Over the last 6 years as part of “FinTwit” I have been asked many times “how can I make money”. I got this question recently, and figured this can be a good series to start where I can share some of my opinions.

Many just want a quick stock tip where they put in $1000 and get $50,000 out of it. These types of trades are rare, and anyone who has been around for a long time knows that long term investment, with compounding interest – may be the best overall approach.

But where do you start? How do you even get money to invest? Are stocks only for rich people? How do I buy gold? Is now a good time to buy a home? How do I buy one?

So many people could start reading this with $8 in their bank account and want to become more financially literate. I’m not a multimillionaire like many of the people who are the “financial gurus” out there, but I did come from nothing and made my way up to a C suite position after busting my ass for 30 years, real estate side businesses, and commodities/equity investments. At some point when I retire, the investments I have now will put me in the millionaire category, but for now it’s about working the process. About once every 6 months I line up the numbers and calculate an estimated net worth and measure how my investments are going. I am a late bloomer to this. While I have been an IT nerd, I finally finished my MBA in 2016. I lost everything in the dotcom bust, and I was negative net worth when I lost my job twice in 2009 with the global financial crisis. Because of what you see below, hard work, educating myself, and getting a little lucky, my net worth is now substantial. You won’t ever see me standing in front of a jet selling a program. I don’t do that. I enjoy sharing my knowledge, and people that know me know I prefer to dress like a homeless guy and disappear into the crowd. I will never buy or wear a Rolex. I have no desire to “flash” wealth. I talk about some investments below – not as a brag, but as part of the plan.

So with this series, I’m going to write a ton, but chop these up into more digestible articles that people can read in 10 minutes and learn something from. I had put something out on Twitter a few weeks ago that I will be creating a video series on this subject. So I think I’m going to write these up and then when they are complete – start a video series with my fun charts, graphs, and flows. I’m going to try and break this up into small lessons and see how it goes.

Lesson 1: set goals

If you are 55 and have $100 to your name and you want to retire next year with $20 million, it’s not really a realistic goal. If you are 23 and have an engineering degree and a nice salary and want to retire at 58 as a multimillionaire, that is doable.

What you need to understand here is that higher returns means higher risk. Lower returns are safer, and thus you are rewarded with less yield. When I worked at Vanguard, a principal there sat me down in her office and talked about how the different products they had worked. Typically, when you are closer to retirement, you de-risk what you have by putting a lot into bonds. When you are much younger, you can be more aggressive and buy things like doggy coin – because if you fail, you have another 40 years of earning. If you are 63 and cash out your 401k for bitcoin, that is a huge risk.

So your goals should be reasonable. But what should you set your goals at? $500k? $1m? $5m?

When I used to think about this stuff like 35 years ago, savings accounts were like 5% interest. The thinking was, you have $1m in cash, and then you have $50,000 a year in income from interest. After taxes, maybe $37,500. Can you live on $3200 a month?

If not, why not? Mortgage? Student loans? Credit card debt? kids college?

What I would do in my mind is to not look at the dollar amount I need in a piggy bank – what I care about is monthly income – and it could be from a lot of sources. Many feel that they will just hit 65 and retire and make bank on social security. Well – they may have to wait until 67 or 68 until they would get the “full retirement”. And – maybe they get $3500 a month but their monthly bills are $3800 a month. This isn’t good.

Maybe your goal isn’t retirement. Maybe it’s just to buy a home. Or an investment home. Or trade stocks. I want to cover a lot of this in the series – but there are key elements here I need to try and educate people on.

- Accounting equation – where to start?

- Debt reduction – probably needed for any plan

- Budgeting and prioritizing

- ROI calculations to buy things. Should I buy? Why not?

- Planting seeds now to harvest fruit later

- What exactly is money? How is it different from currency?

- Asset classes. What things can you put your currency into?

- Basic economics – crash course in high level

- Ratios, charts, metrics. Understand if something is a good buy or not?

- Future value of money (finance)

- How to understand the value of a stock or business

- How to buy investment properties and land

- How to buy gold/silver and commodities

- Understanding risk and how it affects your finances

- Understanding health and how it affects your finances

- The perils of starting a small business

- Classes you should take to learn more

So try to clearly define your goal, for you. Revisit this perhaps every month or two. Do your bills every month with Excel or the like and ensure you are hitting your short term goals.

