No.

When I started REALLY looking into this last summer, and we were all seeing the massive deliveries, many YouTube hosts I watched were all hair on fire like, “this thing is going to explode!”. I joined in! It was fun to think of this thing like a smoking pile of wreckage falling apart.

It’s not going to play out like that. It will play out in a different way, I believe, and this is the way I had detailed in my early Feb piece. It’s not so much that “the COMEX will default” as much as it is….”I have the metals I just sold on this contract, but I don’t want to give them up. I can’t find them anywhere at this dog shit price on the open market. I’ll wait a few days or weeks until price lowers by the daily shorting and try and scoop up some then to deliver. But I am NOT touching my pile”.

See – this is the story that has been playing out since last summer that I saw with the patterns. It was the immediate mass delivery on day 1-2, then a cliff drop off of deliveries. This is what it looked like for March – as I tracked every day. Note that I circled the first 3 days where 36m oz were delivered, out of 58m for the month – and then nothing.

What this shows me is there are indeed some people that are selling and handing over their metals. This day 1 delivery was a little higher than I’ve usually seen, percentage-wise. What Bix Weir reported was that 15m of this was Goldman selling shares as a participant of SLV and then handing over. MY take on this was this was a risk-driven trade. As many of you have read my work over time, I highly emphasize “where the hell are the risk departments”. I THINK what happened was SLV changed their prospectus to say “all the silver MIGHT not be here” after the 110m oz in 3 day debacle, and from that, Goldman’s people said, “take it out, while you can”. To ME that seems to be the only reason Goldman would sell 15m shares of SLV. If most metals desks everywhere are thinking there will be a stronger silver price in 2021, why the hell would you sell 15m oz if you might get 50-100% more for it in the months ahead?

So to me – what you can see by these monthly deliveries is a constant drain of the COMEX. If you look at the red number in the box on the bottom right hand side, you essentially saw 26m oz leave the COMEX from 22 Feb to 27 Mar. This is today’s report I sent out. Check out the red number.

This has us about 11m oz less on a NON-delivery month where you have seen only 6.9m oz for delivery. And REMEMBER, that delivery can stay within the vaults and move to someone else’s ownership in the registered, or move to longer term storage in eligible. But, ELEVEN MILLION OUNCES left the building.

We are now close to 40m oz down in the COMEX in about 2 months with another delivery month coming that could be another 60m oz. Could another 20-30m leave the COMEX? Possible.

But here’s where all of this is going. This isn’t about the 400m “shorts” collapsing. I’ll get to that. Most people associate the 300m or 400m short number with “naked short”. No. I trust that it’s there. I don’t think this is highly disputed by the people who tell you this number.

At issue is….THEY DON’T WANT TO GIVE IT TO YOU.

David Morgan has called this “showroom floor” silver. You can CLEARLY see 117m oz in the registered, ready to go! Yours for the taking!!

Not so fast.

What those reports show you that I put up are that the metal IS there. So if the metal is there, why not just hand over all 60m oz on day one and be done with it? Because they don’t want to give THAT metal to you. What they WANT to do is get cheap shit on the spot market and give that to you. Or, they would just hand over what they sold to you.

Imagine a scenario where there is a contract sold at $26. You have the 5,000 ounces. You don’t want to give it up. You know there’s an options cycle where banks punish spot price. You know you can count on one of the “trusty 8” to spoof during the week. Maybe you think you can buy this for $25 and give that away. I’m not going to pretend I know all the mechanics here, and I’m sure the technical people will light me up for missing the 40 step process. Take the 50,000 foot view here folks. If I have the metal, on day one, why isn’t it just handed over? I’d like you to consider they are trying to source it at lower prices, by other means, so they can acquire this cheaper and hand THAT metal over to you.

By doing this, it protects THEIR hoard they can then short with all over again. “Run the stops” they call it.

