Disclaimer – nothing written here is investment advice. It is a research/discussion piece suggesting that a reasonable analysis of the situation could potentially see explosive moves, soon, in silver.

Right now, I’m seeing some of the technical guys saying, “it needs to hit $24”. I get it. But look up from the paper. There’s a LOT going on right now, and I need you to put down the pencil and step back from the charts.

I wrote an article Feb 3rd in which I argued that the longs can force a squeeze – and how Eric Sprott’s PSLV could end up being the savior. I laid out 4 phases I thought were happening, and then I laid them out in a video I did with Palisades Gold Radio.

- Retail buy out creates buzz and media frenzy. Cannot find physical, which leads to…

- ETFs. These take 1000 oz bars. PSLV is a closed ended ETF and people trust they put silver there. Run on bars…

- Industrial users. With higher premiums and shrinking inventories, this will bring in the whales. 60% of demand is retail, and they may want to buy more to secure their stockpiles in a shortage.

- Shorts cover. I felt at a $35 price point that this would then have a rip your face melt up moment.

Right now, we are between phase 2 and 3. The Twitterverse was buzzing about a possible Elon Musk purchase in silver that would be forthcoming. I don’t trust that report – as it was pretty thin on details – but I can’t deny it. We are seeing tremendous pressure with banks trying to push the price down – I’m counting four distinct attacks – and each time, they have been repelled (one more last night).

If we do have a musk announcement, or we get reports of massive purchases, this will be a massive tailwind to escalate prices, and quickly. North of $30, and you then have more retail FOMO and news picking up the story.

Right now, to analyze the situation, I’d like to highlight all of the tailwinds now at our back. I don’t think many people have any idea how close thing thing is to breaking. I’m going to go over items, in no particular order, to show a casual observer how this is going to melt your face off – in a very short time.

Retail out or close to out.

Many people wanted to just point that this is a tiny portion of the market, and in a previous post I more or less laid out this scenario in depth – but the pressure has been unrelenting. Massively high premiums. Many of my friends are sending me messages about how they just bought for the first time. Many bought in early February and still haven’t gotten it. This creates buzz and gets the word out. It also drives many people to ETFs like PSLV and digital representations of gold/silver like OneGold. This puts pressures on refineries and mints have even jumped the line by paying much higher premiums.

Price is not getting smashed

As of the time of this writing, $27 has been defended strongly for days with attacks. (Edit – there was an $.80 attack yesterday evening on the globex and this has since been repelled) Those I chat with on our groups are getting nervous. Why hasn’t it gone up?? For the casual observer, this is the time of the month before delivery months where we wound endure massive price smashes – something Andrew Maguire calls “monkey hammering”. We are getting the downward pressure, but I feel like there are BIG spenders, like many HFs – involved in defending this price. This is a MASSIVELY HUGE sign that the firepower of shorting might be out, or not as effective – or being bought the second it’s dropped.

On my charts – I’m seeing an ascending triangle that looks to be making a move, very soon. Lots of sideways action – which is good because they haven’t been able to smash.

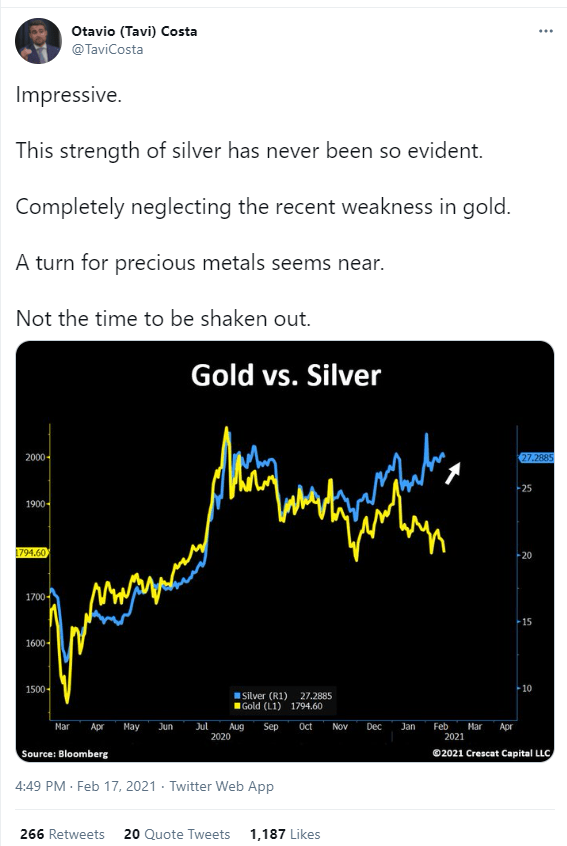

Diverging from gold

What you have seen the last few weeks is gold going down more in consolidation and silver has been up and sideways. This is telling me a lot of the big money rotated in to back silver. Gold is suffering at the moment, but I feel right after silver has its move, gold is next. It’s been showing amazing strength….

