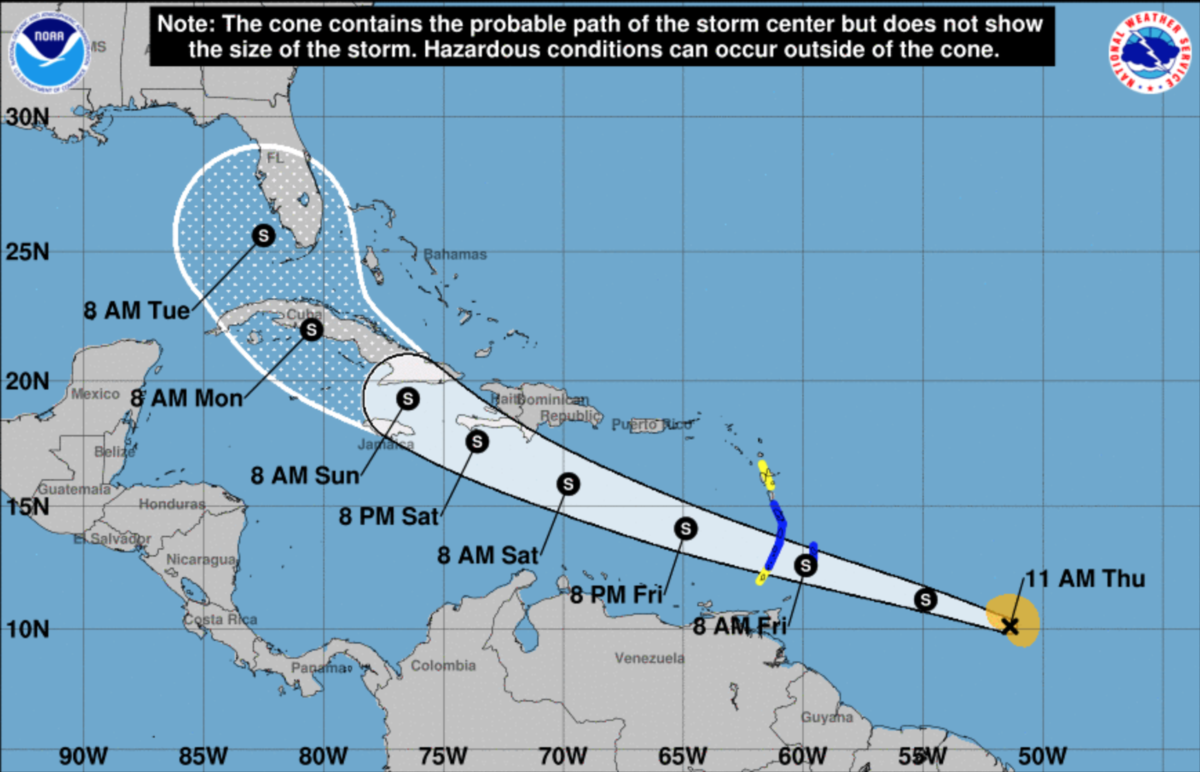

I have used the hurricane analogy a few times with gold, and I want to bring this message to a larger audience to understand how the pricing mechanism works in the grand scheme of a hurricane.

For decades, you have had storm watchers drop sensors in hurricanes to find out the wind strength, track on satellites, and model with complex super computers the possible trajectories they would go. Things that are fuel for hurricanes are warm waters that it feeds energy from. It can only move so much in a day, and sometimes can stall out dumping rain for days. My mother lost her house in a hurricane in 1972 that parked itself over Pennsylvania for 3 days dumping rain and flooding out our state. The storm is a force to be reckoned with, and builds a lot of energy and fuel. Still – with all of our technology, the best we can do is estimate with models where it MIGHT go, then tell people to evacuate or hunker down. Eventually, the hurricane runs into cooler water and its energy is depleted. It then fizzles out.

