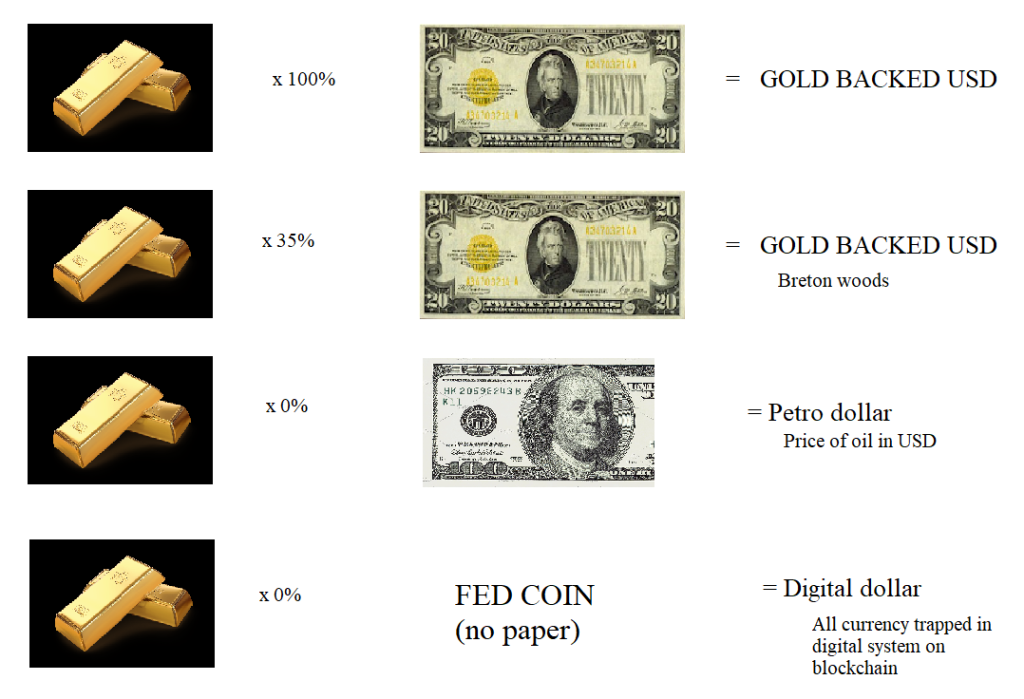

Edit 3/29 0500 – Adding graphic here so people can follow as to what this COULD look like IF Russia announces a price for gold in grams of oil. I had read where existing contracts are expiring. EU refusing to pay in rubles for nat gas and oil.

Back to the post…

Over lunch, walking my dog, I saw a tweet….

Edit: Started to write this then had to step away for a bit – off of work the rest of the day so wrapping this up now.

So I’m walking the dog and see this. Wait. Did I just read that right? The Russian government is offering them fixed amount of rubles of 5000 rubles per gram of gold. I did some rough math in my head and it came out to about $50/g in USD, and I think the going rate here is something like $60/g in USD.

But that is taking the exchange rate of the ruble to USD at about $.01 per ruble. It’s actually something like $.011.

Then this past week, we saw that Russia would sell oil to “unfriendly nations” in gold. Germany NEEDS Russian natural gas and won’t boycott it. So does Austria. Turkey already said they aren’t boycotting. Russia then selects what countries need to pay in gold for a barrel of oil.

This then means gold is the center of the system with a co-anchor of oil. And thus you then have a fixed ruble amount to gold and oil.

FULL STOP.

It hit me that IF this is true, which I verified here which sources it from here (I don’t speak Russian) – then this could mean that Luke Gromen’s prophecy last week could come true inside of weeks. Now, Luke used an exaggeration of 1000 barrels per ounce, which would make oil $2, but I have heard many outlets where Russia feels comfortable with what we would know as $50 oil. Using rough math, that is about 40 barrels per ounce in USD. Anything over those barrels per ounce, creates the arbitrage that Luke was talking about. If it’s 50-100-1000 it makes no difference – what would happen is there would be a rush to gold from “unfriendly nations” that need gold to then pay that amount of gold for oil. For “friendly” nations, they can buy in rubles. But how would you then exchange rubles for yuan? Perhaps they have a fixed number they have in mind – and then so many yuan = so many rubles – indicating China can thus convert Yuan to gold, on demand.

