I tell the story often of when I was 23 and an IT tech at the Vanguard Group of Mutual Funds, I had gone to a “principal’s” office (they are like section managers) and was there for about an hour reloading things. She was probably 40, and had a Wharton MBA hanging up on her wall. We got to talking a lot about investing, and that’s when she decided to tell me about risk and compounding interest.

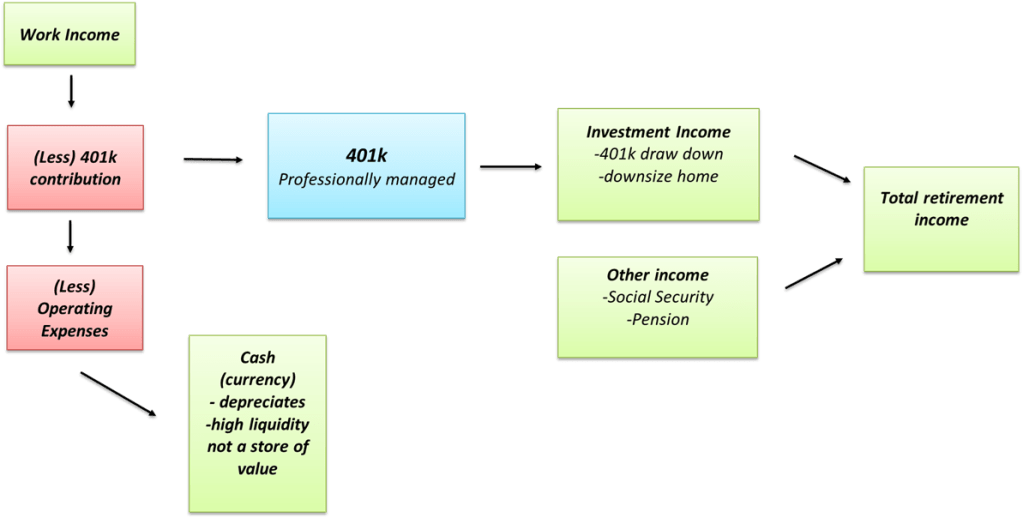

The general rule is that when you are younger, you should put a lot into your 401k and you can have a risky portfolio. As you get older, the principal compounds on top of each other and it explodes in value. When you are in the back 9 of your life, it’s when you draw down the risks, and then you want to preserve what you have. Maybe low risk bonds or the like to give you interest to live off of and not touch the principal.

How this looks? I’m going to use years to make it easier, but this won’t be entirely accurate. It’s to give you an idea. In an earlier lesson, we discussed investing your $400k inheritance into the stock market and commuting to a state school is about 4x better for your life than if you took that $400k and spent it on a useless degree at an Ivy League school.

So let’s revisit this. Let’s assume each year I will start with $10,000 a year, but I will also increase my contributions by 3% a year. The “standard” return for equities over the last so many years is 8%. This might be 5% or 6% – or even 12% in some years. But, 8% is a pretty decent number to start at.

What this shows is that if you put that money in every year – over 43 years you put in $854,000 however – your 401k balance is actually $7.7 million. Some of my friends were extremely aggressive 30 years ago with putting a ton into their 401k. They live with their parents, saved up, and put massive amounts into their 401k. On the flip side, I did have a 401k, but lost my job in the dot com crash and was out of work for 15 months. Had to get cashed out of that. Then, I was so broke and behind, it took me awhile to recover. When I finally started getting a little into my new 401k, I switched jobs – and I had no idea how to rollover stuff. Cashed out. Then two jobs in 2009 I lost due to the GFC – and I was buried upside down on my home I bought at the top. Suffice it to say, I do not have a 401k – but invest in houses, PMs, and equities.

This illustrates how people – in theory – should save for their retirement. I would posit that if they have $x or an amount drawn that is 30% more than what their top SS paychecks would be, that they need to draw down their 401k to nothing before they are eligible for social security. In this example, if I had $7.7 million in my 401k and retired at 63 or so, I have zero need for Social Security. I believe Social Security will never go bankrupt, but I feel my generation is SUPPOSED to have 401ks and strong wealth built – so then SS is not an “entitlement” but it acts as a social net. Imagine you spent your whole life as a waitress or construction and have been paycheck to paycheck most of your life. Imagine you fell off a roof working when you were 32 and became disabled to work. This is what Social Security is meant for.

Anyway – I don’ want to fight people over this, just mention that I believe SS will be around for many years to come. You also have a lot of boomers dying before their parents. My father died of cancer before both of his parents, and my mother died within 2 years of both of her parents – so many boomers may never draw on Social Security, despite putting into it.

