I’m writing this because there is no guide book I’m aware of for us amateurs. It’s been an incredibly frustrating 6 months or so. As you may recall, I’m looking for some sort of SHTF shelter. Started as perhaps a Poconos retreat to build with others, then tried to look at buying and RV. This then went to buying raw land, and then later the last 3 months has gone to acreage with a house on it.

I sold one of my rentals in August, and since then have been looking to add back to the stable with a different kind of property well before I sold this one. Maybe I am going back a year now, but really started stalking Zillow around June/July. I started really getting good with searches maybe around November. I have now become a pro at evaluating a place by a Zillow/OnX listing within about 1 minute for a triage.

The more you work at this, the better you get. I have written this over the last week – with the last few at 3AM today on no sleep for 4 straight days. Fun.

Here are 15 brutal, gut wrenching lessons I have learned.

- Speed kills

I just lost out on a 20 acre property last Sunday because I could not get a buying agent fast enough. Not going to list where it was, but let me give you the highlights. Big picture is, I have had a bad run of Zillow realtors, so I just decided to search on my own for a specific area. Slow initial response, which was a canned response. Then the initial response the next day not automated had stuff in it like, “are you sure you want to buy that far from your house” given in my intro I explained to her what I was looking for. I told her I wanted to see a house on Sunday – it was 8:30AM. She told me she needed 48 hours response, but didn’t offer any other person at her firm to assist. I believe she runs a brokerage and had people that worked for her. By Sunday night I got frustrated and texted the listing agent for the seller disclosures and the listing agent informed me they accepted an offer an hour before me texting. Wanted to wing by phone into the dry wall. 20 acres with a move-in ready house for under $175k.

2. Contingencies kill deals

In two of the houses I wanted, I have lost because I have had contingencies where others have not. In the case of the most recent one, here’s how this went. I learned I lost out, and the seller had 48 hours to field better deals. I told the LISTING AGENT that I was prepared to not lose out on a bidding war, but in the case of talking to her – she mentioned the water had a rotten eggs smell. All I asked for was a signed note that the water was drinkable and the septic was in working order. They had winterized the place as the owner had moved out.

Agent B gets back to me – “unfortunately, the seller doesn’t want to break her word to the buyer”. In the previous conversation, about the water, I didn’t want to walk into a 30k issue. She told me the winning buyer had no contingencies. My spidey sense went up. I had a well growing up, and we had hard water with a filter. The filter had to be changed every so many months, and you’d get iron filings in it. Rusty looking. My water did not smell. The first thing I thought was fracking – but I think the rotten eggs smell we smell with natural gas is added to it. Let’s look this up.

So the COLD WATER was smelling foul. Maybe it is nothing. Could be common and easily treatable.

But – good luck to the people who did not use a contingency to protect against the downside going YOLO on “it’s probably nothing”. You may have some serious problems on your hands. On the flip side, they may be buying with cash and have a pile more cash under the mattresses to dig other wells and get ways to treat the water. The PROBLEM is, that those who are selling properties try to obfuscate the problems as much as possible.

I essentially told the buyer, via the real estate agent, that I will indeed give you the highest value for this. All I ask for was that the septic and well were in working order and that you could drink the water. Suddenly, the seller had a crisis of conscience and would not take more money. The place was winterized because in my due diligence, found the heat pump was out. They used a wood pellet stove instead. They didn’t have the money to replace the heat pump. That tells me a few things. The seller was having problems maintaining the property and could not afford the $2500 quote for the new heat pump. And this same person could perhaps get $10-15k more than the person that just offered her x amount?

3. Supply problems sending prices vertical

Many do not understand what is going on. I have been obsessed over Zillow for maybe 6 months. I put in specific criteria, and out pops houses. Searching for acreage, with 3+ bedrooms, 1.5+ BA with 1,000 sq ft popped out maybe 10-15 houses within 4 hours of me. Maybe a 20-30 more if I used 2 acres. Maybe more if I just go to 1 BA. You get the idea. I have then hidden all of these but a handful many times over. Like – it is HARD to find these places today. And when I have stumbled across many of them – they were on the market 40 – 50 – 90 days mostly with price reductions. In the case of finding things early – in this market I’m searching in, if you buy too early in a listing, you are over-paying by 10-20% and realtors know it. When it is hitting the 40-75 day range, they are lowering prices closer to market, which is then triggering a group of people like me to then flood the buyer with offers. The problem here – is then the contingencies.

You almost have to be willing to buy these properties 10% over “market” AND waive any and all contingencies. This is a RISKY market.

The problem is – there’s not a ton of supply for what I’m looking for, and I may be bidding against people with seriously deep pockets. That’s a problem for me because they do not need a contingency. So I need to have serious cash on the side here to mitigate any problems? The issue then is that the market is not discounting the problems with the house – and these costs are invisibly tacked on to the end of them.

