junior miners in quite some time. I still subscribe to a newsletter, as Mining Stock Journal to me was the best of them – but with metals prices going stagnant and a long winter in for junior miners ahead, I cancelled all other subscriptions. They have REALLY good content, but I was spending a few hours a week reading all of them and prices continued to drop. What I did get out of all of that was a decent group of miners that I like a lot, that should perform very well at some point – but when, I don’t know.

Yesterday, my FSM got baptized by the markets, and I’m tapped in my account – or I’d be adding calls hand over fist for January. Big picture with them was that they missed earnings, but I’m not really worried about this miss. Why? What concerns me about miners is people who are unethical and have poor execution. One time events happen to all miners, and with this, I very much trust Jorge Ganoza and really love the strategic direction of the company. Mining Stock Journal covers them in great detail, so I urge you to pay the $20 per month, get some back issues, and understand the full weight of everything. Essentially the three things that jumped out at me were that they had 4,000 oz of gold from the brand new mine Seguela that they just started and could not sell before end of Q2. That’s $8m or so. They also had issues with a work stoppage on a labor dispute for 15 days at San Jose, and if you compare this to Newmont’s problem with penasquito, for the last two months, it’s a blip. Lastly, as I recall (it’s very, very early and coffee hasn’t kicked in) – they were shifting to a new place to mine in Argentina and had a lot of non-ore tonnage they had to start clearing, which made their AISC higher for the oz they pulled out. Combine all of this – and you aren’t dealing with runaway costs or poor execution, you are dealing with some oz that either didn’t get mined or are sitting on the sidelines – which those oz will show up in profits for Q3.

Below is the link to the great interview done at Arcadia yesterday – I still have the last 20 mins or so to listen to it, as I was working on the phone almost the entire time on my way home yesterday and didn’t get my metals time on my 90 minute commute.

FSM is a mid tier and doesn’t fall into the “junior” basket, but it’s the “flagship” of my stock portfolio and I know some of you were asking me about it – so I wanted to address it. I wish to hold FSM – and large numbers of share of them – through $2500 gold and $50 silver – perhaps even much longer if there’s a decent dividend at these metals prices.

Now I wanted to take a look at what most of the charts of my juniors look like…..

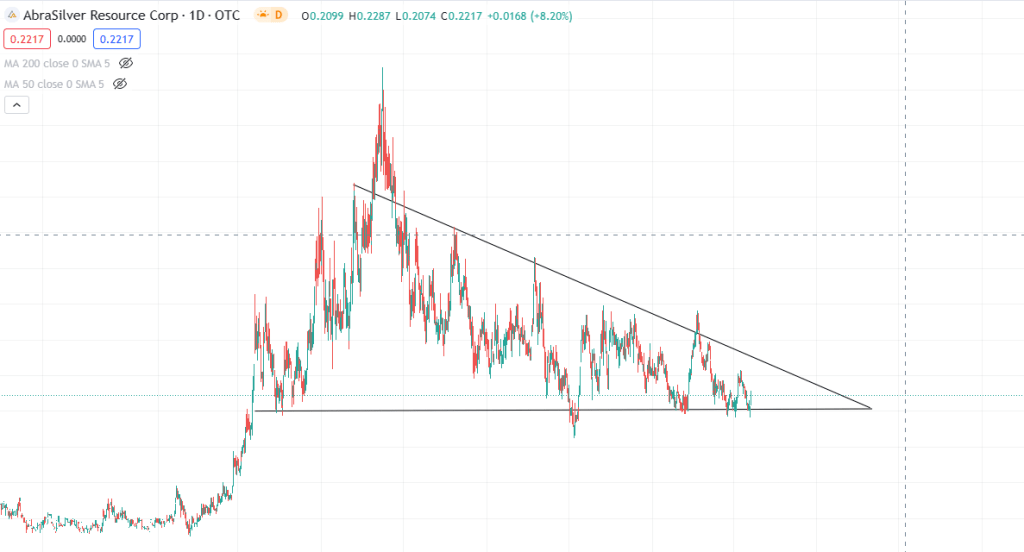

This is Abra silver, and this has a descending triangle. Note the resistance at the bottom “seems” to put a floor in.