To buy, or not to buy, that is the question?

In the last lesson, we did ROI. But I slid a concept in there that was part of this series. I believe strongly in buying things with profits from investments.

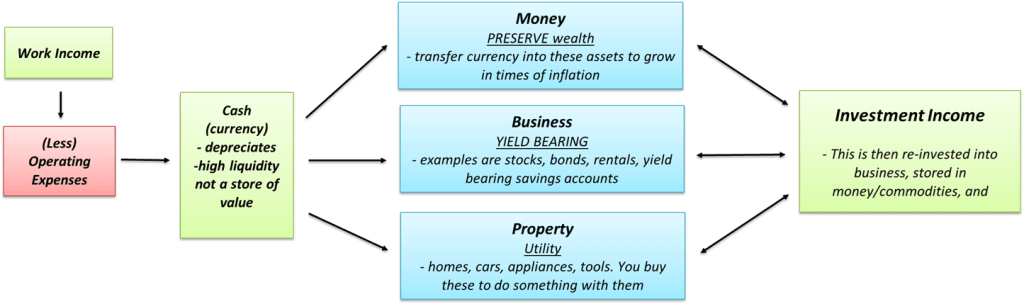

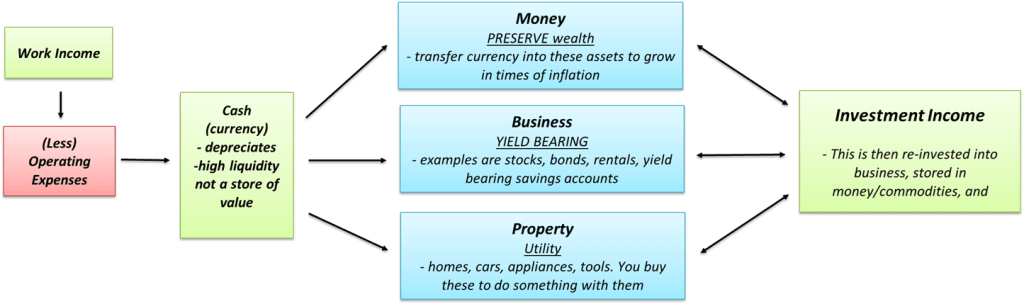

I’m going to blow your mind here a bit with the chart above. This is MY chart. This is original work. Let me show you what they have not taught anyone, ever, anywhere in business. IF you follow this, you will prosper.

I am 49, so I think about retirement now. I got all the toys and houses, and now it’s about trying to retire at some point.

What do you NEED for retirement? Well, in theory, you need to have more income than your expenses – without having a job. If you can replace your work income with your investment income, and you can live comfortably off of that, why work? I heard something when I was younger – we work to live, we don’t live to work.

I have been obsessed with trying to find some sort of model. I believe this is the path most Americans are on.

In this model, you have some flaws:

- Purchases are made from work income. You then tend to borrow money for things and run up debt. This increases the Operating Expenses and reduces your free cash each month.

- This is highly dependent on your 401k not getting crushed in a Depression level event.

- Social Security may not be there for me in 18 years

- Pensions may go bust. “But they are legally….” blah blah blah. They are broke. The only way they do not go bust is government printing – which will significantly reduce the purchasing power of the cash you get. For example, they may promise you $3000 a month, but government could hyper inflate the currency to the point where $3000 gets you a cart of groceries

In this model – it is damn near impossible for you today to save and invest – because there are always wants and needs and toys and fun. This starts adding to your operating costs, and this leaves nothing for investments. So instead of being able to buy things from your investments, you are constantly needing more and more income to sustain all of the debt you take on. It’s not a good look.

So let’s get back to MY model

With this model, you may buy and sell items to get back into cash, then move that cash to another asset class.

What happens when you plant a ton of apple trees in an orchard on your proprty? You may have an upfront cost, maybe you take on debt? Maybe you use a home equity loan for $20,000?

You buy the seeds, rent the equipment, and plant. It takes “sweat equity” of you doing the work. You then have to water them and care for them. Is the soil the right acidity? Do you need fertilizer? What about protecting them from deer? Should you put up protective fencing?

Then, in several years, you get thousands of pounds of apples. Maybe this is $20,000 in apples every single year? With ROI, you saw that taking out money could give you a nice upside. But what do you DO with the $20,000 each year?

Well, people tell you to DIVERSIFY. This is why I outlined the 4 unique ways you can store your “financial energy”. It can be stored as cash, money, yield bearing assets, or purchase of property.

What if we decide that we want to take that $20,000 and plant more? Now we have $40,000 in, and every single year we get $40,000 out? What if we take that $40,000 and then buy more land? The next year, plant more. You are then at $80,000 a year in apples?