During a hurricane’s life, you can see it wobble forward. The trajectory is guided by headwinds, pressure, and fuel. Unlike a stock that has tons of financial energy that can propel it forward on great Q3 results, a hurricane is a force of nature that finds its way based on other inputs. You can find beauty and destruction in it, but make no mistake – all of the models predict landfall. It’s just where it’s going to land, and how strong the hurricane is going to be. No one can predict that on day 13 of the hurricane, the winds will be nwn at 132.67 mph at precisely bumblufuck, Alabama. This is the burden of a lot of people who make gold and silver projections. It is not POSSIBLE to be “right”, but it is possible to understand the storm is coming and estimate the approximate location and extent of damage.

I believe this is how many need to start looking at gold and silver pricing. Stop getting on people for getting a prediction or forecast PRECISELY correct. IT’S NOT POSSIBLE. When I wrote about the possibility of $300 silver by 2030, I was doing just this with the hurricane metals forecast. I was looking at the hurricane and trying to understand the inputs, headwinds, and trajectory to determine the extent of how we COULD see $300 silver by then.

Let’s start with how you might want to look at this storm. IF I was to write a program for a super computer, I’d use these types of inputs as what FUELS the hurricane:

- Fear and uncertainty

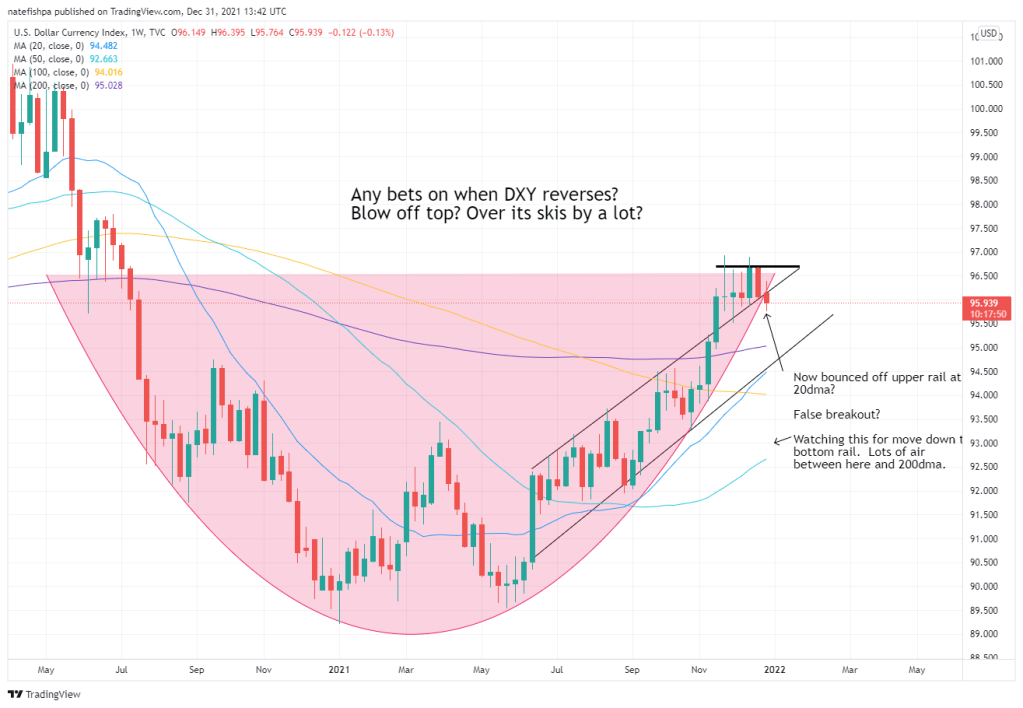

- currency going down (for me, DXY) due to debasement and “money printing”

- Bad economic data

- Deficit spending

- Dovish fed with monetary policy

- Positive regulations (for example, Basel 3)

- Banks not net short

- Supply and demand fundamentals have deficits

- Bullish chart setups and previous analogs

The above is setting the conditions for the hurricane to exist. How LONG it exists depends on the above fuel. Could this hurricane hit Florida and run up the east coast and up through Canada to Nova Scotia? Or, does it hit as a Cat 1 and peter off into the Atlantic immediately upon landfall?