Take the house I just lost – to me, there’s a bad heat pump, cosmetic things that need to be done to the house, a door to be replaced, and the big risk here is the water/septic. While the house sold for $30k less than original ask, to me the risk is that this is a house where you may never have drinkable well water. Perhaps in this particular house it’s mitigated by never living there full time and getting 5 gallon water jugs and dispensers, and use the water for cleaning dishes, toilets, and showering. But really – there could be harmful bacteria in that water and if I rented to someone and they had a little kid who drank the water, that could be a serious problem.

So the price here is not only the price paid for, but the invisible prices of the risks waived with no contingencies.

4. Due diligence is an art form that is absolutely required.

In the property I lost out on in December in Irvona, I had spent perhaps 30 hours over 2 weeks doing due diligence on this. There is one thing I missed though, that will be added to my list – researching the listing agent’s listings/sales. More on that below.

In the case of this property, I had a lot of contingencies based on the risks I saw. Septic not touched in 20 years of the owner owning the place indicated that it may need to be replaced, and given this was near a massive creek, I was worried about it being able to be replaced – and may have needed to spend $30k on some fancy new flow system.

But I also spent a lot of time looking up where the nearest oil rigs were. Where the permits were in the area so a derrick would not be put on my property or those next to me. I looked at flood zone maps, elevation maps – and then went on the find everything a guest could do there within 30 mins.

Another example is property 77. I will leave it at that. This house was listed at $194,900 and was on the market for 90 days. After 2 weeks on the market, they reduced it by $5,000. 16 acres. GREAT woods. But I started deep diving. NO POWER to the place. Owner added a 10,000 watt generator and he used a gas can to fill it up. Place was winterized. I asked for pictures of the bathroom – eventually had to reach out to listing agent because 2 separate buyers agents ghosted me – more on that below. Turns out both bathrooms are in ROUGH shape and need a complete redo. There is a well, but it is NOT hooked up because there’s no power. They bought the place for $60k 5 years ago, wanted $200k? The ONLY improvements were a metal roof (probably $10k on this small of a place) and laminate floors. NOT LVT. Like the discount home depot items – and they didn’t stagger the boards, they lined them all up. So they did maybe $10k of improvements, over 5 years, and wanted 3.33x what they paid?

I spent maybe 10 hours on this property trying to make it work – only to then realize my lender would not lend to a house with no heat. Good times.

I tried to call the power companies in the area. No one provided service anywhere near there. Could be $150k to get power there. But – they have this listed for perfection???? Contingencies….

PASS – move on!!

The last area here I missed is researching the listing agent. Did they have 2 sales all of last year or led the county? Have they been doing this for 10 years, or show up the last 3 years for easy money? In the case of the Irvona property, it was listed by “T”. On my drive up there, I saw several properties with signs out listed by him. I’m like, “he must be popular in this area”. But what I did NOT do, which I just did this past weekend, was look him up on the company site for his listings. Dude has like 20 listings with 17 under contract. HOLY SHIT. Dude moves properties – but most importantly, they are moving relatively quick without price reductions. What that is telling me – is the listing agent is REALLY GOOD at listing at market rates to sell quickly. So, with that knowledge, I would not have gone into that with an under market offer WITH asking 6% seller assist. THAT would have been crucial knowledge.

5. Bail on buying agents – quickly

This market is insane right now for what I’m looking for. There’s really not a ton of supply for these, and with that – they have a lot of warts no one wants to tell you about. How do you protect yourself? I think the only way to get these deals done would be to ACCEPT the risks, stock cash, and account for a SIGNIFICANT issue on the backend of it.

In this market, as long as I have contingencies, I may not get a single deal done. I’m getting too good at finding the problems they don’t want me to know about. People much more rich than me aren’t caring. They are simply popping out wads of cash and plopping it down, and saying – “I don’t care. GIVE me the property, I’ll deal with whatever shit on the backend”.

That is really not a good place to make offers from, unless you have too much cash falling out of your pockets. For you and me – contingencies are there to protect us from major downside risk. So – looks like I need to keep stacking cash, and someday – I too can perhaps waive a magic wad of cash over the table and not care about the risks.

6. Don’t fall in love with properties – until it’s closed

I’m finding that buying these properties is like dating when you are younger. And I’m making the same mistakes as a boy with a crush. This past weekend, I fell hard on Saturday. I’ll cover the deal in item 8 below. I just saw the most beautiful land I have ever set my eyes on. But the property the week before on paper was the best I had ever seen. And in early December, I lost a deal on a gorgeous property.

I am falling fast and hard, and my girl is seeing other people. It’s not a good look for me when these properties are ripped from me, in the last 2, through no actions of my own.

