I am an amateur macro strategist – whatever the hell that means. It’s a hobby for me. I have never been paid to do any kind of work like this. And with this, I’m very aware I don’t know what I don’t know. However, you have many people like Tom Luongo and Lyn Alden who never donned formal attire to work on Wall Street that seem to do very well with analyzing situations – and getting the admiration and approval of those who have worked on Wall Street. I don’t seek that approval. I do this for fun. And, I’m not your typical hobbyist – I’m probably borderline obsessive in how I am with interests, to the point people get concerned for me. Things I think are interesting, I tend to master. That being said – I’m still an amateur at this, and I embrace it.

I also stay in my swimlane with trying to see where the cruise liner is going. Many who are “in the biz” would talk about hedging strategies, play the spreads here, shave a few points there, and BAM! Through low risk, they get a 15% portfolio return!! That’s a BIG deal when you are managing other peoples’ money. That’s a level of stress I never want, nor desire to have.

The setup here is because about 18 months ago, as an amateur, I put a big bet on how a lot of people thought the Fed would have to pivot in September of last year. I trusted all of the experts that worked in the Biz. But not only did the pivot not happen, they kept raising rates. I’m not picking on any one person – it literally confounded everyone. It was at that moment that I decided to go my own way. Understand all of the lessons and valuable teachings from all of these amazing people, but make bets based on how I see them. I then decided to create my own very first 2023 macro forecast in early January. I’m pleased – and somewhat surprised – I’ve been in the zip code with a lot of this. This doesn’t mean I have a crystal ball – please – God don’t do that to me. It means, I sat there and figured a likelihood of where things were going. With 3 months left to go, I am expecting PMs to rise and the stock market to go lower. But 2024 is going to be a continuation of 2023.

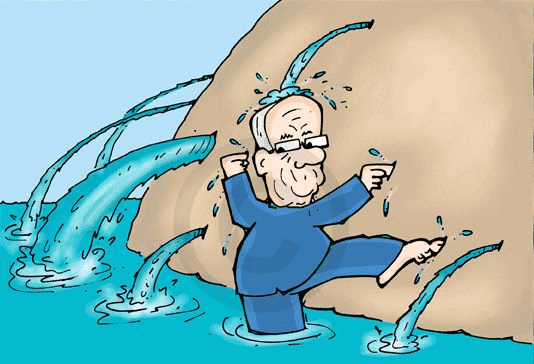

What I think many of us didn’t really fully grasp was to the extent that the band aids get invented overnight. I used this picture in my last writing, but it’s going to be the focus of this writing as to why it will be “higher, for longer. Kinda. Sorta”.

Many of us start school by learning about the brilliance of the design of the Constitution. I had read a book in AP Poly Sci called “Miracle at Philadelphia” by Catherine Drinker Bowen – and it went virtually day by day of the Constitutional Convention in Philadelphia. It talked about the brilliant men there, and how they all came from their farms, businesses, etc – to SERVE the people. They all wanted minimalist federal intervention, and wanted states to have relative autonomy. This eventually changed with the horrors of slavery – as states were refusing to give it up. Federal control was then implemented across states via the Civil War.

But this has led us to a system now where Octogenarians are in office. Barely conscious. Confused. Weak. Stockpiling cash for their family for generations. We are not dealing with brilliant men, today, running our country. We are dealing with political animals that can partially tame swamp creatures. Their craft is saying whatever it takes to appease to a faction that pays money into their war chest to get re-elected. Among them, are many well-meaning people that I admire. But the machine that is now running us is too bloated, too dependent on PAC money, and too much needing a trim everywhere.

This leads us to….

I believe we are at the last area here. I also believe in the 4th turning theory – as my 96 year old grandmother who lived through the Great Depression no longer has a voice to influence the younger generations who just don’t know what they don’t know, and with this – they lose the wisdom and guidance of the older generations.

And I say this because this type of mentality is not allowing for banks to fail. Everyone gets a trophy here. And all of the people paying massive money into these politicians are buying insurance policies. That if their business/bank/whatever fails, that they will get the warm embrace of the taxpayer onslaught of cash to protect them.

Let me explain.

With the banks failing in May 2023, the total amount of assets of bank failures in 2023 eclipsed that of the Global Financial Crisis (GFC). The charts I saw made it pretty close, but who is going to argue about $100 billion here or there. What they essentially did, was give a lot of troubled banks an ability to be rescued, temporarily, with their underwater treasuries. Temporary.

Might I remind you, Nixon “temporarily” took us off of the gold standard in 1971. And the saying goes, there’s no such thing as a temporary government program.

But I digress. These troubled banks would have a year then to get their act together, presumably as the treasuries/bonds they have recover in value, so they can sell them at a higher price to pay back the loans.

