Some are forecasting lower metals prices ahead. It is HARD to disagree – as the level of tightening that is going on would indicate this to be the case. OK, so let’s be GREEDY and go to Apmex and buy silver eagles for $17 – and perhaps a 25% premium, and call it a day at $20.25-$21.

Ummm – what?

Granted – this would be your highest premium “bullion”, but it still is indicative of how RETAIL is having a hard time stocking this. Meaning, no one is running full speed to a coin shop to unload their Eagles. Most sovereigns appear to be in the $24-$25 range at Apmex, and this is using their highest quantities. Then you have credit card surcharges and shipping, and suddenly you are seeing far higher prices.

I have written several articles about “what to buy” with silver – and to layer your purchases. Right now, I’m in the market to buy metal again. However, I’m not paying for Eagles at near 100% premium. That’s just silly. If I wanted to get a 1,000 oz bar, I could buy them for days – but what are the premiums on these? I believe recently I saw some talking $.25 per oz – which is cheap. There are trade offs with each and every type you buy. Counterfeiting and premium costs are the top out there.

The picture is from Water World with Kevin Costner. It was some sort of dystopian future where I guess the water levels rose and it’s some sort of Mad Max on the sea. But when Eric this morning wrote about his thoughts on metals going down, it brought up this image to me.

My first thought is that I need to research local plasma banks to scratch some loot together to go buy stuff. I was actually doing fire sales in Fall of 2019 getting rid of anything not nailed down to buy silver. Old exercise equipment, bikes, you name it.

In “The Rime of the Ancient Mariner” you have a guy who is stuck on the seas without fresh water. The line goes….

“Water, water everywhere, nor any drop to drink”.

In this case, the price of silver is falling based on “selling” silver. In this case, it’s selling silver futures. The one plausible scenario for this is big base/gold metal miners selling the silver as a byproduct and just selling at market. They are continuing to produce metals and forward selling production. Given you may be seeing a slowdown in the economy, you then have consumers of silver slowing their buying. This would create a situation where buyers are there, but only at lower prices.

Another scenario is that many feel a crash is coming – and for example, hedge funds – speculate on this crash by selling silver futures, with the idea a crash could push price down several more dollars, to then buy back at that time. One last scenario that is plausible to many is perhaps you have margin selling, which is liquidating people and the first thing that goes is their highly leveraged futures contracts.

In the CURRENT scenario, you have bullion banks NET LONG on the COT, so in THIS CASE, it’s not likely they are “pushing down” price as it appears they are net long 80m oz or so on paper.

So clearly, there must be a GLUT of silver?

You then look at the REGISTERED for COMEX and see about 43m oz. Looks like a LOT! You then realize we use about 1b oz per year, and with this, that comes out to about 83.3m per month. Meaning, if the big boys started to run out at their wholesalers, you would have about TWO WEEKS of supply on the COMEX sitting there.

But some like to point out the ELIGIBLE has 315m oz! Yes. It is sitting in a vault, and ELIGIBLE. It does NOT have to move to REGISTERED to be sold. People want to pound the table about the eligible. But you have to look at it like this – you go into a CVS to buy diapers. They have 2 boxes on the shelf. They may have more back in the room, or more coming on a truck in a few hours. In the case of CVS, it’s just a shelf-stocking situation, where the price of what is on the shelves is the same as what is in the back room, but it’s just not displayed. In the case of the eligible silver, it is NOT FOR SALE. It CAN be for sale, at the right price, but it is NOT AVAILABLE. It’s like trying to count my Eagles in my possession as SUPPLY. It EXISTS, but it is not AVAILABLE SUPPLY.

And this is what some futures people have a tough time wrapping their noodle around. Let’s just say for argument’s sake that the 315m oz there are owned by Warren Buffet, Elon Musk, and Eric Sprott. Each owns 105m oz. They bought because they love silver and see a time a decade from now it might be $500 per ounce. They are like bitcoin HODLers that are shoving this silver up their ass for a decade. I’m exaggerating my point of course, but the idea is this is in the vaults, but these guys aren’t selling at $20 or $50. They COULD. But they AREN’T.

