There hasn’t been a ton of catalysts lately, so I wanted to do a check in with you and give you some more gold/silver porn for you to run through walls with. I think I’m going to create a slide show for this and submit to Arcadia in the next few weeks to try and give the overview. Buckle in here, as this one is going to be a doozy and give you a summary of where we are, and I wish to explain here that no matter where we go – in my opinion, gold/silver will be king. By proxy, gold’s little spastic and ungovernable brother will be merciless. While I focus on the word “gold” here, you can substitute silver for this in many places.

I believe that 10-20 years from now, movies will be made about a lot of us. I don’t mean us individually as people, but the storylines here will be fantastic. You think of financial movies – and what comes to mind – “greed is good” and “The Big Short” and “Margin Call”. These are movies about stocks and housing, but I can tell you that there’s another movie cooking. The movie could be called “The Big Silver Short” and borrow the name of Chris Marcus’ book for the setup – and then unpack all of the events that will lead to people like Eric Sprott becoming the world’s richest man.

While all of this can sound a little fantastical, I believe this is a once in a 100 year move coming. Reserve currency change, global pandemics, regional wars, global alliance changes – this isn’t a story about someone shorting the housing market, but a few hundred thousand people in the world that perhaps understood some of the big things at play better than most.

I’m going to structure this as follows:

- Where we are

- Why gold will perform with cliff drops ahead

- Why gold will perform with mass inflation down the road

Where we are

I’m writing this as one of my friends heckled me again about stocks melting up. “Nate, you were wrong”. Perhaps. But I just don’t care at this point, as I’m about to lay out that it doesn’t really matter. I HOPE I am wrong, but this post will show that right or wrong, it doesn’t matter, as all paths follow the yellow brick road, and with that, I’m kind of agnostic about how we get there. Am I HOPING for doom and gloom? Hell no. It’s just 99% of the population is now gaslit daily into doing things and thinking things by our media without any critical thinking, it’s just getting herded into lines and cattle shoots of daily crafted messaging to mindlessly go about your life thinking all is well.

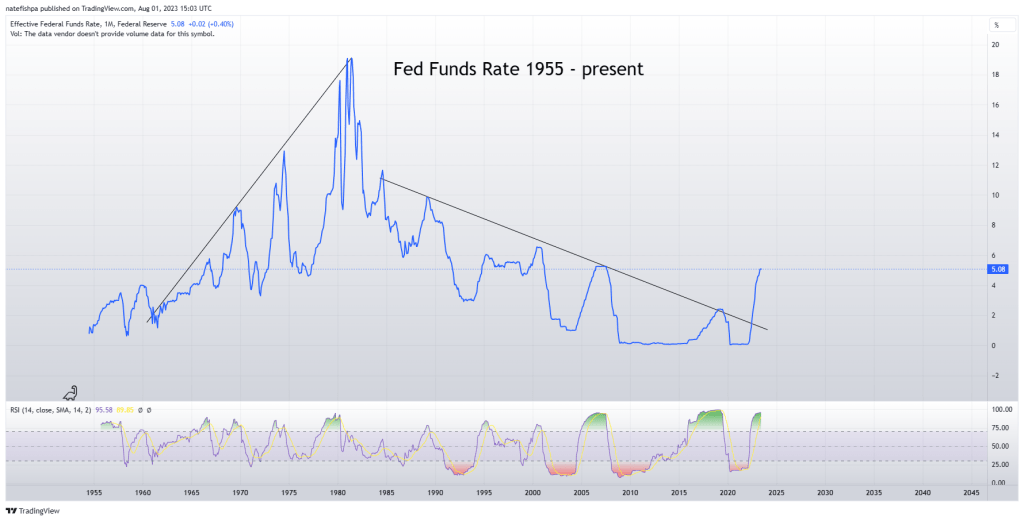

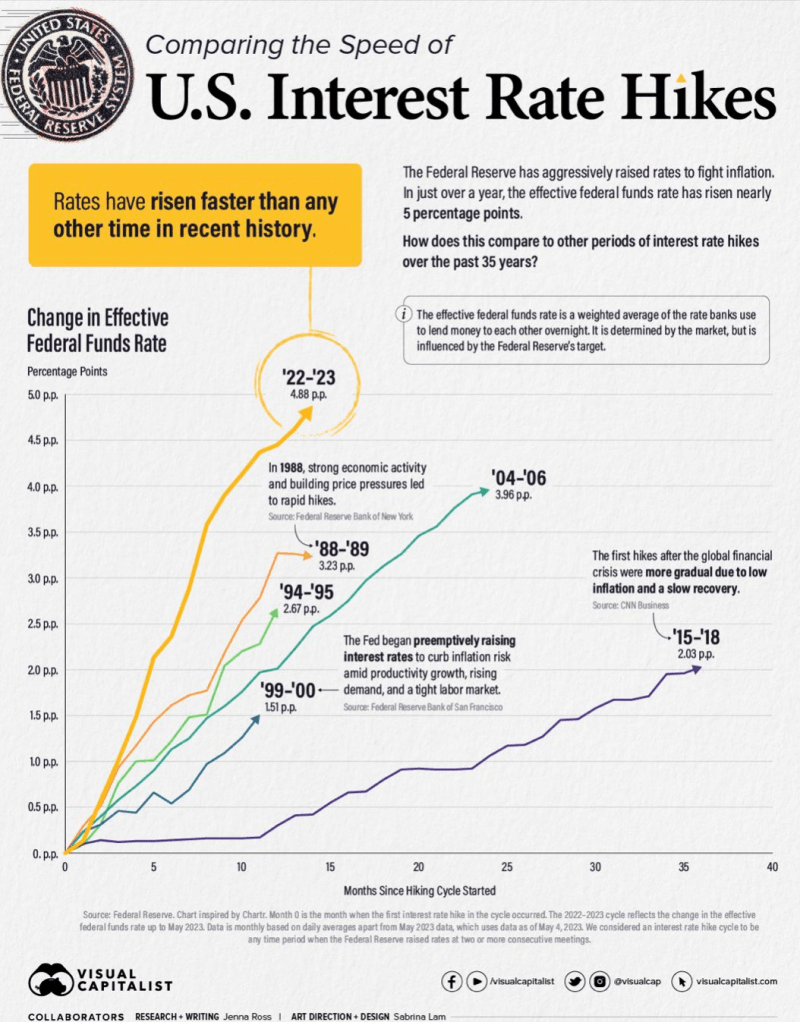

Where we are really is about 18 months into a hiking cycle that had the fastest rate rise in history.

