My friends kill me. “Nate, you said silver would go higher!” Yeah. I still believe very much so, and there’s a very valid reason I’m going to get into here with resource investment, and why so many things are just going to soar. We might be near a bottom for this leg, so wanted to get you a little excited for when the next leg decides to get going.

Here, I have covered demand pretty much. I go WAY back with the solar panel stuff. We have SEEN the 237 million oz deficit – as predicted. But what about supply? Well, I’m going to walk you through a narrative here that makes something like this an inevitability, but most certainly not imminent. I can tell you that this may have been the biggest early lesson in investing I have come across when you use a macro and fundamental narrative for investing. You need to be patient. You THINK – “hey, I want to get in the second BEFORE it goes up, then it’s going to go up 5x, and I’ll be out in a week”. That might be how your shit cryptos work, but not most other things.

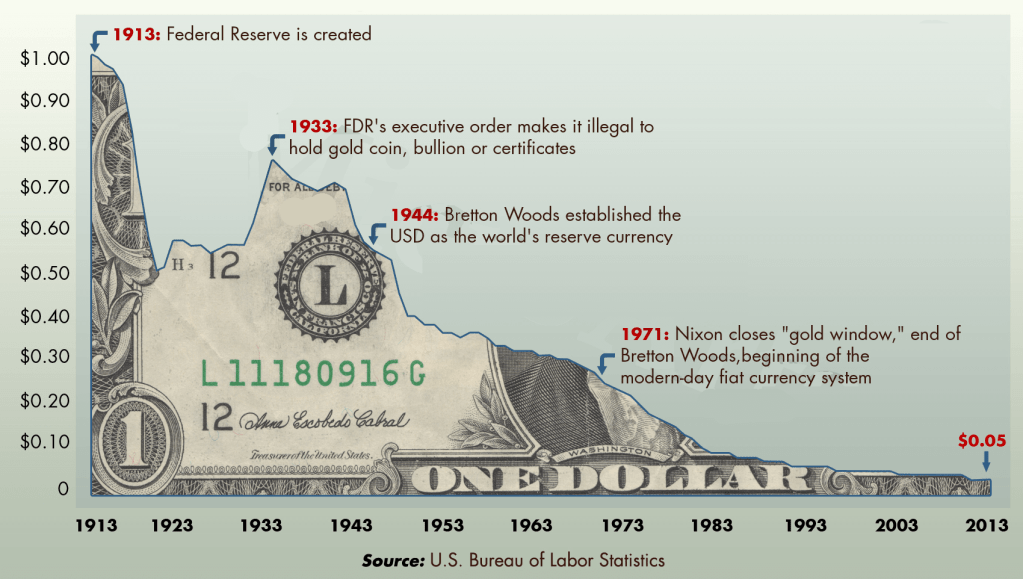

So let’s go back here many years and look at the bigger picture. “Gentle” inflation.

We have all seen a version of this chart.

If you start here, you need to understand what is going on. Essentially, you are continuously diluting the currency over the last 100 years. But the money is borrowed into existence to do things like build houses. This money “air brakes” if you will are set by interest rates. Higher interest rates means a lender wants more money paid back. It becomes expensive then to lend, and a contraction in activity happens – which lowers GDP. As rates then tend to move lower, it is less expensive to borrow money and expansion can happen. The math then dictates if it is a good deal.

Let’s take, for example, if someone gave you a loan for $100,000 at 5% interest, you are paying back the principal AND interest. The interest alone would be $6,000 per year, or $500 per month. Perhaps the loan is for 10 years, amortized and you estimate that is an avg of $10,000 per year with principle, so perhaps $850 per month for a total payment of $1350. The question then is – can you use this money to generate revenues that exceed $1350 per month? The amount over this becomes your profit, and then taxes come off of this.

I’m using this for example with perhaps houses that you want to turn into rentals. When these rentals get bid up by thousands of people entering the market, you then have a problem – for a $100,000 house today you cannot get rent over $1350. So it is NOT a good deal for you.

There are SIX main options.

- The ASSET price of the house has to come down. If less people are bidding this up, the natural progression is for sale prices to lower to attract buyers.

- The RATES need to come down to attract buyers to make it more profitable.