This is the difference between registered and eligible. I hate to fight people on this nuance, but items in YOUR possession in a vault run by someone else is YOUR silver. It is NOT on the showroom floor.

This is an important distinction that must be made above. Many think, “oh, if silver goes up $5 it will shake all of that loose”. Yeah, no. While it is true you may see metals going from registered to eligible, you can imagine Buffet seeing $17.95 silver and buying a million more oz, then removing it from registered into his own little corner of the vault.

But surely that means the LBMA vaults are stacked, right?

This includes SLV. Consider for a moment that you might be Samsung and want access to 1 million ounces. Perhaps you have a bank like JPM who buys you shares in SLV. At any time, you can withdraw this silver. Perhaps this is SLV shrinking from those not trusting SLV to then perhaps buy PSLV?

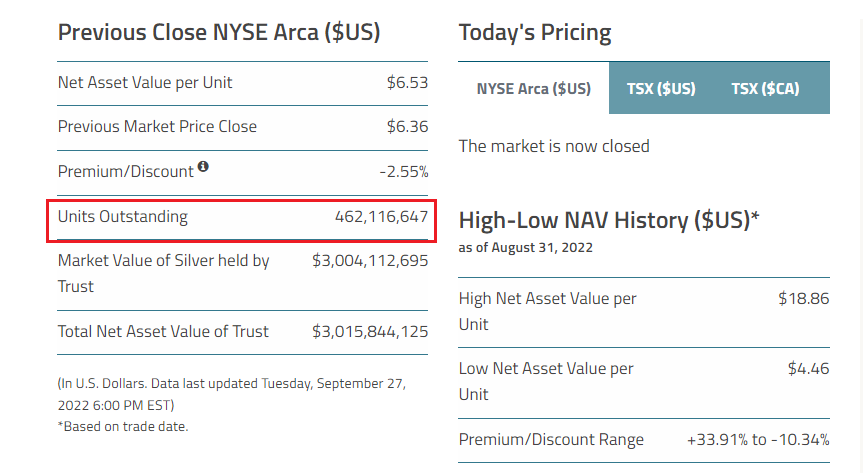

This shows PSLV with 163.4m oz. You can see the inventory a year ago below.

This shows about 145m oz. So while the LBMA has gone down 275m oz or so, PSLV seemed to gain 18m oz. That is 257m oz from ETFs gone, and you can see with the eligible above we were at 400m in the COMEX down to 315m oz in the last 18 months. There’s another 85m gone from the vaults.

This article here also is looking into what I’m looking into here. Vault stocks are plummeting.

Where is it going? It is being consumed by industry? It sure as hell doesn’t look like it’s making its way to mints to then make it into bullion – given the stupid high premiums out there.

Conclusion

I have written countless articles on silver demand – solar panels, EVs, ICE, and investment. You would think with silver prices falling from $30 to hit $17, about a 43% haircut – you would envision the EXACT REVERSE scenario as above. You’d think that all kinds of people were selling, flooding the registered with silver. You’d think that the LBMA vaults would have supply everywhere. You would envision a supply/demand scenario where more supply is coming in than demand, and stockpiles would be overfilling – which would indicate owners would have to discount prices to move it.

But like I said, the EXACT OPPOSITE is occurring. This is a situation where price is falling AS SUPPLIES ARE GETTING RANSACKED. I ask you to point me to what economics classes you took that explain this? Because I’ve taken all of them, and none support this behavior.

While my friends like to make fun of me because they see the $17 handle or $18 handle, or whatever, I just smile, and realize it’s like when you were watching Billy Madison – and Billy just said one of the dumbest things ever…you look at them like…

You have to take it, because they are correct. The price of silver is $17 something as of this writing. But you cannot help to look at them like a muppet of the system we are in. No one has understanding below skin deep. It’s all topical. It’s all algo-driven. It’s all momentum chasing. I can quote the fundamentals to you all day long, but if billion dollar hedge funds program algos to go left when fundamentals say they should go right, left wins. The big deal about the silver industry is how tiny it is compared to many other industries. I believe today, Apple with their spare cash can buy all known available silver on the planet up (in bullion/bar form, not knives and tea sets) 2 times over. If you throw in all of the tea sets, silverware sets, stretchy pants, and circuit boards in dumps – you are looking at 60b oz known to have been mined all time. At $18 per ounce, that’s about $1T in cash. While no company has that sitting on their balance sheet, this number is something to consider. It’s a tiny market compared to many others – and the paper market is easy to direct price.