Why the rate rises to begin with? What happens is an economy can run hot – that is, too much cheap credit is issued, and with this, it can run up asset prices and “inflate” them. Consider if you can borrow $100,000 at .1% interest and then put that all on Apple to 5x? This is an extreme example, but the function of math here involved. IF you can borrow credit and expand your operations and make 3x, wouldn’t you? Yes! Everyone would! And what this does then is have all of those people chase the same finite goods and services, which creates inflation.

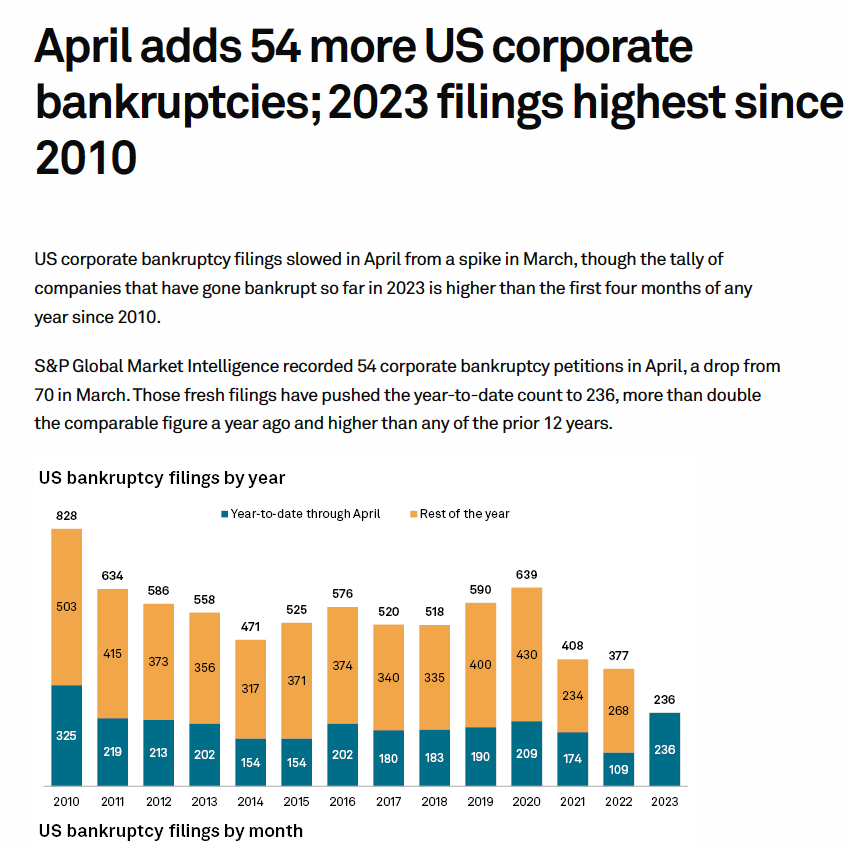

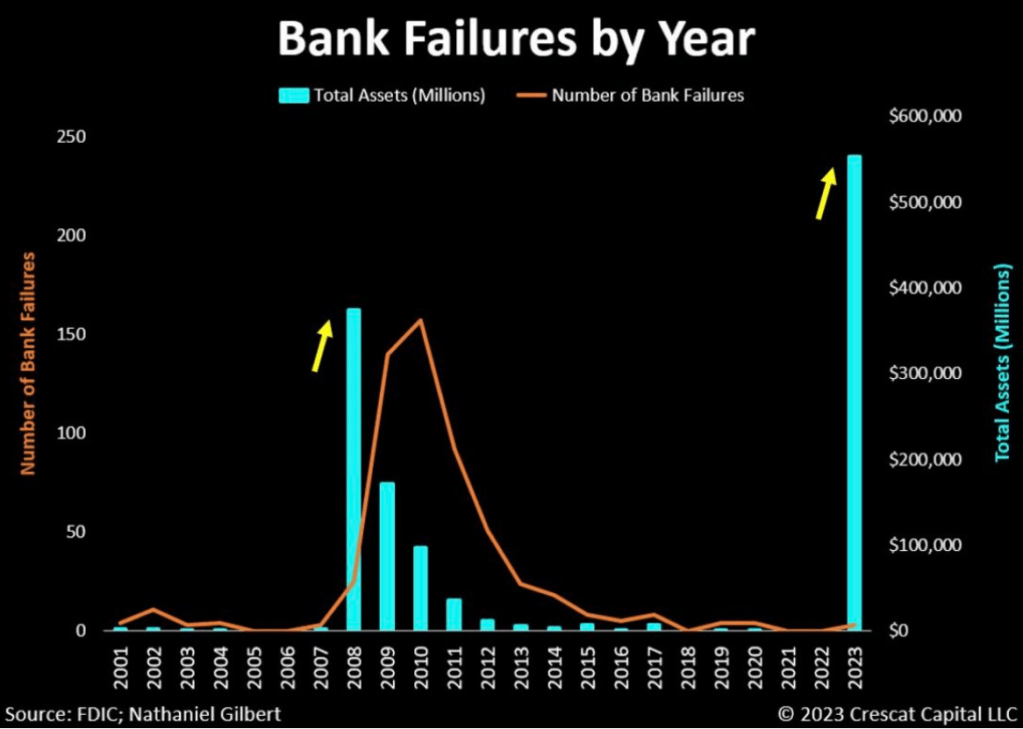

Fed funds rates can essentially be a form of air brakes to slow down borrowing. This can slow the rates of inflation, and with it – slow down expansion. With high enough rates – you start running into contraction. We are seeing the most bankruptcies since 2010 if you look at the chart below.