Well, if you were making $80,000 a year working full time, and you now have $80,000 coming in, do you retire immediately? No. You have to look at your operating expenses. Maybe you assume you owe $240k in your home loan. Over the next 3 years, you use your Apple money to pay your house off.

Now you are making $160k per year. Your expenses are now next to nothing. Your wife has been asking about a pool. OK – maybe you take $80k from the next year and buy a pool. Maybe the next year, you and your wife get 3 year old used cars for $40k and the other $40k is going into renovating the house and fixing up the roof before retirement. Maybe you then take all of that money for 3 more years and put it in the stock market, buy a rental unit, and buy gold – and stock up guns, ammo, and years of food. Maybe you buy solar to eliminate energy bills?

Point is – if you just lived off of that $80k, in 10 years, you would not be any better off. In fact, your expenses may have gone up a lot because your wife demanded a pool. You didn’t have the cash, so you borrowed money. This increased your monthly operating expenses.

So the earlier you start planting seeds, the sooner you can retire. When possible, pay cash – but do so from a portion of the investment yields.

In scenario 1 where the guy is making $80k a year – at the end of 10 years, he still has $150k remaining in house debt. But he also still has $50k left on a pool at 15%. They also bought new cars. He has virtually no money free every month and at the end of those 10 years, his net worth is horrible and he has no possible means of retiring on investment income.

In scenario 2, he planned retirement 10-12 years out to be debt free, have virtually no operating costs, they have paid off vehicles, a new pool paid off, and $80,000 a year from the apple trees and $10,000 from a rental unit – with maybe $300k in stocks/bonds/gold/rentals. At this point, he can retire on the income that his investments created.

Real world example:

In the previous writing, I discussed a bit about my home life. The other half was looking for a pool, Trex deck, and roof over the deck, perhaps with a nice outdoor kitchen. I don’t have $200k in cash. What I did have was $80k in stocks. I sold them when I started to get skittish about the markets, and rotated this into the second home.

I had a choice…

- Take what liquidity I had and put it as a down payment for all of the bells and whistles. I’d probably be loaning $150k for 20 years at 15%. That is no joke. The 15% essentially turns that $150k cost into a $300k cost with all of the interest paid

- Take the liquidity I had, pay off high interest debt used to acquire a “business” asset that is revenue generating.

In the previous writing, I essentially mentioned how option 1 is something like -500% ROI over 30 years, where the second home will yield 14% average annually over 30 years for a 300% ROI.

What this means, essentially, is that maybe 7 years down the road, I can use cash from the rentals to buy the back yard items. While I may not really WANT to do that – the point is that I would be able to use investments to pay CASH for it, rather than taking on debt.

Your friends are lying to you

I did not grow up rich. Some of my friends did. They had their college paid for, I had to get scholarships just to go. They got to live with their parents and save up for a home, I was thrown out of the nest. They get nice inheritances from relatives and pay off their home and buy luxury items and go on fancy cruises.

You see this, and you think YOU deserve that lifestyle. You think, “everyone is doing it, so I must as well”. You don’t know their financial situation. Between my wife and I, we make probably more than 99% of all of our friends and family. And many of those people are living the high life. Lavish vacations, $100k cars. You name it. They either:

- Got money from inheritance

- Won the lottery

- Make a lot more than you think they do (they don’t)

- Live life on credit cards and loans

- Got lucky on an investment that went 20x and they sold it to pay off all debt

- Sell drugs or do OF.

There’s not really any other way. But you – YOU want to figure out how to deal with your money, so you need to plant seeds if you want to retire on passive income.

What kinds of seeds to plant?

The issue you run into is that unless you are really paying attention to everything, by the time you hear about something, the move is over. Now, this frenzy you want to get into – is a crowded market. It’s called a “saturated market”.

