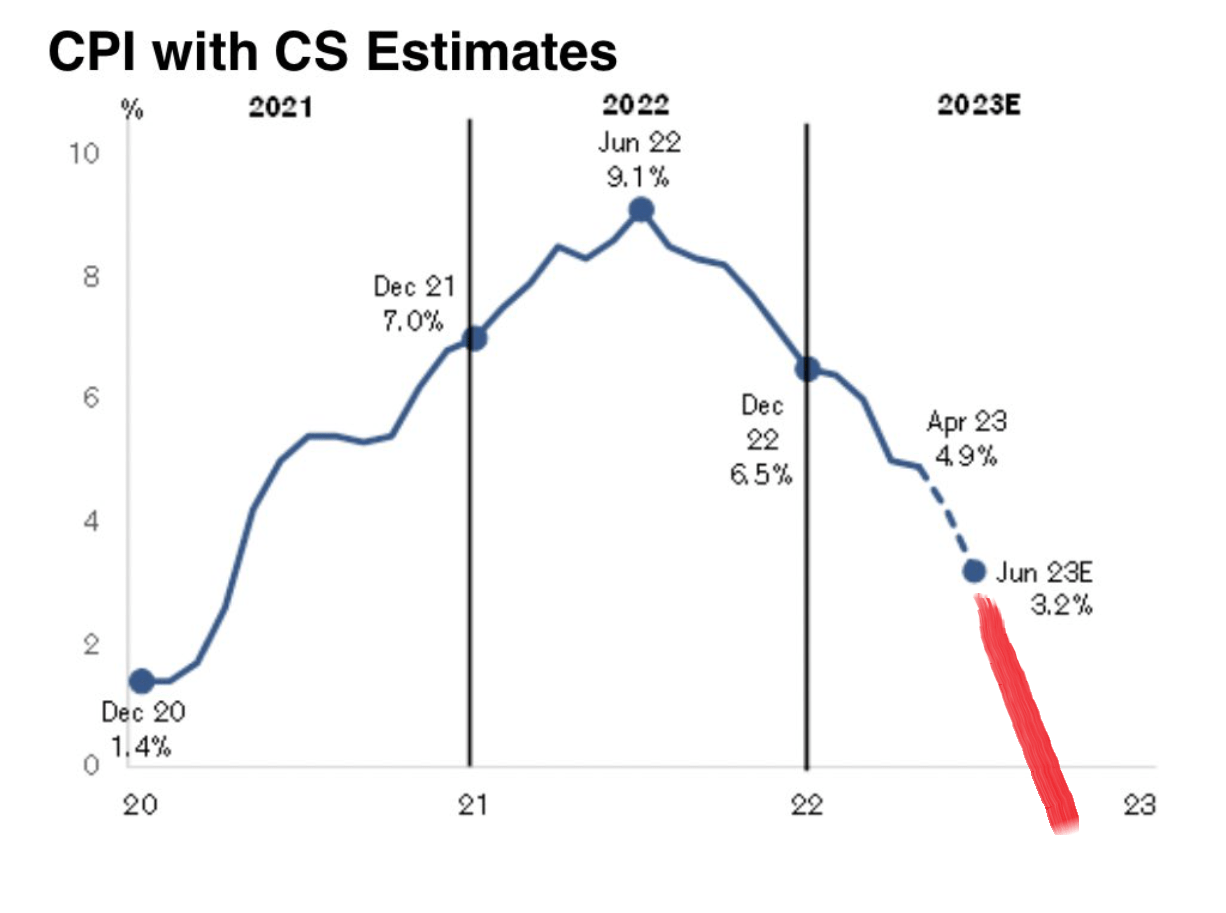

I saw this chart a few days ago and had some trouble re-locating it for this article. But I found an older version that has 4.9% for April and 3.2% for June, estimated.

I also colored in red what may happen. Why? Because it appears the people running the show continue to make policy using the rear view mirror.

When I took advanced physics in college, you learn about acceleration and deceleration. Big picture, is that a vehicle twice as heavy may take 4 times longer to stop, not twice as longer. Now, there’s nuance there with road surface, coefficient of friction with the brand of tires, road surface, incline – etc. My physical professor used to testify in court traffic cases as an expert witness and the fun stories about deceleration were aplenty. Now this “time to stop” can be on the clock and this covers longer distance.