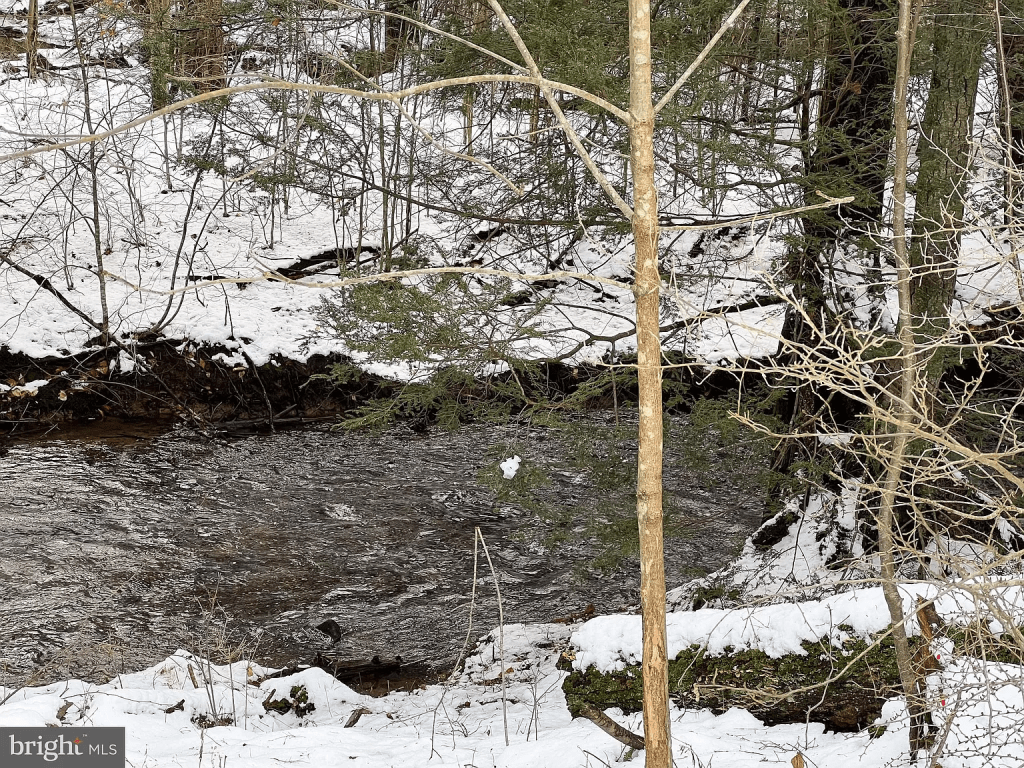

My approach needs to change. If I get emotional, I may significantly overbid. I may have my judgement altered. I found a place Friday evening, went to it Saturday, and she had everything. 7 acres of mostly woods, a big 30 ft wide stream at the border of the property in the back with trout, deer on the property, a 4 BR/2BA home, rifle range with targets already there, privacy from the road, and this amazing sun room to see the entire property. But she got me to put a ring on it in a drunken Vegas night with a giant in ground pool with a pavilion attached to it that looked to be 30×20. I started naming babies with her when it was only 90 minutes away. This was my doomsday bunker, part time vacation rental, and retirement home all in one.

This sun room just needed some drywall. Overlooked everything.

The pictures I took with snow on Saturday do this more justice. The pavilion is HUGE when you are in it, and this is somewhat of an optical illusion with the camera. This is a BIG area and this is not a tiny metal structure.

I was home.

And it was stolen from me.

But the deal can also fall apart for a lot of reasons. Maybe the septic is busted or your lender doesn’t feel right about the price after the appraisal comes back $40k lower. After the deal is signed, YES – that’s the six pack by the creek time for me.

7. Know what you are buying

With this past house, there was an issue I brought up. However, this is why you go to properties and walk the land.

