I’m somewhat of a permabear for markets, but it’s nothing personal. I have been long certain stocks with the inflation trade of out 2020 and made a few bucks. But my “permabear” status comes from a LOT of things, and many of you that are reading this are probably invested in precious metals and have the same viewpoint.

I saw a comment by Traci yesterday, and I really took time to think about it. Am I being irresponsible promoting a defensive portfolio?

Maybe she is following some fear porn accounts that are far worse than me? Am I part of the group she is talking about? Many want to just click and post – but I really sometimes love posts like this because it gives me pause to think about things. I try to be a thoughtful person – which is why you might see a 30,000 word post here, and why I pay for the blue check mark to write god awful long tweets. I want to give my nickel to the collective.

Am I a doomsdayer? Maybe…but with my pieces, you will see that I am very bearish in this country until some things happen, and on the other side of THAT, I feel we are going to kick some ass.

But – today? I wasn’t really even FOLLOWING the markets until late 2019. Let me start this article by counting the ways I’m a permabear.

- Repo. The thing that got me all in was the repo issue on 9/16/2019. Long story short, banks didn’t trust each others’ collateral, and the government had to step in to prevent the banking sector from essentially grinding to a halt.

- Policy. What has been taking place since then is not economic policy that follows any real doctrine. It all appears to be guesswork, reading lagging data, gaslighting everyone into believing all is well

- Crazy bubbles inflated with trillions of spending to prevent a Great Depression

- The worst inflation in 40 years because of this, debt now over $32T

- A Fed balance sheet at $9T

- Hyper real estate bubbles in a lot of major metros – leading to the eventual collapse of AirBnB ST rental vacation housing

- A collapsing commercial real estate sector

- The BRICS conglomerate being more aggressive recruiting countries to ditch the dollar

- The dollar as a measure of reserve currency, is down a ton over the last few years.

- A significant draw down on a bank run in progress (check M2 money stocks) – leading to a worse banking crisis in the first 4 months of 2023 than all of 2008 and 2009 combined

- Loss of confidence in the markets with the nickel fiasco with the LME and “tamping down” silver prices tells me there’s no such thing as free markets anymore. You cannot bet a free market. You have to follow Pelosi’s investments, and get out of markets when Fed Governor’s do.

- Complete loss in confidence of government statistics.

- Breakdown of enforcing the laws. Summer 2020 were riots everywhere. In major metros now, they are refusing to arrest people committing crimes. You cannot have commerce in this environment, as rule of law is how our economy works – period. They are crashing this so they can come in and rescue with CBDCs or more control.

- Completely porous borders

- Culture wars that have gone bananas. Many of us need to find a way to retire before 65 as the business landscape is getting extremely difficult to navigate without getting sued. The rules are changing too fast, and there’s no guidebooks for what we have going on today.

- Massive purchases of gold by central banks since the end of the GFC

- Loss of confidence in elections.

- The 4th turning. From my limited research with this, I feel I agree with a lot of people that we are approaching or in the 4th turning. My grandmother turned 96 on May 23rd, and she doesn’t recognize what this country is. The entitlement of everyone here and the lavish life everyone “has” to live to fit in, makes me sick. The younger generation has none of the wisdom of the Greatest Generation anymore. And they are doomed to repeat mistakes. Over and over. And – we are there.

- Schiller P/E ratios have everything way overstretched, and since we have not had a recession since 2009, we may be due for a strong correction. The Dow had gone up 7x in 14 years, while the Nasdaq went up 16x. These things are due for strong corrections.

- The markets are propped up by only a few stocks which account for all of the major gains. I saw Gayed call this “concentration bias” yesterday. Most of the companies leading this charge are way over their skis with 100-200x pe ratio.

- Zombie companies everywhere with slim operating margins only in existence due to continuously rolling over cheap debt. As interest rates went from zero to 5% in like a year, this stands to reason as a lot of cheap debt rolls over, many of these companies will no longer be able to be solvent. This isn’t an IF but a WHEN. I had once read 38% of S&P are in this category. Could be wrong. Seems high.

- People moving out of California like they are trying to climb over the Berlin wall. There’s a reason.

I’m a VERY, VERY positive guy in my life. I am an engineer (IT) and love complexity and building things. However, from the list above, you are probably listing just the 22 items I could ponder in 10 minutes and I’m sure I have another 20 or 30 I could put on this list.