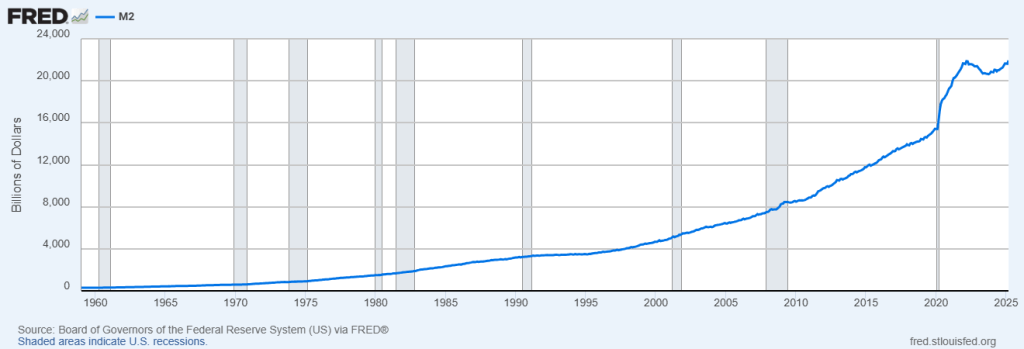

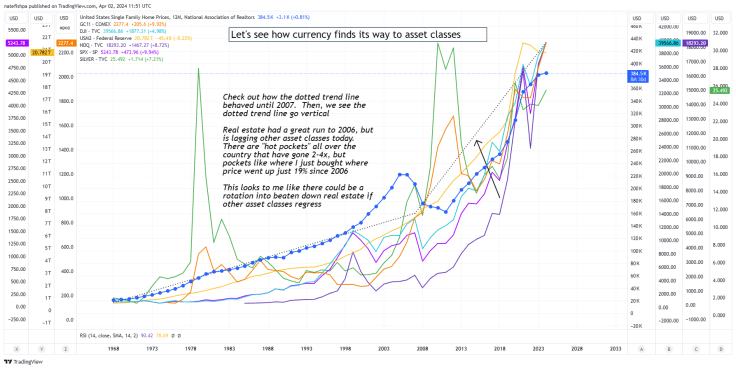

Asset classes have business cycles. “Stonks only go up bro” isn’t real life. All of these asset classes have been going up because we have borrowed more and more money into existence with cheap rates. This has ballooned all asset classes up.

This is the M2 money stock. All currency is “borrowed” into existence.

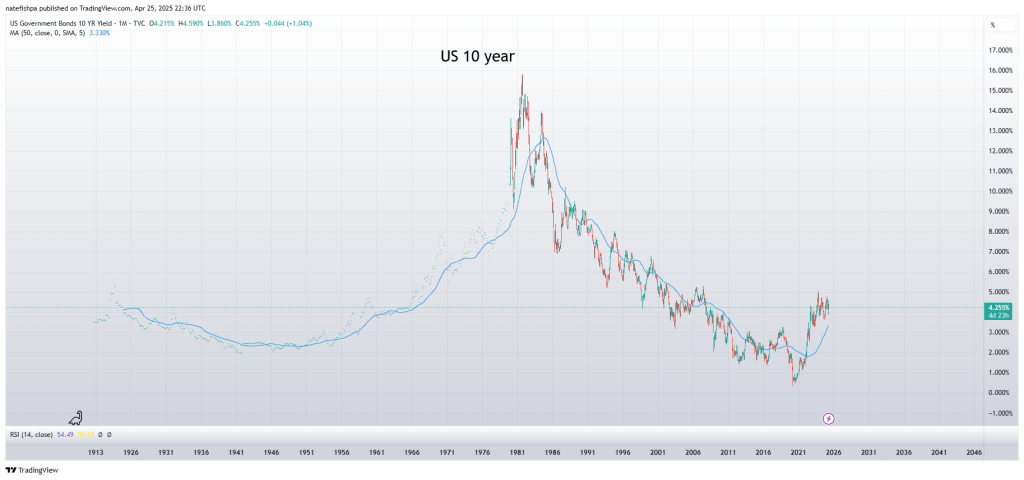

It’s borrowed using interest. Let’s take a look at the 10 yr note over the last 60 years or so

