I wanted to write this today on the heels of the Dow going up on another drunken sailor 400 point buying orgy. I feel any given day a cliff drop is coming, but how to convince you of this?

Start with this…

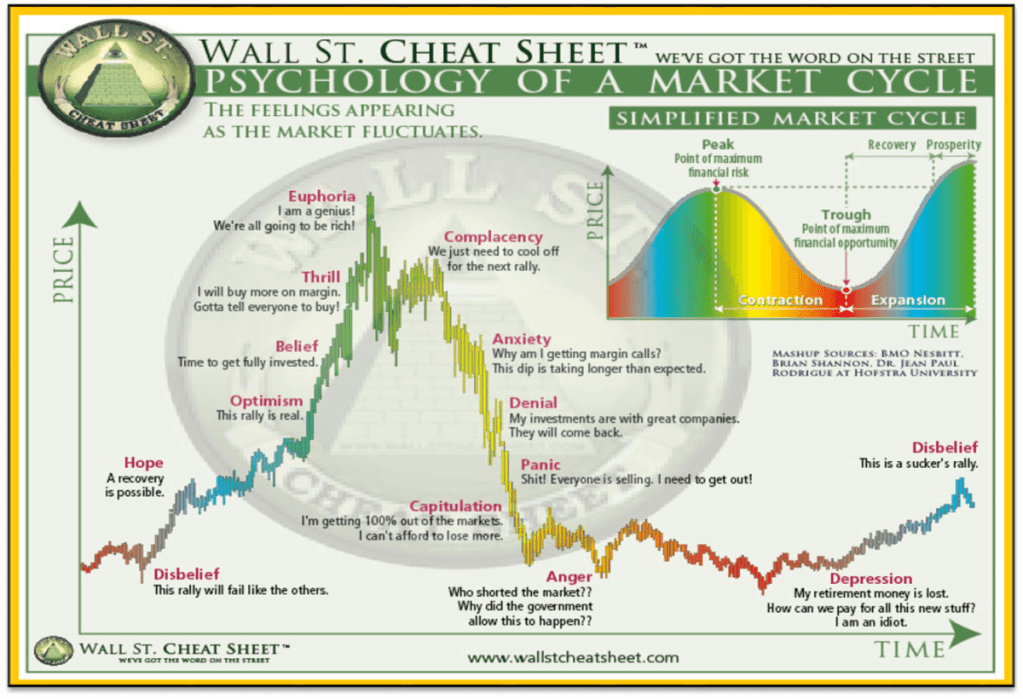

Market cycles. You have to understand the psychology here. This chart doesn’t ALWAYS play out, but I want you to start off with this.

Let’s look back to 1929 and the crash. Most don’t realize that the crash of 1929 was bad, but it’s wasn’t THAT bad. The main issue was a few years later.

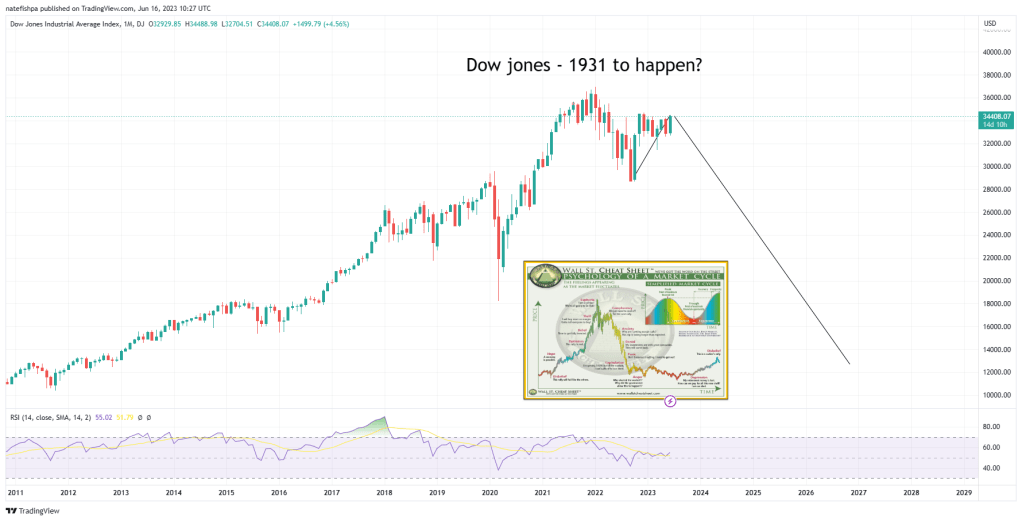

Think of the roaring 20s. It was credit expansion. Now, we are looking at credit contraction. Why? Think about the last FORTY years of the Dow. Look at how it went up 35x!!!

