Uranium target price I think it's silly sometimes when I see some silver target prices out there. I mean, I get it - there's some mental gymnastics going on - and I LOVE silver. It is RATIONAL to see silver... Continue Reading →

Review of Ted’s 800m silver short claim by BoA – new evidence from OCC sheds light on the discussion

Summary: The OCC report does NOT contain gold, as Ted and Bix have claimed all along. Derivative contracts appear like they could be double counted if one of these 4 banks is the lessee and the other is the lessor.... Continue Reading →

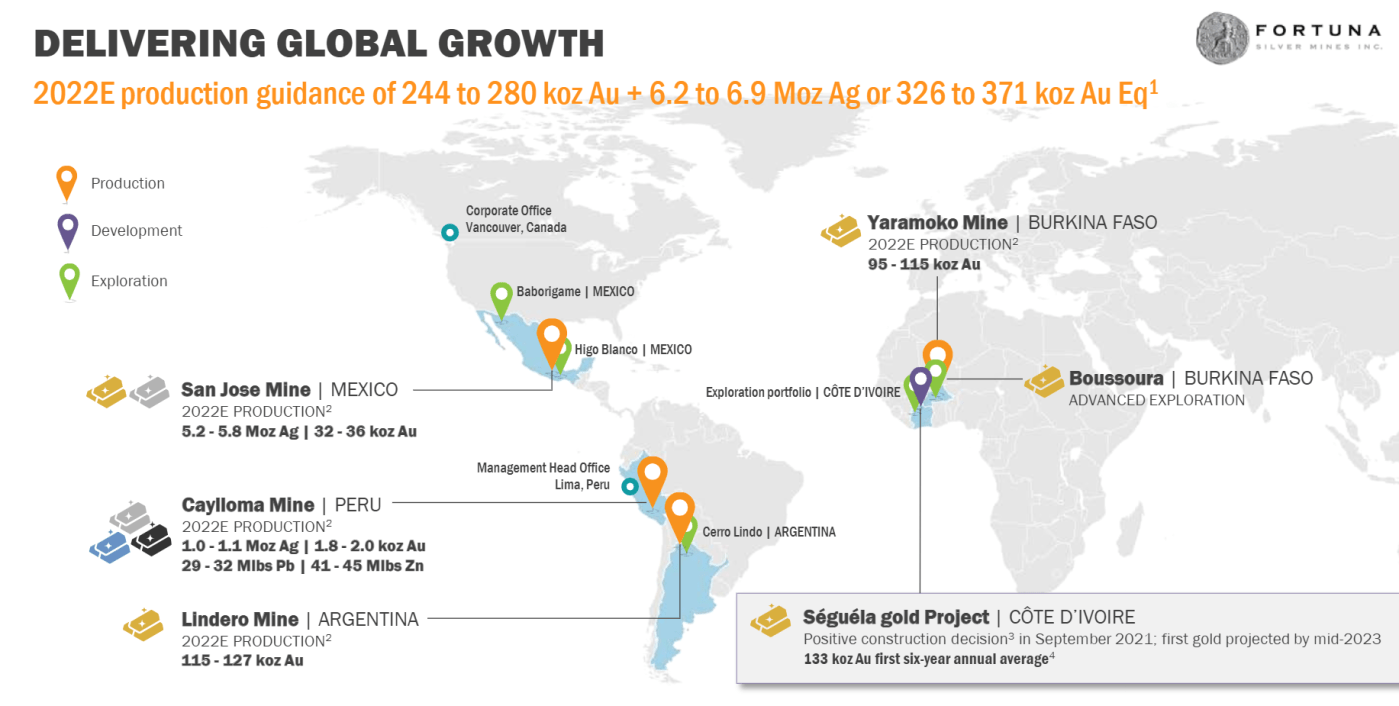

Summary: This is a former silver-miner-turned-junior gold miner with 500k AuEq oz by next summer with diversified assets in many countries. It is significantly undervalued to its peers, and with a potential for $2200-$2500 gold price inside of 12-18 months,... Continue Reading →

In my article this yesterday, I essentially postulated that it is POSSIBLE they really might burn the stock market to the ground to save the dollar. But then I touched on a concept that I wanted to have as a... Continue Reading →

As metals people, we are already contrarians. Right now, I'm seeing lots of comments like: "The fed is trapped!""They can't let rates go up!""Once the hikes start, they have to reverse course!" I don't really disagree with much of the... Continue Reading →

I don't have a magic wand. Nor am I about to mine asteroids. BUT I am seeing one country after another shutting down coal and nuke plants, getting 10x energy prices in cold months - and now having all kinds... Continue Reading →

I took this idea from Tim Pool last week. He was basically saying there is no right or left. There is no democrat or republican. "There is only libertarianism versus authoritarianism". I wanted to bring this up in the context... Continue Reading →

I wanted to write this article to help the community get better information by asking more and more questions. Not provide the answer. Often, we see an article like Ted's come out, take it as fact, and spread it all... Continue Reading →

Recent Comments