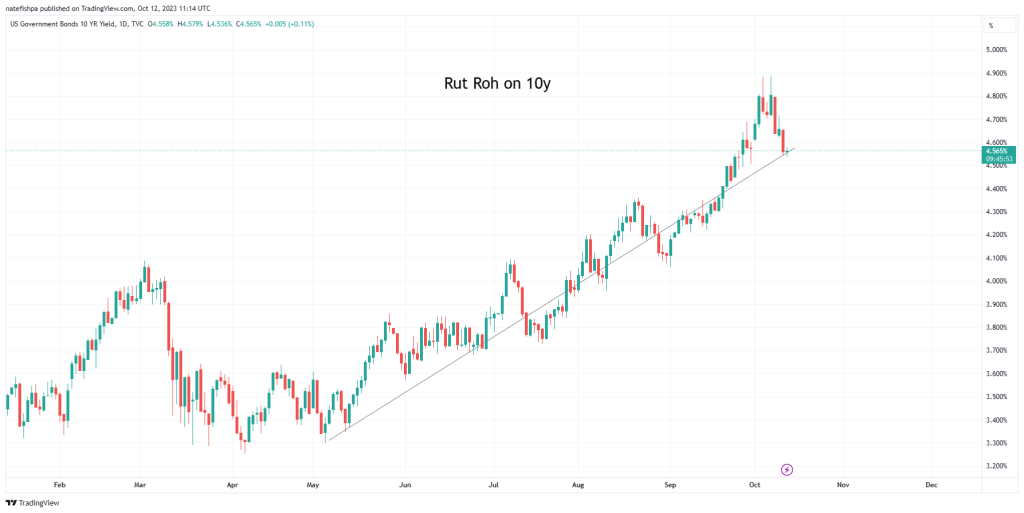

Is anyone tracking that the value of all of this has gone down, significantly since then? Meaning – everyone was banking on rates topping out there and rolling over. Instead, they are climbing higher. And – we consistently hear that we are running higher and higher deficits, need to sell MORE debt – and countries like China, Saudi Arabia, and Japan are SELLERS of our debt?

So…who is buying our debt?

For the banks to not lose everything, you have to envision a day when these all come down in rate. How does that happen? Stock market smash down, then has “safe haven” stuff catching a bid – cash, treasuries, and PMs.

But there’s another thing – what if….it doesn’t really matter if the rates come back down? What if the 1 year payback is snoozed for another year? What if – they simply forgive the loans? These types of things assume we know what they are going to do.

We don’t.

Neither do they.

And that is the piece here that many in the business don’t get or grasp. They work within compliance. Within the laws. Within the rules. What we are seeing, and have seen, is they simply change the rules when the house loses. The house never loses. They just change rules, definitions, etc.

I was betting short on regional banks. The math said they were doomed. I was right. Actually – the guy who made the paid recommends I paid was right. But then they met over weekends, and came up with some things they slung against a wall. And it stuck.

These are your brilliant people today. They care too feckless to allow anything to fail. Too many people have hooks in them. The swamp is too big and needs to be fed a steady diet of taxpayer cash and deficits funded by treasuries.

What you and I see as cataclysmic failures coming with the 12-18 month fuse delay of the grenade in things like banking, housing, and commercial real estate – to name a few – is an opportunity for these people to create new rescue programs to ensure we don’t have 10% unemployment. The means of the “soft landing” means to give literally every industry a parachute that is needed to land on their feet. And what you will see is continual debasement of currency to do this.

See, we crossed the Rubicon, but many of you don’t understand what that means.

When I was growing up, politicians would talk about how to “cut costs” and “keep the budget down”. Politically speaking, I’m a centrist. I have voted for both parties. I can see both sides of most issues. I empathize with both sides. I am a “fiscal conservative” and “social liberal”. This essentially means I want minimal sized government, and for the government to leave people alone – just as the forefathers I admire wanted.

But we are no longer there. We have this…a swamp thing in our government. And – it gets hungry.

So now we get to the part of “higher for longer. Kinda. Sorta”.

If you recall, there was a big scandal in 2021 because all of these Fed guys sold off all of their stocks. After the Dow went up 7x, and the Nasdaq up 16x, they sold it all – stating that they didn’t want the appearance of conflict. No. They all saw that the stock market was the sacrificial lamb being led to slaughter.

Most of the “common” people out there don’t really pay much attention to the stock market. I was one of them. They hear when at all time lows or crashes, but the rest is white noise. Where this affects most of them now is their 401ks. As I mentioned, since 2009 – many of these people made fortunes in their 401ks. And I believe this is where the sacrifice is coming to make this “soft landing”. Why? To keep your friendly bankers happy.

You see, “higher for longer” means in a sense that 12-18 month lag of interest rate hikes working through the system will break things. Intentionally. Because they need to trim the stock market down to force money into risk off with treasuries. So far, it’s been “buy the dip”. What part of “Sell it all….today” from Margin Call is being missed here with the Fed people selling all of their stuff?