You get the idea. An 18 wheeler carrying 10 tons will take a lot longer to come to a complete stop than a Mazda Miata if they were both going 55 mph. This is very important to know in driving, and why you do not want an 18 wheeler up your ass.

Likewise, our chief economist of our country has never taken an economics class, and my bet is he never took a physics class.

When you see the chart I’m seeing, it is easy to make a continuation – why? Because the brakes have not been applied yet. When you saw the rise in inflation – it hit to 9.1% at its peak in June 2022. Remember, they were still holding 0 rates as inflation shot up. Remember the “we aren’t even thinking about thinking about” rate hikes yet?

Most looking at this don’t understand that the rate hikes (and reductions) take 12-18 months to work through the system. While there can be SOME immediate effects, the overall inflation numbers you are seeing are the potential result of the year prior. Meaning, it’s possible that “the solution to high prices, is high prices” would have slowed and reduced inflation all by itself. With buyers being priced out, sales slow.

But now we add a noose to the necks of the economy, and each month for the last year, we have slowly started choking off the ability for people to afford credit. We have put on the air brakes of expansion. Yes.

But now, we must understand we have a cruise liner going full speed towards a dock and no one, I mean NO ONE has put the brakes on yet. Could today be the day where they tap the brakes and stop the rate hikes? Maybe. I’m in another camp where they are still seeing 3.6 unemployment and they have not tamed the housing price or wage inflation issues – and both of those ingredients are needed to reduce CPI for the long term.

Deflation?

The second half of this is “disinflation” – where the rates are still going up, but slower. Many see this rate coming down, and make the error that this means prices have come down too. God no. I saw this yesterday – “Imagine last year you gained 9 pounds and this year gained 4 pounds. You gained weight at a slower rate, but you did not lose weight”. Even Biden himself doesn’t seem to grasp this concept when he speaks. He legit thinks prices are coming down.

Now, the reverse repo crap. I saw another thread on this yesterday which was pretty good. That is, with the treasury needing about $1.1b and the Fed running down the balance sheet $100b a month, the question was, where was the liquidity coming from? It seems to the author, and me, that the only place this can come from would be the reverse repo pool. However, they cannot buy the 10 year notes with this due to some ratio. However, he postulated they could be shorter term notes with this. This seems like where a lot of the funding will come from with the treasury ask to not touch $3.3T in reserves.

However….

We are now needing to look at business. All of these companies have severely declining sales YoY. There have been more bankruptcies this year than any year since 2010 – and we are so early in the year we could crush 2010. Think of all of the zombie companies with maturing debt? Think of all of the banks that continue to see cash leaving them for yield? What about the Fed rolling off $100b per month? The MBS that should be rolled off?

How are investors in the markets not even considering these risks?

Recently, I went to look at RVs, and you were seeing $20,000 off on 2022s and the lot was so full you couldn’t park on the lot. To me, I am expecting price contraction on a lot of things. Housing, new cars, toys like RVs, motorcycles, ATVs, boats. All of these large purchases will need to have prices sharply drop to move inventory, and this also tells me that lower numbers should be ordered for the near term, dropping production demand numbers. When you drive the back woods of my state, you see RVs, motorcycles, cars, ATVs, boats – EVERYWHERE – for sale. To me, this is the first indicator of really bad things coming.

I believe in my heart that as fast and as high as prices rose – a lot of that cash was spent and profited by a few people. Think about all of the Amazon purchases during COVID and how much Bezos is worth now. Point being is a lot of the excess cash consumers had during the “good times” was hoovered up by a few. Relatively speaking. The spigot is off. The “big purchases” will decline, stop – and start to see fire sales to move massive excess inventory. THIS is not disinflation, this is deflation.

My buddy – the former IRS agent, lives in the DC suburbs. We’ve had ideological battles the last few years. What he doesn’t realize is that he lives in the richest suburbs in the world. The excess cash stewing about DC, soaking them in cash, detaches them from rural America just two hours away in any direction. The concentrated cash flows there are also seen in some other big city areas. But most of “middle America” now is going from buying excesses to selling excesses.

In the supply/demand world, we want from….

- Stable supply and high demand to

- Increased supply and moderate demand to

- Infinite supply and destroyed demand

The last sentence there is the recipe for deflation. Couple it with the bank runs you are seeing, and banks may have continued problems lending.

This is now the iceberg of economic activity. How is this not deflation?

Now – to fix that, you need to gas up the money bombers and get to ZIRP again. And THIS is where we get our real inflation to come. Steady….

Leave a comment