Yes – you want short term goals, medium term goals, and long term goals. Examples:

- Do not buy any big purchases in the next 6 months on credit. Pay down $5k of credit in the next 4 months.

- Medium term – ensure I have 6 months of bills so if I lose my job, I can provide for my family during that down cycle.

- Long term – I want to buy a house and retire at 65 and be able to bring in about $8000 a month from various sources (401k, Social security, bonds, stocks, etc)

Lesson 2: Accounting equation

Today, right now, you are going to create a bench mark to start.

Assets = liabilities + owner’s equity.

Assume you have a house for $500k. The note on it is $300k. This means your equity in the house is $200k. Kind of simple, right?

Now let’s start to get your net worth.

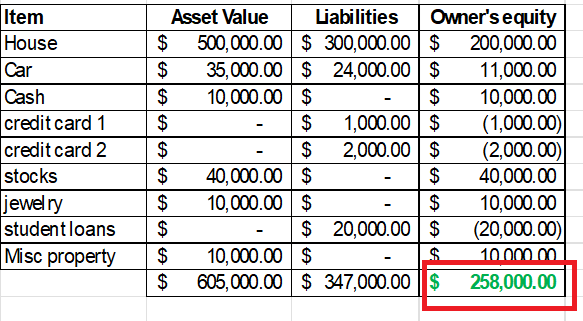

In column 1, tally up the values of assets. In column 2, tally up your liabilities. In column 3, subtract column 2 from 1. Then, auto sum the items:

All of this then gives you your net worth, highlighted in red. This is your starting point. Your situation could look like this…

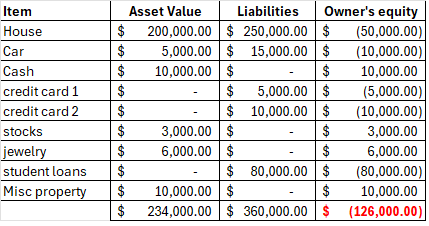

So if you are at negative, it’s not the end of the world. But you obviously want that to be green. In this example, you can see that the note on the house is more than the value of the home. This happened to me in 2008 after I bought a home in 2007. You should know that you cannot really sell your house if you owe more on it than it is worth. I ran into this in 2009 – during the global financial crisis when I lost a job twice in the same year. You have to get permission from the bank to “short sell” – which essentially puts a bankruptcy on your credit. At the time, I worked for the DoD and had top secret clearance, so if I declared a bankruptcy of sorts, it would have cost me my job. And – you are an insider risk threat if you have poor financials. So – this can also prevent you from getting decent paying work for maybe 5-7 years or more!! So – you have to understand that in today’s world, assets can inflate in market value one year, and the next year deflate.

So it’s also important to know when to buy assets, so you aren’t buying at the top like I did in 2007.

This is your starting point. You have to evaluate each and every item for how to attack it. The master game plan here first is to grow your assets and shrink your liabilities. Easy, right? Not so fast.

Assume your monthly income is $6000 take home. Assume your monthly bills are $5500. You are barely getting by. You need to reduce expenses and/or increase your income. I am someone who has hustled his whole life, and last year, I had 13 different streams of income. I only have one job. But for example – cutting my own lawn saved me $120 a month. Eating in and not going out saved me $300 a month. I have rental units that give me income. Solar credits. Learning skills so I could do a lot of my own contract work and avoid costs for a handy man. Selling energy back. Oil lease. Trading metals and stocks. Selling a property. All of this adds up.

Lesson 3: Debt reduction

Dave Ramsey talks about having no debt all the time. He’s like 70 and a millionaire many times over. Trying to tell a 23 year old to pay for a $500,000 house in cash is silly. His overarching point though is “debt is bad”. But, some debt is worse than others.

“Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants, and debt is the money of slaves”.

Back 70 years ago or so, we had a savings-based economy. People would save up for a car and get 5-7% interest in banks. Somewhere along the way maybe in the 1980s and 1990s, credit became much easier to get, and the savings-based economy turned into a debt-based economy.