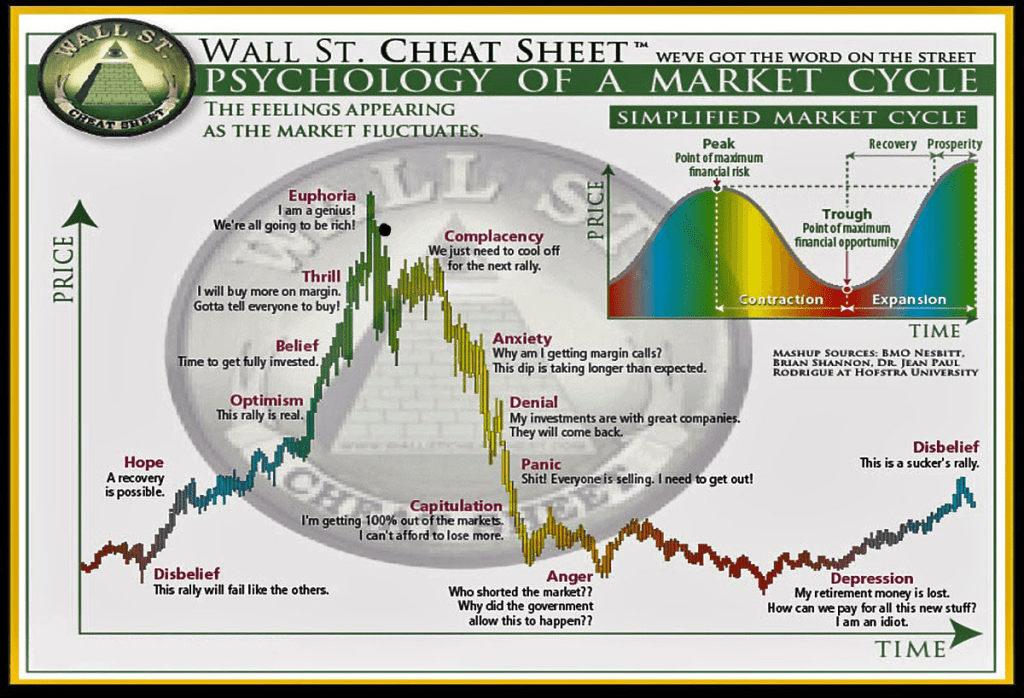

Do you think it looks a little like this?

What you saw is like a 40 year drop in the 10 yr. With this, you then have mortgages with lower rates. Corporate bonds with lower rates.

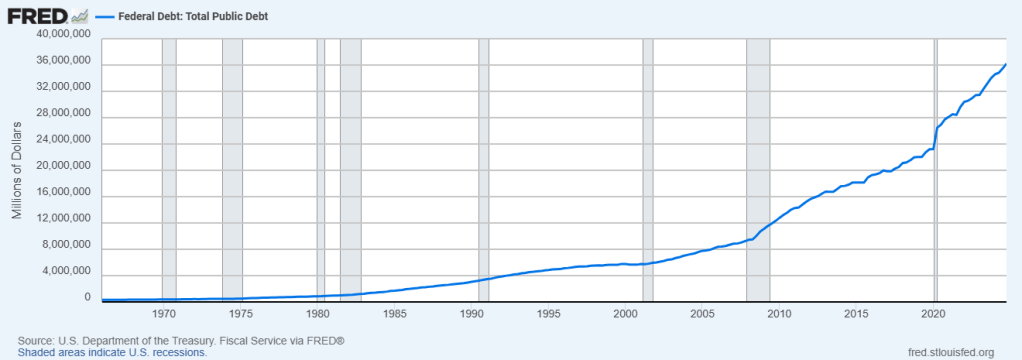

What this means is – you have cheaper and cheaper credit. And – so does the US treasury. Let’s take a look at our debt.

Let’s understand what we are seeing…

As interest rates went lower and lower, more and more money was borrowed into existence. Not only by the Federal government, but by private citizens. Remember, fractional reserve banking doesn’t need them to have the cash. They “blip” it into existence. And it is destroyed when it is paid off.

As you have more and more and more money in the system, it increases inflation. What this means is that there’s more and more money out there to bid things higher. This is why 24 year olds are looking at $80k cars and $700k houses and are making $60k and are hopelessly lost. The solution is NOT to give them money, from the government.

The solution to tons of liquidity with cheap debt – is to increase rates.

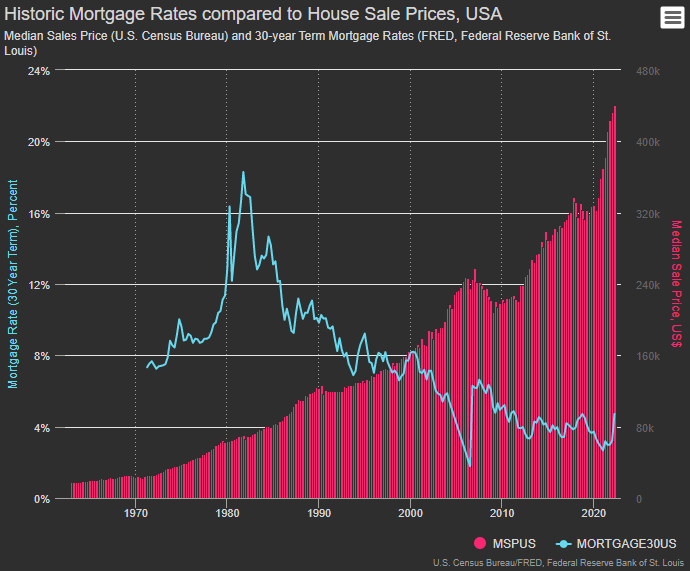

When we went off of the gold standard in 1971, inflation went rampant. This is what took mortgage rates to 20%. Higher rates freezes the housing market – which we are seeing now.