- The loan needs to be a longer term to make the monthly payment lower

- Increasing the money you pay out of pocket to reduce the loan amount needed.

- Rents need to be increased to make it profitable.

- A combination of several or all of the above

Until we get to this point, people will continue to enter the market to buy these properties for rentals. Asset prices increase. The “inflation” of the housing then signals that rates need to go up to slow the rate of inflation. Credit can also be harder to get via higher credit scores needed or your debt to income ratios are scrutinized more. Additionally, banks may want higher out of pocket contributions to reduce the percent borrowed.

You can see how this works with rentals – and during this time, you may have more and more houses being built. More apartment buildings being built.

But as the saying goes, the solution to high prices is high prices. In the example above, I believe we have been at the critical levels of all of this for years. What happens is supply runs to the market which then satisfies the demand. That’s one side of it, the other side of it that many don’t think about is demand destruction. When prices are so high, and while you may need an apartment, now the only thing you can afford is to get roommates to then split housing costs. This is what has been going on with NY prices for perhaps more than a generation that the rest of the country doesn’t see. If you are born and raised on Long Island, NY – there’s a reality for most you are living with your parents until they pass on.

So to satisfy the “high prices….solution” model you need:

- Satisfy supply

- destroy demand

Where I’m now going with this is to look at things everyone buys. I used rentals because of my experience in understanding how the market can be profitable under the right conditions. To buy now is to most certainly lose money. But when you buy things – they are made with things – raw materials. These raw materials can all be rather the same – like gasoline is gasoline no matter what brand you buy. Sugar is sugar. You get the idea.

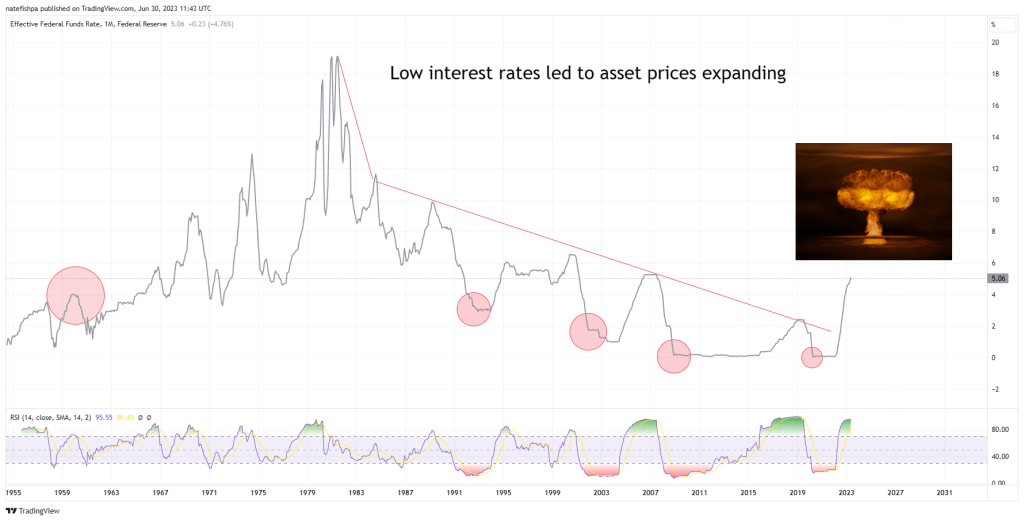

When you have lower interest rates, you have conditions met above that make the cost to borrow lower. This allows for expansion. What you see in the chart below is 40 years of interest rates going lower.

Did the air brakes not work?

There was a combination, in my opinion, of four major deflationary forces at work which kept the credit expansion continuously going while also keeping inflation from “running hot”.

- Globalization

- Technology

- Petrodollar usage everywhere for goods/energy

- Abundance of energy

The above are now a major cause for why “it is different this time”.

Globalization

With the above, you can see how as I was growing up in the 1980s, factories were starting to move out of this country to elsewhere. IF you see the chart above, you could see how the inflation in the 1970s led to…union busting.

IF you could crush the unions by simply not using US-based employees, why would we not then build a factory in Vietnam where labor could be 1/50th the cost? Sure, it might cost us $100m to build a plant there, but then we have 40 years of cheap production.