Meaning, my default mode now is bearish. It is time for a recession, to prune the tree. There are probably 50 choices of toothpaste when I go to the store. While good times can flood the markets with choices, tight markets for most products will mean the belt is getting tighter. Less sales. High core PCE inflation means tight margins. This is a recipe for recession and unemployment.

Yet, the labor numbers we are getting don’t reflect this. At all. In one of my theories, I felt the shitty corporate situation is being masked by companies ditching excess commercial real estate. They are trying to hold onto talent as long as they can. Think about it. What is corporate’s problem with telework? Loss of productivity? I ask you to understand a math problem. Do you want to surrender the productivity of laying off 50,000 employees by cutting their jobs and having empty office space, or lose 10% of productivity from those 50,000 employees and cut commercial office space by having them mostly telework?

The jobs numbers have now surprised to the upside 14 months in a row. This is either terrible economists, broken formulas, not understanding how TW can save jobs, or lying for 14 straight months.

“Beating” projected numbers now is another tool these clowns have. They set $10 as the mark, it gets everyone bullish. Throughout the quarter, they down revise this to $8. Then, they hit $8.50 and beat “the street’s” projection of $8.00 and the stock rallies. Everyone is goldfish these days.

So – we have established, in my best opinion, a strong case to be default bullish. But why am I super bearish in June?

Super bear!!

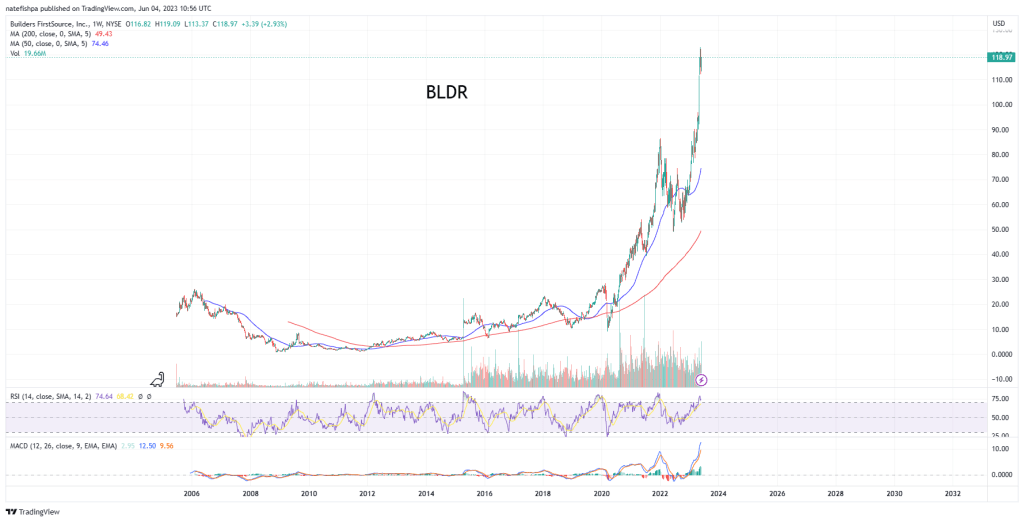

Recently, I started shorting and playing puts. Did good on some and got out, getting smoked on others now. In what world can a company YoY lose 31% revenues, have mounting inventory, and a weak ass housing market and melt UP?

This is not a tech stock that is curing cancer. It’s a company in the residential housing sector. All of these fools are convinced that there’s a housing shortage. I believe that is wrong for four reasons:

- The AirBnB growth of much of the supply of these houses being taken off the market removed a lot of available inventory, acutely. This will come down as a recession hits. Biden’s team wants affordable housing? They have to crush these rentals and get the supply back to market. This means lying about employment numbers (or pick any number) so you can keep jacking up interest rates to choke out all of these fools.

- Blackstones of the world also bid up a lot of these properties with the idea of taking a home and then renting it. Well, from what I heard, many of these types of companies bought up massive inventories, and the value of these are dropping with rents dropping. This has had companies like this avoiding their asses being handed to them in losses by selling these holdings to pension funds – who are guaranteed by law not to fail. Wait until this shit hits main street. Selling steaming piles of shit to a teacher’s pension fund. The fund cannot default – so these houses will get liquidated someday and the printing press will cover these losses and create more inflation.