What may really bake your noodle is this. Your home is not appreciating. At all. The value of the currency you hold is getting weaker because the purchasing power is being diluted by all of the currency created.

Question. IF we have massive currency dilution, and rates may continue higher to stop people spending so much on credit, would it not make sense that we can see home prices come down? Yes.

If people are losing their jobs, aren’t you worried about them having to sell homes? Yes. If people stop traveling, will all of these AirBnBs not rented get sold? Yes.

But this isn’t unique to homes. It’s in all asset classes. This chart is maybe from a year ago, and you can see it is a race to find the best place to put cash before it devalues to nothing.

If massive amount of people are borrowing cheap, and seeing blown up assets – AND higher rates will be here for longer, that is the opposite of inflation. It is DEFLATION.

And like I mentioned earlier, if you want to take advantage of inflation by borrowing cheap to get assets, it then stands to reason if you see DEFLATION coming, you sell over-priced assets to hold cash, because the CASH will actually become quite scarce in a deflation. No one is working, so people need to sell whatever they have for cash, and since everyone is broke, maybe you bought a treadmill for $2000 and now you have to sell it for $35 to buy food for your family this week.

So the first factor – “do we see inflation or deflation ahead”? This is a lot more complicated than it sounds.

But next, you need to know WHY you invest in these asset classes. What are the properties of them?

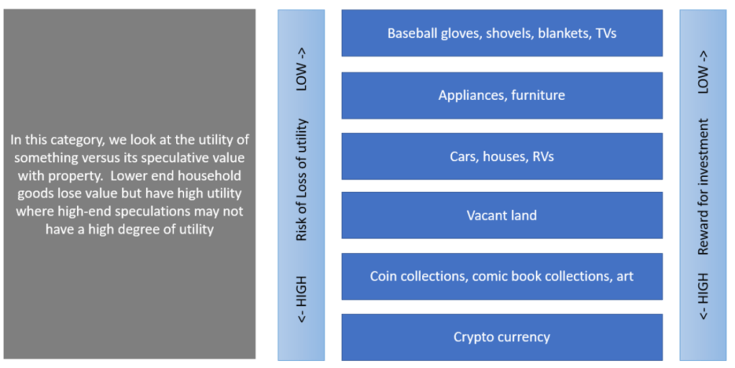

Let’s look at property first. You have things at the top like a baseball glove, tools, clothing – you buy these for the NEED. But when you buy a $200 baseball glove, and it is beaten up for a season, you might be lucky to sell it for $20 on Facebook market place. So the items towards the top have much more practical usage than towards the bottom. As you go down this, it’s less utility and more speculative. for example, buying art is somewhat of an illiquid market with relatively few buyers. You buy a painting for $20,000 and maybe are hoping for it to be worth $1 million someday.

Remember in my list of priorities, speculative purchases should be LAST. It’s less critical if you are 24 to buy speculative assets than 64. The younger you are, the more aggressive you can afford to be.

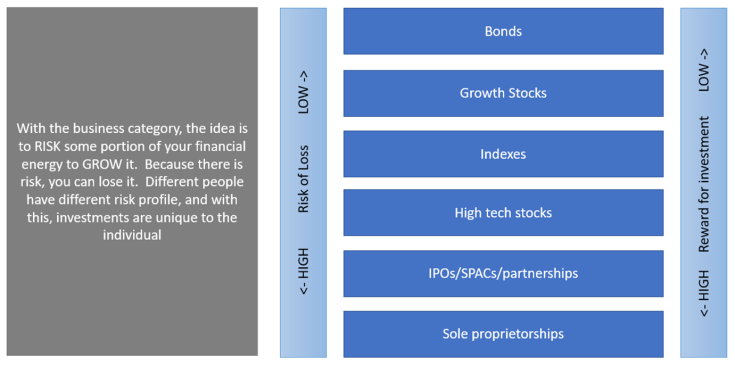

With the business asset class, you can see that at the top of this, there’s less risk – but the reward is lower. As you go down this, the type of investment has higher yield, but is much more risky. Again – when you are 24, the type of cash you put into this class is different than if you are 44 or 64. Perhaps the 64-year old is putting all of his cash in bonds at 3-4%.

