Note: This is not financial advice. I’m not a financial advisor and I’m wrong 100% of the time. Investments are risky and nothing mentioned here should be considered financial advice. Invest at your own risk.

Over the past few weeks, a few of you have reached out to me with positive feedback. While I’m not a financial advisor, and none of this is meant to be financial advice, I can tell you what I like – and why. What you do with your money is your own business. Bitcoin? Have at it. Weed stocks? Good for you. Retail? Good luck – not for me.

Recap on BNO – lessons learned? What could other people learn from this?

Recently, I detailed what I liked about the oil market. I had a really good play, and I was up big – but I did the classic mistake of a rookie – I wasn’t disciplined with my exit plan. I chose BNO as opposed to USO. I just knew I wanted to follow Brent oil. I got LUCKY with this. Those who were in WTI oil got their asses handed to them. Those of us in Brent got a taste of great hope and then some losses at 25% or so.

What I did was jump in to the oil market. My play was correct. My logic was correct. How I executed my buy strategy and exit strategy was poor, at best. I ended up with very minor losses (relatively speaking) because I protected myself – but had I stuck with my original play, I would have been very well off. If I wanted to, I could get back in and let it ride out, but if I can double my money in 6 months or 1 month, I’ll take 1 month – which is where Gold is at with me. I may come back to BNO and ride it up, but not at the moment. It was always a long play for me. However, I converted too much money to a long play and I needed to be more efficient with how I invested.

What happened? ETFs. These funds help you play the market, so to speak, without actually owning a barrel of oil. With WTI crude, their futures contracts are in Oklahoma or some shit and you MUST take delivery on contracts. What happened was the ETFs that loaded up (USO) bought these futures contracts and the people running the ETFs realized their predicament at the last minute. They had no means of taking delivery and ended up having to pay people to take their oil. Brent Crude is a water-based oil in that it goes right to the super tankers – THOSE contracts can be mitigated with cash and do not require delivery.

So with BNO, I got in at like 10, then dollar cost averaged to 8 something. Loaded up on options for $8 and $9. Price went to $11 and I saw no reason not to let it ride out. And then…oil went negative. For the first time, in history. So – one day I’m up big, and the next day stop losses got triggered and I had to exit my options.

Looking back, I was up over 50% on my investment. That was my “pull the trigger” exit strategy. I got greedy. Down 25% on the play. Had I just held the shares for another 6-12 months, I’d have doubled my share investment and made back the losses on the options and then some. I had hedged with the shares to offset the risks with the options. So – I could have also bought back in at $6 and held until $12 or $18 – but my guess is I’ll wait until things open back up and catch it at $7.50 or $8 on its way back up and see where that goes. It could linger at $6-$7 for the next 2 months until the demand is fixed.

So – correct play. Poor execution on my part, and impatience right now to buy and hold. $6 is a good price, but with these ETFs, I want to make sure there’s no “negative” Brent price this month. Wait. I’ll lose the $1-2 on the low end to avoid that risk.

Gold stocks – the play.

I’m a big silver guy. Silver follows gold. I’m in on silver right now, but I think the bigger moves will be this fall to winter. I got positioned where I wanted and bought low. But the immediate opportunity is screaming my name, and I’m looking hard at it.

Where we are right now is this:

- Gold has been on a bull run since last year. Gold prices are steadily increasing and gaining support

- Global turmoil is having the “fear” response driving gold higher

- Everyone is printing paper currency to oblivion. This has an inflationary impact with gold (and silver).

- The stock market dropped due to COVID. Everyone agreed the stock market was “overbought”. A correction was going to happen at some point – perhaps to 22,000? 24,000? No models had 80% of planes being vacant. Our economy STOPPED. This affected just about every industry negatively.

- The stock market is due for another correction down when Q2 results come in. Some stocks got hammered on their Q1 results – with COVID only affecting 1-2 weeks out of a 13 week quarter. What’s going to happen when you have a quarter where you have literally no earnings? I own Norwegian stock. Bought at $12. Went up to $18 the other day. Down to $14 now. I am aware that this stock can hit $2 at some point. It’s the risk I am knowingly taking for the possibility it will get back up to $60 like it was before COVID. Could it take a few years to get there? Yes. If it hits $2, would I back the truck up and buy more? Yes. But this is the life of MOST stocks right now. A sell off will happen. Where do you put your money?

- I would not buy properties right not to rent. Properties for the most part may be over valued, and you have the significant risk of tenants not paying. So I would not put my money here – now. Many landlords may be dealing with vacancies. Many landlords may have to sell properties quickly – and there may be a glut of homes for sale. This depresses prices. Why would I put my cash into an asset that will depress in the next 12 months?