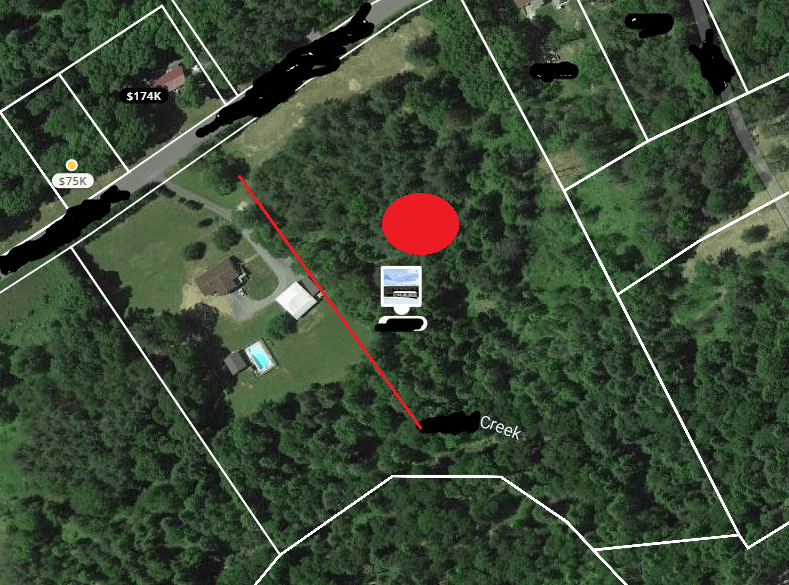

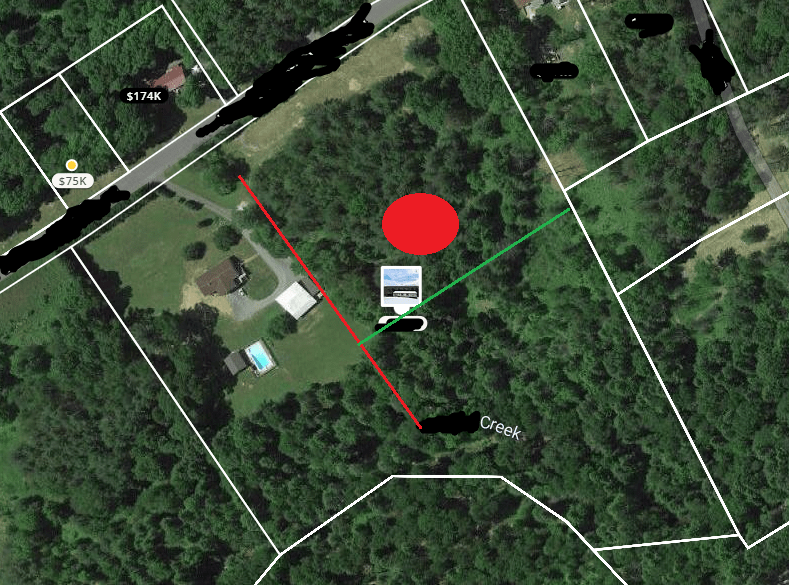

Zillow had this at 6.8 acres. OnX had it at 10.5 acres. In both cases, the lot lines were the same. Everything in the white appeared to be with the house, which tracked with the 10.5 acres. When I was there, I had 3 straight nights of no sleep, and zero reception. I could not load OnX, and I completely forgot I had these pictures saved. So I only walked from the red line down to the creek, and to the left of it. That FELT like perhaps 4 acres.

However, when I was there, it appeared there may have been some sort of construction at the big red dot. This entire area to the right of the red line I was going to use for hunting. If this was off the table, well, ok. But it would be nice to know where the approximate lines were before I drop massive money?

I asked the realtor and the listing agent said that indeed it was subdivided at some point recently. However, there were no approximate drawings. I felt that the RED LINE was actually ok for what the price was, and was willing to even give that land up to make the deal. But I needed to at least understand what I was buying!!!!

If this was 7 acres, and the big parcel is listed as 10+ on OnX, it stood to reason that this is PROBABLY what the plot now was, with the green and up being the new lot

But I just didn’t know. My questions about her past had her run to another man.

8. Get the deal done

In this case this past weekend, I’m fighting for her. I don’t want to let her go. If she is meant to be with another, so be it, but I needed her to hear how I felt about her – and I was blocked from doing so.

I inquired about the place with the listing agent at 7AM or so, and he got back to me around 10 or so that I can see it today, but would have to be with his associates as he was out of town. No biggie. Told me there was an offer in hand, and owners were to make a decision tonight. OK! Let’s do this.

Drove like an hour and 40 minutes. Get there, walk the land, fall in love, and I’m ready to commit. I tell my realtor at 3:30 to get the deal done, and he suggested escalators so I am not outbid. Perfect!

But at this time, it’s 3:30 on a Saturday. He says he’s going out with family soon and will be out of pocket. He talks to the listing agent and tells her he has a buyer that wants to put in a bid, but due to the late nature here, can he slide it to Sunday morning. He tells me he offered her to get an associate to draw it up and send it over. Listing agent tells him Sunday morning is fine, or at least that is what was conveyed to me with my 14 year old in the car with me. Family is important to me, and I’m very cognizant here of the time of day so not sure there is a guidebook on how this is to be handled on a Sat evening when no one is around, and sellers give Sat evening deadline. However, if the listing agent extended the deadline until Sunday AM, I was ok with this.

Edited: In the fog of war afterwards, I calmed down. Another agent in southern NY/northern PA told me I’m probably losing these deals due to requiring inspections and having all kinds of contingencies. A few years I would have thought that was silly talk – but she explained a lot of the buyers in these super rural areas are blue collar and great with their hands. They walk through, they don’t see anything they cannot deal with, and they put in a bid perhaps lower than mine, but waive inspection.