DXY/10 year not having effect

What we are used to seeing is a monkey hammer of silver, then a narrative comes out – “the 10 year is surging!” and you look, and it’s up 3 basis points. Or “dollar is rallying!!” and you are seeing .5% higher – and you look at the price of silver, the same as now, 6 months ago and the DXY was 5 or 6 whole points higher. These monkey hammers happen on very thin moves, then they try and explain the situation later. What you are seeing is these monkey hammers on gold are having no effect on silver.

PSLV buying in droves

Everyone buying PSLV, it seems to be making a difference. A few weeks ago we all heard SLV was adding 110 million oz in 3 days, and no one really believed it – because price did not move up. Sprott has been sending out tweets daily on their purchases. Inflows are spectacular. I’m seeing like 3m a day now and it’s not stopping. They seem to be literally draining every bar not nailed down. And you can tell this seems to be, as James Anderson wrote, “relentless AF”.

ETFs changing their prospectus – showing lack of silver at this price

As Ronan Manly at Bullionstar reported, it seems several ETFS now have changed their prospectus to essentially state all of the silver might not be there. Rather than going into the market and buying silver at higher prices, which their investors would want, they just say there’s none available. Wow. And how has the Wall Street Journal not picked up on this yet? ZeroHedge has, and I think those industrial users in the know are very much in tune with this. What if this is now becoming well-known news to these industrial users?

Low interest rates

Gold is a non-interest bearing asset, and silver is as well for that matter. They do have great utility, but when interest rates were 20% in 1980 or so, it made sense to park your cash in these and earn money to live off of. Over the years, the government needed to spend more and more money – and the only way to do that was to “refinance the house” at lower interest rates. To do this, they needed to change the CPI formula in 1980 to more or less mask inflation. As this “inflation” dropped, they could lower the 10 year. In a low interest rate environment, with inflation GREATER than the interest rate, this is GREAT for gold and silver. This is a negative yield – so a low interest rate is on catalyst of this. Now – many are seeing 8-10% inflation every year on the dinner table, with medical expenses, housing costs – but we keep getting told “there’s 2% inflation”. These low interest rates of 1.3% or the like are offset by the REAL inflation households see of perhaps 8%. These low interest rates CANNOT be raised or else we default on our debt. If only we had inflation to go with that….

Inflation is here

As many are now reporting – inflation is here – sort of. You have all of the politicians saying we have an “inflation deficit”, but scanning the news headlines everywhere, you start to see inflation creeping up. Articles talk about “food price inflation”, but this is…inflation. Many newspapers also sort of hide this, as standard practice seems to be to hide this type of thing. If inflation is not being WIDELY covered in newspapers, AND the government is telling you that clearly, we are in an inflation deficit – then this justifies more money printing to stimulate the economy. Gold and silver are major protections to your wealth during a time of inflation, AND the fact that this leads to policy with more debasement of currency is also tremendous for the PMs.

In my morning newsletter I send out to friends and friends of friends, I pointed out a few days ago some incredible signs of inflation not widely covered. Take a look at the 12 month performance of these items:

Food price: 14.69%

Industrial Inputs: 30.81%

Metals: 28.63%

Coal: 25.63%

Propane: 29.84%

Russian natural gas: 26.84%

Corn: 19.05%

Rice: 20.37%

Oranges: 23.08%

Beef: -20.86% (this puzzles me?)

Coconut oil: 42.05%

Soybeans: 33%

Rubber: 40.36%

Copper: 27.89%

Gold: 25.64%

Iron Ore: 67.76%

Nickel: 21.65%

Silver: 45.68%

Fertilizer: 63.13%

The biggest DROP was oil prices. So this made overall inflation look smaller. Meaning, the cost of everything you buy goes up, but you drive a lot less with COVID so you don’t see the overall change. Oil is now over $60 a barrel and supplies will be getting tight. All of the above items need oil to produce.