This is Discovery Silver, and with this, you see a falling wedge

If you take a cheat sheet at the technical patterns, you see…

I feel both of the above patterns are potentially bullish. However, what most of you don’t understand is that this is a PROBABILITY and not a CERTAINTY. Meaning, if you see a certain pattern, it might actually play out like that 60%-70% of the time, at most. So if you take your entire portfolio and bet that both of these will resolve UP, you have a 30-40% chance of being wrong on the direction. Call options then amplify this error, on leverage.

Hooked

I got hooked on junior miners as I got involved with them around the collapse of 2020. For about 4 months, my entire portfolio went up over 2x. I have documented this a few times – and it was not my great knowledge of miners – it was the entire sector. And – I used the knowledge of people smarter than myself to get me the best of the best.

What has transpired since perhaps silver squeeze has been nothing short of apocalyptic. I am selling an investment property now (under contract) and I will be having a massive influx of cash into my account within a few weeks – and this will more than offset my baptism by BDLR. In fact – the sale of my rental was a hedge against this. I had planned on housing to take a nosedive with puts. That is, I expected housing to fall by end of Q2, and with this, bad numbers would come in and by now, my puts would be on fire. The housing market melted up, and it was a GREAT time to unload a property with a lot of equity that wasn’t a great performer. In fact, I was losing money every month on it but in the totality of my property portfolio, the wins from others were paying the mortgage of this, so I didn’t really care.

So when I make these bets, I usually have hedges on the other side of it as a way to offset losses or perhaps make some of it back. In this case, I’m making in profit approximately 4x the loss of my puts. I’m not Warren Buffet – nor do I claim to be. I’m a small time retail investor who is learning as I go, like you. But the best lesson you can learn from losses, is how better to manage your risk next time. With these puts, I determined I needed a better strategy to get out of them earlier – to move the strike price or date out more rapidly. I woke up like THE NEXT DAY to being down 33% on my puts, and the immediate thinking all of you have gone through is “oh, give it a few days, it can turn around”. That has resulted in the next few days finding out you are down 75% – and you are faced with cash preservation for what remains, or your hedge should do very well. In this case, I got EXTREMELY lucky, as I felt my hedge would have me break even, not do a 4x my loss in puts.

But I was hooked on the action – many of you are hooked like gamblers. I hope I’m not in that camp – but I’m more hooked with the learning about all of this and doing better next time. I make a great living, and I’m 47, so if I have a miss on something, it’s not the end of the world. Likewise, you need to understand risk so you do not take super large positions on things that are very risky.

One of my friends, who will remain nameless, bet MASSIVELY on an oil drill story. It was very much like a gold miner drill story. There’s initial discovery and then everyone is super excited and pile in – and you can see your bets go up 3-5x easily. With Great Bear, there was a period of time where initial investors had a 54x. While we all want this, most of us pile into these stories AFTER the initial discovery – and with this, we can then ride the hype machine up, and then at peak fervor, sell and let someone else hold during development. With my friend, he had TENS OF THOUSANDS on an oil drill story, and a bad hole took him down 80-90% in a day. My friends and I make fun of each other all day long, but this was a particular situation you don’t joke about. This is the kind of stuff that had people throwing themselves off of buildings in 1929. I had literally begged him in communication to draw down his investment to manage the risk, and he kept acting like I didn’t know what I was talking about.

The point is – different types of investments have different levels of risk. And with this, you must manage this risk accordingly.

An example here might be – assume you have Newmont, and bought at $40. You see there’s news about a mine finding a massive vein and the stock goes up to $60. This is a 50% win! Do you turn around and SELL? Maybe you sell some. But you think it could go to $100 and perhaps $150 when gold is at $3000. You love the dividend, and want to hold. Your fear now is that people piled into this at $60 and it might pull back to $50. Long term holders don’t give a shit. They will let it sit. People who are more active with their account might then buy some puts on NEM. If the stock goes up to $100, they lose out on the puts. If the stock drops $10, they make that money back with the puts and can then buy more stock at $50 with those wins.

I bring this up because the guys who know what they are doing have far more complex ways of dealing with risk than I am talking about. If you just look at an Abra right now and take multiple paychecks worth of cash and throw at it because it is beaten down – and the technicals says you have a good chance of it going up (60%), it is tempting here to put all the cash in and pull the lever to get a 5x in a few months.

Doom?