This is the BRICS versus non-BRICS financial system.

////////Break here for my non-metals friends, to catch them up. If you are a following me on Twitter, you can probably skip over this section and catch up with “Where we go from here”.

For all of my non-tinfoil hat friends in Facebook land that got this far, you need to understand some history here briefly to catch you up, because you need to know what all of this means for your budget for the next few months.

- In the US, we have gold and silver in the Constitution. Silver was in our money until 1964ish (with some exceptions). Over the last 50 years, our banking system has tried to sever the ties between gold and money, calling it a “pet rock” and an “asset” but not referring to it, as it is laid out in the Constitution.

- In 1913, the Federal reserve was created as our central bank. At that time, a $20 bill was equal to one ounce of gold and had been for many years.

3. In 1933, the government demanded the people turn in their gold for the sum of $20.67 by executive order

4. They had until May 1, 1933 to turn it in.

5. Above, you later see that the government re-priced gold to $35 per ounce. So they took your gold, gave you $20.67, then turned around and told people it was worth $35.

6. At the beginning of WW2, the US sold people a lot of stuff, and asked for payment in gold and 100 year leases. This is how the US amassed so much gold in its possession.

7. The Bretton Woods agreement then backed the USD by gold, at a rate of $35 per ounce.

8. In 1961, the London gold pool was established. It failed a few years later as they could not keep up with the outflows. Here’s a summary…”

By 1965 the pool was increasingly unable to balance the outflow of gold reserves with buybacks.[4] Excessive inflation of the US money supply, in part to fund the Vietnam War,[5][7] led to the US no longer being able to redeem foreign-held dollars into gold, as the world’s gold reserves had not grown in relation, and the payment deficit had grown to US$3 billion.[8] Thus, the London Gold Pool came under increased pressures of failure, causing France to announce in June 1967 a withdrawal from the agreements[9] and moving large amounts of gold from New York to Paris.[4]

The 1967 devaluation of the British currency, followed by another run on gold and an attack on the pound sterling, was one of the final triggers for the collapse of the pooling arrangements. By spring 1968, “the international financial system was moving toward a crisis more dangerous than any since 1931.”[10]“

9. The Korean and then later the Vietnam war happened and the US seemed to be spending like drunken sailors. The French called BS and decided to try and exchange a ton of US for gold. Nixon then in 1971 said, “no” – if you have USD, then you cannot come and exchange them for gold.

10. The Petro dollar system was created in 1974. What is this? “In this new environment of decreased power, the U.S. came up with a new plan to get some of this hegemony back. Nixon and Kissinger sent their Treasury Secretary to Saudi Arabia in 1974 to establish the Petrodollar system. The framework was simple, the U.S. would “buy oil from Saudi Arabia and provide the kingdom military aid and equipment. In return, the Saudis would plow billions of their petrodollar revenue back into Treasuries and finance America’s spending.”

11. As of 1971, all currencies have been fiat currencies not backed by anything. Increased money supply, somewhat controlled with financing national debt and fractional reserve systems, allow a certain amount of inflation to allow for growth of the system.

12. Inflation ran rampant from the 1960s through the end of the 1970s – gold went up 24x, silver went up 29x. To stop inflation, Paul Volcker set the Fed interest rates at 20%, effectively stopping inflation in its tracks. The debt at this time was $300b and stunted growth through the 1980s. By the end of the cold war, our spending had hit $5T to fight the cold war.

13. For the past 40 years, interest rates have been juked lower as “inflation has been low”. This was pretty much the result of when wages became higher, we simply sent the jobs somewhere else where wages were lower. Wages thus relatively remained stagnant for those 40 years while inflation grew at 2-3% per year.

14. In 1980 and 1991, they changed the CPI, or the measure of how they track inflation. This artificially kept inflation reported lower – so social security payment adjustments and government wage adjustments could remain artificially low.

15. In 2008, the Global Financial Crisis hit after years of fractional reserve lending going off the rails. Bad loans were being issued and the paper that backed the debt was worthless in many cases. Watch “The Big Short” to get a good idea of what happened.

16. From 2001 to 2011, gold went from $250 to $1923. This was on the back on 9/11 as a catalyst, but the also had the “dotcom crash” as part of it as well as lots of war spending and deficit spending which increased the debt.