- Demand. At 7-8% interest rates with sky high housing prices, it’s now a demand issue. A supply issue was when you were seeing 20 bids being put in and a house was selling for 10% above ask in cash. A demand problem I’m starting to see is listings coming down in price to attract limited buyers. This is MY area. You will have the acute problem in the cities above.

- Unemployment – I believe the true unemployment is going to start to creep up, and with this, many houses will start to hit the market. This means the markets are priced at the margins. Just because Blackstone bid up the properties and the most recent one they bought for $700k to make your property value go up, doesn’t mean it is worth $700k when Pete loses his job and has no savings and sells quickly for $400k. Your comps are going to change quickly.

All of the above scream to me that home builders are going to come down, a lot. Instead, you see irrational spikes up?

But why now. Why am I hyper bearish now?

Now that the debt ceiling argument has passed – which all of us knew was theatre, there is no debt ceiling limit for like 2 years. We are funding hundreds of billions to Ukraine now, and there’s an orgy of new spending for “Green”.

The Fed wants to lower balance sheets more. The want to untangle the MBS they bought to keep housing mortgage rates low.

But now, they need to pay for this and issue treasuries. This month. From what I have read, they will need to fund $1T in treasuries – soon.

To me, this means that unless they have sovereigns lined up to buy our debt (last I checked, Chinese, Saudis, and Japanese were all selling our debt) – it means we need lots of funding.

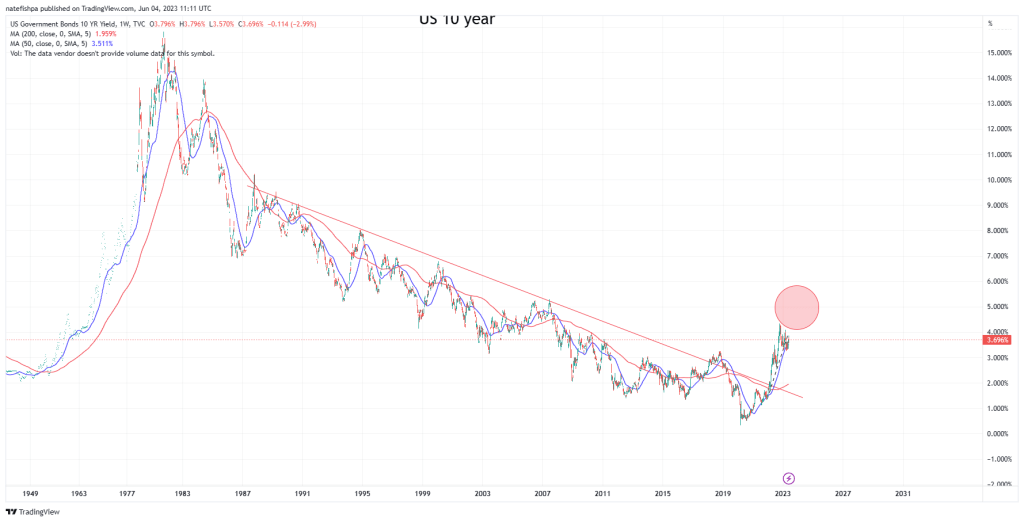

Could this draw down the reverse repo cash? Could this trigger a 5% 10y?

Additionally, I also read that half of the gov’t’s $32T in debt is due inside of 2 years and needs to be refinanced. This is typically short term debt. Would it not be reasonable to see the yield curve inverted even WAY further in this situation? Who has $16T sitting around to buy this?

It stands to reason that the higher rates coming will attract capital. Where is this coming from?

- Sovereigns? No – they are selling US debt and want to get out of USD

- Gold? It makes sense. No yield. But CBs around the world are buying gold and anyone in the gold trade now is there because they can reasonably see a US currency crisis.

- Stocks – you could see pension funds, hedge funds, etc start to sell large chunks of their shit stocks that aren’t Apple or Amazon or Tesla. This is 95% of the stocks that could go down, and hard. Think about a pension fund who could get 8% return with a short dated treasury?

- Cash – There’s still $16T or so in M2 money supply. Banks pay no yield, as their business model cannot afford to pay this out anymore. We are seeing deposits leave banks and go to money markets. It stands to reason at 5-8% they would go to treasuries.