Instead of saving up for a year to buy a car for $10,000, they just pay $1,000 and finance $9,000. Maybe it’s at 8%. Maybe over the course of 3 years, with interest, you paid $14,000 for a car that was $10,000 and since a car is a depreciating asset, that car may now be worth $7,000. Does it make a lot of financial sense to pay $14,000 for a $7,000 car? No. So Dave is right on some points.

But what about a home loan for $500,000 at 2.75% for 30 years? Assume stocks return 8% per year. If you had $500k in cash, you’d think to just buy the house cash. But if you invested that $500k in stocks for 30 years and had 8% return on that every year, you can see how it may be beneficial to invest that $500k in stocks and then take a 2.75% mortgage on the house. From the profits on your stocks, you pay the monthly note and have excess left over. This leftover can then pay your house down faster if you put the extra on the principle.

So a home loan at 2.75% is DIFFERENT than a credit card at 27%.

Risk on

Furthermore – you want to understand the markets. Are we in “risk on” times where stock market is in a bull run and going higher? Do we have high inflation expectations? Could assets explode higher? In a Risk ON market, consider a concept like this:

Buy a house for $400k with 3% down (FHA). That’s roughly $12,000 down plus some closing costs. You see this is in an up and coming market, and your buddy told you that next year they will be building an office complex right next to it – and the deal is being signed next week. He has no idea you are looking for a house there. You buy the house. You take out a Home Depot project loan for $15,000 at 12% to fix up the place.

Every month you own the home, you have CARRYING costs. You have your mortgage, taxes, etc. You used a Home Depot loan because you used all of your cash for downpayment.

Two years later, the value of the home is now at $600,000. You pay off your note for $385k (remaining) and the balance of your home Depot loan at $12000. Take off realtor fees and closing costs, and you have about $600k – $70k = $530k. Subtract the $12000 HD loan and you get $518k. Subtract the $385k note and you get $133k.

So you invested $12k and in 2 years that turned into $133k. Is that an 11x?

Kinda. You had to pay a mortgage for 2 years, but that was your living costs. So if you had that same payment and lived in an apartment, the person that owned a home just added $133k to their net worth when you accumulated nothing.

Risk off

If your home is worth $800,000 and you have a $400,000 loan, you see $400k in net worth on the house. Great! But what happens when there are mass layoffs and homes hit the market? One house in your development that needs to sell FAST may undercut the competition to sell first. This now provides a comp in your neighborhood. And, overnight, your house value could go to $600k.

Well, at the peak – you do not want to sell. And if you are hearing rumors there is a recession on the way, you want to have cash available to buy things cheap. So you want to get into cash – but not sell it?

Assume you have $50k in credit card debt. You have a pool loan for $80k at 15%. You have car loans at 8% and you owe $50k on your cars. You are worried that if you lose your job, how the hell are you going to make all of these monthly payments?

All of this stuff might cost you $5000 a month just to make monthly payments that might take you 20 years to pay most of it off. I’m wildly guessing here. Why not use home equity at 5% loan to consolidate debt? You then take a home equity loan for $180,000 on your $800,000 home. maybe it’s a “cash out refi” where you refinance your house from $400,000 note at 5% to a $580,000 note at 3%. You might have the same monthly mortgage payments – but now can pay off $180k in high interest debt.

So because you did a cash out refi (like a home equity loan if you refinance) – you can then free up $5000 a month you were paying in high interest credit.

If you want to, you can put that $5000 in the bank for a year and get $60k cash. If you keep your job, maybe you then apply the $5000 every month to your home’s loan. Instead of 30 years to pay off the note, maybe it’s paid off in 7 years.

So before, you were looking at maybe $9000 a month in bills. You made $11,000 a month. After your cash out refi, you have $4000 a month in your bills, and now you have $7,000 free each month instead of $2000.

So shuffling high interest debt to lower interest debt can massively help you free up space and breathing room.

In a “risk off” scenario, people should be wary of buying homes at or near record highs along with interest that is at 3 decade highs. This is what cools the housing market. Don’t be like Nate and buy at the peak of the housing bubble in 2007 at 7.5% interest.

