In part one – we covered the very basics of understanding net worth to start your program. Talked about the accounting equation, and paying down debt. Lastly – I suggested a strategy of how you can spend your money on what priorities.

From here – I want to pivot to decision making on plans and purchasing. There are quite a few measures – but I want to stick with a simple one of ROI – or Return on Investment. I feel this is imperative to teach this to high schoolers prior to deciding on college.

Here is the formula:

ROI = (Gross Return – Cost of Investment) ÷ Cost of Investment × 100

Let’s take an example here with buying a stock. You paid $100 for the stock. In 2 weeks, you sold it for $120.

$120-100 / $100 x 100

(20/100) x 100

.2 x 100

20% ROI

This is pretty simple. But my mind runs into problems when you get multiples. Now assume we bought the stock at $100 and sold at $300 a year later. Put the numbers in, and you get:

($300-$100) / 100 x 100

2 x 100

200% return. But that is a 3x? So in simple terms, I’d see a 3x immediately and subtract 100. 200%. But when your brain sees 200%, you think it’s a double. A double is a 100% return. You put 100 in and you get 200 back, for a profit of 100.

College

OK – let’s now use this for deciding on college.

Say I love philosophy. I want to study the classics. I get a 4.6 GPA in HS, a 1500 on my SATs. I apply to Brown and somehow I get in. Brown is now $93,000 a year. This – is stupid. But let me walk you through how this works.

How are you paying the $372,000 for a 4 year degree? Cash? Maybe you have an inheritance from your grandfather for $400,000 and this is for your school.

What kind of job are you getting with a 4 year philosophy degree?

This might be harsh, but there’s not really a lot of jobs out there for a 4 year degree in Philosophy. They tell you that you need a PhD to teach at a college.

You are out of money.

You just spent $372,000 on tuition. What is your yearly return? What is your return over the life of your career?

Let’s assume they sell insurance or work as a retail manager or work in sales. Most likely, they are looking at $40-50k a year to start. Maybe $60k if they are somehow lucky. Let’s start with 50k and do an ROI for each year and then the total. We also factor in a 3% cost of living wage raise, etc. Understand – you probably don’t need a college degree to be a barista or to be in sales – or be a retail manager. Often SOME college degree is needed to sell insurance. But you don’t have a ton of options.

What this shows you is that after 43 years of working, he got $4.2 million in salary.

But what if you just put $372,000 in the stock market? Assume 8% returns year in and year out.

This shows if he put the $372k into the stock market, he would have earned $10.1 million over 43 years. AND he could have worked as a retail manager on top of that to make another $4.2 million.

So he inherited $400k and used it for school for a silly major at an overpriced university. Which, is worthless without another $400k for a PhD so you can make $70k a year at Montana South State University in D3.

Let’s change these numbers to make like an engineer, or IS, or something like that. And, instead of going to Brown, we are going to go to Penn State for $19,000 a year. Maybe we commute and the tuition only is like $12,000. Let’s see how these numbers work. Instead of $372k for tuition, let’s look at $48,000 over those 4 years. You then invest the difference (to make $372k to be fair) of $324k into the stock market. Because it is a STEM major, we are going to start them at $65k and have 3.5% raises yearly.

So we have 2 variables:

- major

- cost of college

From here, we then see how our STEM grad fared over the same period of time.

This guy saved all of that money on tuition – so he invested the other $324k in the stock market.

Very similar results to the choice above, but less seed money then has compounding interest hurt you a little.

So let’s review….

So the Brown kid was super smart in high school. He listens to everyone and spends his money on the best education he can get in a major he loves. PSU kid had good grades and a good SAT score. His father is in finance and his mother is in banking and they sat PSU kid down to show him how he would be better off going to a local state school and investing the rest of his inheritance.

What you see is that the career earnings of the PSU student is about 4x of the Brown student.

Here’s another fun fact. If you are trying to be in IT or many other professions, your college doesn’t mean shit. In fact, if you have Harvard and you want to come work for me – it could be a problem. A super smart 22 year old is book smart, but he doesn’t know what he doesn’t know. His IQ and SATs can be a problem in the workplace because often he would think he’s smarter than everyone and not work well with others. And – the Harvard kid is thinking he wants $200k a year for an entry level job paying $65k a year. So – hard pass.