But WHY????

Because credit was cheaper. More borrowing. Adding more plants. Building more inventory. Hiring more people. Look at the Fed Funds rates for 40 years.

This also looks like a market psychology chart. Is this credit expansion over? Are we in the paradigm of 1950 to 1980 with interest rates increasing?

Credit expansion

The problem many of you don’t see is when credit is cheap, it leads to increased asset bubbles. Why? Imagine you can borrow money at 2% to buy a rental property. With that, you might be able to rent it out for $2000 a month and make 7% return after all expenses. That spread is FREE MONEY to those who play this. So what happens is these things are quickly gobbled up by the market. All of those rentals out there will then be bid up, to the point where the return is 2% and the FREE money is gone. In fact, it may get to 1% or even negative returns, as those late to the trade will project higher rents down the road or perhaps even lower rates.

This makes a $300,000 home become a $600,000 home when you have bidders all over the place. Such is what happens when rates were 2.5% and houses got bid up in 2021. The amount of refi transactions were off the charts, and these refis were very profitable.

But what happens when rates rise? The reverse is true. It costs more to borrow. If someone was making 2% off of the rental, but rates are now higher, then a new entrant buying at THOSE inflated house prices would LOSE 5%. Meaning, anyone who bought those rentals at the very least would have to DEFLATE the house price to offset the higher interest rates. At first, you just have less buyers for the market. Transactions plummet. But as the noose sets in around the neck of the economy – some of those rental owners now suddenly are seeing vacancies in their high priced rentals, and have to lower rental prices to attract people. This may lead to negative cash flows. And with this, those who were late to the trade suddenly aren’t breaking even, they are now starting to bleed cash. This will have a chain reaction of reducing these prices as they come to market to entice buyers.

Just as lowering rates created a form of FREE MONEY for buyers, when rates start to go up, you now start to have those LATE to the trade underwater on their asset purchase. Hoping to create yield from this, they now are starting to bleed money. Those EARLY on the trade may start to see lower rents, but due to being early on buying, their asset prices may still have equity.

This is the problem. Many of you are dug in, and convinced all is well because the gaslighters running things told you that this isn’t a recession because they then changed the definition.

But when you understand that these higher rates ARE deflation, you then have to address your thinking under a completely different paradigm.

- Asset prices will come down BECAUSE

- Yields on assets will come down BECAUSE

- Credit expansion CEASES causing

- Higher rates of unemployment CREATING

- Lower economic activity

If you do not understand the principles above, you need to have people professionally manage your money. There is evidence today that a lot of what you are seeing of “strong markets” is actually a handful of stocks hyped up that are carrying the water for the rest of the stocks.

Where we are, today.

I stole this off the internet from Twitter on a reply from someone. Shows you about where we might be, today, with market psychology. I think this is the Nasdaq, so there’s your hype machine about to drop.

But stock prices are driven on sentiment. Right?

We just heard Powell say that he plans on raising rates twice more this year, and no pivot for “a couple of years”. Meaning, all of you front running an interest rate reversal to zero have some real problems ahead.

IF banks wanted to exit their large positions, here’s what they do…

- Get you excited about something so you buy from them and bid stuff up.

- Sell tranches into the rise and exit positions

- Short the fuck out of said stock and push your lettuce hands out of the market on your stops

- Buy back from you at pennies on the dollar.

This is how our professionals operate today. They will hype things up, then rug you. This his how they take money from retail.

I have a bear scenario today with I think 32 or so points of data that I need someone to spend time on and refute, point by point. If you think we are going way up from here, you aren’t paying attention to interest rates, at all, and have convinced yourself in 6 months it will be back to zero.

Jay Powell was just asked about Yellen’s $51T comment about debt, and asked if the Fed would fund it. In a nutshell, he said “no” and “that’s not a ME problem”. His job, today, is to keep the FED running. While they absorbed debt with COVID during a national time of crisis, the Fed will be letting this debt run off and selling into the market. AS Yellen and company will be holding out the cap for more and more treasuries. As foreign entities are buying less.

Where is the funding coming from to pay for all of this debt? Retail bag holders who are buying stocks today, and when they sell off in a bit, will have their FA take defensive positions in high yielding T bills and treasuries.

“You, stock bull, are a man of genius.” Mr. I don’t-care-about-the-interrrrrest-rates! “We salute you, Mr. Stock Bull!”

Last train people. I mean you can’t call tops or bottoms. But at least set some stops for the rugging coming.

Leave a comment