How a hurricane moves forward in time

Now, the conditions are there, now how close is the hurricane getting to landfall and reaching peak energy? This would be a high sustained price on a gold chart. It can only move so much in a day, and this is governed by fib levels and RSI. If fib levels and RSI get too overstretched, the hurricane may then slow and recharge before pushing forward. This is the gold price from 2008 to 2011.

With this, you can see it in a trajectory wobbling, gaining energy, blowing some off – and this shows you what I see as the path leading to landfall. At the top, I am picturing this hitting landfall and then the energy dissipating at its peak. It hit Florida as a Cat 5, and then you can see the energy draining as it marches up the east coast. Along this hurricane’s path, it decimated islands in the Caribbean.

What governs the direction of the hurricane?

We saw above the conditions that created a hurricane, and we then saw about how much it could move in a day or two. But what is making that move within that channel? What is the resistance that can slow this to a crawl or keep it a Cat 1 that never makes landfall?

- Higher currency price (DXY going up for me)

- Real rates running higher

- Stonks going up, providing a high yield to their financial energy

- Hawkish fed policy/rhetoric

- Fiscal responsibilty

- Good/great economic data

- Negative regulations (pegging gold price, illegal to own, taxation)

- Banks very net short

- Supply and demand fundamentals have surpluses

- Bearish chart setups and previous analogs

- Banks changing rules as they go to benefit them

Short term noise

What many of us see day to day is the bullshit the banks play with spoofing. That is the most visible thing we see. However, you need to see this as ocean waves. If you are in the boat and going 3,000 miles, you will get waves pushing up against you. It offers short term resistance, but it doesn’t stop you from going those 3,000 miles. I am someone who deeply believe silver is highly manipulated and suppressed downward. However, if you look at gold at $35 in 1971 and $1800 today, that is a 51x move. If you look at 2000 to now, that is a 7.2x move. We can see violent run ups with gold, then periods of cooling off. So the short term manipulation is very effective on the daily charts to run stops and have banks make money on fools who bet the futures. However, when the tidal wave hits, the banks get on the right side of the ship. This tidal wave trumps the smaller waves and overwhelms them. This tidal wave will reverse a lot of short term noise, when it hits.

To me, the manipulation motives appear to be to gaslight a population over 50 years to forget gold and silver were ever money and to discourage the use of these as such – and to treat them only as commodities. If you are a country, and the population freely chooses to exchange their paper currency for gold and silver, what will happen is the prices of gold and silver will go up, up, and up more and people will then no longer want to hold the paper – so it is a direct enemy to a country’s paper currency. For a country to achieve its goals, it must have unfettered access to spend whatever it needs to spend to achieve its goals. Gold and silver are constraints to this spending. It is the ultimate check and balance to a country.

In my country’s Constitution, we actually have gold and silver listed as our only money. I believe there are many libertarians out there who have understood gold and silver’s place within a government and why gold and silver are still in the ring duking it out. If it wasn’t for some of them, gold would still be $35 and illegal to own. And, they realized far before I was born that a government’s power is limited by its ability to spend. If you remove this power, the government cannot grow and encroach on your liberties. I only saw this recently in my country where a mandate was pushed out to employers that forced employers to then force employees to get a mandatory shot or else they are no longer allowed to work. This could only be achieved if a workforce was enslaved to do so. A workforce that did not have debt would not be able to be coerced using this measure. Instead, we have a population massively in debt, and if the employment is taken away, they are threatened with destitution. This is a form of tyranny I have never seen in my life, and still am trying to grasp it. It is a harbinger of things to come, which is why fiscal restraint and sound money need to be pursued stronger than ever before.

This is why it is extremely important to understand gold and silver – and how it operates. I am not writing this to predict a moonshot like bitcoin with these. The conditions are there for this to happen, but you need to understand the metaphor of what is happening. And, why it is important. We are at a juncture where this whole thing can fall apart – and this could first be seen in the DXY.