So as a lot of businesses go to roll over their debt, they will find either a) they are instantly insolvent, or b) they need to significantly increase their prices to pass on to you. Those in column a will declare bankruptcy, lay off people, and that is that. Those in column b may get some form of bailout restructuring – maybe they are in a company that is green or the like – and this company now has plunging sales due to the higher costs, and they lay off people.

All signs in the next 12 months point to:

- Higher unemployment

- “Temporary programs” being extended or forgiven

- Colossal business failures of those who have run on cheap debt

- Stock market going down as profits significantly decline in most stocks. Mind you, there will be SOME good value stocks, but most overvalued crap is going down

- Fed/Treasury creating even higher deficits. They can only do this by getting a rollover from the stock market to then go into treasuries/etc.

I cannot see inflation of some things going away – we are seeing “wave 2” of inflation with wage inflation. People are seeing costs go up 20% year over year, but wages flat. They want to strike, just as the company has debt due and has to lay off half their workforce. The ONLY way to defeat wage inflation…is to create a condition of high unemployment. And, I believe – while this is counter to the Fed mandate – I believe for them defeating high inflation is of higher priority than low unemployment at the moment.

When will the pivot happen?

The main issue then is the Fed doesn’t want to put its thumbs on the scales during an election. Meaning, if they hold too high – for too long – November 2024 can be at devastatingly high unemployment. However, if they pivot now, the issue is they haven’t tamed the inflation beast enough, and wage/energy inflation is going to come back with a vengeance.

I believe the metric is somewhere at 5-6% unemployment and/or 25,000 Dow. Those items could/should get there by April, if they literally sit on their hands and let things fail. I don’t believe this is a cliff drop down. I believe in Michael Oliver’s assessment of an arm wrestling down move. This means that you do have people buying on dips with Fed gaslighting, but also when you have small rallies, they are sold into by the banks unloading their bags. This “soft landing” is mean to keep the banks whole, not you.

If you wake up and the Dow is at perhaps 24,000 in April, you are seeing your 401k perhaps losing 33% of its value from peak. Things are much less affordable. Unemployment is at 5.5% and student loans are being cancelled by those affected to keep that cash velocity moving through the system. More programs launched to rescue car makers, manufacturing, commercial real estate, etc.

Global conflict is rising, because we have a weak government these days, and everyone knows it. I love my country, but we took some wrong turns to get where we are. My full faith and credit is focused on gold and silver. I believe the stock market is the sacrificial lamb here, and while the dollar may rise – so will PMs. I believe with all of the printing they will have to do, I can’t see the 10y getting below 3%…but the higher for longer is – in my opinion – meant to slay speculative stock trading, deflate the 401k bubbles, deflate the housing market bubbles, and deflate speculative crypto buying – to then perhaps usher in the Fed Coin to assist those in need.

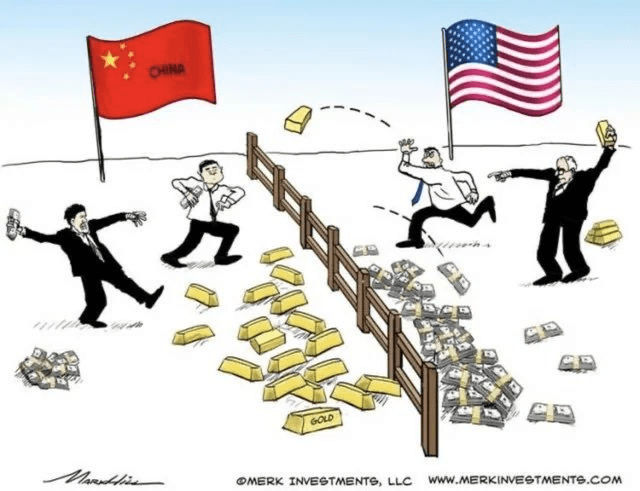

Deficits are out of control. And while the DXY might have a strong move as stocks are sold, our printing press is devaluing our currency faster than we can print it. I believe the East is buying gold. I believe gold is where everything is going within a decade.

I believe weak men create hard times. I am betting this is where it is going. I don’t care if in the short term the Dow hits 36,000 and someone wants to clown me. If you understand this is now how we operate….

Then you are light years ahead of everyone else.

And if you understand that this is how geopolitics has been moving for the last 14 years…

Then you also realize that The Wizard of Oz just wasn’t a movie, but perhaps a time traveler from the future…

This….is higher for longer. “Follow the yellow brick road”. But it’s kinda. Sorta. Until one of their friends needs the rates to come down. Then, we have it. Until then, expect the muppets to be marched out to give hope – to have the retail buy dips from the banks selling their bags, to then have hawkish tunes to have the hedge funds shorting things to oblivion and make money on retail selling those bags back cheaper to them.

You see – higher for longer is meant to drain you of your wealth, while everyone in the big money sector is protected, and gets rich all the way down. And then owns all of that at much cheaper prices than today. Gold is perhaps the best hedge here against deflationary impulses, inflationary money printing and cash creation, global conflict, and bank failures.

Leave a comment