Dollars

In an inflationary scenario, it makes sense to take out loans at 2.5-3% to get assets. Let inflation inflate them higher, and your excess cash you can deploy in other investments for an 8% return. When you feel your asset has inflated to the value you think is too high – sell or refinance here. Capture that equity somehow. So if you could buy a gold ounce today for $3300 at 1% interest over 10 years and sell next year for $6600 – it’s a good deal.

But the reverse is true. Taking a 7% loan out to buy a $3300 ounce of gold which then has gold drop to $1600 next year means this cost you a lot of net worth and the monthly nut is going to kill you.

Therefore – in a “risk on scenario”, it is my opinion that if you can get favorable debt to acquire assets, I’d do it. If I saw a big freeze coming – I’d get out of assets and into cash so I can buy things I like, like gold, at the 50% discount window.

When everyone is scared, buy. When everyone is exuberant, sell. No one will ever call exact tops or bottoms, but following world events, economics, and understanding what’s going on around us can help you make an informed decision.

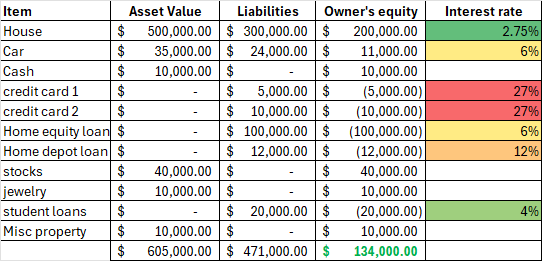

So in the example above – assume I want to consolidate debt at 5%? This will tell me that I’m looking at the reds first, then the orange, then the yellow – and last to pay off is the green.

Start small if you have to. Maybe your credit cards cost you $1200 a month just to make minimum payments. Borrow $15,000 at a low interest rate (if you can) at maybe 5% over 3 years. Pay off the cards. You have perhaps $700 a month for that loan for three years. This frees up $500 but in 3 years that debt is gone. Maybe at the same time, your car is paid off. You then free up another $500.

So at the end of those three years, you are now $1700 per month better off. Maybe now you go after the balance of the Home depot loan costing you $300 a month and that is paid off in 7 months. Now you have $2000 more a month. Now we have $80k left on a home equity loan costing you $1000 a month. With $2000 a month extra, maybe you pay off that note in 2 years.

Now that is paid off, you have $3000 extra per month 5 years later. But in that time, you also got raises and found a new job paying you more. So your income is now $2000 more a month. You now have $5000 free and clear every month.

Do you pay your student loans off? Do you pay your home off? Here maybe you do a hybrid solution – in my opinion. Put $1000 towards the principal extra on the house, and $2000 in the stock market to yield 8%. Bonds at 4% for $1000. And – $1000 a month towards an investment home you just bought. You needed 20% down for this, and you want to flip it:

For the flip, you have a short-term personal loan for $20k to buy a $100k home with two units in the city. I know these numbers seem silly to some, but you also don’t live where I live, where things can be cheap. While the cost is $1000 a month for mortgage, taxes, insurance – you fix up the place nice with some savings and sell for $180,000 in 4 months. Maybe this nets you $20,000 in profit. Well, maybe you only had $1000 down in the private equity deal. The investors in you made 50% return in 4 months. You used $1000 and profited $20,000 for $19,000 overall profit for a 20x using your hands as a side hustle.

Or – you rent out both of those units for $1500 total. So you have $500 per month of free cash flow (random numbers for example – not literal). You hold it for 40 years. During the course of that time, rents may increase with inflation 2-3% AND the value of the property could increase 2-3% a year. So as rents increase, you put everything extra on the principal and maybe the property is paid off in full after 7 years. Then, instead of $800 a month extra (with inflated rents) you have $1500 a month because the mortgage is paid off. Maybe your $100k home is now $130k? And now you have 33 more years of earning $1500 per month. Look – before you real estate gurus start trying to attack my numbers – I know these are obviously off. It’s for example effect.

So at 7 years, instead of $5000 cash free, it’s like $6500 free.

While you are reducing debt, roll your savings into things that can yield. Take those profits to accelerate the debt reduction. This is a process that may take some of you 3-6 years. But once you have a lot of this going in the right direction, it’s clear sailing from there.