As my NY agent Nichol wrote to me – “sellers want easy”. As my semi-cousin April told me (our mothers were best friends and we grew up as pseudo cousins – and wanted to give her YT page a shout) – “buyer demand is so high and sellers have so much leverage…”

In my case in my Milroy, PA loss – the buyers had waived inspection, and while my offer was potentially much better with escalation clauses, sellers “wanted easy”.

Lesson then later learned – NO CONVENTIONAL LOAN REQUIRES AN INSPECTION. This was not known to me, as my previous buys many years ago were:

- Transfer of deed and cash out refi for one

- Bought FA 3% down and lived in it for 7 years.

- Bought FHA 3% down and lived in for 2 years, sold for 50% profit

- Built with 5% down and builder incentives in 2014

Soooooo….I have never done a conventional mortgage with 10-20% down. I had just assumed all financing needed inspections, since the bank wants to ensure their customers are not buying shit houses.

You learn something new every day in real estate!

8. Walk the land and look for specific things

In the case above, walking the land provoked significant emotion in me. You cannot get that from a zillow or OnX map. The pool and pavilion are much, much bigger than anyone can see in a picture. The picture of the sun room above shows it from the side, but you are missing the 180 view from 20 feet up of the entire property. In the fall, this must be absolutely breathtaking with the tree color changes. From the front yard, you could hear the stream. The picture of the stream makes it look 4-5 ft wide, but that picture is from about 10 ft up. The stream is closer to 30 ft wide, and you could see fish in the water, that’s how clear it was. Where I was standing near the end of my tour, the water was nearly 4 ft deep and a “swimming hole”. There was a rifle target set up, and this is what I was looking to do with the property.

But the walk also revealed the building next door. I didn’t look terribly hard, but that then got me posing questions about the lot lines.

Had I not walked it, I would not really have fully comprehended the beauty of the place, and the size of things. And, I would not have discovered the potential lot line issues the cash buyer with no contingencies may be walking into.

When I’m walking the land, I’m also looking where water is. Where it is pooling. Looking for dumping areas that might be environmental hazards. What headaches could I be inheriting? What smells are present here with a mushroom farm or chicken farm a mile down the road?

9. Pay what it is worth – to you

In the case of the property I lost in December in Irvona (the listing agent for that is my buying agent for the place I just lost), you have to try and make your best guess at what it is worth – to YOU.

My frustration with my agent for this deal was that at no time did he ever offer an opinion on what he thought it was worth. I probed him a bunch of times. Silence. By the time I had a bad feeling about this guy, there was an offer in hand and I needed to get an offer in. When constructing the deal, I had to force feed him a negotiating strategy.

I loved the property, but there were two BIG drawbacks to me. First, there was only one bathroom – on the first floor right next to the living room with a sliding door. Anyone doing their business there was going to be announcing it to anyone in the living room. I could not convert one of the 5 bedrooms to a bathroom as was my plan, given the old farmhouse and pipes. My RE had a construction background, so I picked him for this specific purpose to tell me how much things might cost for me to do – expand the house, convert a BR to a BA, etc. No dollars ever came out of his mouth. VERY nice guy. But I wish he had provided me feedback.

When I went to make the deal, I came in low. The lender he provided me only pre-approved me for the value of that house, not more than $100 more. I had no wiggle room for a bidding war. I didn’t have a ton of cash on me, as most was in my trading account and PMs. So I was interested in a seller assist.

The SECOND issue was the house had like no insulation and electric heat. But the baseboard heat didn’t appear in the kitchen, and the basement had no heat so the guy winterized it as a hunting cabin every year. This means I could really only use the house for 7-8 months, maybe 9 unless I spent a lot on upgrades with the heating. Mini splits, heater in the basement to ensure pipes don’t freeze, etc. Because it was electric heat and not efficient, maybe I was looking at $400-$600 heating bills over the winter if not winterized.

To me, I had to discount the negatives here.

I lost. Buyer paid full price, no contingencies. The house was winterized, so they could not test the well and septic. The house was right next to a giant creek, so possible the septic was bad and it could not get a new septic. Maybe it was due for a $25,000 replacement because the system in place would not work with the soil moving forward due to environmental changes.

Also – remember, if you maybe have some rents coming in, that reduces the out of pocket every month to you, which can boost the amount you are willing to go higher someone else may not.

10. Get the right lender.

The RE agent above with the construction background pointed me to B. B gave me a pre-approval for the exact amount of that one house. I tried to tell her I’m looking for a second home, and it could be anywhere in PA. This was a lower amount than I thought I’d be pre-approved for, and it significantly affected what I could buy.

And – a few days after I got the pre-approval for a second home for this, she started getting upset with me and telling me any future home would need to be treated as an investment property – needing 20% down. I asked her why, and she told me it was about my plan to rent it out. Ummm…you can rent out second homes for short term rentals. My primary usage was for a second home. If no one ever rented it, I didn’t care.