17. To help the “too big to fail banks”, the government created programs like TARP and Quantitative Easing to buy treasuries, etc to keep rates low and steady the economy. This blatant manipulation of the market was to save the financial system – which had become grossly mismanaged. Instead of letting big names fail, they manipulated markets to pick winners and losers.

18. QE finished, a “success” – but meanwhile our debt kept piling up. Our interest rates continued to lower, despite obvious risks. In 2018, the financial market almost blew up with Powell trying to raise the Fed Funds rate. He quickly pivoted. Gold woke up as this was a clear danger signal.

19. Repo market blew up in Sept 2019, signaling banks no longer trusted each other’s collateral.

20. The zombie virus hit, locked everyone down, and 2 weeks became 2 years as the only way to save a system then became printing money like more drunken sailors. The whole world did it. As if a tandem jump with a parachute, each country took turns further debasing their currency against REAL things. $6T spending bills. Double the fed balance sheet to $9T. QE at $120b per month for YEARS.

21. For months, Fed chair says “inflation is transitory” and after 8 months of that, conceded it is here for some time, then tries to gaslight people into thinking he actually knows when it will end when he hasn’t been right on any call, pretty much ever.

22. Russia invaded Ukraine. Most see tanks. Few see the real currency war at play. Russia tends to supply the world with a LOT of stuff. So does Ukraine – like food. War started just as winter was coming to an end and the would-be planting season to start in Ukraine.

23. Gold spikes on war, but quickly many realize that most commodities have already been suffering the effects of the worst inflation in 40 years.

24. US sanctions Russia using access to the SWIFT system and USD as punishment. Other countries then see the US just weaponized the world’s reserve currency against Russia. US appears to have a strategy to strangle oligarchs into ousting Putin. Putin seems to have a plan to weaponize commodities to take down the West’s banking systems and USD hegemony.

25. Sides are being taken.

////////End of break

Where we go from here

I do not think it’s wrong to call this World War 3, but not as the way you would picture it. I believe what you are about to see is a mix of…

- kinetic war (Russia vs Ukraine) and possibly China vs Taiwan

- Currency wars – USD hegemony at stake.

- Cyber wars – if you can deprive your enemy of the ability to communicate and send signals, you may dominate warfare.

- Space wars – we have supersonic missiles and a Space Force

- Propaganda Wars – both sides have their fair share going on

- Commodity wars – the paper-backed Western exchanges versus the Eastern-backed physical exchanges. Russia has been a student going back to 2004 on how the West manipulates metals prices.

- Market wars – If they can take down the dollar, how are our companies valued relative to other things?

- Trade Wars – you have the Chinese belt initiative at play with Russian commodities looking to sell in gold

All most see are the tanks on TV. And, right now, you have sides being chosen. Some of these sides may flip.

Side A – US, Canada, most of Europe, Australia, Japan, South Korea.

Side B – Russia, China, India, North Korea, South African, Iran, middle east, Turkey, Venezuela, Cuba, and many South American countries. I think a lot of African countries rely on Ukrainian food and are influenced by middle east oil/money – with heavy Chinese influence.

Side C – undecided – the rest of the world who just want to get by.

Here’s how this can play out…

- IF Russia is backing the ruble with gold, AND it is selling oil in gold, that then prices oil in gold for outsiders. IF an arbitrage exists for countries to buy Russian energy with gold, they will buy gold and flip it for oil, saving a lot of money.

- This can re-price gold to whatever Russia wants it to be. My guess is this was decided well beforehand and also my guess is Putin is pushing a number that is “do-able” to the West and not meant to break all of the markets. Meaning, 50-75 barrels could crack the gold and silver market overnight into a smoking heap of shit, and end that game instantly. There is nothing the LBMA or COMEX can do when everything they have is being bought up in a day – meaning it forces prices up vertically IF they want to exist, at all. Shorts – like big Western banks, get religious experiences. As of THIS moment, they are re-thinking how short they are in gold and silver and contemplating an exit strategy next week.

- Ukraine will be broken up – the eastern provinces will be neutral. Crimea will be Russian. Ukraine will not be NATO. That seemed to be the kinetic objective, all along.

- The dollar is no longer the world’s reserve currency. Remember above, about the Petro dollar? The agreement was for the Saudis to buy our debt, and we buy their oil? I just saw the debt they buy from us has gone from $180b to $100b. I see we only buy 9% of their oil. China needs a lot of that.