Lesson 4: budgeting and prioritization

There is a saying that you “pay yourself first”. This goes back to when I was a kid I heard this. You start stacking some cash in your piggy bank. When do you spend it? What should you spend it on? Here’s my opinion on the matter – go talk to a licensed financial analyst for your planning. All of this is for the sake of education.

Priorities:

- Home/apartment

- Car/transportation

- Utilities

- Food

- Health/fitness

- Saving 6 months of bills

- High interest debt reduction

- necessities (shampoo, clothing, shoes)

- Education/skills/trades

- Mid-interest debt

- Interest bearing investments (stocks, 401k, local pizza shop, bonds)

- Entertainment

- Vacations

- Low interest debt

- Luxuries (nice furniture, high end vacation, cruises, expensive cars)

- Speculations

What I observe with today’s society is that sooooooo much debt is taken out by younger people. They buy things on credit to get things they cannot afford, to impress people that don’t care about you. Maybe you are a 27 year old couple and you buy a million dollar home, each have a Lexus in the driveway, and go out to eat 3 times a week. Unless you are both surgeons, this is extremely dangerous. Men feel like they have to signal they have money – for security purposes. Women want expensive nails, clothing, and makeup to attract mates.

What is happening is all of society has turned into corporate slaves leveraged to the hilt. A job loss ends them, immediately. This is not how you build a healthy society. Here are some comments on each.

- Home/apartment. Location is a big deal, obviously. But when you are 23-24, you should be looking at more affordable homes. Townhouses, older split levels in outside of town, row homes, starter homes. My first home purchase I was 24 and bought a 1 BR condo in King of Prussia. My idea was that I would get married by 27, and when we were ready to start a family, buy a “starter” home which would be like a ranch/split level. And, at 40 – we could then buy a massive dream home as our forever home. So many 26 year olds today think they DESERVE a 5,000 sq ft Malibu beach house. This – is the power of social media eroding your brains. Once you both have graduate degrees and both have 6 figure incomes, that’s when you look for your forever home with 20% down so you aren’t leveraged. 20% down on a $600,000 house is $120k. So you need to save that somehow – stocks, investment properties, bonds – etc over perhaps 15 years. Too many people today are 28, get approved for a $700,000 home – put 3-5% down, and have massive, massive home payments.

- Car. When I was 16, I got a 1984 camaro for $2600. The year was 1992. I beat the piss out of that thing through college. I had it for 7 years. At 23, I bought my first new car, a Jeep Cherokee. A few years later, I had a 2005 Escalade. I have made a lot of car mistakes over the years, and I finally found what works for me. 3 year old vehicles with low mileage, with low interest rates. This may be a pipe dream to you today. Maybe you start with the 8 year old car? I drive a 2021 Ram 1500. It also has helped me immensely with the rentals I own – being able to do tons of manual labor. One problem I had for a lot of years was a stupidly long 90 minute commute each way. In that case, I did have a 2017 Highlander Hybrid – it was brand new, and it got like 30 mpg. The longer the commute, the more reliable and newer the car must be. Get a lower priced car and ensure proper maintenance is done and you will be ok. When you are 45-50 with no debt and want to pay cash for a Lexus then? Have at it. You have no business at 27 to have a $1200 a month car payment to try to impress someone. You are an idiot. When you get older, you will kick yourself for buying that 5 year old Escalade because while I loved it, the low gas mileage along with $600 for any part, ever, that broke a lot – and the cost to maintain the thing was just a bad, bad move. Consider delivering pizzas or uber with your car for extra money. I delivered pizza in college with a beater and it did me pretty well. I think when my truck is paid off, I may just keep it until it falls apart. I don’t have a commute these days, so I’m ok to drive it into the ground.

- Utilities. Start with bare minimum. Electric, water, sewer, internet, TV, heat, trash. From here – you then want to have an honest conversation with yourself on what exactly you need. Do you need the heat at 75? Or, can it be at 64 and you wear pajamas in your home? Can you find a cheaper internet provider? Do you need 600 apps/channels? Can you install more efficient windows/appliances?

- Food. I have always cooked a lot at home, but in my 20s I was going out on dates a lot. The bills start adding up. I rarely go out to eat these days. Maybe once a month or so. Maybe twice if you count a pizza. This cost can get insane. Some ideas to help here?