- Real estate? If you have a $500k in AirBnB houses and your rents dropped off a cliff, it makes sense today to sell, take the cash, and stash in 5-8% notes.

So to me, Treasury issuance very near term to me may be the greatest catalyst.

I believe with this, very soon we will see a very bad half of 2023.

When a permabear is hyper bearish, ask why?

Stack my list against bullish reasons? To me, this whole thing is setting up for another leg down with a good rugging. Can you explain how issuing $1T in new Treasuries this month can be bullish?

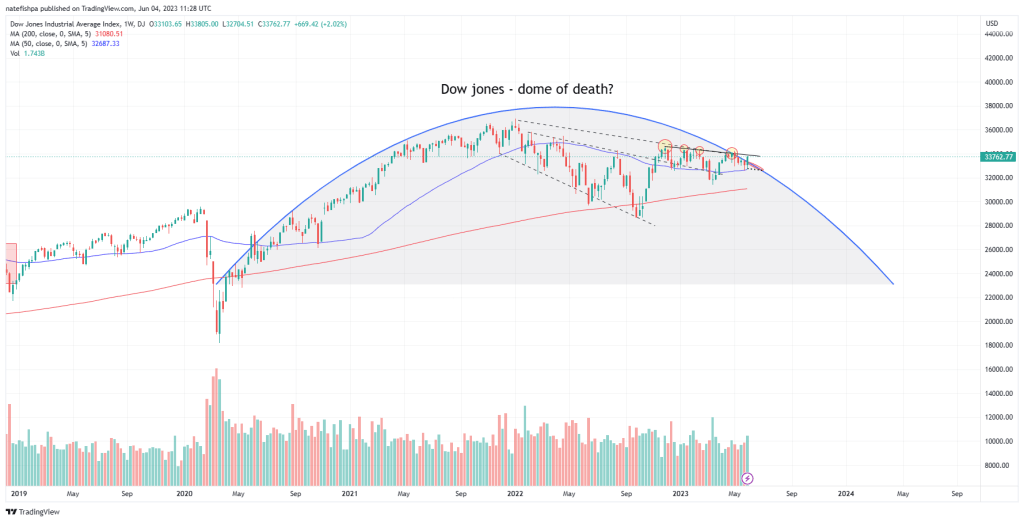

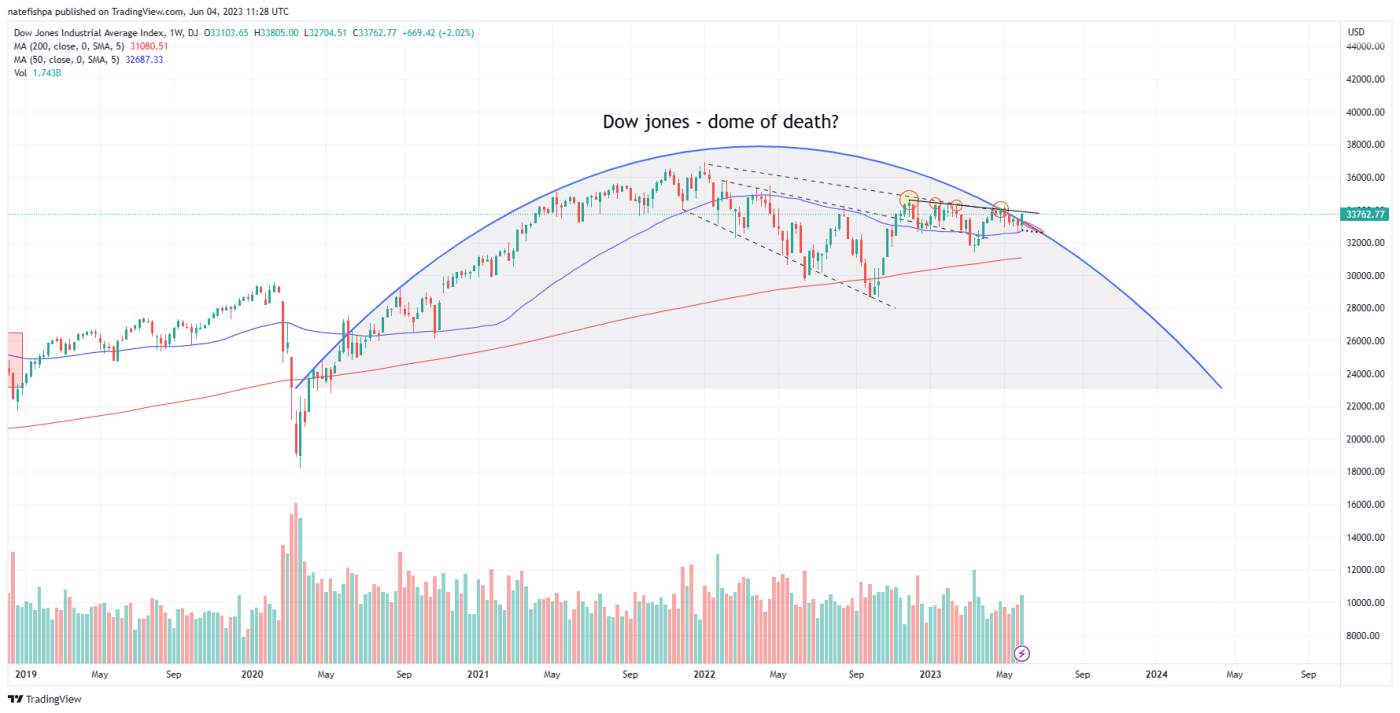

My chart above is a cartoon drawing over squiggly lines. If you zoom out 50,000 feet, do not pay attention to the inaccuracies of the pretty lines at the micro level. Look at a cruise ship slowly turning in choppy waters at 2 miles per hour. SEE the arm wrestling match going on as liquidity is being drained from the system as a recession is underway.

All of the gaslighting you see and hear is about slowly pulling the air out of the bubble, not to prevent the markets from going down. If you understand that, it makes more sense. The powers that be NEED funding for the government to operate. They need YOUR CASH to do so. But if they break markets, they break future sources of cash.

In THIS lens, understanding there is no real free markets anymore, it is reasonable to take a default bearish stance until a lot of these bubbles are deflated. Maybe we stop short of the March 2020 lows before a recovery.

The big problem is, the country is drunk every day and don’t even admit there’s a problem. Until the problem is understood, and recognized, and a bottom happens, a real recovery cannot even begin. Looking at the chart above, given the Dow went 7x to the peaks, tells me they are nowhere near the time they need to sober up.

When you start to see the jobs numbers decreasing and unemployment going up – THEN and ONLY then is when an ease in interest rates can start. Each month these drunkards see good jobs numbers and low unemployment, they are feeding their cash into a bull trap.