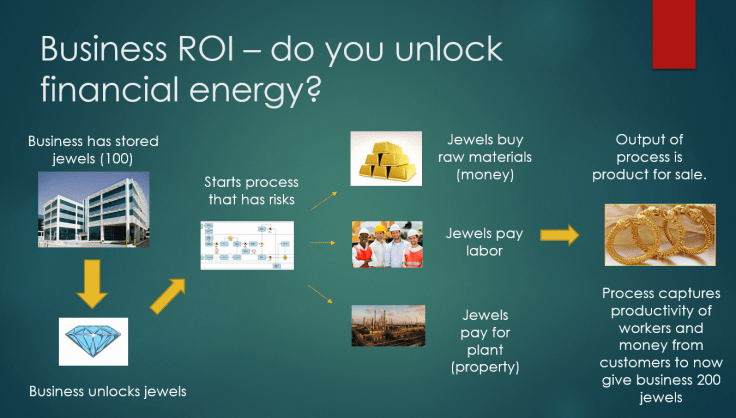

Let’s say you have a “sole proprietorship”. That is, you open up a widget store and you have 100 “jewels” of financial energy to start. Something like 90% of these businesses fail within 5 years, mostly because they use a lot of leverage and they may not be strong with marketing.

In the below example, I show you how you take this “financial energy” and you then buy raw materials, hire labor, and create business processes. This harmony then yields PROFIT. If you make the best widgets in the world, maybe you have a higher margin than competitors. But – business has cycles. And this is why Blockbuster Video doesn’t exist today. Companies that are outdated and cannot adapt either get crushed in competition for reducing prices to keep market share, or tech moves on and people stop buying their products overnight. Luckily, in a lesson down the road, I will talk about ratios and how to look at a company from a high level. I’m not a Wall Street guru, but I can point you to the very basics.

Lastly, we have money…

What is money? You think it is this…

This is currency. They USED to look like this:

That is, a $20 bill would get you 1 oz of gold at the bank 100 years ago. Gold was money. Paper was the RECEIPT for the currency. Basically – all hell broke loose with currency in the 1970s because the peg to gold ended. But – all of this cash then got borrowed into existence – and cash then sloshed around all of these different asset classes.

So – gold is money. Or, it was. And so was silver. These are monetary precious metals. But silver is also used for 1000 products and is the best conductor in the world. Gold doesn’t oxidize, which is why this is the best LONG-TERM store of money.

I made a theory like 5 years ago – that all of these things like silver, gold, copper, lumber, cattle – all of it – is money. Gold is the form of money that is the best LONG TERM STORE of wealth. But gold has had a relationship to all commodities for thousands of years. So as gold goes – so do they. Kind of. Sort of.

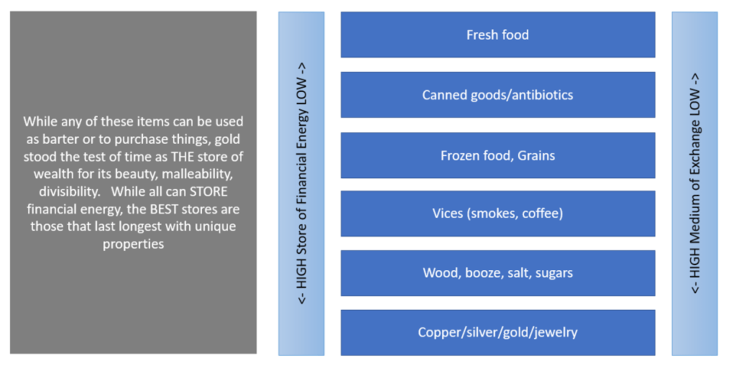

You can simply say “commodities” here, but I increased my definition here for “barter items”. Why? I’m a prepper. I know you cannot eat gold. But if I’m producing 100 eggs per day, and my family is eating 20 of them, if I can take forms of payment in things I need like medicine, cool. But when you are all stocked up – maybe you then prefer gold/silver/etc as payment so you can store this financial energy until the next currency system is stood up.

With this, I have items at the top that would spoil or rot the quickest – and I put that as perhaps the best MEDIUM of exchange. You need a fence done, and need someone to fix it. You can pay me in food. I accept. Much of the items near the top are daily items. Preppers like me have tons of stores of all of this. This is part of my preparation – I put financial energy from INVESTMENTS into MONEY (and barter/food). for example, my second home also has 8 acres of woods – so I can also make lumber and firewood. I have chicken coops there and I can raise chickens. So I have already planned for how I can live in a bad situation. It may not be ideal, but I’d rather be the guy that has excess that I can sell for something rather than be the guy that has nothing and is trying to feed his family.

So in this category – you have the PMs at the bottom with things like jewelry as well. GOLD DOES NOT YIELD. It is a LONG TERM store of wealth, and essentially, it soaks up cash from lots of inflation. So a savings account may get you 2%, but gold’s value is the asset appreciation from the devaluing of the currency.