- Buy in bulk. Things like grains, rice, beans, cans of sauce – I get from the Webstaurant store.

- Cook up extra and make meals. I make up rice and ground beef in bulk to make my fun burritos. If you cook for an hour for one meal, this gets tiring quickly. Cook for an hour on Sunday, and you might have meals for most of the week.

- Grow some of your own food. I used to pay $7 for a thing of sweet cherry tomatoes at my grocery store. I started a garden and had tons of tomatoes, cucumbers, zucchini, raspberries, basil, and mint for years.

- Buy bulk meat from farmers. I buy half hogs and quarter cows and freeze them in a stand up freezer in the basement.

- Raise chickens. At my vacation home, there are two chicken coops. Someday if I ever live there full time, I can raise chickens and have eggs all the time. I can have chicken here and there. My dad and me used to use chicken feathers (called hackle) to tie flies for fishing. I live in suburban hell here and this prevents me from having chickens here – so plan where you want to live accordingly.

- Hunt your own food. I haven’t done this yet, but I have the equipment to do it.

- Fish for your food.

- Go pick fruit – I would take the little ones to pick fruit with me at an orchard and its far less expensive than the stores and 10x more fresh.

- Learn to cook with different methods. Baking, frying, slow cooker, air fryer, braising, boiling, simmering.

- Learn to make things from scratch – I have been able to make pretty damn good pizza dough here. I can make pasta from eggs and flour. I can make cookies and breads/rolls. Having basic cooking skills from scratch can also help you save a ton. Love that latte? Instead of spending $7 a latte, figure out how to make it at home for $1.

- Have fruit trees. At my vacation place is an old apple tree that the deer eat from. But if you were rural (and not in the mountains like me) you can have fruit trees – apple, pear, peach, etc. Not only can you make up a ton of desserts and treats, but you can sell excess or help provide for family and friends

- One meal a day. When I lost 175 pounds, most days I was just eating one meal. Food costs plummeted. I was eating giant salads. Tomatoes from the garden. Zucchini pasta/sauce. Raspberries and cream cheese.

- Fasting. Skipping a few meals is not going to hurt you. Actually, it may help you a lot more than you understand. Take a look at the health benefits of “autophagy” and how all religions have fasting protocols. It won a nobel prize for medicine in 2016 and most people still don’t understand it – and think they need to eat 3 meals a day. Spoiler alert: you don’t.

- Health/fitness. Maybe you do not need a $200 a month gym and a $4000 elliptical. But a pair of good running shoes and a decent trail bike with some tech can keep you pretty active. Walking the dog. Hiking. Tennis racket. It doesn’t cost a lot to be healthy. It can add up if you are a gym rat, need the best equipment, need protein shakes and pills. But for most people, you need to ensure you have the bare minimum needed to move around – walking shoes, etc. This is a priority because none of the below matters if you are dead.

- Save 6 months of bills. No one under 38 was in the workforce for the Global Financial Crisis. I lost my job twice that year. I also lost my job for 15 months in 2002 due to the dot com crash. Everyone under 38 is used to bitcoin going vertical, house prices going up, and stonks always in the green. Sure, you had a scare in 2020, but you have no idea what sustained job loss is like. And, it might be here again soon. If you have $10,000 a month in bills, it means you need $60k “liquid”. I don’t have cash. I always put it into something. Precious metals, stocks, debt, homes, etc. If $60k is a lot for you to save up, you then need to realize you are in over your skis with monthly bills and need to reduce it. So if you cut your budget by 25% to $7500 a month, you then only need $45,000. For a 23 year old, you need to not be in a situation where you lock yourself into high asset prices at high rates. This can set you back a decade to dig out of, if the markets go bad. It happened to me. But, I had savings, so I was able to get through them.

- High interest debt reduction. I went through a lot of this above, but once you have ensured you can survive a zombie apocalypse for 6 months, then attack your high interest debt. Why? Because you could lose your job tomorrow and need the cash to pay your mortgage and car. Maybe you pay this off first, so you need to save less for 6 months of bills? Maybe you take half of your money that is left over and put half on saving for 6 months of bills, and half towards principal on your credit cards. 6 and 7 are very important to you not having to rely on the government or family/friends if crisis hits you. It is YOUR responsibility to harden yourself.

