal, and some shrugged it off. Maybe it’s nothing. Since silversqueeze, the COMEX is now down about 70m oz. To me, you are seeing how the silver deficits are being source – as we speak.

To me, the above chart shows the structural issue of what’s going on in silver supply. In 1980 and 2011, there was no PSLV to invest in a silver ETF you knew was adding silver. Where the cartels would perhaps win before would be to choke off physical supply from anyone and stupid high premiums discouraged silver investors. Now, you have the COMEX being drained as a delivery vehicle AND SLV being drawn down by participants AS investors flock to PSLV.

Below, you can see how some people are going to be industrious and make some money during this.

It is silly, at this point, for a Musk to talk about buying a mine. Or is it? Let’s look at the top car producers worldwide…

What you see is the top 3 each making 10m cars each. Number 10 on the list was at 3m cars, and Tesla was not in the top 10. Despite having a market cap more than the top 10 car makers combined, Tesla is woefully behind all of them on production and revenue.

But the point is this – the silver needed for all of these new EVs is about 5 oz per car, according to Keith Neumeyer. Currently, it’s just over 1. You can see on the silver institute numbers that you have 90m oz for about 77m autos. What happens when that number goes up from 90m to 300m as more EVs are made? When solar goes from 100m to 200m a year in silver needs? Where are they getting that silver? Could they simply BUY a First Majestic for $5b and then have all the silver they need and control who gets it? Could this be a situation where large companies that have literally hundreds of billions in cash start to use that cash to buy up mines?

IF that’s the case, and you have Apple sitting on a hundred billion in cash or the like, how hard would it be for them to start buying up the SilverCrests, Discovery, and Bear Creeks? What about the Fortunas, Endeavors, and Pan American Silvers?

If you are an electronics/tech company flush with cash, couldn’t you see this as the next arms race? These mines are severely depressed in market cap. You are going to need a lot of copper, silver, rare earths. Why are you going to face shortages if you can just buy the source?

To me, it is possible Musk is the least of your worries, as there are over 1,000 products that have silver in them and soooooooo much cash sloshing around the system right now – it just stands to reason that some of these tech companies may start to spin off “resource” companies to start to acquire raw materials, with specifically prioritizing metals to the parent company. Think about a solar company who might need 10m oz of silver a year buying First Majestic, taking the silver it needs, selling the rest into the market and selling the gold mine off?

Think about “Apple Resources”. Think about “Samsung Resources”. There could be 10-15 major companies like this that do nothing but gobble up mines over the next 5-10 years. Now, imagine these 15 control the price of silver to the market by selling based on supply/demand and BYPASS selling to banks at COMEX prices. Apple gets paid in a silver stream for their investment, and secures silver for the next 100 years. They sell silver to their competitors at $200 per ounce. Companies like Newmont who are primary gold companies may not be bought and might cost $70b – but they produce 54m oz of silver a year andf they could sell to Apple Resources for $200 per ounce. Gold companies may not be a target, unless they are small enough and have significant silver byproduct.

And you are worried about premiums to get silver. That’s cute.

Unobtanium and Unaffordium do not begin to describe what COULD happen. For now, you are seeing ABC bullion and the like struggle to keep the lights on and you want to call them greedy. Well, just wait 5-10 years when you are turning in your silver for $200 per ounce to Apple resources (who bought SD Bullion to sell excess mine supply on the free market) and you just got a 10x on your investment. Is that greedy?

Day 1. Hour 1. Minute 1 of ANY business school. “You are in business to make money. Period”. If you do not like the high premiums, Apple Resources will have a bullion store where you can buy at $3 over spot at $203 per ounce. Silver at $200 spot, of course.

Make no mistake. The hoard that is available to people right now at the COMEX and SLV are being raided. When the big companies cannot get their silver guaranteed to them, they will simply start buying up the miners because of the amount of excess liquidity in the system will continue with mergers and acquisitions to make big conglomerates bigger. And this will set off a frenzy of buying you have never seen before. Until you see something beyond absurd. Black Rock buying Blackrock.

$50 silver is for chumps. I’m whale hunting here son.

Leave a comment