And this:

Why is this happening? Many companies needed to expand or die by getting left behind. They take out corporate debt that matures years in advance, and at the end of that time, many companies have been used to “rolling over” the debt into lower and lower rates. What has happened now, essentially, is that the debt is maturing and with this – they are facing significantly steeper payments if they are to roll the debt, and do not have the cash to just pay the debt. Many of these companies were running on show string profits with extremely low debt rates. Now, you significantly increase rates – and BOOM.

This has already hit a lot of tech in late 2022. Now we are seeing a lot of the “zombie” companies getting hit as trying to rollover debt would make companies almost immediately insolvent.

Meanwhile, “they” changed the definition of a recession last year, and pretty much the only way now to tell if you are in a recession is a year after it happened. Makes sense, right?

What then “should” happen is a lot of companies start shedding jobs, and unemployment rises. Currently, we’re not really seeing this – despite all of the bankruptcies and layoffs. As if – the data somehow doesn’t match up with reality?

Let’s also talk about “unemployment”. If you are looking for over 12 months, you then drop off as “voluntarily” leaving the work force – despite perhaps still looking. Those who aren’t “well off” may also be doing part time work and “side hustles” to make ends meet.

This is the FRED labor participation rate. What this shows is, as a percent, we peaked at like 67.5% in 2000, dipped to 60% in 2020, and are around 62.5% today.

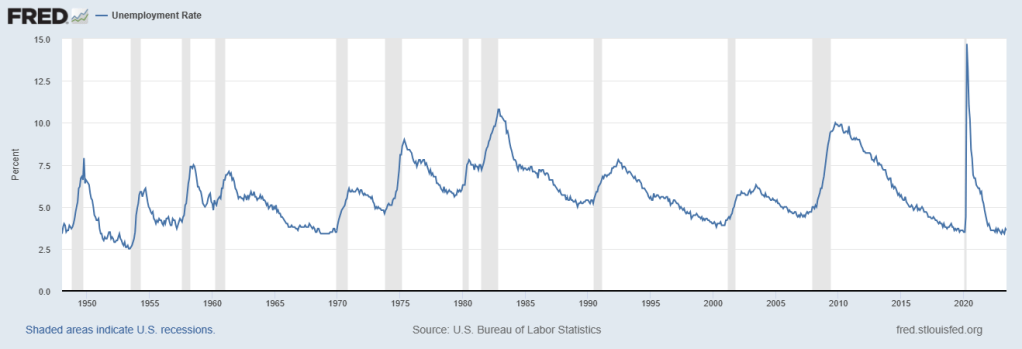

This is the unemployment rate…

Look at the gray stripes – this indicates “recession”. You can see how these rates slide down in good times, and the second a recession hits, unemployment skyrockets. We hit 10% unemployment in 2010 and 1984ish. You can see the “blip” up with the COVID shut downs, and look how that “recession” lasted like a month, despite everything being closed for like a year. You can see the spike of unemployment hit 15%!!

Did those people actually go back to work? What about all of that PPP? What about the $6T printed to assist the economy? Much of this the Fed bought to keep rates from going vertical.

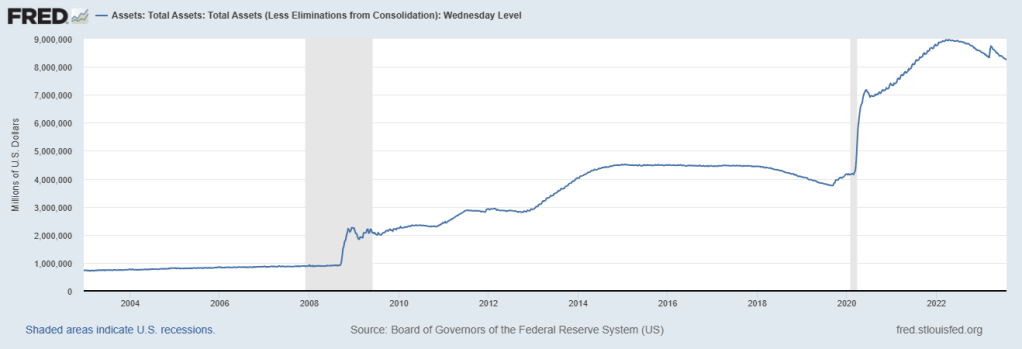

Look at where they bailed out everyone in 2009 for $1T. Over the course of the next few years, QE was used to help the economy recover. It appears as if the Fed stopped adding to their balance sheet in 2014ish, and only in 2018 when they tried to bring the balance sheet down – it seemed to significantly affect the financial markets.