I pressed her again on this for a deal last week I was looking at in NY. First, she tells me her firm cannot work in NY. OK. Then she reminds me of the home being a second home and she needed 20% down. Again, I pressed her on what she is talking about – everything I told her was the same from the start.

She wrote this to me:

“Short term rental income, such as VRBO or AirBNB, cannot be used for qualification on the purchase of the home. Use of short term rental income requires a history of rents appearing on your tax return. For your information, rental income can be used to qualify for the purchase of an investment property if it will be leased full time. The rental income used would be determined by the appraisers form 1007 or form 1025. If the seller of the home has a lease that is being transferred this would also be considered in determining the amount of rental income to be used in qualifying.”

What she seemed to conflate, misunderstand, or just plain out miss was that at no time during this process did I ever project to use any rents from this place as income for purposes of the mortgage. I own rental properties – and the rents I put down as income are verified with leases and absolutely count.

Instead of ADDING the rents I put down – she REMOVED them.

I went with another lender on Thursday, as my pre-approval expired and was approved for 3x as much. This allowed me to date my dream girl I just lost.

11. Research the agents

In the first case, I just tried to do some research in the area. It was a remote area, and a local search brought up like 3 for there. The guy I picked had a construction background. But I didn’t research him well, I didn’t even realize it was a thing. Why???

The listing agent for the property I lost, TN, had a page on Keller Williams where he had like 20 listings with 17 under contract. THAT is SERIOUS volume. To me, this means he is pricing it right. I also was astounded by his marketing of the property. Had I done the research on my guy – maybe I would have seen a small track record of just the last 1-2 years. I don’t know. But had I researched the listing agent, I would have seen he prices things to move, and perhaps I should have taken that into account with my bid.

Had I done the due diligence on both realtors, I’d probably be the owner of the Irvona property today. But – I also would have missed out on dating my dream girl. Maybe it was meant to be?

12. Start with initial contact with listing agent

This is something I think I need to point out. In the NY deal, I struggled to find a buying agent to get me out to see this property on a Sunday. By the time I bypassed the buying agent I was going to work with and directly contact the LA, she told me the sellers signed a deal like 30 minutes before I texted her. Had I just reached out to her to start, I would have found out some things first and her sellers would have understood there was another offer coming.

In the case of the dream girl, I found this on Friday evening laying in bed. After I got the new lender, I decided to change the price parameters of the search, and I swiped right on her. I knew it was 8PM on a Friday, and I wanted to engage TN – my buying agent for that area. I texted him at like 7 or 8AM the next day. He got back to me maybe 10AM on Sat. That’s when he told me there was another offer in hand. Had I directly texted the listing agent Friday night, I would have found an offer was made less than 24 hours ago and I could have expressed my interest in seeing it ASAP.

I feel like many of these agents have people who are flakes with fleeting interests. If I’m going to see a property, I’m going to buy it, unless I find absolutely MAJOR issues. I do not think these agents also realize my background or the due diligence I put into things – and as a buyer, I’m getting pushed around by agents who are extremely busy and overworked and may not be able to get back to me in a timely fashion.

It’s also possible if you get the rock star agent, he may be so busy he doesn’t have time for you. If you find an agent with not a lot of sales record or experience, you may lose out on deals. In the case of my dream girl – TN told me that the LA was also an appraiser, so the house is probably coming in what the bank would appraise it at. Meaning – my “full ask plus” should have been approved with my financing. This is a double edged sword. It’s also possible that the appraiser knew it was the list + 10%, and a cash offer would trump a financed offer at full ask because the financed offer may not come in at appraised value.

13. Cash deals win

In the above – I was told it was a “cash deal with little contingencies and the seller was happy”. Well, the problem here was I had financing and approved to buy this. But if the appraisal comes back less than what you are bidding – either you need to come up with more cash or the deal falls apart because the lender will not risk it. When you do the purchase, you have to make it contingent on financing getting approved. A cash deal removes the bank from this equation, and thus a cash buyer can bid as high as the cash they have.

Most of us are not walking around with the cash in our pockets to buy a place like what I just lost.

14. Spotty service

Where I have been looking – cell service has been challenging at the least. In two of the situations, I had asked about this and gotten great info about local high speed carriers. In the first, I had no real solution and the entire town near there seemed like there were no towers. ”Can you hear me now” guy has not been to PA mountains.

This then takes into problems with getting there with navigation apps, guests coming and getting lost, or breaking down. I think it’s important to try and look up coverage maps and with this, when you are going to these remote places, ensure you have a tank of gas, maps, printed out directions, and have a general idea of where you are going. Stop to use the restrooms before you get too remote, because these places really have nothing around for many, many miles.

15. Know what you want, and don’t want

I know what I want. Many don’t. I can tell, by now, with a listing of what it has that are on my YES and what is on my NO. A house right at the road 10-20 feet away? NO. A creek at the back of the property 10-30 ft wide you can fish in? YES.