- Stocks are risky

- The 10 year is at like .6%. Historically, in times of turmoil, people went to cash, the 10 year, and gold for safety.

- “Cash is trash” – per Ray Dahlio. Right now, the dollar is strengthening against just about every currency out there. SD Bullion did a great video that showed gold is at an ALL TIME HIGH in almost all currencies except the US dollar. That is coming. As the dollar strengthens, gold weakens. And vice versa. Right now, people are clamoring for dollars world wide. Soon – as countries re-open, the dollar will weaken against them and gold will move higher.

- Gold is a legitimate move to protect against inflation.

Here’s how the play is going:

- Gold has moved higher and higher. Take a look at this one year chart.

- Price targets for miners have been based on $1200-$1250 gold.

- Q1 earnings reports are due out May 5-14th for some of the miners I’m watching

- I believe all of these companies will be price targets due to increasing gold price during the quarter

- Gold is the only asset class up for the year

- Tumultuous earnings reports are coming out. I believe this is the end of this mini run back up and there may be a stall prior to things going down.

- The gold mining stocks will start to get some attention

- Gold will continue to rise in price with low interest rates and currency printing

- The dollar will start to fall against other currencies, strengthening gold

- Q2 stocks are going to be abysmal. for those like Starbucks that have been closed a lot, their earnings will suffer. For companies like Netflix, as states/countries reopen, less people will be watching. So they might have stronger earnings, but they will be on a downward trend.

- Q2 stocks for gold miners will be off the charts. There are three elements at play:

- Higher gold prices will continue through the quarter. There may be pullbacks here and there, but the trend will continue upward

- Ridiculously low fuel prices. Remember, the oil price collapse really wasn’t felt in Q1 at all. Q2 will be riddled with cheap fuel well into Q3. I’ve read some reports that HALF of mining expenses are fuel-based. If fuel prices dropped by half? That’s 25% of your operating costs evaporated.

- Companies paying their employees in local currencies driving production costs further down. For example, the Australian dollar is WAY down against the US dollar. If you are selling gold in US dollars – that is less you are having to pay your employees. The local currencies everywhere are down against the dollar – this will be mostly shown in Q2 operational costs

- With Q2 stocks in the tank for everyone – people will be looking where to put their money. Yes – gold is a good start. More on that later – but if Wall St is seeing that gold equities are where all of the profits are these days – how long until the Index Funds, retirement funds, and pension funds start dumping the pickup truck full of cash into this sector with a promising Q3 ahead? I feel July/August is going to be a HUGE month for gold mining equities. For ME – I’m going to assess where I am then – but if things are going well, I’m looking at options on some of my favorites and construct an exit strategy so when big money gets in, I’m pulling the rip cord on the options and cashing in.

- The Wall St move to gold and gold equities is going to attract those who have not dealt with precious metals. This will in turn make gold prices continue to move north.

I believe we are in a “golden” age for gold equities for 12-18 months. Gold is up 33% in one year and the conditions are right for it to continue to grow as an asset class. Only when a real recovery starts and interest rates start to rise will you start to see some pressure down on gold. While all of this currency printing is happening – this also spells inflation, so when the Fed finally does turn off the tap, there’s a period for awhile where gold will continue to rise and then be flat before turning south.

At these two points I will exit gold equities:

- Interest rates star to steadily climb

- Fed stops printing press completely.

At that point – probably early next summer to next fall, I am seeing the housing market being low and if interest rates are rising, my guess is stocks will also be low (ish). At that point – it’s a good time to convert my metals position into real estate and equities that are non-metals.

The silver window

Silver has had a tough year, but it’s future is pretty good – in my opinion. Gold is the clear favorite for now, but everything I’ve read, seen, and believed in talks about silver making a move 3-6 months after gold. They all explain this situation:

“A guy walks into a coin shop. He’s hearing gold is going through the roof and wants to buy in. He takes out a wad of cash, and the dealer puts a 1/2 ounce gold coin in his hand. The guy seems perplexed, and complains. The dealer then shows him the massive amounts of silver he can get for it and explains to him that silver is going to go up too. The man then takes his pile of silver and leaves”.