But I want you to consider they tell us we have a 1.6% inflation rate. What happens if they decide, one day, they need to more accurately capture inflation information? The first thing some of you economists out there will do is call me an idiot because I know nothing. Sure, run with that concept. The point is – you economist types are looking at macros of global economies where 95% of the wealth is held by the top 1%. So….if velocity of money has gone down, do you think that is from the bottom 99% not spending or the top 1% tucking these tendies away in bank accounts in Switzerland or the Caribbean? Meanwhile – if you were to ACTUALLY look at inflation for perhaps the bottom 90% of income earners – you will see REAL inflation in the economy.

They WANT inflation

If you look closely above – they have been screaming for more inflation. The velocity of money is WAY down, and the amount of M2 money supply is wayyyyy up. Just about everything is inflated in value – check the stock market. Why? Why would they cry for inflation??

I have written about this a few times in my articles, so I won’t go deep into this – but our government, and many across the world, are now at a crossroads. They can at some point cut spending, by a LOT (like 90%) and RAISE taxes – by a LOT, DEFAULT, or DEFAULT through inflation. The first two are non-starters, because they can’t get re-elected. But – if you were to inflate your way out of debt, like after WW2, then you can simply make the nominal values of your currency higher by printing more. This inflates money supply – and creates higher prices due to more dollars competing for the same scarce resources.

In years past, I’d say that the metals suppression meant to keep the dollar from being de-valued was necessary. However, you can see every currency now at a race to zero. How better to start “winning” the race on inflation and devaluing your currency then removing the chains that have been masking inflation for the last 40 years? If you can show MASS inflation now here, and your currency is about to be de-valued – that 1% of people that have 95% of the world’s wealth, and presumably dollars – will start to pull dollars out of their vaults and buy “stuff”. When this happens, you start showing the world you have a STRONG GDP. Essentially, you fan the flames of inflation in order to knock loose stored cash. And that, it will.

Now…the problem is – if inflation hits, won’t interest rates rise with inflation like the 1970s? Not if you dust off the playbook from the 1940s.

Yield Curve Control

Now that inflation is here – and should be announced at some point, you would expect the 10 year to move up. Wait…it has…a lot in the last few months. Last I checked it’s now at 1.30%, and silver is STILL over $27. Lots of strength. With rising rates, we just can’t keep doing the house refi. Rates are higher and we will default. So – you put in something called Yield Curve Control to keep interest rates in check. They did this after World War 2. This is LIGHTING BOLTS for gold and silver, and the mere whisper of a hint of this is what took gold to its all time nominal high of like $2088 this summer. Silver seemed poised to follow 6 months later – but those pesky short positions have kept it in check. So far. But – when YCC comes, and it will SOON, this is the catalyst to take gold to $2300. See – I was listening to another video in which the commenter said a lot of stocks have dividends at 1.5%. So if the yields go over 1.5%, then people will roll out of the stock market and into these. They cannot have that. So…we are expecting YCC at any time now. It’s just a matter of WHEN with gold, not IF. And this will take silver up as well.

But those shorts have kept silver from its all time nominal high. Now what?

COMEX GO BOOM

My friends tell me – “Nate, I hear you, but look at the manipulation”. They are referring to articles like this and news headlines like this:

But – these guys are now long. It seems they got out March 2020 and hung 8 other large banks out to dry. I believe they saw the writing on the wall – that silver and all commodities were going to rise. It’s almost as if the government plain told JP Morgan that they want to inflate things to get us out of debt….

Point is – the firm accused by many of being the main ringleader of the price suppression is now long 196 million ounces and reports are they have leased silver to others in need, and this may be at an end. Apparently lease rates have gone up, a lot. With the recent silversqueeze phenomena, it’s possible that the leasing has either stopped or rates went bananas, which could have been why these ETFs changed their prospectus.

I digress – the COMEX is the futures market where all of these prices get set. I have also written that most of the time there’s 200 day’s worth of yearly mining production done in 1 day, and it spiked to 900 days production one day in early February. The deal is – if these entities either do not HAVE the silver to sell or want to give up the position they are shorting – all hell is about to break loose.

As I have written also – the last two delivery months were something like 85m in Sept and 70m in December. In Sept it was the second to last day the last delivery was made, and in December it was the LAST day. What you see from these is the first few days, those with legit metal to sell, move it. You see these numbers knocked down by like 50%. Then, the rest of the month it is plain to see they are trying to source in the open market and either don’t have the metal, or want to part with what they have because they cannot short anymore. I wrote that a lot of these banks need the metal so they can hedge against it – in essence a zero-sum game meant to keep bond prices from falling off of a cliff. As I detailed above – it appears our government is on a path of YCC and inflating us out of debt – and these suppression tools actually seem to be fighting the fed. No longer are stackers against the fed. The stackers are actually WITH the fed for once, it seems.