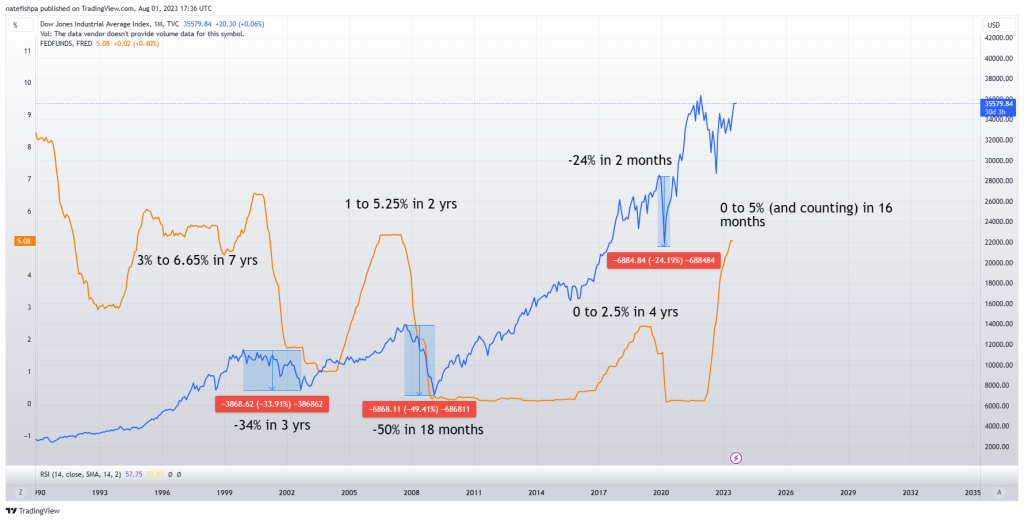

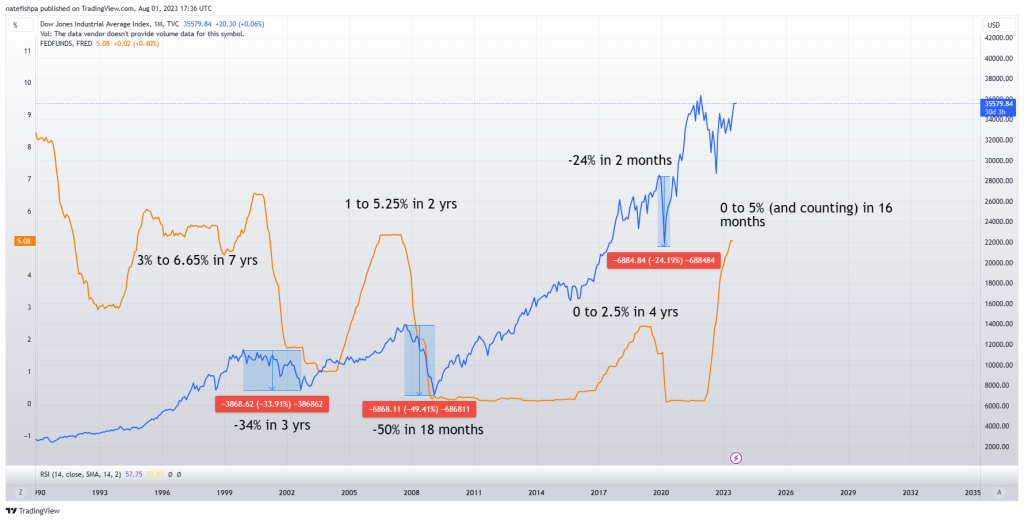

If you look at the history of rate hikes over the last 25 years, you can see that as rate hikes increase in distance and speed, it impacts the recession greatly. Let’s track three items above:

- 1993 to 2000 we saw rates come up a bit – normalize to lower a little, then at the time of “pets.com” and froth was happening, rates went up pretty quickly about 2 points. Overall, the entire move was 3% in 7 years, and with this, the recession was 34% down, but over the course of 3 years.

- 2005 to 2007 we saw a drastic rise in rates of 1 to 5.25% in 2 years. The speed and size of this move took us down 50% in 18 months during the global financial crisis.

- Our last move here was over a good deal of time and took us from 0 to 2.5% in 4 years. The speed of the fall was drastic, as COVID also happened – but the move was already underway down prior to COVID.

My concern now is that this move from 0 to 5.25% is the biggest move in 25 years – and we did it in 16 months.

The next closest was the GFC in 2008. So we have moved MORE in LESS time. With this, one would expect problems. Well, we have more bank bankruptcies (by dollars) in the first 4 months of 2023 than all of 2008-2010 during the GFC.

The big mechanism here, of course – was that many of these banks bought longer duration federal debt, and the value of them went down. When a bank run, of sort, happened – banks were forced to mark to market and take the losses and could not pay out the deposits.