I mentioned, I got EXTREMELY lucky in April-July 2020. I only really appreciated that after years of watching consolidations – and seeing companies that were darlings outright fail and go to zero. Two items I had in my portfolio at times to trade were Pure Gold and Kore. Pure Gold basically went belly up as it seemed they had no mine plan as part of this, as they wanted to fast track the mine and skipped de-risking steps that might have delayed it 1-2 years. With Kore, it was a darling of TWO of the stock pickers I had subscribed to, but the permitting problems in CA wiped it out. There are RISKS with many of these miners that people just aren’t tracking.

How can your investment in a drill story fail?

- Dusters. Bad drill results. People sell out and sometimes rather illiquid stocks on the OTC can really go down hard when there’s no bid. People continue to drop prices aggressively to preserve cash. By the time you even glance up at work, your investment in that stock is down 50%. You then try and sell and no bids.

- Running out of money. Most have no clue that mines have no income for 10-15 years. In order to get the mine into being, you have to beg, borrow, and steal. Or more appropriately, issue stock, borrow from the bank, or even sell warrants, streams/rights. maybe a company has 10 assets and they really want to drill 1 or 2. Often you can see them accumulating these properties in times where metals are distressed, and sell when metals go higher. But the reality here is that when you drill, you are improving the value of the land by taking $5m to show that $50m in metals exist. If you take this $5m, and only show $10m in metals, maybe the next round of financing has no takers. This means the company can no longer drill. They are people with land than can not be further developed until financial conditions get better. Some of these stocks can potentially go to damn near zero.

- Takeover – if you are distressed above, perhaps someone offers to buy your property. This cash might then help to get initial investors a 10x on their investment, but you just came to the party a month ago and you take a 35% haircut – or more.

With rates going higher and higher, the cost then to borrow for mines goes astronomical. Debt maturing has to be paid off or financed at higher rates – and if you are carrying debt, the cost to service it may be double and wipe out profits and make you insolvent. This also is a risk coming.

My point here is that the ME of THREE YEARS ago who didn’t know better threw a good portion of his investment portfolio at juniors and hit the 60% up probability. The ME of TODAY fully appreciates the risks here, and while I’m chomping at the bit to add to my positions, there’s also a good likelihood this entire sector could take a further beating if there is a stock market event cooking.

My strategy here is to wait for my cash to come in, and with a portion of this, perhaps have some real low bids out there on my favorite stocks just lying in wait. A credit event happens, and someone sells “market” just to get rid of it, and with this, I get one of my favorite stocks at a 90% discount. If you take a look at a company I had traded a few times, Santa Cruz – you can see this “fishing line” move, which appears to be people selling at market.

So with this – have fun with the sector the next few months, collect your favorite names, but be careful that these charts that are showing strong support can get obliterated with a 1200 down Dow day as people are selling everything not nailed down to address margin calls. FSM got me good, and I have to move some things around. I could not imagine having a 90% portfolio in these, on leverage, and they have a 60% down day. So be safe.

Understand the risk, and try to learn from it. Try to hedge where you can, IF you are taking on risky positions. Do not invest more than you can afford to lose in these. A good idea I had heard was – “many of these can be a 3-5x, but the downside is perhaps 50%”. Many of these don’t drop 50% in a day, but they trickle blood drops at a time and you wake up 6 months later down 70% on a junior by losing .5% a day. With the higher risk stocks, I usually have no more than 1-2% of my portfolio allocated to one of them. I then have perhaps 10 of these split between gold and silver, and also split between jurisdictions – so I don’t have a stable of Peru miners and a president that wants to shut down mining is elected and wipes me out. If I have GREAT success with one – that same guy also suggested to sell half at a 2x. I have had MANY 2x, a few 3x, and low single digits in the 4x with juniors. The risk is losing out on the 54x Great Bears by selling a lot of that. I get it, but they are one in perhaps 5,000 out there. If you sell half at a double, you can – in theory – hold that position indefinitely as “paid for in full”.

So – I just want everyone to be careful. Be greedy with the low prices, but also be aware there may be a stock market event cooking where you pour thousands into these juniors and they all fall half or more from here. While not likely that much, you need to have it in the back of your mind.

August 22, 2023 at 7:10 am

Where do you buy junior mine stocks and if there is possible to buy AI stocks?

Best regards,

Edgars Bulajevs

LikeLike