I have 10.5 years of college completed. No one has ever cared where I went. They wanted to know if I had the skills and ability to do the job.

So if you plug in a STEM for Brown, it’s going to be somewhat the same result. Instead of a 4x for PSU guy, it might be a 2.5-3X.

The point is – you wanted to find the BEST RETURN for your inheritance. The best return for that is to go to a state school with a STEM and invest the rest in the stock market.

The problem is – every one of you is on a hamster wheel. You need a 4.7 GPA. Perfect SATs. The right clubs. All so you have the privilege of paying $90k a year for a useless education.

Now…..those elite schools DO have a purpose. Why would I choose those top schools? This is the only reason I would….

- I have a lot of cash, from an inheritance or my parents are loaded

- I want to be a doctor, lawyer, or investment banker

- I will use my performance at this high end college to get into Wharton or Harvard for my MBA or JD.

- I will then use the network at those elite schools to get a starting salary at $250k per year.

When all is said and done, the above is perhaps 7-8 years of college. Probably well over half a million dollars. But in that case, you make half of that money back in your first year of earning! Your break even is 2 years. For the philosophy degree, it was 7 years until you broke even.

Advice: unless you are top 2-3 in your HS class, are loaded, have perfect SATs – go to a state school and commute.

I did this with an ROI calculation. The same can be done with investment properties.

Investment Property Example

I own some investment properties. I also sold one about 20 months ago. On one that is 2 units, I somewhat inherited it and bought it out from someone in 2005 to ensure my grandmother wouldn’t be kicked to the curb. Over years, I have put a lot of money into it, and it is a home run. My AirBnB is now booked up most of the summer. That is looking nice. But I am doing something different than with the other ones.

Let’s just now assume I’m buying a city property. Maybe I know a guy and he wants to settle in 3 days, cash. He might get more if it’s on the market for 3 months. I know that in a few months, there is a major investment coming to the area. People will want to rent there.

When you buy a home to live in, you can buy FHA for 3% down. Conventional for 5%, 10%, etc. Typically I have run into investment homes need 20% down because it’s a higher risk of default. What if your tenants don’t pay?

In the above example, I had saved $20,000 and I had pre-approval for the loan and was able to buy it for a sale price of $100,000. Let’s skip the closing costs, transfer, etc to keep this simple.

This means for a $100k house, you need $20k down and you will finance $80,000. Today, the rates are 6.48% listed. I think it’s well over 7, but I’m just using a quick thing I got online. This shows you that your $20,000 may give you a $4000 cash return every year, or a 20% return. If the stock market returns 8% and bonds return 4% – this 20% is a very good usage of your cash.

However, let’s change some of the variables. Interest rate will be higher, property costs more, rents are lower, and repair costs are higher.

When you look closely at the variables to buy a rental, you can see how it can be very lucrative OR a very expensive mistake. Meaning – if you tell someone you are “buying a rental” that is like someone on December 27th saying they are “joining a gym” right after the new year. You can join it, but the weight doesn’t magically come off. You have to do the hard work. With this investment, you have to be particularly careful about your analysis.

In my experience, this trade has been dead for a lot of years. I was early on this, so I have some sweet deals – AND I did this kind of stuff before I engaged. I will use a yearly ROI to see if I can get a better return in the markets. If my numbers are greater than 6-7%, then rentals I’m cool with. If it’s lower, maybe stocks.

But there’s a different ROI I also use for this type of stuff. Let me give you an example for a 40 year investment with my AirBnB. I will give you actual numbers here. But what is interesting to note is that the ROI early isn’t great. On my other real estate investments, my numbers are closer to 30% yearly ROI. While this sounds fantastic, it took significant capital and MASSIVE risk to do this. In this case, it worked out well. But that ROI? That “excess” I then will use to pay down the AirBnB. So I will inject this as “extra principal”.