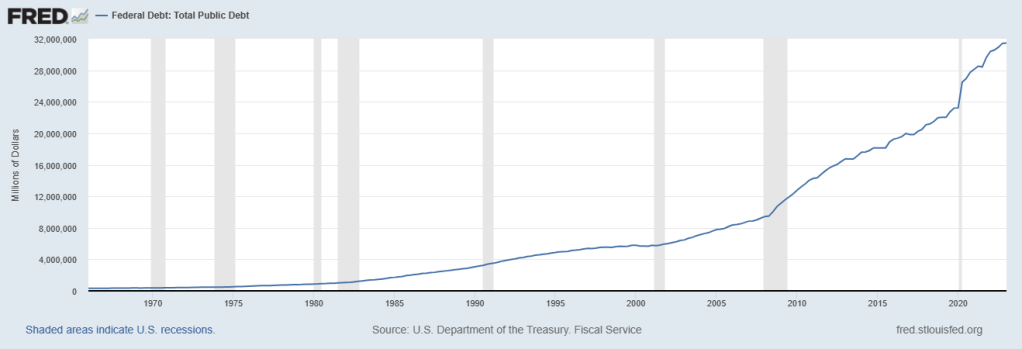

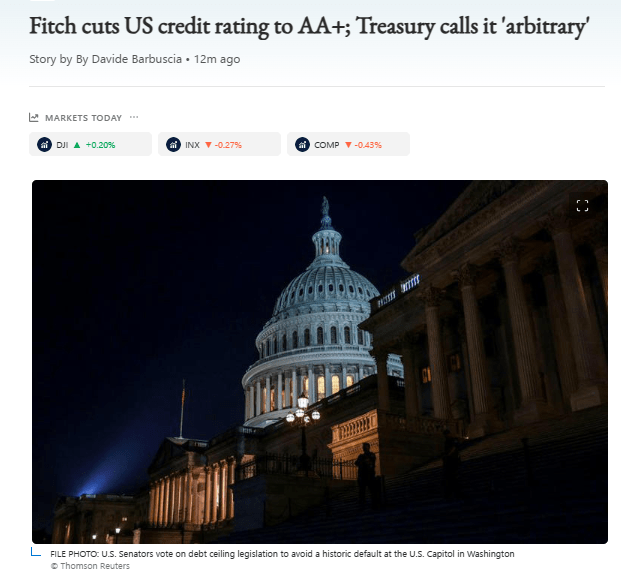

Speaking of which – we are now at the point in the game where we have $32.6T in debt, and with the higher rates, it’s now costing us over $1T per year in interest just to service the debt. This is, of course, at the same time China is reducing their US treasury exposure – as is the Saudis. And yes, at the same time the largest holder of treasuries – Japan – is also doing the same.

Powell seems to want Yellen and Congress to rein in spending, and it seems the Fed is reluctant to buy any more debt. If the Fed isn’t buying more debt – and neither are foreign countries, then who is?

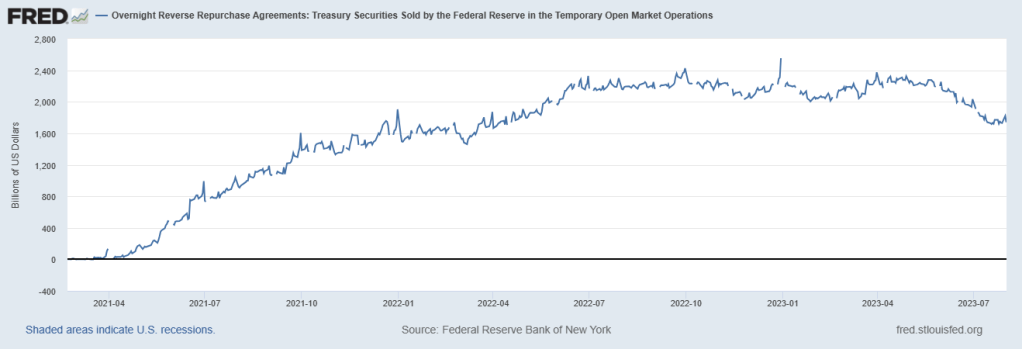

It appears that from its peak of $2.5T, the reverse repo operations are now at $1.7T.

So this may be acting like a sponge to soak up excess cash? Look, I understand the repo market ok – but put a gun to my head to talk about this plumbing, and no. I know there is excess cash on bank’s balance sheets and they get a nice rate to park cash here.

While all of this is going on, the Fed is kind of doing a victory lap on “defeating inflation”. Unfortunately, what nuance many of you are missing is – this is “demand destruction”. The danger you have with this, is the reverse of the danger you had when leaving rates too low, for too long – which then overshot and created inflation. Now, the risk is deflation. I wrote all about this as well.

But did they really win? Or, did the sort of paint a turd?

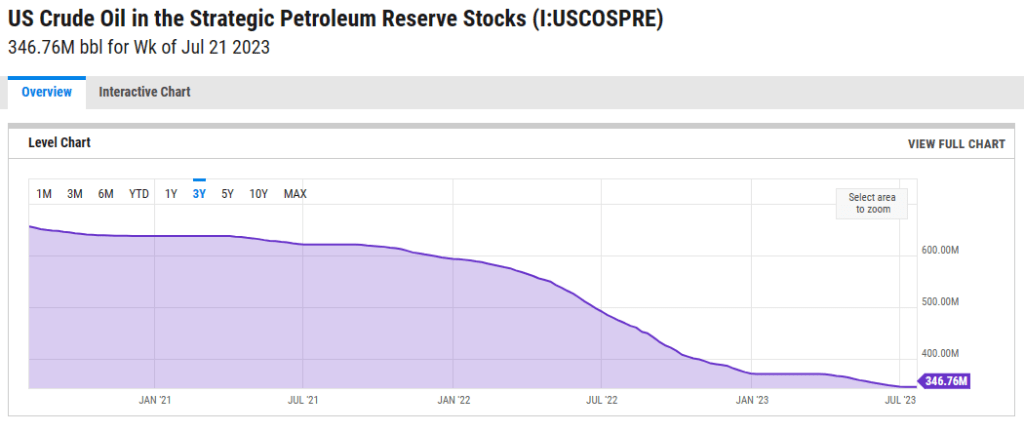

While all of this was going on, the US has drawn down the strategic petroleum reserves. This kinda helped keep gas prices down and mute inflation for a period.

Question then is – at what point will they stop drawing on it, and will they refill it? If not, why not? And how much did this affect inflation coming down? How much of these energy costs were then removed from the system?

Many people then see “inflation down” and confuse disinflation (prices rising at a lower rate) with deflation (prices going down). In some cases, I am seeing prices revert – but in many cases, you are still seeing a form of “shrinkflation”.

While all of this is going on – we then talk about houses. Apparently, because so many people (like me) refinanced at sub 3%, no one wants to sell and buy another house that is more expensive and at much higher rates. This has led to the new housing boom – but it’s also a symbol of a problem with the “AirBnBust” where so many people bought houses to rent out part time for AirBnB. Well, economy is heading south, and with this, less people are booking. This potentially has a domino effect that may happen soon where the market starts to get flooded with these houses for sale at the same time that homebuilders spent billions of borrowed money to make thousands of houses. Home builders now are going through colossal incentive programs to get people to buy these houses, and margins are starting to get crushed.

Meanwhile everyone, stonks go up.