I have heard this exact story about 20 times – and truth is – it was very similar to my experience this past fall. I had a roll of silver dimes I inherited. I had an old peace dollar as well. Not much. I asked the dealer how much could I get for it. I had no idea of the value. Total was something like $70. I told him I saw some stuff on the news and wanted to get involved in gold and silver. First – he told me to keep what I had, it was silver bullion already. I thought I needed fancy bars or something. I went over to the case, and saw 1 oz of gold at like $1400. I’m like…”no”. I then saw these beautiful American Silver Eagles and asked how much? He looked at the panel behind him for the Kitco spot price and said “$19”.

I went in there expecting to get like $200 in cash and then get like a small bar of gold or silver. I left there spending $400 on a tube of American Silver Eagles and was HOOKED.

I have since changed how I address my silver position, but nevertheless – many Americans will be going through that same exact situation in the upcoming months.

And THAT is why silver lags gold. It also has the same hedge against inflation that gold has. However, these days, silver is heavily used in manufacturing. So – sometimes it tracks with gold, sometimes it tracks with commodities like zinc and iron.

At the first sign of a recession, you have silver dropping. Less cars will be produced!! So – it makes sense that there is less demand. However, something very interesting happens:

- Silver demand drops at first due to manufacturing needs dropping.

- Silver is MOSTLY mined as a byproduct of other base metals like zinc, copper, lead. When this mining drops, the supply of silver is over-amplified.

- Silver is used in a lot of electronics like circuit boards, cars, electric cars, phones, solar panels, and even yoga pants and band aids. There’s more and more industrial applications for this every year.

- Silver also acts as money and investment supply goes sky high. All of the mints pretty much worldwide ran out of silver. There’s been a mad rush for both gold and silver. While silver spot prices at one point said $12.50 and now $15 – you cannot buy an ounce of it for that. The COMEX (commodities exchange) is kinda/sorta broken at the moment. More on that later.

- Industries like car manufacturers buy 1,000 oz industrial bars for usage. They try to buy many months out, but they don’t want to buy too much and the price goes down. That being said, in times of short supply, an industry absolutely needs that silver or else they don’t produce goods like cell phones. So industries put in larger order to avoid a shortage. This actually helps cause a shortage.

On top of all of this, you have mining issues with COVID. Mines around the world have been shut down. However, many of these mines have product on hand or material to run while the mines are shut. The refineries are shut. The mints are shut. You have industry like in china re-opening.

So spot price, at this moment, is $15. Keith Neumeyer, CEO of First Majestic, said in an interview with Kitco that “something needs to be done about that” and he’s not selling his silver to the COMEX for $15 per ounce. He said he’s not letting it go for less than $17. This sets up an interesting scenario.

You also have a First Majestic who is a primary silver miner, but only 60% of what they mine is silver. 40% is gold. So a company like this is going to have a good run up with gold stocks as well.

Silver is more violent in its moves because it is a tiny industry relative to gold. It is often measured in something called the Gold to Silver ratio. This means, “how many ounces of silver does it take to buy one ounce of gold”.

- Silver comes out of the ground at a rate of 8:1 or 9:1, depending on your sources. So, it is not that much less rare than gold.

- At some points in early times, 2.5 ounces were valued equal to gold.

- For most of history, silver was set to 15:1 to gold. This goes over thousands of years.

- In more modern times in the last 80 years or so, it’s been closer to 30:1

- In more recent times, it’s been closer to 45:1

- Generally speaking, when the gold to silver ratio is high, you buy silver. When it is low, you buy gold. The concept is these metals take turns out-performing another and you can arbitrage gains playing this ratio.

- As of last month, it was 124:1. Meaning, on paper, I could take 124 ounces of silver and exchange this for 1 ounce of gold. This is an ALL TIME HIGH IN HISTORY OF MAN. This would suggest to back the truck up on buying physical silver. OR….it also means that silver miners may be extremely undervalued. More on that.

The question then is – is gold over valued or is silver under valued?

Today’s rate is about 113:1.

Let me ask you, is gold over valued? Remember everything I’m saying above – all other asset classes have been outperformed by gold this year, and these asset classes will organically move to gold over the next 3-6 months in one way, shape, or size.

One could argue that gold should be $2,000. Bank of America said in 18 months gold will be $3000 per ounce. I’d posit at THAT point, gold might be the overbought class and money may move back into properties, cash, bonds, or equities.

Let’s play that game for one second. If gold is $3,000, and we just go with the current ratio it is, you’re looking at $26 per ounce silver at that time. Remember – the ratio is way out of whack and silver WILL outperform gold very soon. That ratio will start to go down.

What is the BEST case? In 1980, it hit 10:1. In the 2011 episode, it hit 30:1. Even in 2016, it hit 65:1.

So what happens under each of those scenarios to the price of silver – IF it performs like it has previously?