- Much of the world will start to buy commodities from Russia and Side B in gold, IF they want to trade with them.

I’m probably wrong – but I think the objective the entire time was to force these sanctions to then “back Russia into a corner” to do this with currency. In this case, they are not the aggressors, but responding to a counter-attack. This is a “measured response”. If they wanted to escalate, it would be 100 barrels per ounce of gold. My guess here is this forces the world off of the Petro Dollar.

End of conflict.

Maybe I’m seeing this through the eyes of gold only, but if you wanted to remove the dollar as the world’s reserve currency on YOUR timeline and prevent a smooth move to a digital global currency scheme the WEF likes, then this was your opportunity.

The aftermath…

I think the kinetic war above isn’t going much longer. I think it’s been leverage to get the territories he’s wanted all along – and get NATO away from Ukraine. When I did this map a few weeks ago, I understood WHY the attack happened. I’m not condoning it, but the West made promises that NATO would not move ONE INCH EAST.

The map above in red shows former Warsaw Pact nations that are now NATO. The blue was still non-NATO and bordered Russia. In 2014, I read that there was an ousting of a Russia-friendly PM to put in a Western-friendly PM. Around that time, Russia took Crimea. My guess was it was to secure the base, and if the PM was western-friendly, then that base could be seized by the West at any time.

It’s sort of like if Russia asked Mexico and Canada to be part of the Warsaw Pact. Look what happened with the Cuban missile crisis?

So where are we going IF this is the path forward? Edit (3/26 noon eastern time) – ZERO PERCENT CHANCE ALL OF THIS COMES TRUE. I add things like this to identify POTENTIAL RISKS so someone can understand impact and likelihood, THEN choose to AVOID, ACCEPT, TRANSFER, or MITIGATE. You need to write your future, for you, but understand how the items above COULD affect the below. I, nor anyone else, has a crystal ball.

- Lots of more inflation about to hit the US. We now have $30T in debt, not $300B. We just raised the Fed Funds rate to half a point and the stock market looks like it’s ready to head to the gutter.

- Dollars from across the world will come crashing back. If the ruble gains a lot on the exchange with the dollar, and the petro dollar system is over, no one needs to hold USD. As the USD devalues, people will send them here by the truck loads trying to bid up everything. Hyper inflation is not out of the cards IF our currency devalues that quickly.

- Our stock market may melt up – or melt down. Could depend on the stock. Since dollars may flood here, some may buy into things like Boeing. But overpriced companies that rely on semi-wealthy people to buy expensive goods like Tesla, might have a problem. Car companies might end up being bid up and taken over. Some companies that are zombie companies may melt down as interest rates will go vertical and cost of capital is too much.

- Our dollar will no longer go as far as you think to buy foreign goods. Meaning, the avocado you buy for $1 may be $3 now. Food prices may go vertical. Anything you buy in Walmart made in China will go vertical.

- The West will have to also use gold to stabilize price increases. USD will flock towards gold and it’s possible that in USD terms, gold does a moon. You won’t be able to buy it at coin shops.

- Food prices will cause a lot of civil unrest in a lot of Western nations.

- Credit freezes, as rates go vertical and no one is lending anyone anything unless you have perfect credit and collateral.

- Demand slows. Inflation slows. Unemployment recedes as we start to build stuff here cheaper than buying it overseas.

- We bring factories back. We drill oil. We mine our own minerals. Our fractional reserve system is defeated. We may have inflated out of a lot of our debt due to using a lot of the gold reserves we have.

- The US goes back to a production powerhouse within 10 years and we’re back at the table. We have a stupid amount of skilled workers, educated people, and resources. We just chose to not exploit them in favor of giving them dollars. Local supply chains reborn and trade balances resume.

Q&A

I got a bunch of comments in the tweets and a few had the same type of comment. I wanted to address these here and point to this post rather than re-typing 140 characters.

- Nate – Is the central bank giving you gold for rubles? If not, it doesn’t mean the ruble is backed by gold.

Russia just designed a better mouse trap than the “gold window” we think of. We think of a vault, then someone walks up and says, “here’s my 5,000 rubles, give me a gram of gold”. That isn’t what they designed. Now, it is very possible someday that is what occurs. Right now, what you are seeing is VERY similar to the 1933 gold confiscation act above, where the govt gave $20.67 and then at a later time, after they had collected a lot of gold, re-priced it to $35. This is sort of like that, at this stage.