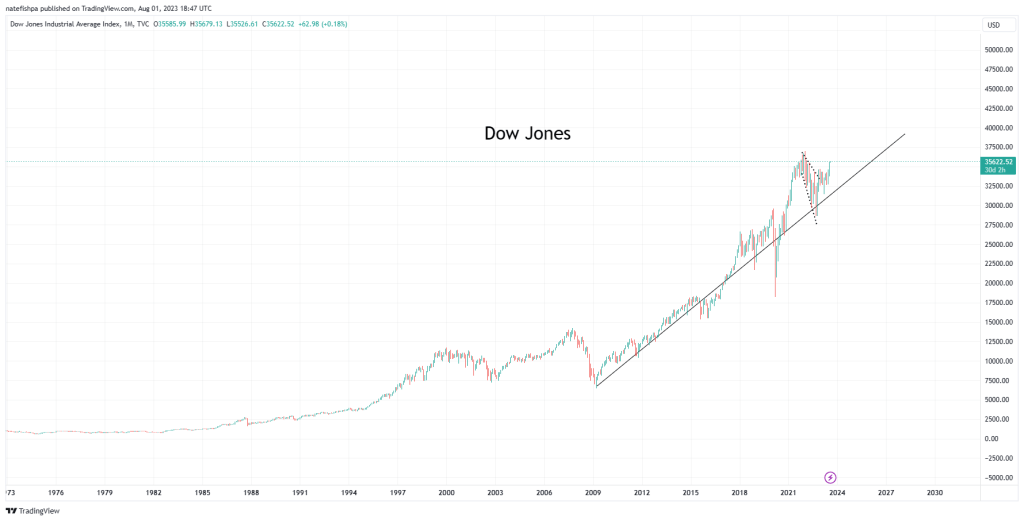

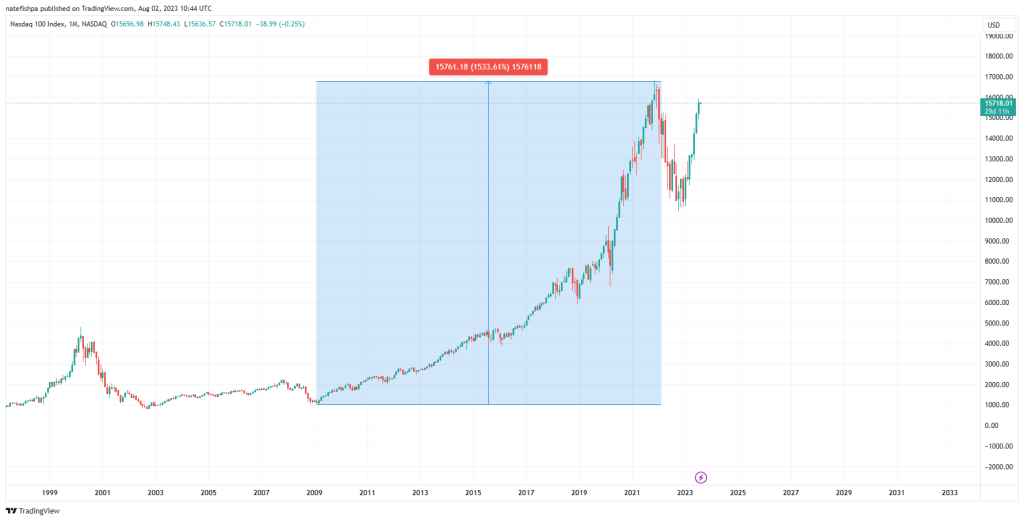

I drew a line here for people to see how insane this move has been since the bottom in 2009. Remember, the GFC wasn’t REALLY solved. We just sort of punted it, and made money cheap to borrow. What that trend line shows, essentially is new money being borrowed into the system and working its way to stonks. The chart below shows that we TRIPLED our national debt since 2009.

If our economy was so damn good to make stonks go up 6x, why were we running serious deficits every year? Why weren’t all of the taxes from wages and businesses paying down our debt?

What this all looks like – to be frank – is the US creating treasuries at dirt cheap rates, then essentially spending this into the real economy and encouraging 401ks/stocks and pumping this up? Think about how much of that stonk spending above is 401ks run by Vanguard and Black rock?

Yell has even been in front of Congress and didn’t give a shit about $50T in debt coming. She used some fancy words like “real rates”. Meaning…imagine you can borrow money from your friend at 1% and take it to the casino to make 20%. Essentially, that appears to be the kind of reasoning they have. That it doesn’t matter how much you borrow from your friend, as long as the cash flows come in to pay the notes, who cares.

Well. It now matters. Why?

The amount borrowed – that rate is creeping up. And as far as the incomes? That’s coming down. So…things matter.

We are now at a point in time where our debt to GDP is 120 and floats between 130 and 120. This is a big deal in that you get to a point at these levels where you default on your debt. How? You default through either not paying or inflating your way out of debt.

At this point, you are starting to see property taxes substantially rise. This is also squeezing homeowners and landlords. I just sold one of my properties as taxes kept going up and it really hurt any profit. Rents will have to be raised. Unless wages are massively increased, people will just continue to get poorer. This then potentially leads to a lot of job hopping, strikes, and wage pressure upward. The ONLY way to defeat this is….by increasing unemployment.

So the wheels are falling off. I just wanted to catch you up to where we were.

The question that guys like me look at in analysis look at – where is the macro picture going. You essentially have a few choices….

- Deflationary – the case here is there’s a lag on rates and there’s a bomb going off, and soon.

- Inflationary – higher tax revenues and constantly doping the GPD through direct spending into the economy by the government can potentially mask the debt to GDP issues. Higher tax revenues keep governments solvent yet another day for kicking the can.

- Stagflation – chopping sideways with inflation eating away wealth.

In the below – I feel it’s it important to see how gold has reacted with deflation and inflation.

In times of DEFLATION

While I believe that we are looking first at some sort of massive deflationary hit, it doesn’t really matter for a 4-6 year out period. This matters if I short the regular markets or do puts on them for timing.