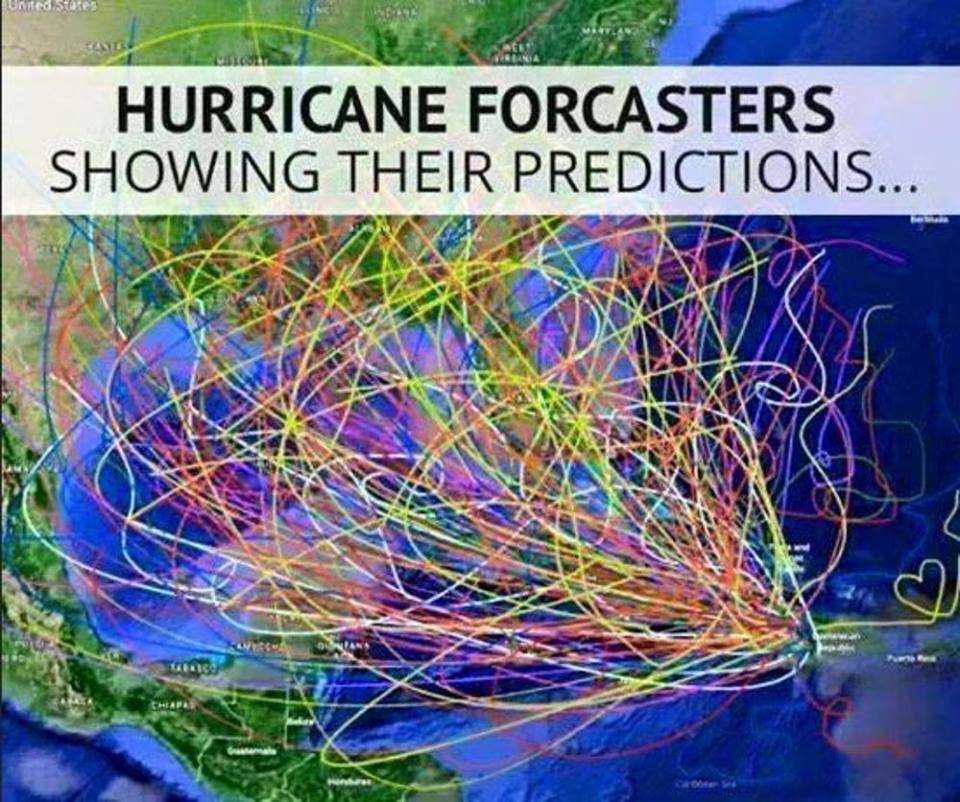

Seeking out the all knowing

Many of you want some guru on Twitter to tell you silver will be $38 by end of January and it hit $38 by end of January. I can attest these people do not exist. You want this intel to then make bets and make lots of money. But all this guy can do is look at all of the indicators and make a best guess. I made a prediction in February that didn’t come true, and learned a valuable lesson about putting time on things. I have explained WHY it didn’t come true. The answer to that was number 11 in the direction section. All of the conditions were there, and a bank changed the rules in the middle of the game. That is what we call a “known unknown” – and now this type of thing is factored into my hurricane forecast model.

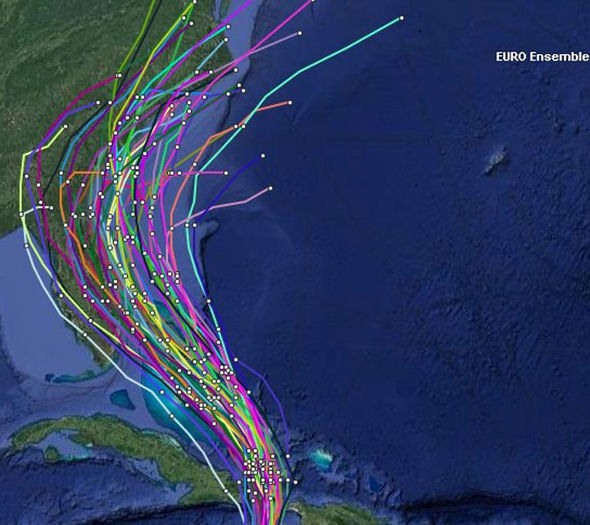

I think many of us all see the hurricane coming. None of us can be CERTAIN where it’s going based on a chart, as you can see 800 other things are fed into the super computer. Beware of certainty. Listen to those who speak in probabilities, as it is the ONLY way you can look at this.