What they have just done, which the US never did, was then go one step further and peg the value of oil to gold. This is the key here, which I’ll get to in a second. In my studies, I did a chart where I priced gold to oil using the USD as the converter. IF you just look at the price of oil, or the price of gold, in USD – you get a lot of erratic looking lines over 70 years or so. But when you tie those values of gold to oil, you get almost a beautiful sine wave.

Using this, you can see the RELATIVE value of gold to oil. It comes out to about 1.93g per barrel. The first thing you and anyone else is doing right now is trying to convert this to USD in your head so you can understand what it is worth. That’s the faulty thinking here. you need to understand the price of oil in gold.

So, if I’m a Russian central bank, and I am BUYING gold at 5,000 RUB/g, you then must ask “how many grams of gold is Russia asking for a barrel of oil?” This is what I’m expecting to hear this coming week.

“At issue here Nate, is the CB is NOT giving me gold for Rubles”. Directly? No. THEY DON’T HAVE TO because of the oil pin. That’s the beauty here.

So if I am China, I can use 1g of gold to buy 1 barrel of oil or 5,000 rubles. If I am in China, 5,000 rubles is equal to one gram of gold which is equal to 1 barrel of oil.

If I am a Western power, I need to buy in gold. This is a ONE WAY TICKET for gold to go to the BRICS system. If you are in China, you now know 1g of gold is equal to 1 barrel of oil. Meaning – if you need rubles to buy oil, you can turn in gold. If you need gold to buy oil, you can convert 5,000 rubles. By proxy, 5,000 rubles = 1 barrel of oil.

The window gives out oil. Gold is MONEY in the market place to BUY oil. Rubles thus can convert to gold in any market place because both buy 1 barrel of oil.

Can I go through the drive up window to the CB and exchange 5,000 rubles for 1g of gold? No. I can’t do that here either – but I can go to an exchange and use a FLOATING CURRENCY to buy gold. The issue here is the USD is a floating currency and thus has no value. And that is what is exposed here.

The RUBLE becomes one of two ways to buy Russian oil. The other is gold. Then ask yourself how long until Iran, Saudis, etc start asking for gold and not USD. IF you want their energy, you must bend the knee to their terms.

The petrodollar ensured we’d buy a lot of Saudi oil and they would buy our debt. They no longer need our dollars. That is now dead.

And the Euro? Looks like you can’t buy Russian oil with the Euro either. Or Yen.

Who kicked who out of the monetary system?

Follow me here. 5,000 rubles = 1g of gold = 1 barrel of oil (I have no idea what the price in oil would be, using an example). As long as the CB backs one of them with either of those two, they are all equivalent value in the market place.

No run on gold window. Ever. Brilliant.

2. But I did the math and this comes out to be a $1,400 gold price. What gives?

First, I believe the problem here is you converted the ruble in today’s currency exchange to the dollar. Not a great idea. Let’s go back to the above, and use 1.5g of gold per barrel.

31.1g of gold per ounce which can buy you 20.73 barrels for an ounce at a cost of 155,500 rubles

Today, the price of oil is $112 per barrel for WTI, right? If you look at what the Russians are offering above, you see $2,321 for the gold equivalent of 20.73 barrels of oil.

This is what Luke was saying – I’m just spelling out the math for you.

Here, you then buy an ounce of gold for $1950, buy 20.73 barrels of oil from the Russians, then turn around here to sell the oil in USD for $2,321. You just made $371 off of that arbitrage.

That was one ounce of gold. Now, if you are able to do that a million times a day, you can make $371m a day.

At issue is when you hit the bid to buy a million ounces a day, a funny thing is going to happen. Price is going to keep going up in gold until it doesn’t make any sense to do the arbitrage anymore. That could be days or weeks until that price matches what the Russians are selling the oil for.

What just happened, without you realizing it, was the value of the dollar just went down against gold, as you needed more currency units to buy that one ounce of gold. The Russian rubles didn’t move. So the dollar may have lost 25% against the ruble in just a few weeks.

The main issue is everyone wants to convert rubles and gold to dollars instead of gold to oil.