The end game

No one knows the date, time…or even MONTH this will “break”. But what I THINK this break is going to look like comes down to constant drain on the sources used for shorting. Remember, the COMEX above is one source – but perhaps the SLV is another source like the Goldman example above? If Goldman has taken out – perhaps others have as well? I wish I could find an SLV versus PSLV chart that was handy – but you could clearly see the COMEX registered and SLV in a healthy downtrend and PSLV going up.

We also feel perhaps that many of these mints like Perth may be rescuing the COMEX, of sorts. Many of these unallocated programs which are trying to tell you the silver dust on a broom in a factory is part of the working inventory probably should have had some sort of smaller piles at the ready for immediate disbursement within the 10 days. Either people took it, or banks took it. And all of these mints seem to be out of metal constantly now – which people call “in the wrong place”.

So I also call bullshit on that. Yesterday, I piled in to a conversation with I think Monetary Metals? They had basically written a zero hedge article stating they see no silver shortage, and you can buy as many 1,000 oz bars as you want from them – at 5% markup. Back of the napkin math, that puts you at $1.30 premium. I also saw a post from Silver Bullion who said they have no problem getting bars. I asked about their premiums and I believe in the conversation I saw their “best tier” price was 4.35%. Please correct me if I’m wrong on this. That’s a $1.13 premium. I had a follow up question asking about “why the high premiums” and essentially they told me that was a markup from the refinery. So let me get this straight – from what I understand, in “normal” markets, you might see a $.10, perhaps $.30 markup on 1,000 oz bars, but now you are telling me there’s “no problem” finding them, but we are just going to charge you a 10x premium? Wouldn’t that suggest that the market is tight? Please, explain to me like I’m a 5 year old why market experts tell us on one hand that a “normal” market you might have a $.20 premium on 1,000 oz bars, but now it’s over $1 and there’s nothing to see here?

Where I’m going with this is that this could end very, very, very horribly for a lot of people.

In early March, we had the 10 year pop up which delayed any form of doomsday scenario as this kept gold in its place. I think everyone felt gold needed to have a move to then unleash the hounds with silver. But the 10yr just sort of delayed, and now we are back to your regularly scheduled program.

The mockery is heating up from Jeffery Christian. Kitco and others are now marching out disinformation to discourage people from investing in silver. The paper shorting games are breaking many of your souls. That is the game they play and their idea is to try and delay as long as possible to get the goldfish and squirrels to run along.

We are seeing articles about how there are 5 billion ounces out there, and there’s no shortage. But, they continue to leave out the qualifier “at this price”. At $200 silver, it will be falling from the rafters. At $26, not so much. This is how we see backwardation and $1.30 premium on 1,000 oz silver.

The end is near. Near is also a relative word. Could it be this week? Not likely? Next week? Probably not then either. But it’s coming.

If you go back to my metrics, I am showing that we are on the precipice. PLEASE tell me where I’m wrong below.

Just like in my February piece, there are 4 phases that are going on, but here’s how this COULD play out this month in the COMEX. Some of the items on here you could argue one way or the other. This is a BIG PICTURE look at the markets.

The first few days, we may see the 25-30m physical ounce delivery. Could take COMEX inventories down another 15m. While we may ASSUME the big 8 have their metals, maybe there are millions that are naked short and sold at $24.50 and now they have to source in the open market at $26 plus $1.25 premium? Ouch. So this could be soon in May, as price goes up for this event.