Once you get a lot of the YES votes tallied and determine there aren’t a lot of NO votes, you then start to do due diligence. I would start by a spreadsheet for all of these properties. It’s time consuming, and not necessary. Once you have done this enough, you get a system.

For me, it was…

- House – in price range? Have acreage? Cool – let me look at the zillow plot map to see if there’s a creek on the property or across the street.

- Oh – on top of neighbors everywhere? Pass. I want to shoot and cannot be in a development with HOA rules. Love the creek, but pass.

- Plot looks good? Not on a highway? Let’s check OnX for the slope, lines, and the nearby area for hunting.

- Both maps line up? Creek? No real neighbors? Privacy? Price range? Outbuildings? Right BR/BA? DIG IN. FIND THE RISKS. Then – with the risks, once understood, decide on a plan to avoid (too big of a risk), accept (ehhh…I can live with that), transfer (contingencies on deal, flood insurance on outbuildings), or mitigate (let me look up a pool service in the area and understand the costs of pool maintenance over 12 months averaged)

Once my evaluation of her online profile was complete, I then make contact.

Conclusion

I have probably over-extended myself to some of my RE friends bitching and complaining about this smelly industry. Look, I have taken a lot of business and contract law. I started as a criminal justice student for 2 years, and then had a lot of law classes as part of my MBA over 4 years. I am NOT a RE attorney. I am NOT a RE agent. But I know enough to know that this business stinks, a lot.

To me – every listing is obscuring something. It’s my job to research her history. I understand how sales try and put the best face forward, but for the most part, I’m seeing a lot of people slapping high prices on shitbox properties with 100 warts and then selling it as “cozy”. GFY. It’s a shit hole and you priced it 40% higher hoping some poor bastard will take this off your hands. And now, for the last 9 months, you cannot sell it and reduce price by $1000 each month hoping stupid people are still taking your shitbox with lipstick. YES! Many morons are out there who will bite. If they just put the right makeup on her, they can sell it to you.

But the industry also has a lot of newer people the last few years who have no business being here. Buying agents, listing agents, finance people. It’s just a lot of incompetence now at a lot of levels with people making shit up as they go, and not understanding basic laws, tort, and contract laws. Many of these people thought they’d come in and ride the wave of everything higher, but what you have is a lot of people who have no idea what they are doing then trying to roll noobs into their dose of incompetent fairy tale stories.

I don’t know how this is going to end for me. Will I settle on “sturdy and stable”? Will I never get over “the one I lost”? Will I compare every new property to the one I just lost? Will the legal system intervene in my recent escapade and have me win her back? I don’t know.

What I have to say is this. There are a lot of people out there trying to extract every last cent you have in cash, and every cent you can borrow to line their pockets for commissions, to then be done with you the second the deal is signed and they cash their commission check. Life is hard. The have rent or a mortgage to pay. They have mouths to feed. You hope they have ethics, but if times are hard, and they have to have you part with your cash for them to put food on the table, they choose their family every time. What this means is that everyone needs to have their guards up in these transactions, at all times. People you think you trust, you need to step back and take an objective view.

This is a dirty, smelly, rotten, and corrupt business. If you cannot be an apex predator you will be rolled and people will part with your money, with a smile on your face, as you are the hapless poor bastard taking someone else’s steaming pile of poo.

If you find the good ones in the business, hold on to them. If you find the perfect girl for you, work with speed and get the deal offered, and use escalators to ensure you aren’t outbid. Review your lender to ensure they have the right information that isn’t screwing you out of what you can buy. And – insist your deal gets to the listing agent, come rain, sleet, or snow within 2-3 hours of you telling your BA you want it. They will need to draw up the contracts, get you to sign digitally, and get back to them. This took me 2 hours yesterday for this entire process. If the deadline is a Sat night and your agent cannot assist, ask for one or an associate who can make that deal happen then. I trusted the deadline would be extended – based on a conversation I am not privy to. Meaning, urgency needs to take place at all levels of a deal.

But above all else, be careful. Contingencies are there to protect the buyer. If you are sitting on an extra $100k in cash, and you just found YOUR dream property – perhaps you remove contingencies and just accept the risk and mitigate later. But if you are borrowing money, like most are, don’t get over your skis. Make sure that the place you are borrowing for has drinking water and septic – with contingencies. Make sure you know what you are buying, and what the lot lines actually are. My cash buyer friend may actually find out he bought half the land he thought he bought as the LA took the cash and ran.

Do numbers. Understand commission-based motivations. If a buying agent is commission-based – what is their incentive to negotiate a price down, for YOU? By them negotiating prices lower, they are lowering what they get paid. The listing agents may price 5-10% over market, then the buying agents don’t want to waste any time with a buyer who wants to lowball that price as they see it as a waste of time. I saw a property that was listed at $250k on the market for many months. I estimated based off of what I’ve been seeing, it was closer to a $200k property. I talked to a buying agent about it for 5 mins, and basically I was told to F off.