Of interest, I want to see what they set oil at in gold price. I have heard he is happy with “$50 per barrel”. This gives the Russians a nice profit, and the Saudis – but shale oil costs $60 to produce. If the Russians can put the price of oil in 1g of gold, that is roughly a $60 barrel to us today. But if we do the math above, that could put gold at….

Let’s go back to the above, and use 1.0 g of gold per barrel.

31.1g of gold per ounce which can buy you 31.1 barrels for an ounce at a cost of 155,500 rubles

Today, the price of oil is $112 per barrel for WTI, right? With 1g per barrel, you see $3,483 for the gold equivalent of 31.1 barrels of oil.

Now, imagine that arbitrage? Pay $1950 to then flip that for $3,483? That is 1,533 profit for each ounce of gold bought. Think about how the ruble then advances against the dollar in that situation where you now need $3,483 currency units for an ounce of gold…but you still only need 155,500 rubles.

THAT is the type of stuff that will break the LME and CME.

Now, Monday is Opex. Imagine if you will, a cliff dive Sunday night as we have seen many times – and just as gold is taken down $50 and silver taken down $1, on no news – imagine Russia announces they will sell to “non-friendly states” 1 barrel for a gram of gold, as much as they wanted. Just as all of the banks are max short.

Here we have the banks about to get their asses handed to them in silver – let’s not forget the 1.2b oz short that BoA now has…

And this is followed by how their asses are handed to them in gold at 8:30 AM

I hope these people are religious, because 1929 has nothing on what is about to happen to these folks.

3. But Nate – gold and oil are too volatile against each other. This will never work!

I’m not saying this is the endgame, but they appear to be clear building blocks in a plan to build this system out. What I used in my oil/gold measures above were the yearly closing costs on Market Watch to smooth volatility. COMEX gold smashes affect prices as well as oil to -$37 on hedge fund gimmicks. The “Western” price controls are going away with this models and here’s how this could work.

Ruble to gold, constant.

Gold to oil, vary.

Oil at the “gold window” of CB.

Meaning, if you are selling oil to Germans at 1g per barrel, and supply tightens, next month price could be 1.03 gpb. In times of tightness, people may cut back because the price in gold gets too steep. If the price goes low, people may consume more or stock up to push price back. My suggestion here is pricing oil in gold will allow for market variances with contracts and avoid a “gold run” at the “gold window” which happened to the US. The mistake there was a direct dollar to gold pin with no allowance for variance in energy costs and war – both inflationary.

Over the course of the next 50 years, it will be harder to find both oil and gold. So their relative values may be intertwined – which then allows for market participation and arbitration to steady the market.

Example, today I buy 1,000 barrels of oil on the blockchain with Kinesis (example only). I own the rights to these 1,000 barrels, and they cost me 1 KAU (1g of gold). If you see price of oil going to 1.25g per barrel, or 1.25 KAU, you can sell your oil for gold which then allows you to profit off of this market structure and allows for steady supply/demand fundamentals.

When oil is being sold on the blockchain, it is REAL oil, not a paper promise. I believe there still is a place for the COMEX to hedge, but this will remove 95% of the paper shit and allow for proper hedging – and COMEX would not be a price maker, but a price taker, so if you paper short the market in futures, you are simply hanging yourself and not driving price down. The arb then exists with an immediate physical market to buy that and blow you out of the water. COMEX in this model would be checked and balanced to a legit hedging platform and not a price smashing mechanism of all commodities it has become.

All of these commodities going up are not “going up”. They are re-pricing to the amount of fiat shit in the in system and you are seeing the values of dollars and Euros going down in real time against real things.

Not many people really grasp what is going on, but the people reading this far have probably 80-90% of the puzzle where 99% of the masses are watching “Real Housewives of Allentown, PA”. Clueless.

This is where the opportunity lies, I believe. And this is what many of the high end bankers realize is going on – but they may double down and bet that someone takes out Putin before this happens. Make no mistake, this is a war far beyond tanks.

March 25, 2022 at 8:47 pm

… and silver might do what, in this scenaro?