All of the above indicates a credit event is coming, and with that, I am expecting a stock market drop of significance. The chart way above shows that every time we raise rates, eventually that lag catches up with it, and when that happens – the markets head south. The chart also shows a potential for how drastic the drop can be in a relative short time frame. The ONLY thing that stopped the fall last time was the Fed bailing everyone out due to COVID. A big part of me feels Papa Powell is now in the business of hard lessons to save the dollar. I had written about all of this two years ago coming – and with it, the ultimate choice was between saving the markets and saving the dollar. A few weeks later, all of the Fed guys sold all of their stocks.

Pain is coming. He even said it was.

Yet many people are thinking we are going to melt up are simply not paying attention to this chart I had above.

You can literally watch rates go up with the grenade pin pulled, and then you can see the explosion later. Only THEN do the rates start to come back down.

If we look at the last 4 times rate hike cycles happened – gold does VERY well once a pause happens. The last 4 times – from the time of the pause until a peak

1989 – 34%

2000 – 847%

2008 – 405%

2018 – 86%

One can then argue that the rates pause when problems are seen in the economy, and with this, a “risk off” event happens. You can then also say with a straight face that gold competes with the 10yr for a flight to safety.

But this time – it is a little different. You can see central bank buying gold since 2009. With this, we eventually saw how the US seized Russian reserves – which set the table for the BRICS to stand up their own currency outside of the SWIFT system. While I believe – and have written – about how a trade currency stood up in gold COULD work, ultimately the point here is that many countries are now steering away from the 10 year as the “safe haven”. I’d posit that within the scope of de-dollarization, that gold would start to take more of a lion’s share of the “safe haven” status.

Meaning – even if doom is coming, you can reasonably project a sizable move in gold will happen when a pause happens. I believe this could be further emphasized by the fact that many see our unsustainable debt and with this, feel there is some form of risk holding our debt.

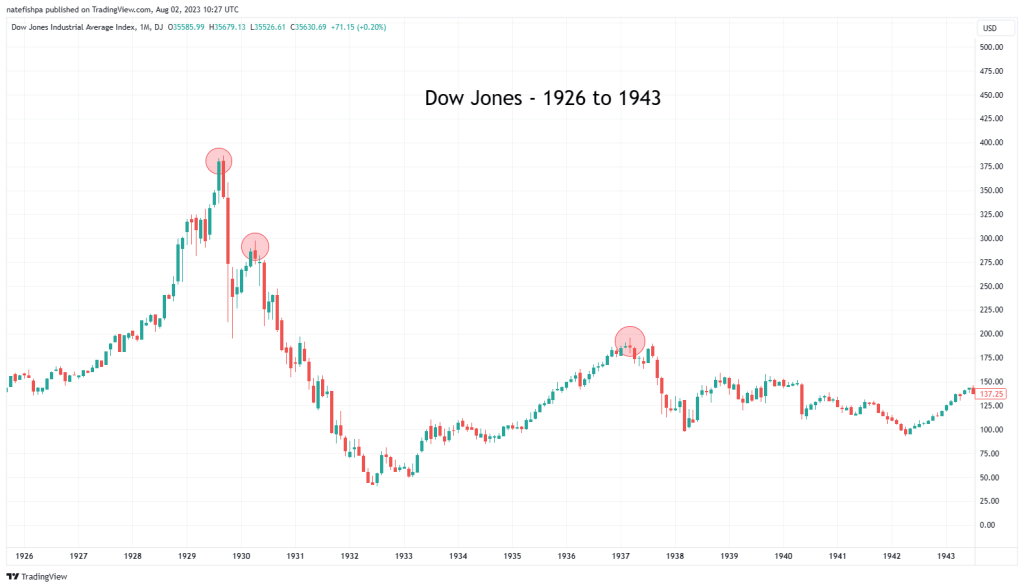

We then take a look at the Great Depression. Everyone of course knows about 1929. But many don’t know about the rallies that took place only for them to get rugged.

If we look at today, we could make an argument that 2021 was 1929 at the peak.

Basically here – we are at a crossroads. IF we do not get a higher high, we run a great risk of significant rollover. And with this, no one on the planet can tell me we are healthy. As bankruptcies are piling up, debt is piling up and serviced at higher rates, commercial real estate circling the drain – the ONLY thing I believe keeping us going is a “resilient” home market, and even that is starting to drop off of a cliff. The great lengths that home builders are going to entice people to buy has limits.

One COULD set the count down for doom in days, if not weeks. I believe with the 2nd quarter numbers that will come in, many will start to feel the decline. All that is really needed now is a catalyst. Labor numbers – as you can see above – seem to be juked. IF we come in with much higher unemployment, that could signal to the fed to pause. It doesn’t mean to lower rates. The idea though is that I believe – like many – a significant credit event will need to occur to stop Darth Powell here. I believe that as long as he sees stonks go up, all that is happening is the noose is getting tighter on retail to get rugged.

So – does the pin that got pulled from the grenade 16 months ago with rate hikes start to detonate? Remember, there’s a LAG here, so IF we start seeing doom, we could perhaps just now be feeling the first 1% with 4-5 more percent in the chamber about to ruin your 401k.

Where does the money rotate to? My bet is that IF a credit event occurs that as people are buying the 10yr, you are seeing China and the Saudis and Japan selling into that. Meaning – Bond guys think they are about to get PAID, and my contention is that it is an asset class that is falling out of favor as the world benchmark. I believe gold is about to have a day. Why? We are damn near $2000 DURING A RATE HIKE. Let that sink in.

Silver has soooo many supply/demand issues, even if a credit event happens – the main drivers for demand is threefold – solar panels, cars, and investment. Solar panels are the tree hugger’s wet dream, and with this, demand will not fall much – incentives will keep the top 5-10% buying them. While a large recession here will also take auto demand down, what many don’t realize is that EVs are coming a much greater percent of the market share and they use 3x the silver of the traditional ICE. Meaning, even WITH auto demand cratering, the overall demand for silver will continue to rise. Lastly -with investment – IF we start to see gold rise substantially and kick in the door, the silver citizen mafia will do their thing and drive prices over $50 like a hot knife through butter.