What you are now finding is that those “cheap goods” we used to buy in China are too expensive to make there now, and China then opens factories in their countries of influence. Many of them are now rising up and these costs are increasing.

Meaning – there’s less hell holes on the planet left where you can make “cheap” stuff. This ties in to commodities below.

Technology

In it’s nature, technology is deflationary. Start with the “computers” at NASA. They were PEOPLE who computed. You then had machines able to perform these tasks, much faster and much cheaper. Since the microprocessor has been created, dear God the advancements in our society have been stunning. Think of then how Japan and South Korea cranked out tech? Think of Taiwan today with chips? Robot workforces have eliminated a lot of need for factory workers.

This then plays into the idea of how AI is going to take ALL jobs. Not so fast, chief. It can be a helper monkey, at best, now – but you still need the demand of customers and credit to build things. So AI might be something that needs to be refined for a decade before you get much usage out of it. I am into the idea of quantum computing, but I think that is also a decade away. In the meantime, technology is hitting a wall with much more you can squeeze out of “cloud”. Everything that can be automated, has. For the most part. Until we get major breakthroughs with quantum computing and AI, this is slowing down tech and acting inflationary.

Petrodollar usage

This is deflationary in the sense that a lack of competition for something also means there’s not efficiency. Less friction of exchange. A “universal” dollar that business can use is “easy”. But other currencies are also constantly trying to devalue against you. This makes it “cheaper” for factories to be built there. This means that your US dollar can buy a LOT of goods against the foreign-made products. The “dollar” is exchanged for energy, and with this, it had a relative value for oil/nat gas, etc.

Abundance of energy

This is deflationary in that if you have a factory, you have power costs to run it. You have energy costs to extract lead. Giant Saudi oil fields. US shale. Nuclear. Solar. Hydro plants built everywhere. All of this led to perhaps stable energy costs which allowed products to be made/shipped pretty cheaply.

The perfect storm

The perfect storm has arisen which threatens the 4 tenets above of “deflation” which allowed for near zero interest rates to thus expand.

Globalization – as countries at the poorest levels want a fair deal for extracting and working, this increases wage pressures upward. There is no hellhole on the planet not exploited yet, with perhaps Africa being the last bastion of this. However, with the governments there being as stable as quicksand, it’s been a challenging place for any investments to go. You have a 70 year war with NATO and the east now starting to create a strong BRICS faction to rival the “G7+”. Russia drew a line in the sand with Ukraine, and the maps I created show 30+ years of NATO expansion east which has now created major issues. China has become a LOT more prosperous with the US buying good from them for 4 decades, and China has major influences on the region. These factions now are looking to re-negotiate pricies from the west higher, which I believe is the root cause of a lot of the global conflict you see today. We need “cheap stuff” and if they threaten to not give it to us, we blow them up. Anyone can spin it however they want, but cheap goods keeps people being re-elected.

Technology – as I mentioned above, most of what we can automate, has been done. There’s diminishing returns here now until we have breakthroughs with quantum computing and AI, but the race now many of you don’t know about is the US building chip factories here before China makes a move on Taiwan and bans the sale of chips to the west. I believe this is why we tend to care so much about Taiwan. I’d love to say American loves the Chinese people there, but I believe this is transactional. Once we are self-sustaining with chips, I believe a lot of those back room deals you and I aren’t privy to changes the south china sea a lot. I’ll leave it at that.

Petrodollar usage – as the Saudi are now making deals to sell to China in Yuan, you are seeing a relatively quick break down in the dollar as a reserve currency. While the USD isn’t going anywhere for some time, as more and more people do not need it anymore, you now have to realize more of these dollars are being exchanged for goods, services, land, stocks, etc. We are actively seeing banks being run on. While you can reasonably attribute this to yields being 5% now with things – it’s also of note to realize the $17T in cash all around the world may start to make its way here. No new credit may be needed in USD. This can mean that the cash on the sidelines is now needing to find a home and starts to bid things up. I believe THIS is what you were seeing with “no recession since 2009”. I believe THIS is also what you have been seeing with gold being bought by central banks since 2009.