Sober up people. However, you won’t, until you hit a bottom. You are driving around now, barely able to see, and you are aiming your car in the best direction you can. But inevitably, you are about to drive your Tesla into a house and it’s going to catch fire. You are going to stumble from the wreckage, having no insurance, and ask others to account for your mistakes. They will be fed up with you, and you will be on your own. Then, and only then, will the country start to go back on a bullish path for me.

Down we go. It’s not fear porn. It’s a sober account of watching your drunk friends making stupid mistakes.

June 4, 2023 at 7:04 pm

I love the start of this list. I’d recommend creating a massive list that is ongoing. A few to add:

1. Inflation understated vs Shadowstats is hidden massive problem

2.,Pension underfunded crisis

3. Overall US entitlement debt of $150T

4. Global Debt $300T+

5. Student Loan Crisis

LikeLike

June 4, 2023 at 8:57 pm

You are correct. Going to make this a page for the ongoing macro. I will add yours to the list. Agree with all but the student loan crisis. I can add as an honorable mention.

Going to call the page something like ‘bearish macro’ and add in the next few days

There’s a bunch I didn’t mention but yeah, I can add to it. I want this linkable for all fellow macro bears to link.

LikeLike

June 4, 2023 at 9:24 pm

This week, the valet at the steak house died suddenly. My next door neighbor’s 13 year old daughter died unexpectedly a month ago after her body’s immune system attacked her. Her dad has myocarditis (early 30’s). We saw a 43 year old father die of a heart attack in 2021 while on a snorkeling tour. We had to make an emergency landing a year ago because the guy 6 rows in front of me was having a heart attack. Every week, I hear multiple clients mentioning doctors appointments, deaths, heart attacks, hospitals, cancers and strokes.

Multiply this times thousands.

When the steak house hires a new v@let guy, that will show up in the numbers as a new job.

First time unemployment claims will never increase.

LikeLike