If you are serious about real estate, get a license. I am at some point. I want to learn about a lot of this more. But more importantly, you need to really understand business and contract law. Many realtors didn’t go to college – no worries. It’s a sales job. Coffee is for closers. But this also means a lot of them do not have the years of legal education you get with business classes. This is what I’m seeing. Basic contract law is completely either not understood, followed, or obeyed – and this opens up anyone to litigation. I don’t even think people are aware of how a lot of this works and they make shit up as they go.

Right now, my experiences with the real estate market are the wild west. And I’m rapidly getting an education on how wild it is. I plan to be Clint Eastwood in this movie, and not the poor bastard digging his own grave.

January 29, 2024 at 12:06 pm

Yep, 1. often times, a bona-fide offer never makes it to the homeowner. The realtor wants someone else to buy the property. 2. I know of a beautiful cabin on a gorgeous stream in Durango California that was in foreclosure. A close friend of the “banker” in charge turned in a $40,000 cash offer for the property. The bank took the offer and wanted the home off of its books. 2 years later, the “friend” sold it to the banker for $45,000. It’s now worth $450,000.00 3. the same “banker” was in charge of closing out a widow’s estate. a $35,000 diamond ring went missing during the process, however no problem because the insurance carrier paid out on the claim. The “bankers” girlfriend was seen wearing a beautiful diamond ring at Christmas later that year. get some sleep!

LikeLiked by 1 person

January 30, 2024 at 5:38 pm

Interesting points. The thing is, real estate is cyclic, and we are at the peak of the real estate bubble, hence we are at peak mania. This feeding frenzy will surely end in a bubble pop soon, and those who bought at this top of the market will be holding the bag on homes that will swifly go underwater in their loan to value ratio. I’m 56 and I have been there and seen it. For just one example, my neighbor bought their home at the peak of the last R.E. bubble in early 2008, and paid on that home monthly for 9 years, finally selling it in 2017 for a $15,000 less than what they paid for it back in 2008. So, they left after 9 years of $1800+ monthly mortgage payments, and a $15k price loss. Lesson? Real estate is not always a good buy, and never buy during peak bubble mania. Best wishes, Glenn

LikeLike

January 30, 2024 at 5:53 pm

Glenn – I hear you! At this point – since I wrote this, I lost out on yet ANOTHER place. Sold in 7 days. I bought one in 2007 and that one was an albatross for me, so you think I would have learned my lesson? One counter to the “bubble will pop” narrative is a part of some of my thinking is – this is what de-dollarization looks like. Meaning, we have so many dollars coming here from overseas back to us. They are selling hundreds of billions of treasuries or letting them mature and taking the cash – then buying up things here. For example, the stock market. You see stocks go parabolic, and you sell – and then you perhaps roll this into real estate.

My problem is that as much as the “bubble” is possibly there, the supply isn’t. If this was some frenzy, you would see people flooding the market at top shelf prices. We aren’t. While many are top shelf prices, they are still below 2021-2022 by a lot, for those I’m looking at.

If Maloney is right, and there is a potential move of $17 trillion in USD moving from overseas to us, there will be no pop, only more cash competing for ever more scarce resources.

One thing that supports what you are saying is that from a ton of the houses I have looked that that sold in 2016-2019, they are so far jacked up from those prices, it’s insane. However, 40% of all money ever created was created in a small window around the beginning of COVID. That money is sloshing around the system to.

My BELIEF – is that for the specific type of home I’m looking for, people are hunting down these properties and throwing whatever they have at them for a secure location to get to. Those properties just aren’t coming onto the market because none of them care if you offer them 2x-4x what they paid for it, they need their remote home.

This to me might be peak nervousness of political strife to come. Maybe it’s just me. Been stalking zillow for 6 months so I have a good idea of what is out there and what is moving where for the types of places I’m targeting. I am not looking at anything under 1 acre, suburban, or city. So I have been studying the rural and remote locations and it’s just not good with supply. Not good. And the prices these are selling for isn’t unreasonable by any stretch, it’s just there’s virtually none of them to be had. And that is the issue.

LikeLiked by 1 person

January 30, 2024 at 6:31 pm

“If Maloney is right, and there is a potential move of $17 trillion in USD moving from overseas to us, there will be no pop, only more cash competing for ever more scarce resources.”

Knowing Mike Maloney, he probably is right, and to be honest I have not considered that thesis, or the implications in such a circumstance. I do know that China’s real estate and stock market are both in a very significant nose dive, so I have been thinking we here in the USA will soon be doing the same. But then also I have been completely amazed for years now how we somehow been able to kick the can down the road against all economic downturn gravity pointing otherwise. So Maloney’s prognostication may very well be right….God alone knows, but for sure the economic storm clouds are sure building on the horizon!

LikeLike