Abundance of energy – the wokists are also into environmentalism, and with this, the dumb ass idea of ESG was created. This is also on top of the narrative of global warming. Perfectly safe nuclear power has been tested over the years – especially with Fukishima. This made tons of investments in wind and solar, which just flat out do not get the bang for the buck as fossil fuels. Meaning, it is now costing a lot more to produce goods in the West. The east, for the most part, laughs at ESG and with this, are using coal plants to make electricity cheaper than us. But fracking kind of burned out. Saudi oil fields may be less efficient and their reserves may be a lot less than they report. With Russian sanctions, we then also shoot ourselves in the foot to get cheap energy. So we blow up Nord Stream to choke off gas money to them.

Putting it all together

With the rates going up to 5%, you can see Powell is trying to deploy the air brakes as well as crush demand. But with the Perfect Storm here that removes all deflationary forces, interest rates need to continue to rise. I believe we may be seeing perhaps a decade of this. Here’s the choices:

- Keep air brakes deployed to slow/contract growth and crush demand. This is a DEFLATIONARY impulse to hit to STOP inflation.

- Let off the air brakes, to which the inflationary pressures will indeed spiral out of control. With the USD rapidly losing World reserve currency status, with BRICS trying to create perhaps a gold-backed currency – this could lead to not only the USD losing substantially more ground, but the risk is then a form of super inflation or high inflation.

In item 2, this is a capitulation move. And with this, it devalues our currency against everyone. Quickly. While this will make it more attractive to make goods here again, no one will be able to afford imports anymore.

But I feel you all need to look at this from 50,000 ft. When you look at what the COMEX is and does, it is a beautiful design for price discovery. I LOVE it. Now, the other conversation here is how banks have used high frequency trading to then manipulate prices lower – but all manipulations come to an end, and the end of the cartel manipulation is close. The DESIGN is nice. The overseers have allowed corruption and manipulation to thus put us in the situation we are today.

That is, due to the artificial low prices, it has robbed us of price discovery. With this, NO ONE has entered these markets or invested in them for a decade or more. It has meant that in the US, while we have SUBSTANTIAL metals and energy, we ship paper green currency to hellholes and they then give us shiny metals because it is cheaper to mine there than here, by a lot.

Stepping back – let’s look at copper. $4 a pound, give or take. All of these mines in Chile that are huge are 100 years old and near end of mine life. It may take $3-4b to build a new copper mine – but this isn’t just coming up with the money, this is perhaps 10-20 years of work until you are pulling copper out of the ground from inception. Grades are lower. Fuel costs are higher. Labor is higher. Margins are compressed. But people keep buying copper. People keep making copper, as long as it is profitable. A market like the Comex says, “hey – we need copper and we are willing to offer $4”. The SELLING then comes to the market with perhaps forward production to hedge it. They will take $4 today to deliver it months later. But there’s people SELLING that are just betting the price will go down. The speculative nature of these industries help give it liquidity. But the high frequency stuff that runs stops then creates an artificial $4.

What this does is allows mines that are in production to continue to operate, as long as they still have resources. But this price point may not entice more discovery. THAT is the main issue that perhaps only a few thousand people on the planet are tracking. As mines are running lower on life….grades are reducing. Stockpiles above ground are being drawn down.

This last part is what wraps up everything in a bow.

Supply prices to go vertical

We started talking about the rental units above. Those markets are saturated. At these rates, AND asset prices, no one can really enter that market and make money. You need more deflationary pressures to do so. But the same can be said with stocks now. When you look at Schiller P/E ratio and the like, you find that the stock market is a crowded trade. Even gold has doubled from its low in 2015.

But all of this building of “stuff”. Where do the raw material come from? Many of you just think about buying stuff on Amazon. People run up credit cards. They get mortgages. All of these goods. All of these products. They all need raw materials and energy to produce them.

And they are all now on borrowed time. This is not an IF. It’s a WHEN.

I think we all agree that Papa Powell at SOME POINT needs to pivot to avoid a deflationary death spiral. High asset prices AND high rates? There’s no safe YIELD anywhere other than bonds/treasuries. This would potentially cause a great depression. Why? With high rates, remember, asset prices need to come down. Expansion stops, and unemployment goes up. RENTS collapse, exacerbating the problem.

That’s door number one.