When you see the $17 number, find ways to get greedy. I will be dollar cost averaging silver miners as they get ground into dust. I have what I need with physical – but I will be wanting to add perhaps to PSLV, Kinesis KAG, etc. I owed uncle Sam a healthy chunk of change this year on an extension, while my rehab costs on the one rental spiraled out of control, so I haven’t bought shit in 6 months. At these prices now, I’m about to buy shit all the way down, like I did in march 2020 and made a killing on the reflation.

My greed targets here, IF I were cashed up. I’m going low risk to high risk.

- Physical silver. I have what I need, but look for deals on junk silver. At the silver price now, I was buying at this price in 2019 at 11 and 12x. Meaning – a $5 roll of silver dimes was costing me $55-60. 10 oz bars are also good. The premiums are too high on any sovereign right now. I like the idea of buying 100 oz bars from the guys cutting up the 1,000 oz bars, but you have to have SOME concern on resale down the road and forgeries. It’s about managing risk – you may get it DIRECT from legit people. But re-sale 15 years down the road they may not take it.

- PSLV – to me, this is the lowest risk of the ETFs.

- Large and mid-tier gold miners that produce a lot of silver as a byproduct. This is NEM (54m oz silver??), FSM, AG, PAAS.

- Kinesis KAG – risk involved with platform and geopolitics with forms of crypto. Hard to get money there unless you use crypto as intermediary.

- Vaulted silver – I don’t like not having immediate access to my silver. I don’t like the idea of gov’t entities perhaps seizing contents of a vault – they can do this if they suspect money laundering. Meanwhile, 99% of customers are legit, and the 1% that did something wrong gets ALL the contents seized. Kinesis allows me to spend my silver, if I need it. I can also take possession of it from any of 9 vaults worldwide.

- Large silver “primary” miners – companies like Endeavor and Aya. I don’t know Aya’s silver percent, but I like them a lot. Endeavor has a higher cost of mining silver. If silver tanks further, these companies are in danger.

- “Silver” companies like Hecla. These are thought of as silver companies, but now may produce lead/zinc as primary and silver is a large byproduct. They are all running into lower silver prices and rising costs. There is danger here of losing money.

- Silver near term producers – everyone likes MAG and Silvercrest. They are set to produce soon, and if I recall, MAG had really low AISC for the mine operations.

- Base metal companies that have a silver byproduct – issue here is deep recession/depression which can tank base metals companies.

- Foreign companies with great risk to capital – like a Chinese silver miner. Still, it’s a low cost producer.

- Viable silver companies looking to get built – think Discovery Silver who needs $20 silver to be “a home run”. 600m oz ready to be mined, but needs permitting, capital, and a construction decision.

- Viable but risky silver projects – think Bear Creek here. 500+ million oz, but in Peru and it may be a higher cost producer that needs an awful lot of capex to be built. At $30 silver, you are printing money with this company. But…at $17 silver, it looks like it will never be built. Risky. But if we move to silver at $50 and has a floor here for decades, this investment today could easily be a 10-20-50x.

- Drill stories and interesting projects – I love my junior shit stocks. LOVE them. But they are VERY speculative, and with this, I tread carefully. You MUST understand the Lassonde Curve to play in this arena. IF you do not know what this is, you have no business investing in the last 3 items here. For example, I love Black Rock, Vizsla, Silver One, GR silver, and many others like them – some of these have more defined resources than others, and are at different points on the curve, but my point is that these are HIGH RISK – especially if we have to endure YEARS of this pullback. Many of these can become insolvent and go to zero. In this case, find those who cashed up last year, are miserly with cash burn rate, and have experienced teams running the show.

Leave a comment