Now, we have to simply wait to see if Q2 numbers start to drive the markets down. IF not, and IF we still have “low” unemployment numbers, then it’s possible we see further hikes. Which, actually, can pretty much destroy a lot of banking, and with this, keep gold’s bid pretty high until a pause is announced.

In times of INFLATION

When QE happens, it seems gold is sold and everyone goes RISK ON!! Meaning, why would you hold gold if you could put that cash into something that could go 5x? If we look at the chart here of the Nasdaq, we can see what appears to be a 16x from trough to peak.

We have also seen a strong pullback, along with a recent recovery on “AI”. First quarter earnings calls for everyone apparently just used AI every 3rd word and the stocks levitated. And this is the other part of the equation you need to pay attention to. While I believe this is a steaming pile of horse shit snake oil, all of you seem to be buying into this. I think quantum computing is 5-10 years out. I believe AI is in its infancy and while there is promise with a Chat GPT type of tool, the garbage that it reads through can produce inaccurate results. Meaning – I think there’s a case to be made where you can perhaps double the productivity of your company with half the resources. This, of course, would drive down costs and increase profits. This would justify the uber high schiller P/E ratio.

So let’s assume for a second this DOES happen. Risk on is in effect. Everyone sells gold and hurls it at the Nasdaq. One has to perhaps consider that all of these future profits are already baked into the price. Meaning, any money going there is simply inflating a bubble.

Oil costs are going to have to start increasing – as productivity is going up, we need to ship more units. While we can make twice as much for half the staff – we then realize with greed that we can make 8x profit with twice the staff and expand. At these insane rates. We justify borrowing at 8% because our returns will be 100%.

The debt then explodes higher, and with this, tons more money is introduced into the system to expand. Energy costs skyrocket as there isn’t enough crude/nat gas coming to market to support factories and shipping. With all of the expansion, we need more employees – but there’s not enough out there. We have to pay more energy costs and wages to produce the amount of goods we expect.

But where is the consumer? With slowing economic numbers, many rang up credit cards and were worried – but now, mom and dad just got jobs making 50% more!! Housing is booming!

All of this is on promises of deflationary cost inputs with tech. To sell more goods to a consumer that is tapped out. In this sort of euphoric utopia, some form of UBI is introduced to help the poorest pay rent and buy groceries. Meaning – the ONLY WAY that you can get consumers for this orgy of an economy with prices going vertical is to have massive government programs supporting the bottom 20-40%. This means, of course, getting us to $50T in debt in no time. And, since there was a “blip” with the economy – rates continue up north of 10-12%. The top 5% of the US population is living in delight. Stocks have gone vertical.

But the underbelly here with gold? We are seeing a form of super inflation in this scenario. Similar to 1970s. Energy costs skyrocket, and the consumer is seeing 10% inflation. This had gold go up 24x and silver 29x during the 1970s, with a massive blow off top. In this scenario – the debasement of currency is the driving factor for gold, and the overpriced stocks relative to gold ensure a floor. Likewise, in this scenario, manufacturing of everything is chomping up all global inventories of silver far faster than we can replace the stock. This will have an effect of explosive commodities prices as the thinking here in this model is unlimited goods – at lower production costs – but ALL of these things, are BUILT with commodities that need to be mined, drilled, etc. This is a WALL that is hit, that cannot be overcome without vertical commodities prices. This, ultimately, is what creates a form of hyper inflation.

And this is what gold did during Weimar.

Meaning – that as long as demand is there, prices can go up. Demand can be there only if they have jobs (or UBI) which stimulates the buying. If you closely lean in to the MMT crowd, they believe in UBI and “no recession in my lifetime”. This is because in some hyper-Keynsian future, government is fanning the flames of inflation to keep GDP high. And, it taxes the shit out of the best earners to support the bottom 20-40%. Think about how your higher wages then means more tax revenue. How your stocks being sold at massive profits drives capital gains taxes. How your home price going vertical is now driving your property taxes significantly higher. And now – California is talking about “wealth tax” to tax what you have, NOT realized gains from the sale.

In THIS form of reality, gold as an asset class would lag behind a 16x Nasdaq – however, the main implication is that UBI will be needed in this model, and with this, you will see more and more debt issued to “fund” the GDP. This is a fully controlled socialist paradise where there are no longer any free markets. In this scenario, I believe a CBDC is required. I also believe attempts to outlaw gold in G7+ countries could try and take effect, but all this does is lower the price for BRICS+ countries to buy from the west. Ultimately, I believe this scenario ends in a hyper inflation as the currencies become worthless. This is when serious players in the East with gold take over.

Meaning – gold can melt up with a hyper inflation. It will also most likely be part of world currencies to rebuild a system after a hyper inflationary event, as it has over the last 5,000 years.

Conclusion

Whether we see interest rates go up a little more and then devastation to our economy and markets that lift gold up 200-500% OR the AI gaslighting and shitty earnings propels the markets into clown world valuations – it doesn’t matter. In both cases, gold rises.

And, in both cases, gold’s spastic little brother will have a jet engine propelling it higher. I have written a lot and spoken a lot about silver’s supply-side problems. However, in both scenarios, silver’s demand is unrelenting, and WILL hit that wall.

What you see daily with price movement now doesn’t really make a difference, unless you are playing calls/puts. I have my positions. I have played World Level chess games for 6+ hours. This is cake to just sit on my hands and let it play out. For how long? Who cares. It is inevitable. In my opinion. Prove me wrong.

P.S. You like my Charlie Kirk silver to the moon meme? lol

Leave a comment