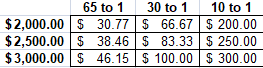

Please stare at this. Even if the price never goes above 2000 and silver only snaps back halfway, you’re still looking at $30 silver. Look at the insane side of $3,000 gold and 10:1 ratio? $300 per ounce silver? Why not? Have you seen what palladium and rhodium have done? Sometimes it’s not simply the rarity – platinum is 8 times rarer than gold, but costs less than half – it’s the DEMAND. And guess what – in times of chaos, every time, throughout all of history – people have turned to silver and gold as money. And they will again.

The last 9 years, you have the primary silver miners like AG and PAAS being more and more efficient. Buying new technology like an HIG grinding mill to take pay from 67%-95% efficiency. AG did this, and I’m expecting their Q1 profits to be stellar – not only due to mining silver more efficiently at an all in sustaining cost of $12 per ounce or so, but high gold prices (remember, 40% of their inventory is gold). Because of the gold aspect and the new mill, I expect AG to outperform PAAS.

So…AG is making really good profits on…$17 silver? That is what they are banking for the Q1 earnings. I suspect for the next quarter, silver will be higher – but remember, their gold prices are climbing. AND they are in Mexico, which is losing ground against the dollar, so labor is cheaper. And………the low fuel costs. So I’m REALLY expecting a good 2Q earning from them.

This is BEFORE silver breaks out.

In 2011, AG’s share price hit $24 when silver hit $49. But it only hit it briefly – and apparently for inflation, that is something like $70 per ounce today.

This is what the silver prices looked like in 2011. See that second spike? That was after the 2008 housing crisis and all of the currency printing. That big spike in 1980 was someone trying to corner the market.

If you look at that – you see a nice bull run from 2000-2011.

The big questions:

- Will silver do what it always does by lagging gold by 3-6 months?

- Will the COMEX issues get resolved? It seems there are a lot of banks these days trying to get out of short positions. I’m noticing very sharp drops on silver – like $.30 in 2 minutes, followed by a run up, followed by another snap down. This looks like banks dumping shorts now because they are losing all kinds of money. A bank that has done metals since 1684 (that is not a typo) got out of the business yesterday or the day before (Scotia bank). These sharp drops I’m seeing are indicative of dumping metals or something like that. JP Morgan has 3 people who have been arrested and are testifying against them with RICO charges for something called “spoofing”. To me – I see sharp moves up in silver within 3-6 months due to the inability for banks to short anymore – too much upward pressure.

- Where will the ratio hit at its peak? 70? 50? 30? 10?

- How will low fuel prices reduce operating costs for these mines?

- Will lower sales due to mine closures negatively affect stock price, or would their profitability be more front and center? I’d contend that lower sales could be explained away with COVID – but if their profits are much higher, this is very attractive as an investor. Those who are more efficient will get more attention.

These are questions that muddle the silver mining equities. Maybe you bought silver at $18 per ounce and it goes to $36 per ounce and you double your money.

But – if you buy stock in a company at $6 per share that pulls silver out of the ground and is very profitable at $17 per ounce…what do you think happens to that company’s stock at $30, $60, $100 per ounce silver? AG was at $24 in 2011. Could they get to $50 per share? $85?

These are some more questions I ask myself.

Silver – when it outperforms gold – do I move money from gold stocks to silver stocks? Maybe you have a Barrick now at $27 that gets to $45. But what if you have an AG at $8 that can get to $45?

I think the big money right now is going to gold equities in the next few months. But wow – is there an opportunity for silver equities behind it!!

Who am I picking for ME?? You should not listen to me and do your own research.

- Big gold – Barrick, Newmont, AEM, GDX (ETF of gold miners)

- Junior gold – Pure Gold Mining (Sprott backed), Goldmining Inc, GDXJ

- Big silver – AG, PAAS

- Development – Magenta Silver (MAG)

- Streamers – SAND and OR

One big issue you have with big gold is management. Managing mines worldwide makes them top heavy with management and makes it harder for them to find “big” mines to develop. They rely more and more on buying up smaller juniors with sizable claims.

If you want to buy “physical” silver, but do not want to store at your house for security reasons, OneGold is really good to get the action of gold and silver without paying the commissions. Goldsilver.com is also a service that can assist. For example, with OneGold – let’s just say you bought silver at 120:1 ratio. When it gets to 40:1 ratio, you can just open your app, sell your silver, and buy gold in seconds rather than having to send it in to Apmex or pray your local coin shop is buying what you are selling.

Leave a comment