Door number two is the most likely. At some point, rates top out as enough pain is felt and unemployment hits 5%. Asset prices will have to come down. But the perfect storm in inflationary pressures are there. As rates come down – there goes the neighborhood with bonds/treasuries. “Risk on” starts again. But….this time….we add a new player to the game.

Scarcity of raw materials. Scarcity of energy. Prices will increase exponentially as the few with cash/credit bid on what is left. Those copper piles? Drawn down. Silver stockpiles? Drawn down. Uranium? Gold? Oil? Natural gas?

All of these items that have had a decade of low prices and lack of investment are set to soar. Not immediately. We saw what happened with lumber with the housing demand in 2021-22. This is more acute for immediate demand of housing. But we have environmental people running things that promote ESG and no permits for mining. This leads to….”where the fuck you getting $4 copper in 10 years”.

Answer: You don’t.

What you hadn’t considered is that as people come back and try to bid up more “stuff” – this time, the “stuff” they want to bid up – just isn’t there. Which bids up raw materials at the manufacturer level. This is your Godzilla. While these prices are now passed on to consumers – this can also lead to more margin compression. Higher P/E ratios and even LESS profits. Why am I going to invest in a company with 100 P/E ratio? You aren’t. You then start looking for value. You will see silver miners pulling it out of the ground at a cost of $25 and a profit of $50 an oz.

The logical play here is that there is an inflection point with each of these commodities. It’s a day of reckoning where the artificial push down in prices leaves the sector. We have seen it with palladium. We have seen it with Lithium. The available above ground supplies and mine supplies simply cannot handle demand – remember – tons of cash on the sideline. Home market saturated. Rentals saturated. Tech stocks. Way overvalued. Stock market? Way overvalued. But commodities?

Oh boy. Way undervalued.

Silver

We now get to the point of the program where Jeffrey Christian talks about 60b oz of silver above ground. How there’s 5b oz in bars/coins/rounds. So look – there’s supply!

But. At. What. Price. We only have 800m oz being pulled out of the ground today, with diminishing ore grades and mine lives, with increasing inflationary pressures. Who is building a silver mine for $20 silver? No one. I checked. There are mines that are out there that might then come online at $30 silver. $40 silver. But the damage was done. 10 years of lack of investment. 10 years of smashing prices down.

There’s now going to be sustained 200-400m oz deficits every year until this is resolved. WHERE do you think they get this deficit metal from? They need to buy it from you and me. I believe that within a few years, prices in USD for commodities like silver and copper will go vertical. With silver, they need to pry it from investors who see it as money. Gold isn’t used a ton in industry, so unlike the need for solar powers, you don’t NEED more gold, you can simply bid up what’s here indefinitely. This will soak up a LOT of the excess USD in the system as countries get out of USD and into gold.

But the silver needed for solar panels and EVs. Even IF there’s a depression – THIS will still be high demand because the people creating the depression also think solar farms and EVs are going to solve all of our environmental issues.

The macro here leads to much higher levels of inflation coming back in 1-2 years the second they take their foot off the neck. But with silver, unlike copper or gold – the DEMAND will continue like the Terminator in T2. It simply cannot be quashed by a deflationary impulse due to governments insisting on solar and EVs. This could even mean massive higher tax incentives and credits to make this a reality.

While I think they are certifiably insane at this point, and we all know they kinda sort don’t understand economics and physics – what is super clear is they do not understand basic math. That is, $20 silver 5 years from now is a fairy tale. While my miners are getting ground into dust, where do people think $20 silver is coming from if it costs them $25 to mine? What stacker who has these 5b oz is selling at $20 silver?

Whether Darth Powell takes us to a Great Depression or hyper inflation – both paths have silver being used for energy needs in solar and EVs.

Unrelenting deficits coming. This also can translate to “follow the yellow brick road”. Why? As you see gold ticking higher, it’s a sign that USD are being exchanged for gold and the inflationary death spiral for commodities is going to start. Silver will be the shining star, and eventually, silver miners will be the next Apple and Tesla.

July 1, 2023 at 1:02 am

“I believe that within a few years, prices in USD for commodities like silver and copper will go vertical.”

-Agreed, for all of the justifications that you have raised in this article. And I’m all in, doubled down, and betting that this assesment is correct.

LikeLike