With this starting investment, I had budgeted $30,000 closing costs/downpayment. I had also budgeted $40,000 for renovations and furnishings to take a year. This would have required significant time for me to spend there over the year doing repairs – that I could do. For example, paint the entire house, do trim, etc. However, after I bought it – I wanted to start using it and renting it out ASAP and the other half wasn’t happy with my schedule away from home so much over a year. So what I did was “throw money” at the problem. Up until this point, I was using money from liquidating most of my stocks last May. I was worried about a deflation bomb hitting and moved my “financial energy” to real estate debt. So $70k was paid out of my stocks – which then more or less transferred into equity. That is another item I will show you in a minute. But this also means I had a $41,000 overage. This is split between high interest credit cards, 0% interest home depot purchases, 0% bed purchases, and a 12% Home Depot project loan. I am able to absorb this due to the profits on my other units that can pay this down rapidly. So I’m following my rules from part 1 about paying down high interest debt first.

The numbers above to give me 4%? Rough ballpark. Right now, I’m at break even for rents/operating costs, but for a whole year, I’m projecting the rents to average $2750. If they are 2500, this goes down to 2%. But with THIS property, it serves multiple purposes. Unlike my investment rentals that are full time leased out long term, THIS investment has:

- Utility – vacation. Rather than spending $10,000 a year on vacations for 1-2 weeks, I get to live in this many weeks and weekends a year.

- Utility – Pool. Instead of spending $115k on a pool here, $17k of that renovation cost above is for the pool.

- Utility – Deck/roof. At my primary residence, our back yard is a sauna. This place had a deck that I repaired/painted for $300 and tons of tree cover.

- Emergency – mountain home. This provides an emergency shelter far away from civilization if societal problems occur

- Emergency – food/water/energy/shelter. This place has a well with a creek, I have extra food stocked there, I have 8 acres of wood I can chop down and burn and cook. Tons of animals all over the place I could hunt, and a lake 1 mile away to fish at if need be.

Ideally, I just break even on rents/costs. I have projected some profits in this due to having a full year booked out. I only did a partial year last year.

Let’s now do the mortgage amortization schedule. What I will do is pay $2000 a month in additional principal from profits on other investments. So the profits from them are paying down the 7% note on the AirBnB more rapidly. What I will do with this model is then also put in what the estimated value is in the place now and in 30 years. Let’s assume this is a 30 year investment. I put $111,000 into this. What I want to do is understand my net income from this place over 30 years, assuming I pay off the note early. The ROI yearly then jumps when I don’t have a mortgage on it.

So let’s assume here my investment is $111,000. What total net income do I have in 30 years?

The amortization table shows that if I put $4000 extra towards the principal it would take me about 4 years to pay this off. Let’s put this in as “additional investment” so the top number of $111,000 then reflects the investment of $4000 over another 4 years – or $160,000. This $4000 is the rents from all of the properties. The “carrying cost” I am eating which is also additional investment, but not towards the principal. Let’s put that at $96,000 over 4 years.

Total investment now is $111,000 + $160,0000 + $96000 = from all sources. Then for the last 25 years, there is no mortgage payment, but you still have operating expenses like taxes, insurance, utilities, and lawn care.

The sweetener to the pot is the value of the house over those 30 years can go up substantially. While ultimately this is inflation – you can average out all of this over those 30 years to get an estimated year ROI. Earlier on this is much lower, after 5 years, it’s much higher. So I wanted an average for the entire 30 years.

If you just put $255k into the stock market at 8%, you get $2.3 million after 30 years. The problem with that, is I didn’t have $255k at the start. I had $70k or so and the rest was borrowed and injected from profit from other units.

The numbers above are actual. This shows total out of pocket for me over 30 years with investment and operating costs is $642k. But I am estimating $1.6 million in rents. So this gives you an “operating” profit of almost $1 million – but the property itself may increase by $572k.

Overall, it increases my net worth by $1.5 million over those 30 years.

But what you must look at is this. My actual “out of pocket” seed money is the $70k from stock sales plus 4 years of just paying the mortgage out of my pocket, allowing all rents to filter to the principal.

What I am doing is the INVERSE of paying down high debt interest rates. I am championing the items with the highest ROI to then feed the principal on debt at the highest rate first. So this summer and fall, the moneys that will come in will go towards the high interest debt I still have (plus $2k a month from me) – then I have 30 years of collecting profits.