- necessities – shampoo etc. I put this a little lower because we all need the basics, but if you’ve ever been poor, you also know how to stretch these things and get the last molecule of toothpaste out of the tube. Until you have all of the items above settled – maybe you buy cheap shoes, no brand soap, off brand toothpaste, and ration things you have so you can make them stretch. Getting “wealthy” isn’t about driving a nice car. It’s about proper financial hygiene. My buddy is very well off and drives a 1997 suburu. People drive through his development and see his car and think he is poor and won’t rob him. Point is – people with real money aren’t buying an expensive car to impress you. They don’t give a shit about you. So why should you care what they think about your car. $80,000 for a pickup? GTFO. Point is here, you need to learn to be thrifty with your necessities to eventually catch up so you can buy shampoo that doesn’t make your hair crunchy.

- Education/skills/trades. I got a lot of scholarships as an undergrad. I graduated owing $14,000 to the federal gov after 4 years in a private college. I am indeed “the renaissance man”. My background ended up getting me a ton of different types of scholarships. Then – my employers paid a bulk of my grad school over SIX YEARS with tuition reimbursement. Always check to see if your company has tuition reimbursement. Try to get grad school done as early as possible, because it gets really hard at 40. The more education you have, the more doors it opens up. This is also why health is above – because a lot of positions (like sales) may need people to be fit, in shape, and be presentable to the customer. Develop skills – I work in IT and over 30 years, I learned how to run many different systems and tools across many disciplines. Harden yourself against unemployment. With trades here – this is something every person should learn. How to paint a room, do drywall, change a garbage disposal, change an electrical outlet, repair toilets, mowing grass, chopping wood, flooring, drop ceilings, growing food – all of these skills you learn means you do not have to pay someone else to do them. Like doing your own taxes. Sometimes side hustles are cost avoidance activities. I have like a $400 payment for student loans probably for the rest of my life, but put that against my earnings over the years and it’s a very, very strong investment in me that has many times paid for itself.

- Mid-interest debt. This is kind of evil as well, and you want to accelerate this payoff, but focus on the high interest first. Many look at the AMOUNT you owe rather than the rates, which is a massive mistake.

- Interest bearing investments. I think that once all of the above is humming along, it might be time to buy your first stock. Or bond. Or home to rent out. This is your “seed planting” that I will cover in another lesson. Add to things you like a little at a time, and don’t just drop a chunk of $30k on Microsoft because you think they will double in 2 months. Invest in companies you believe in, that are priced right, that you feel may be very valuable in 5-20 years. Semiconductors, AI, tech – all of this is the rage. But anyone who lived through the dot com crash also knows most of this is going to get washed out. Would you rather buy it in 6 months at 50% off, or now, and lose half your money? I will cover this more in another lesson, but what to buy and WHEN and for WHAT PURPOSE is part of this

- Entertainment. I might want to go to a local baseball game and take my youngest. $5 a ticket. get him a hot dog and ice cream. We have an afternoon for $20. My other half wanted me to take her to the Bronx for a Yankees game. This would probably have cost $1000. Problem is, I have high interest credit cards at the moment to pay down from overages on my renovations. So I would avoid the Yankees in the Bronx at the moment until my high interest and mid-interest cards are paid off. Meaning – I can go to the movies, I can buy some small things. But larger events and costly things should be available AFTER your high and mid-interest cards are paid down. Discipline here is important so you don’t dig the hole deeper in high interest credit.

