I wasn’t planning on writing an article about this, but I was Tweeted by Happy Hawaiian before bed last night. I didn’t take a look, as the 3-year-old little monster wiped me out. Daddy needed a drink yesterday 🙂

So I woke up, fed the dog, got the coffee on, and saw he had quoted this in a list he has. Uh oh. I look up, and see the carnage and wreckage of people who predicted bad things with the housing market over the last few years. I think Happy is in the camp of tight supply, so I’m going to take my nickel’s worth of time here to walk you all through what I’m seeing with the demand side. I plan to link this then under what he wrote so there’s some context.

First, the tweet…

Now – for those of you living under a rock and don’t know who Happy is, he’s a pretty damn sharp guy who I have followed since just around the silver squeeze. He got my particular attention with his DD on Reddit with something I think was called the SMOEC analysis. It was completely original and blew my mind. Over the course of a few years, we have exchanged some DMs. My analysis here I’d like to think like we were two guys at a bar having a beer going back and forth. This was my MO with my HS friends – although that was coffee at Dunkin Donuts and all of them are PhDs now and I’m the Howard Wolowitz of them with only two master’s degrees. Meaning – I enjoy a good debate and think he’s a sharp guy to engage with. No one has a crystal ball, so presenters in a debate make their cases, and you have time to let things cook and see where they land.

Next, let me walk you through the Global Financial Crisis for me.

I bought a house in 2007 at the peak of the market, then lost my job twice in 2008-9 due to massive layoffs. I could not even sell my house because the equity on it disappeared – close to $70k lower than my mortgage. I, like many, rolled closing costs into the mortgage so I had that nut I was then down on. Luckily, I had gotten jobs within days of losing my previous jobs, or my only other option was to short sell and it count like a bankruptcy. Eventually, I ended up renting it out as one of my units.

If people look at why there is a supply issue, it’s two issues major issues: Those with low rates not looking to ever sell, and those who own a lot of short term rentals (or even long term rentals) and rents are disappearing.

The first is the one I’m sure most are tracking. People like me have massive equity in my current house and refinanced at like 2.7%. I’m in my forever home. That’s almost half of the country. I can produce charts on this, but can’t find at the moment. Sufficient to say I’m not making up the 50% note here.

However, many have bought in the last 2 years at stupid high prices/rates, and they are me in 2007. They have no equity. So the 50% like me are pretty safe, but the millions who recently bought, are NOT. The solution to high prices here…is high prices. This “demand” is going to get killed by math, where high prices AND high rates make monthly payments something no banks can green light. I remember the FOMO I had. “Supply is disappearing – this house is the only one I can afford in this market, I need to pull the trigger!” My, how 12 months changed the prices on houses.

If we look at price points with the simply charts you see in economics, you get this…

The concept here is that as supply gets more rare, and demand remains constant, the price goes up. Likewise, if the supply remains constant and the demand goes up, the price goes up. This chart was never actually in Adam Smith’s book, but every person who has ever taken economics understands this concept.

The flaw in talking about housing SUPPLY is ignoring the DEMAND. What Darth Powell has done essentially is create a policy to crush DEMAND. With rates going up vertically, it starts to become cost prohibitive to buy a house. You can see all of the articles out there which shows how a monthly payment could perhaps double with the rates of today from just 2-3 years ago. Meaning, unless everyone suddenly made double the salary, people are not going to be qualified to buy as much. The debt calculators used to green light homes is flashing red. The banks are losing deposits by the truckload to issue new loans as J Powell is creating a situation that is sucking deposits from banks to go to money markets.

In no way, shape, or form, would I advise someone to buy a home today. What TODAY is, is me in 2007 with the extreme lack of supply on the market – you overpay to get into something fearing prices will always go up and you will never be able to buy a home.

The global financial crisis was then the hammer to demand. High unemployment came out, and the economy was in recession. People then were worried about buying a house during rough times. They also now saw prices coming down and rates coming down, and decided to hold off.

It is hard to fathom the demand continuing under these circumstances. Unemployment is now creeping up, and if the rate rates take 12 months to back the cake as many suggest – JUST NOW WE ARE SEEING THE RATE RAISE EFFECTS OF 12 MONTHS AGO. Bankruptcies are piling up and are the highest since 2010 and we are still very early in the year. Zombie companies going to get wrecked. Commercial housing getting wrecked. Unemployment will go up to damn near 5% in short order. Companies entering woke politics are getting obliterated.