Pool heater and decking

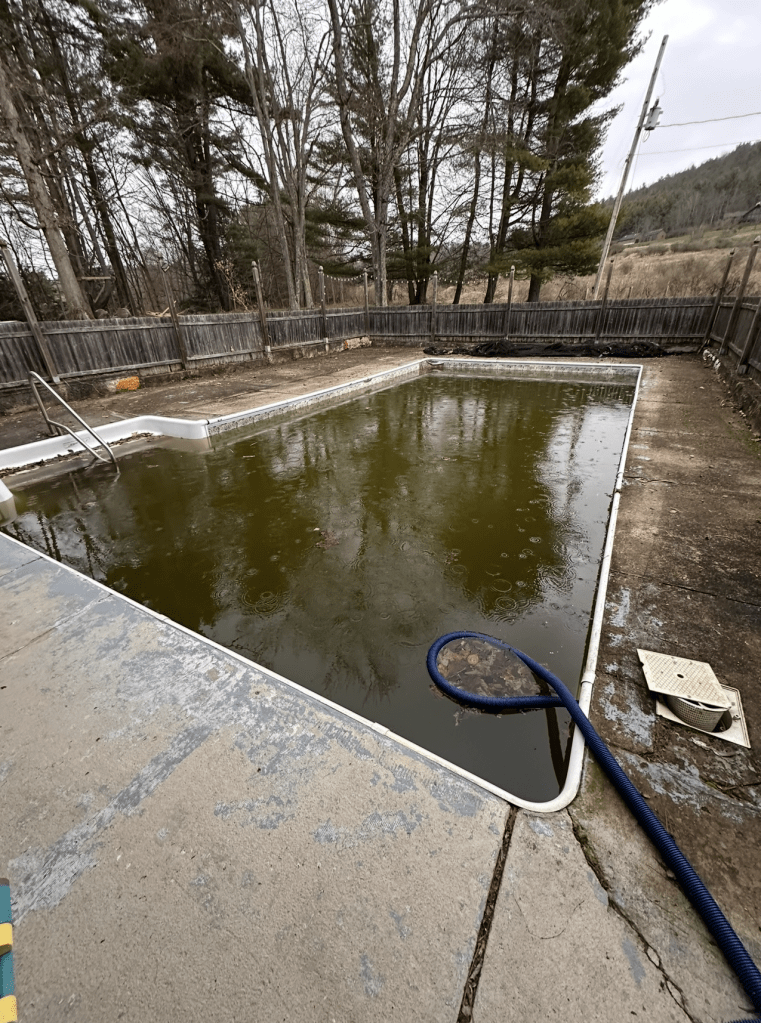

Here is another ROI from a real example. My AirBnb is in the northern PA mountains. This is what the pool looked like when I bought it.

The pool heater is $3000, but with install and gas line setup, might be closer to $5000. I am also looking for an epoxy solution for my concrete problems.

This is the disaster of a pool when I started.

I had bought this from an estate sale, so the owner could not tell us anything about the condition of anything. This is partly why I got a great deal on the house. I knew I was going to have to sink serious money into it to repair it.

What I have done…

- power wash the concrete the best I could

- replaced the fence with a brand new fence with 6′ high privacy and stained it. Did all of this work myself. ($1400 for fence and stain costs)

- Had a liner replaced, and filled up ($9000)

- Added a salt cell, new pumps, automation, and a dolphin ($4000)

- Bought a pool cover ($2900)

So just the pool alone I put in $17,300. A new pool here, with BASIC concrete and BASIC landscaping – along with needing to move a pipe and a retaining wall is about $120,000. I could not justify that at this house. And – with AirBnB – the top thing searched for is “pool”. So this was part of the marketing plan, but I didn’t really factor in all of these pool costs. My budget was $5000 for a new cover and dolphin. So – I really messed up on this.

Here is where we are at now:

The concrete is sort of an eye sore. It is also a risk for tripping. I want to de-risk this as much as possible. I also had to turn away maybe 15 people over the last year who asked if the pool was heated. I had to say no. I thought that might be a $7000-$10000 thing. I had heard it might cost $27 a day in energy to heat.

I revisited that thought recently as I found a Hayward pool heater for the size I need for $3000. The epoxy solution to fixing my concrete is about $13,000. As an alternative, if I wanted to get all of the concrete dug up and re-poured for this, I’m looking at maybe $40,000.