LikeLike

March 25, 2022 at 9:49 pm

Your analysis was going very well until point 8, 9 and 10 “back to the table in 10 years” – I don’t buy it – and wages? they would have to go down as those of China or Mexico – the standard of living would have to drop drastically – Unemployment recedes? people don’t want to work, they want IBU – “cheaper stuff” – “We drill oil. We mine” etc, etc, wishful thinking –

LikeLike

March 27, 2022 at 10:37 am

Exactly. US has been losing competences for what, three decades straight now? You’ll need literal generations to build that back, on top of existing civil divide.

LikeLike

March 26, 2022 at 12:27 am

Silver most likely at first will lag gold and perhaps drop to a 120:1 or so gsr at the very beginning but then rapidly catch up as people realize what is going on as commodities will start to reprice to gold’s new price. So perhaps silver overshoots and hits a 30:1. At $3,400 gold you are seeing a $100+ silver price in that scenario.

LikeLike

March 26, 2022 at 12:30 am

Cy – my grandmother is 95 and lived through the Great Depression. I have read up on the 4th turning a little – not an expert. I believe some hard times are coming again. They got through it. They just needed to understand needs versus wants, reduce waste, save, do what you can with your own hands, and build community to lean on. We have lost all of that in this country and the glimmer of hope I have is that whatever bad may happen- which is not certain-that we come out of this as a stronger, resilient, and more grateful society for what we have. So much needless waste and taking things for granted.

LikeLike

March 26, 2022 at 7:23 am

The banks getting burned actually may make sense. Lets not forget JPM has the most physical silver out of anyone so they win either way even if their shorts get crushed.

LikeLike

March 27, 2022 at 1:35 pm

Does this scenario slow or stop the “cashless society” movement?

LikeLike

March 27, 2022 at 1:38 pm

Eurasian Economic Union website had a section on a proposed “basket of currencies and commodities” backed international settlement unit, sort of a multinational multi-commodity grc alternative on their official website for a few days, with a pilot end of march. it was removed for some reason. I do not have a copy of it, if anyone does, can you post it?

it could be that the timeline was too aggressive, or it has been nixed. So, while I like your post, RUS may not be doing this alone and it may not be just gold if that basket-alt-grc has not been canceled.

Is this tied in anyway to the PBoC’s digital currency and the SPFS? I believe so because all of this seems planned out and as Kissinger said “Who controls the food supply controls the people; who controls the energy can control whole continents; who controls money can control the world.” China will be partner to this somehow and I expect their digital currency work to play a role.

LikeLike

March 27, 2022 at 2:02 pm

Tony – I believe their timeline for cashless society was 2025ish if I had to estimate. This significantly speeds up their timetable I would believe. It’s sort of a race now. Race to get to new currency while trying to force oligarchs to get putin out at the risk of gold taking over world dominance from the dollar.

LikeLike

March 28, 2022 at 1:02 am

Where would the BIS CDBC and Project Dunbar type work fit in to this gold-oriented world? Are they part of this move to gold?

LikeLike

March 28, 2022 at 1:03 am

Typo: BIS CBDC

LikeLike

March 28, 2022 at 11:36 pm

You all forgot one big factor in this whole thread from the writer to the comments, Who is the Chess board Maker and who is the Chessboard mover of the pieces? He is getting rid of the evil that has controlled the world since Babylon and before, This isnt his first rodeo since He created everything. the World is about to be re introduced to the one who is neither dead nor sleeping! His signs and Wonders will be Astounding to the masses but to me it will be Magnificent! He is God and He does control all things. HE sets up Kings and he removes kings, Man makes his plans but GOD gets his way! I am enjoying the movie because i know the movie maker and i even know a few secrets he has planned since 2012, Millions will know and hear what I know when HE makes his move with His bargaining chip and His Trump card that is still in His hand and he will play it when and where He chooses.

LikeLike

April 6, 2022 at 4:31 pm

Thank you for stating the REAL KING – GOD. I totally agree that no matter what man’s plans are, no matter how evil, may prosper for a time. But ultimately, those who believe in God will have ever lasting life, and what is more important than that!

LikeLike

March 29, 2022 at 5:29 pm

Nice job organizing this timeline Amigo….IMO, TPTB have 2 options. #1) Pay the man (maybe even as a delaying action) or #2) Go to War. However, as you alluded to, if they open this door and agree to his terms, then other countries will now have the courage to kick the USD to the curb. The Evil Empire used the Death Star to destroy planets and I suspect, those in power now would choose option#2 in lieu of giving up their power (especially if they are elderly).

LikeLike