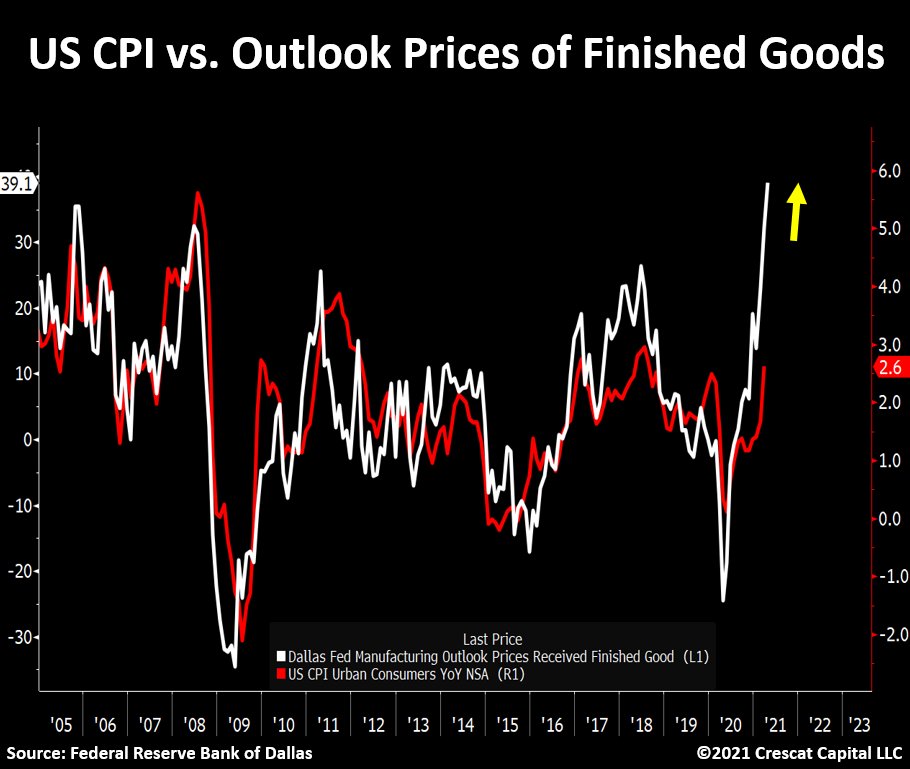

John Lee has felt $27.50 was a few trading sessions away, and this might be the catalyst. He says after $27.50, look out. Now, he doesn’t have a crystal ball, either – but what $27.50 now has that it didn’t have in early March is a CPI at 2.6% and the widespread adoption that inflation is now a big deal.

This chart posted by Tavi Costa yesterday to me speaks of what is about to happen to silver and gold, at any time.

You all need to read the entire thread here.

What this suggests is the CPI, if reported authentically, could be rising to 6%? This would also suggest the 10yr will have to rise, a lot. The fed doesn’t want that, and will indeed do yield curve control. This was also part of my article that suggested that end of March was doomsday unless things like this popped up. But now we are getting there.

This type of chart will be popping up everywhere, and SOON. Dinner table inflation is now here. Something I think I heard Larry Lepard call “shrinkflation” is here – where they charge you the same amount, but you get less. Everyone is now hearing stories of all of the supply chains breaking down because you can’t get employees.

There will be a realization that if you want these employees to come back to work, you will have to pay more to attract them off of their couches. Which is NOT taken from the wallets of the owners, but passed on to consumers. Forcing prices even higher. So – inflation 1970s style is here for a long time.

But Powell says it is “transitory” and they have “tools”. I want you to go back and watch interviews with every single Fed chair after they left office. They basically say, “I had to say that. Company line. What was I going to do, tell everyone we have no idea?”

They have no idea.

So inflation is coming, and hard, and the yield curve “management” leading to “control” will make negative yields go MORE negative. More growing concern about inflation…..what to do?

Of interest, in this country the ones with the most money are the baby boomers, who lived through 1970s inflation and all remember how gold and silver went bananas.

You have all of this money. What do you do with it???

- equities – everything is way overvalued. Tesla at 1150x P/E ratio. Any money I park here could do a cliff dive. Everything is over valued.

- real estate – housing prices continue to skyrocket. Prices are way frothy. Housing market could blow up again like 2008.

- Commodities – everything like wheat, corn, lumber – all of this stuff at record highs.

What is UNDER VALUED? Gold, silver, and the miners.