When evaluating choices for a BUSINESS, you have to start with the NEEDS of the project.

NEEDS:

- must fix the tripping hazard – part of this solution is grinding down concrete and fixing holes

- must be non-slip – it is nonslip

- must be durable – this has a 10 year warranty

- must not corrode with salt water – this is safe for salt water

WANTS:

- Aesthetically pleasing

If BOTH the concrete and the epoxy solution fix the issue, you then have to evaluate costs. If the epoxy solution is 1/3rd the cost of the concrete solution, it’s kind of a no brainer.

This is the potential solution….

But how do we calculate ROI with these solutions? I’m going to use the below method:

- How many more days can I rent with a heater than before?

- How would I pay for the heater operating costs?

- How much does this improve my rents from before?

- How much did I avoid in liability?

With this, let’s add all of May, half of June, 3/4th of September, and 1/2 of October. That gives me maybe 12 more weeks of rents. If a week of rent is about $1000 (estimated), then it would take 6 weeks of rents to pay off the heater. This is adding 12 weeks of rental capacity that might be too cold to swim otherwise.

Initial investment = $6000

Benefit = $12,000 more per year in rents that didn’t happen before.

Payback period = 6 weeks.

ROI in the first year could be 100% each year. If the lifespan of the heater is 5 years, let’s look at:

Total investment = $6000

Total INCREASED weeks of rent, over 5 years = $60,000

Total ROI is about a 10x.

As for the COST of heating it, this can be an upcharge just to cover the heat. Problem is – this $27 a day can add up. What if I just ate that $27 per day?

For a week that’s $189 a week or $2268 over the course of the new rents. Over 5 years, that means it is $11,340. What I can do is in those times to rent, I can add the $27 and include heat automatically in THOSE stays. Or, I might be able to “upsell” them. But they probably aren’t renting in May if they don’t have the pool heater. So – it might be more prudent to just add this or a portion of this to the rent. What if they rented for a week and it rained twice? Should they be charged $27 a day for days they didn’t use it? Maybe I use a formula where I only add $17 to the rent for those days. This can then be seamless to the customer, and includes days where they may not use the heat. I can adjust this after I get my first gas bill, but what if this is cost neutral?

Well, if I wanted higher rents, maybe I need to justify it and make the pool “pop”? Maybe this completed pool will increase rents by 20%? AirBnB uses a formula, and with this – more interest in my property drives prices up. This is roughly $22 more per day on average.

Now assume I added the heater so I have more weeks. If I’m booked solid – this might net me $5000 a year in more rents from the aesthetics. This can also reduce the amount of vacancy.

If the solution lasts 10 years, then I get $50,000 in higher rents against the $13,000 investment cost. That’s a 384% ROI.

These solution then are pretty good to approve. One thing I didn’t put on here was “carrying costs”. I plan to pay for these with credit, and use the first rents of the year to pay off all of this stuff over the course of the rental season. So this might add $2000 in carrying costs, but you can see that is somewhat neglible for $50,000 in increased rents PLUS $22,600 over 10 years of having 2 heaters.

Total investments are:

- $13000 for the epoxy

- $10,000 for 2 heaters over 10 years

That is $23,000 investment to get back $72,600. Or overall ROI of 315%, less a few thousand of carrying costs.

But let’s also think about something. If I do NOTHING to the pool concrete, I have a non-negligible risk of someone tripping. I will cover risk in another lesson, but the general gist is this….

Cost of a lawsuit? Maybe $100,000. I have insurance which would pay IF I was doing everything responsibly. Maybe the insurance people say I didn’t address an obvious hazard and this isn’t on them. Well, what are the odds of that happening in 10 years? Conservatively, let’s put this at a 10% chance of occurrence.

When you then do ROI stuff, you are also looking at COST AVOIDANCE. Take the $100,000 and times it by 10% for $10,000. Then split that over 10 years, and my AVOIDANCE is $1000 positive.

At the end – I could also in theory add that to the “what I get back”. So maybe it’s not $72,600 but $82,600. This takes the ROI from 315% to 359%, less perhaps $2000 carrying costs.