In this example – maybe you had $200 in the year 2000 and bought an ounce of gold. Your brother held the $200 cash in a low interest savings account. 25 years later, his savings account might have $350 in, but gold is now $3300 – it went up 15x. Will it continue to go up? Maybe – if we keep making more and more and more money with low rates. But – if rates are climbing higher, and you bought gold at $200 and sold at $3300 – you made a great trade. You anticipate a form of deflation is going to happen. Your favorite company stock fell by 80%. You buy. A house in the neighborhood was bought for $700,000 4 years ago, and now they can’t find a buyer at $300,000. You run the numbers and decide you want to buy it cheap as a rental. You have 14% ROI planned, when everyone else is seeing their 401ks draw down, their precious metals lose value, and homes cratering in pumped up markets. Gold should fare much better during a deflation than other assets. Things like bitcoin may be the first to be sold to dust in an inflation. Who knows.

Conclusion

Anyway – in this lesson, I wanted to point out the importance of planting seeds young – and to use the seeds from the apples that fell to grow your investments. Eventually, you can potentially borrow against your orchard for cheap with a large downpayment on a reasonably priced home and have $1500 a month mortgage. Rather than a $5000 a month mortgage. Stop taking out high interest credit, unless absolutely necessary and ONLY if it is a short payback period so you do not get killed in carrying costs.

We reviewed what types of seeds you should plant, in what orchard, depending on what time it is in your life and your risk appetite. You learned how things don’t really “appreciate” but rather the value of the currency has been diluted.

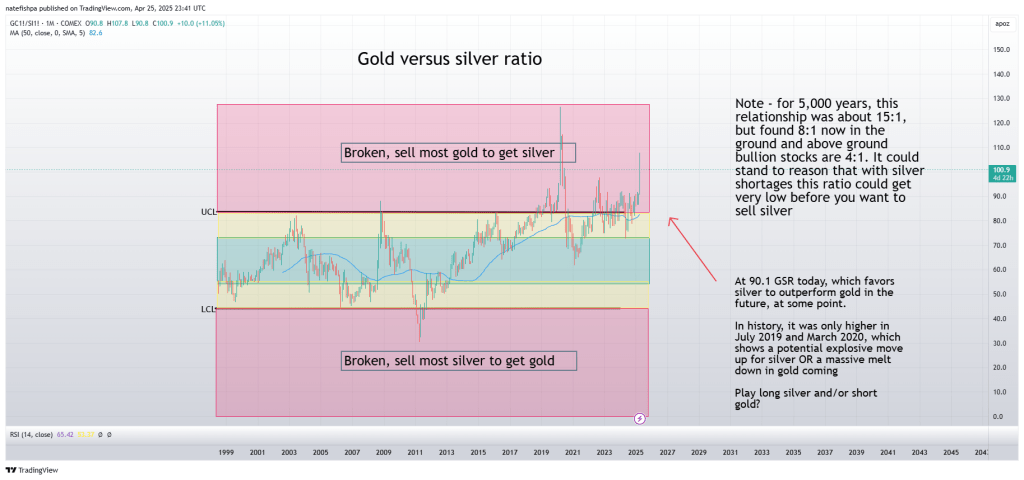

At some point – I don’t remember which lesson, but we will look closely at ratios. For example, the historic price ratio of gold to silver is 16:1. Today, silver is found in the ground at only 8:1. But the current gold to silver ratio is 107:1.

Now, if you had $100k in the bank and wanted to put SOME of that cash into precious metals to hedge against inflation, you then look to perhaps which precious metal might be undervalued to another. In the below, I used the charts to then sort of super impose a “statistical process control” upper and lower control limits here to more or less signal when you might sell gold to buy silver, or sell silver to buy gold, or buy evenly, etc. So maybe you see this chart and are like “dude, gold hit $3500. Silver moves after gold. Maybe silver could hit $70 an ounce, and it still would only be a 50:1 GSR.

So look for the ratios to then even diversify within the asset class you are investing in. You should be always on the lookout to avoid over priced assets (relative to other things) and lean into things that are under valued. Sometimes, things are under valued because the business ran to shit – so it’s not an automatic buy. But the pros have algos and bots that are alerting them to these things all the time – and they have tons of auto buys and sells set up when they see flashing lights. They aren’t gods. They are just good at understanding relative value of things. I say relative, because inflation makes the nominal value of dollars go up – but you have to understand prices relative to each other because if you just look at the nominal value, you are missing the affect inflation had on that number. When you compare assets with ratios – they are both affected by inflation – but perhaps one is “under valued” as the inflation cash didn’t make its way to silver yet.

Leave a comment