This is what you might think gold gurus are like.

This is what most of them are like…

Why? Because many of them only use one of the above tools to predict. They are CERTAIN. They look at the charts, and they tell you with 100% certainty you are wrong. Beware. Step away from that guru.

Ask what tools they use to analyze. The best ones I follow get pretty close, and they use many tools. Charts are one of them, but they may also look at a lot of those potential fed minutes and say, “if they are dovish, it might move gold up to $1835. If they are hawkish, we might see $1500”. This is telling you this…

The best guys I follow with charts and forecasts are Patrick Karim, Kevin Wadsworth, Gareth Soloway, David Brady, Michael Oliver – they use charts for different reasons and can give you a wide berth of where things might go. Some like Brady and Oliver may have a LOT more macro tools added to it to add complexity to their forecasts.

I have seen David Hunter also get trashed many times – somewhat unfairly. His forecasts using the tools he is using appear solid – the only real issue I’ve seen with his forecasts are putting time to them. This is why you see many long time industry pros trying to dodge putting a time with a dollar amount. Many who are critical of Hunter can point out he’s had sort of the same predictions since 2019 and you can find the YouTube videos easy enough. One could say the 2019 videos were predicting the March 2020 smash. If I’m looking at this like a weather forecaster, I can see the games they have played to delay a lot of this which has added a lot more fuel to the hurricane. His forecasts would be like “hurricane will make landfall by Friday”. On Friday, he says they will make landfall on Sunday. On Sunday, he pushes it out until Tuesday. I do not think his forecast is incorrect, per se, rather adding the time element to it gives it the appearance of it being “wrong”. Truthfully, if you say it’s going to rain tomorrow, and I go and buy an umbrella, and it doesn’t rain – I will think of you as inaccurate. However, if you are a Hunter and you tell people at Cat 5 is coming, to board up your house because an eventuality is highly probable, you can buy into that without the risk of being “wrong”.

If you listen to some of the chart guys I talk about, they will say something like, “IF we can get to $1835, $1875 is close behind it”. Most people HEAR $1875 is coming, then gold hits $1760 and they want to trash them. But in that same sentence, they may have said, “If gold fails to get to $1835, it can fall to $1800 and behind that you might see $1750”. If you listen to these guys, they give you some short term forecasting which is pretty close to accurate. I listen a lot to these guys for near term chop and watching signals.

Conclusion

The point of this was to show you how complex precious metals pricing can be. It’s not as simple as banks just smashing. Or reading a balance sheet at earnings time for a tech company. Gold is a $12T market and is a beast. When it gets a head of steam, it’s going to wreck coastlines somewhere. If you can understand gold as a hurricane, and what fuels it, how far it can move in time, and what creates directionality to it, you can begin to understand why it is a hedge against other things.

Gold: Its direction relies on “other things” actively trying to oppose it. Its fuel is based on how bad shit is getting. Its movement in time is governed by greed and fear.

We have a cat 5 hurricane barreling towards the coast. When it gets there, precisely, is unknown. How volatile it gets is unknown. How much stronger or weaker this will get is unknown. But we do know it is out there, off the coast, and coming at all of us. Are you sitting on the beach saying “fuck it” with a beer, or are you preparing by buying wood to board up your home, getting supplies, and buying insurance?

Red sky at night, sailor’s delight. Red sky at morning, sailor’s warning. Morning it is….

Leave a comment