Financing and carrying costs

I think this is the trickiest of things people forget with ROI and investments. Dave Ramsey is like “debt is bad!!”

Well, no. High interest debt you carry for years is horrible. However, did you see my “payback period” above? If you can borrow to expand your business, and you can carry this debt for a short time, ensure payback, and ensure it’s a good ROI – then it’s a no brainer. What happens is debt, used correctly, can fund more and more income to the business.

So if I plan on $23k in rents this summer, and I have to carry $18,000 in debt for a short time – I pay monthly interest on that principal. So maybe I am paying back $21,000 from the rents coming in. The risks are…

- what if no one rents? If I build it, will they come? Well, I already have half the summer already booked, so this minimizes the risk

- what if the work is shoddy? Well, you need to work with bonded and insured people. If I do this myself and screw up my pool – that’s going to destroy my rents this summer. If someone else accidentally screws up my pool, they have insurance and it can cover the damage. So – know your limits with DIY when you are talking about business liability.

Home upgrades

This is the part where I am going to catch some wrath, but you need to hear me out – whether you like it or not. So many men hear things like – “we need a new kitchen” or “we need a nice deck”. Often – they have a lot on their plate, and they are pressured to do these upgrades to a home.

Here is the problem. How do you pay for it, and what is the payback and return? I’m going to use a real world example here that I’m running into. The other half wants a Trex deck, a roof over it, and a pool in the back yard. We priced out all of this, and it seems to be in the ballpark of $200,000.

- Trex deck – $40k

- Roof – $40k

- Pool – $110k (but will need other work/landscaping and add another $10k)

When you look at this – you then see that you have a LARGE ask here. What do you do? Ask yourself some questions…

- What is the return on these items? It looks like for the deck and roof, maybe a 25% return. That is, you spend $80,000 and maybe it increases your property value by $20k. The same can be said for the pool – in fact, many people actually do not want to buy a home with a pool due to the maintenance and having tiny little ones. For $120k, this may get back $30k.

- How are you paying for these? If you had cash, you might be able to negotiate this down to $180k. Maybe. But so many firms offer financing today at like 12-15%, so that’s how they are making double dip profits. They get you on high margin items, then you are in debt hell for 10-20 years trying to pay for it.

- If I had the cash, how would it perform with other investments over 20 years?

With home upgrades, I would like to refer people to the list I had in the first writing of this series where you prioritized where your cash went…

While many may look at “home” at the top, I would argue this should fall into Luxuries OR – if you somehow could get favorable terms at like 2%, maybe you do it then.

The problem then comes that most people aren’t sitting on $200k cash. So what happens then is you end up with a massive monthly payment for 10 years. Maybe that’s a $2900 a month payment at 12% for 10 years. That means – with interest – your $200k upgrade actually costs $340,000. But wait – these items are supposed to add value to the home? Assume it adds $50k of value. You just paid 7x the value of the upgrade. And – if you never plan to sell you home, and this is a forever home – that is just cash that is getting locked into an illiquid asset. Additionally, the pool costs for maintenance are added to this.

This means that you put in $340,000 and get back $50k. And you aren’t selling your house, so you will never realize that $50k gain. But, if you DID have $200k in cash and put that in the stock market instead of a pool, you then have $400,000 at the end of 10 years. And, with the double you just had, you sell half and pay for the pool/deck/roof in cash. And, you never touched your principal of $200k. This gives you an end position of $250k. Meaning, in 10 years, it’s a 25% return overall – because you took the 100% return and pissed it away on something that loses value. The point here is that it makes more sense to put that $200k into a revenue generating asset, then buy the LUXURY with the proceeds, never touching your principal of $200k.

So then the question is – do you try to go into debt with mid to high interest rates? Or, is it more feasible to pay off debt, invest, and buy luxuries from proceeds of investments?

Remember above, with the second home?

- I used $70k cash and $41credit (carrying for a few months). My total cash in is like $111k.

- Instead of using $200k in credit for the pool to have $2900 a month OUTBOUND, ideally, my payments on the second home should provide me a very solid ROI over 30 years with a total ROI in 30 years of 315% and a yearly average of 14% over that time, skewed higher substantially as rents increase and the principal is paid off.

So let me tell you how my male brain works.