With this – you have seen 1,000oz bars get sucked up everywhere. Premiums at $1.00-$1.40. Large orders cannot be fulfilled for months. And we are to believe there is ready supply just sitting at the COMEX? If you look at the registered and eligible, you find about 400m ounces. Check this link, and go under “silver stocks”.

With this, you see 147m that are “for sale”. However, just because it might be there, doesn’t mean they want to hand it over. Remember – this silver is there so they can short it and “legitimately hedge”. So they would prefer to keep shoving prices down and dissuade you from buying. Meanwhile, keeping the pile there forever to continue to short against.

At issue is the “open interest”. Most delivery months, they knock this down with buying people off and getting them to “rollover” their positions to the next month. As I mentioned the record was 17,000 contracts. We have Friday, Mon, Tue, Wed to knock these down to at least 17,000.

Looking above, you still have 68,000 in open interest. That’s 41,000 contracts to knock down in 4 days, or about 10,250 per day. The last few days, the number has ramped up a little, but I recall 4,000, 6,000, and now 7800 as the last 3 days. This leads me to believe they will try the plunges again….

So if we do get 100m (20,000 contracts), the silver LOOKS there to deliver, but they don’t want to give it up. They may have to, as the COMEX vaults continue to get drained. As Rob has pointed out, they estimate 50% of the “eligible” could be available as well, but it’s an estimate. I pointed out, that if this is industrials holding in vaults until they need it or doomsday rich people, they aren’t selling at $27. Or $40. If the last two delivery months were of note, this shows maybe 30-40m of these ACTUALLY sell, suggesting they may need to source 70m ounces in the open market – OR give up their silver – or default.

Tiny market

Compared to gold and oil, this is a TINY TINY market. I know Jeff Curry mentioned 25B ounces, but that’s talking about band aids, stretchy pants, and traces of silver in TVs – all in dumps across the world. The trace amount in thousands of products is not economical for recovery – and it seems there’s about 2b ounces in 1,000 oz bars in vaults and perhaps 3-4 billion in home investment/jewelry/silverware. TINY. Meaning, it doesn’t take a lot to move the price significantly.

Whales getting involved

In the last week, Andrew Maguire reported it seemed there was a $1.5 billion long involved with the silver side of things. That “deep pockets” were defending silver – and I’m noticing that the past several days, $27 has been defended vigorously. At the same time last week, Elon invested $1.5 billion in bitcoin and said he may buy gold. Elon’s companies MASSIVELY need silver to exist. Just a few days ago on twitter, reports came out that Elon Musk has bought a lot of silver and an announcement is incoming. Now – THIS is speculative. But I can tell you this. While the bitcoin people talk about “institutions coming” and “central banks” buying bitcoin – gold and silver have been money for 5,000 years and institutions and central banks ALREADY back gold and silver. Hecla just announced stupid profits. Newmont just announced stupid profits. First Majestic just announced stupid profits – and this is the ONE SECTOR NOT IN A BUBBLE.

So I can tell you this – whales are coming, or are already involved. If I was short silver right now, I’d be talking to my risk departments as we speak about the dollar amount at which I need to cover before I make the bank go out of business and become insolvent like Bear Sterns. Oh yeah. JP Morgan bought them.

Everything else is in a bubble

It would suggest that the last items to go would be those most suppressed. BTC and TSLA are hockey sticks. We are at the end of a massive bull market, and everything is melting up in a crack up boom. It would stand to reason the last thing to go would be the anchor to reality and money. But – the dam is about to break on that. Silver now, Gold in April/May, and the DXY this summer. Where everything else is in a bubble – this is also the ONLY undervalued real estate out there where gains can be made rapidly. As we saw with GME, a hoard of motivated investors took a $325m market cap company to $24B. The only thing needed to nudge silver enough for all of the dominoes to fall was about $4b in investment. By my count, we surpassed that, to perhaps $5b. Marin Katusa suggested if this happens, it’s $6b. I’d defer to him – my point is now wallstreetsilver is growing, memes have picked up, videos have started, and it’s just a countdown for the mob to wake up and attack at full strength.

The end – competition for scarce resources

This now has all of these forces combining to battle over remaining bars of silver

- retail

- Industrial

- Large investment houses/hedge funds

- ETFs

- Banks trying to cover shorts

All of this in an environment where our government is begging for inflation, buying $120b of bonds to keep rates down, and have YCC in their back pocket.

And silver…still at $27. Paper game go boom.