So we now have a culmination of events brewing:

- May buying on May 1st (Saturday) could have the same gap up on Sunday night we saw at the beginning of silversqueeze. This could be a tailwind. The big move Sunday night could be knocked down then on Monday, but tere may be a good amount of momentum with this.

- Widespread acknowledgement of inflation which may significantly rise will start to get boomers to recall inflation and go to gold/silver.

- REAL yields will continue to get lower, and trading algos will start to side with gold

- Gold/silver 8 month consolidations now healthy for major liftoff

- Gold and silver severely undervalued as an asset class – against LITERALLY EVERYTHING else. THIS IS the last place to find value, and the spigots are about to turn on, and hard.

- COMEX inventories drained 40m oz in 2 months. Unclear how much longer those who are giving up silver actually want to give it up. It’s possible that with everyone seeing rising prices, early May deliveries we do NOT see 50% delivery on first day.

- Possible BASEL 3 implications for gold and silver by end of June requires a lot of “squaring” of the books to untangle possible unallocated positions.

- May has WallStreetSilver billboards coming out (I should still be on the top 15 list for donations, BTW). We now have 64,000 silver enthusiasts. Could this number go over 100,000 with this campaign? Imagine 100,000 people continuously and at all times taking retail off of the shelves. Buying PSLV. Buying Kinesis.

- Supply chains are falling apart everywhere, and this has risked mine supplies, refinery outputs, etc. It is LOGICAL to assume a MAJOR industrial player may have problems sourcing silver in May. This MAY NOT happen, but it is POSSIBLE.

- It is POSSIBLE more come to the COMEX in May for “in month” deliveries. With the new 3,000 contract position limits, a single individual COULD come and demand 15m oz. This could be devastating to those who are selling this on registered and do NOT want to release it. Just ONE whale could throw this whole thing north of $30 in a blink of an eye. No Hunt brothers needed.

- For me – the BIG deal is OVER $30. The ABOVE items can contribute to this. IF we get north of $30….it is GAME OVER.

With specific regards to the COMEX, I just don’t know the date or time – or inflection point – where whoever is selling this at $26 decides…”yeah, I can’t let this go at $26 because price is now moving”. And they will try and source other places to hand over those bars. Could this go on a few more months? Sure. But the end result is the same. The longer it goes on, the worse it gets for anyone short (BoA???)

Hold the line my friends. We are the LAST group it seems to have cash thrown at their industry. And because of that, and the low prices, we are a “value buy” at this time, relative to literally everything else.

Your patience will be rewarded…

So will the COMEX explode? No – but every ounce that comes off of the COMEX, the more pressure applied. Given all of the macro circumstances going on – it does seem even a marginal price up over the next week or so will put extreme pressure on naked shorts who sold at $24.50-$25. This could start a chain reaction and one of these days they will lose control of this whole thing. Don’t worry about the day to day monkey hammers. Step back and look from afar. Your day is coming.

April 28, 2021 at 2:49 pm

One question I have in regard to the “silver shortage vs. no shortage issue” — what is the significance that approx. 90 million oz. of silver were added to the Comex from late May 2020 thru late February 2021? Is there anyway to know where that silver was coming from?

LikeLiked by 1 person

April 29, 2021 at 4:10 am

The logic of not willing to give “away”, say 20 M oz misses me. If I am GS, JPM, or HSBC – I will “gladly” pay $1.30/oz for 1,000 oz bar -just to have extra, say 50 Moz. The problem is that refineries are tapped all out (probably 100%) – so there are no more sources of silver @spot (see Perth Mint). What is extra $65M to a bank like this? Not too much – they can borrow (primary dealer) at 0.25% from the FED. BY keeping the price of $Silver in the channel, say $25-27, I showed earlier they can make $2 B or so/yr . So what is $65M? A decimal point in earnings. The more realistic explanation would be – they MUST have the registered Silver on COMEX – so they can short painlessly against it w/o exposing themselves to naked shorting. And that game gives them $2B /yr in earnings. Yes, this is speculation, but substantiated one.

LikeLike