- Other half demands roof/deck/pool

- I try in good faith to get estimates. I want to understand the effort, cost, and interest rate if we were to finance

- You want to satisfy the elements of the request with the best return

- You evaluate different options. How can I get these things, but have someone else pay for them over 30 years?

- You do rough ROI in your head and make the best LONG TERM financial decision you can.

- You lead with your decision, and face the consequences of doing what is right for your family

Why is this a big deal?

I am 49 years old, and both of my parents died young from cancer (57 and 66). There is a chance whatever got them is getting me at between 55-71. I don’t like that reality, but hope isn’t a financial plan. What happens if I’m the bread winner and die? And the other half has to sell the home because she cannot afford it without me? What happens is this IF you choose option A – your $200k back yard that you financed, you have a 10 year note on it. You owe $2900 a month. But you then have to sell the property, and the equity of the sale pays off a home equity loan and the solar panels, leaving maybe $30k in equity. This most likely is going to the realtor and bank for closing costs.

This means my SO will have to pay $2900 a month for a pool and back yard she cannot use. Or, liquidate everything on the planet to maybe just break even? I have 2 children, and my decisions have been to invest highly in the family. LONG term.

With my plan, in 7 years – all debt is paid off, and I will have strong cash flows per month. Maybe at that point you pay cash for it, and it costs $200k. But that $200k came from FRUIT FROM THE TREE with the seeds you planted 7 years earlier.

Meaning – the pool/deck/roof may not be a terrible idea to enjoy your home, but the payback on the investment is awful and it is far worse if you finance it at 12-15%. Rather, I used half of that capital by selling stocks at a high, then rotating $70k into the vacation home.

Bottom line, is my decision for the family got us a pool, a place we can enjoy, a vacation spot, and an emergency rally point. And, it will have a yearly average of 14% ROI for a 30 year return at 315% whereas financing the back yard over 10 years provides a -580% ROI.

I stand by this decision. This is the kind of thing that the person in the house that normally deals with bills and finances needs to understand. It is ok to say “no” because running a family’s finances isn’t about NOW, it’s about your children and THEIR future.

Could I be dead in under 10 years? Unfortunately, yes. While it can happen to anyone, my risk factors are high, and because of this, I’m doing all I can to provide for my children after I am gone. I am trying to teach my oldest about my side business and he’s a math whiz, so he should pick this up quickly. I think my youngest may have more interest in swinging a hammer and building homes. Together – these two could have their own company. And, my investments that they inherit would seed the beginning of the business so they do not have to have leverage to start, which then reduces their liabilities and increases their profit margins.

My second home purchase was also considering 30 years down the road for my children. All too often today, there is friction in the home over what to spend money on. I grew up with my parents fighting about money every day, all the time. I vowed I would make enough money so I would never have a fight in my home, ever, over money. The reverse is true – the more money you make, the more you fight – it’s just over more expensive things and priorities. My MBA and all of this was about trying to understand investments and run my houses, as well as using the management portion for my day job.

If you can master ROI and do things objectively, you will not fall into financial ruin. There can be downturns in the economy, and job losses – but we know based on the priorities listed that you have 6 months of bills liquid (can be cash, stocks, precious metals, crypto). We also know you have no high interest or mid interest debt. We know you have cash generating assets you invested in, so maybe that can also help on the monthly costs.

Overall, you need to make hard decisions based on numbers. Can you have occasional luxury indulgences? Maybe – maybe you buy your wife a $500 handbag because you made $20k in profit from the homes last year and you want to give her some love for the support she showed you. But for major financial decisions, you MUST be on the same page and with this – I’d recommend you and your SO sit down and create your own priorities where income goes.

Conclusion

We just discussed that:

- not all debt is bad – but low interest debt can help you expand your business

- You need to prioritize, for you, how you allocate your income

- Economies normally have cycles. Know when to buy and sell assets

- ROI is a good way to measure outcomes. Some of it is art, some of it is science.

- Some form of ROI/data should be used for most financial decisions

We reviewed ROI for…

- college majors and schools

- buying a rental and understanding yearly and long term ROI

- paying for investments to a business.

- Understanding payback on home improvements based on how they are financed and how may be the best way to pay for these luxuries, if you do them.

Leave a comment