Got my popcorn, your time is on the clock sir. Checkmate in 3. Delay if you will. This is imminent.

Putting it all together

We now have all of the below forces working against those shorting silver, and at the tailwinds to those long silver. At this point, it’s just a waiting game. Let’s review the below:

- Retail is out

- Price is not able to be smashed successfully to drive down contracts

- Diverging from gold

- 10yr up/DXY move up not phasing silver

- PSLV buying in droves

- ETFs signaling they can’t get bars

- Low interest rates that cannot go up

- Inflation here (signals significant negative yields)

- They WANT inflation now

- Yield Curve Control to help us inflate out of debt

- COMEX deliveries looming to possibly be all time record

- Tiny market

- Whales getting involved in something ALREADY recognized by institutions/banking – doesn’t need acceptance hurdle which bitcoin has

- Everything else is in a bubble – leading silver/gold and those stocks as sectors with massive gains still on the table.

- Many entities competing for scarce resources lead to hockey stick move

Bonus item: Most people don’t realize that silver is a major component in solar panels and crucial for many electronics. 2-3 oz are used in each electric vehicle and silver now has been the breakthrough in battery technology. With a democratic led government here calling for green everything – they may not realize this requires oodles of silver. Any day now, a $1.9 trillion stimulus will be signed which isn’t even covered above – and probably very soon we will get a state of the union in which green will be mentioned 100 times. These items can happen at any time and boost the allure of silver.

February 19, 2021 at 6:05 pm

One gold isn’t digital. Some vaulters who use LBMA warehouses like Gold Money and Bullion Vault I wouldn’t trust because I don’t trust LBMA banks but vaulters who have their own warehouses are actually buying 1000 oz bars to hold for their investors.

LikeLike

February 19, 2021 at 9:08 pm

Excellent article. Quick questions:

1. As well as Silver miners, can one invest in Silver futures as well assuming one has a reputable broker? If one were to go long Silver future contracts, would the price of those would get squeezed and go up massively to reflect the real price in the physical market at expiry?

2. What happens to the Silver futures after roll over/the next month?

3. Would there be a ban on buying physical Silver with whatever fiat money we have after any crash in the dollar?

LikeLike

February 20, 2021 at 5:54 am

One point in the PSLV prospectus concerns me —

If physical silver bullion prices increase between the time of completion of an offering and the time the Trust completes its purchases of physical silver bullion, whether or not caused by the Trust’s acquisition of physical silver bullion, the amount of physical silver bullion the Trust will be able to purchase will be less than it would have been able to purchase had it been able to complete its purchases of the required physical silver bullion immediately. In either of these circumstances, the quantity of physical silver bullion purchased per trust unit will be reduced, which will have a negative effect on the value of the trust units.

Currently one unit (one share) = .361 oz. of silver. So, if I understand the above excerpt correctly, should the Trust experience the difficulties noted above, the Trust could simply reduce the amount silver per unit, and, thus, devalue one’s holdings in the Trust.

LikeLiked by 2 people

February 20, 2021 at 9:52 am

I can see your concern with that. However – consider the concept of $27 silver and $9 premiums some people have paid. You paid $36 for an ounce, but you have 3/4 of that retained value if you wanted to sell. No etf is perfect in capturing spot price due to fluctuations. I can tell you my news feed is blowing up with them daily purchasing silver!

LikeLiked by 2 people

February 20, 2021 at 3:13 pm

Understood. Though, as one who is well-invested in PSLV, I would prefer an orderly inflow into the fund to prevent the dilution per unit or simply suspend purchases in the close-end fund for awhile.

This morning, I just checked the units per ounce and the fund has been diluted at some point very, very recently from .361 oz. per unit down to .3606. Basically, one-tenth of one percent. With this dilution, I lost 4 oz. of silver. The ounce per unit ratio can be found at this link:

https://sprott.com/investment-strategies/physical-bullion-trusts/bullion-calculator/

LikeLiked by 1 person

February 20, 2021 at 4:55 pm

This is an excellent observation, and possibly of some concern which justifies monitoring.

LikeLiked by 1 person

February 22, 2021 at 12:31 pm

Quick questions:

1. As well as Silver miners, can one invest in Silver futures as well assuming one has a reputable broker? If one were to go long Silver future contracts, would the price of those would get squeezed and go up massively to reflect the real price in the physical market at expiry?

2. What happens to the Silver futures after roll over/the next month?

3. Would there be a ban on buying physical Silver with whatever fiat money we have after any crash in the dollar?

LikeLiked by 1 person