- Vacations. Like I mentioned, I grew up poor. The most my dad EVER made in a year was $13,000 and my mom was a stay at home until I was like 6 or so. Money was tight. But they wanted to take us on vacations. So we packed up the shit mobile and took the tent and the coleman stove to a campground 15 minutes away for a weekend. I loved it. There was a lake there I’d go fishing in, and we had a row boat we’d go in. There was a public pool there. 18 months ago, the other half talked me into paying for a Disney Cruise. I loved it – but – the price tag was like $6,000 for everything. most of my vacation time has been on the in-laws couch on Long Island for 15 years. I bought a vacation home that doubles as an AirBnb. Ideally – I make some money on it to pay for repairs. But this has everything – 8 acres of wooded land, a creek, a nice fire pit, 4000 sq feet, an in ground pool. I bought it from an estate sale dirt cheap and threw my stocks at paying the down money and half of the renovation costs. Ideally, this thing is paid off by rents within 5 years. And – I can go up there 1-2 times a month. I can go alone for a peace of mind and do work, or I can take family or friends and have a leisure trip. While I liked the Disney cruise, it was $6000 for 4 days. This vacation home – should net me the entire value of the home fixed up – for FREE. So in 5 years or so, I would have a $400k fixed up home – fully paid off – with $3000 a month in income from it. Is a vacation home for you? Probably not at 25, but maybe at 45. Regional trips can be fun too – get in a car and go. Why not have people PAY YOU to own your dream vacation home? In 10 years if I want to move there, it’s fully paid off. Or I can pocket a pretty penny.

- Low interest debt. My home is at 2.99% I think. Still owe like $270 and it’s worth maybe $550. Don’t know. I bought in 2014, where the real estate prices were low. I lucked into this. Then, with COVID, the refi happened. My monthly mortgage payment is probably about what people pay in nice apartments, and I have like 4000 sq ft and a yard, park, and close to my rail trail for biking. I am in the best school district in the county. But the question then is – do you pay this off? I put this last – because if you do everything right above – you will be paying this note off with the fruit harvested from your investments over decades. Do not pay this off with your income from your job. Pay it off with rents from your rentals, your AirBnb income, income from bond interest, the sale of stocks that made 3x, dividends, etc. I refuse to pay off low interest debt with cash from my job.

- Luxuries. You want a $10,000 table in your living room? Pay cash. Ensure all of the above is good to go. Want a new Escalade? Pay cash. Want a trip to Bora Bora? Pay cash. See where I’m going with this? What you are seeing now is 25 year olds buying luxuries on credit. OMG. This is why maybe a 50 year old is buying a nice new Corvette. He busted his ass for 30 years and his investments are printing cash, so NOW is the time to indulge. Our culture is broken, where 29 year old married couples see everyone on social media living their best lives. They put all of it on credit cards. They fight about money and what to spend it on. Truth is – most people do not understand WANT vs NEED. This is a hard lesson you get growing up poor. If you understand life through this lens, you will be served later in life. For example, you may need a dining room table. Why? To eat food on. How old are you? What’s your financial situation? What’s your skill set? You can make your own damn table. You can buy one at the thrift store. You can get one at Ashley furniture for $1000 or so. Facebook marketplace to me has the best of both worlds – nice stuff with steep haircuts from someone else using it. It’s how I furnished a lot of my vacation home. You WANT a $12,000 table. You may NEED a plastic pop-up table to eat on. If you are 25 with your husband/wife, it’s ok about wanting to buy a $12,000 table someday, IF you are fiscally responsible.

- Speculations. I put this last because where most of the items above are reducing your debt and increasing your net worth, this item here can produce such wild results, that you could lose all of your money. Art, bitcoin, beach front property developments, gambling – Any dime you put into this category has a high risk of going to zero, at some point, some how. Can you get a 50x on bitcoin? Sure, perhaps if you bought in 2014. Early movers and adopters are usually those rewarded with speculation. If everyone you know is trying to buy bitcoin, they are bag holders being sold something where THEY made the 50x, and you are simply transferring your wealth to them, with the HOPE that someday someone will pay you 50x what you paid for it. Bitcoin people hate me for this stuff – they think it’s a lot safer than it is. This is the lack of understanding risk, which is completely dismissed by super hype machine people that need to keep pumping the price or they lose everything. Maybe you buy art for $100 at a street fair and the guy dies next week and that is now worth $1 million. Odds are it’s going to be in the back of someone’s garage torn and dusty in 20 years. Great at black jack? you have a system? Yeah – those people have chandeliers that are worth more than your entire net worth because – the house always wins. And if not, the house will throw you out for card counting or being too good. Can you pull the slot and win $50,000? Sure. Is it likely? No. Are you likely to lose your money in the slots? Yes.

Part 2 will be coming in a few days…

Leave a comment