It is my contention that those who bought in the last two years who lose their jobs are going to get smoked. This will be in the hundreds of thousands. Since we all know that houses are priced by comps in the neighborhood, those that start to lose their jobs and can no longer afford the payments will want to fire sale. This will start to bring comps down in ALL neighborhoods. My property value is nowhere near any hot housing market, and the value of it is perhaps 50% higher than I paid for it in 2013. I don’t really care if I lose 20-30% in paper value because the low mortgage payment I have is just higher than a 3BR apt around here. This is me with my house…

So The second issue with supply has to do with the 2.5 MILLION homes that are owned by short term rental companies. I had NO IDEA it was this much. Apparently, coming out of the pandemic, with the “travel trade” many bought houses and bid them up to rent them out as AirBnBs. Amy Nixon was on Wealthion about 6 months ago talking about “the AirBnBust”.

The research showed that there is between 2-2.5 million homes that are rented for short term rentals. This is…..ungodly high. And, as these business owners bought up a lot of these, they jacked up the prices in the area outbidding you and me who needed to buy. Cash offers 20% over listing were crushing those trying to use mortgages. You had Blackstone then coming in and buying a lot.

Amy (or those within her groups) coined the term AirBnBust. Meaning, all of these properties bought (that were bidding up the markets and scooping up supply) are no longer being rented and a bust is forming. The bookings dropped off of a cliff. This means you have BUSINESS OWNERS having an ASSET paid for in cash OR leveraged up that no longer is bringing in revenue, or a fraction of the revenue.

You are the business owner – you have one of a few options:

- Wait it out. Perhaps you bought cash. This is costing you taxes each month. And, because values went up, so did the taxes on all of these. This is crushing you.

- Sell it. Throw it on the market. Because of the tight supply – those hitting the market would get scooped up, but as these MILLIONS of homes come to market, each one may start to sit longer (high prices/interest) and those leveraged need to make a profit, or not break even. The listings start high, but prices start falling. This then lowers the comps everywhere.

- Turn it into LT rents. This floods the market with dwellings for rent. I own rentals, and I saw rents climb. But if someone can rent a nearly new 4BR home for what I rent out a 3BR apt for, this is an exodus of high rents for properties like mine, as I now have to lower rents to attract and retain renters. But – more secondary downstream effects – Those who bought homes to rent LT now are facing renters leaving them for better deals, forcing these guys to lower rents – perhaps lower than their mortgage payments. Many of these LT rent owners will then sell.

Speaking of Blackstone potentially having issues – I had read an article that Blackstone and many other companies like this bought up a lot of this supply. Remember the “you will own nothing and be happy?” Yeah – big companies were bidding up properties. Well, I had read companies like this are now realizing they are perhaps DEEP underwater on the value of these, so they have sold packages of these assets to teachers pension funds. Let that one sink in for a minute. A big company realizes their assets are not anywhere worth what they paid for them. They can go down like those in 2008, or they can get it off their books. See, pension funds are guaranteed to be paid out, and bail outs will happen for pension funds. However, the Blackstones of the world will NOT get a bail out. Smart.

Meaning – a lot of these BIG companies who hoovered up supply in 2021 and jacked up the prices got the hell out of it at the peak and offloaded that steaming burning bag of shit to a fund that is guaranteed to not fail by the government. As pension funds may find themselves in trouble in the next year, you may find a lot of these houses coming to market. At fire sale prices.

Air brakes

I think the design of our system is beautiful, when the free market runs it. The problem is, it’s been many years since free markets ruled, and it’s easier to see the footprints of big government manipulating the economy more and more to pick winners and losers. This isn’t supposed to be how it is.

With the DESIGN – when economies get too hot, rates go up. This has the following effects:

- Asset prices will have to come down. Assume a $350,000 house at 2.5% interest has a much different monthly payment than that same house now valued at $700,000 at 8% interest. The interest rates effectively force the sale prices lower. But we are at the point in time where asset prices are STILL HIGH and the air brakes are being deployed. This will effectively seize the peak housing market prices. In RESPONSE, AFTER the damage hits, you will see as part of a RECOVERY that rates decline to ensure the drop in assets is not a free fall, but glides lower. DEFLATION is the enemy of governments. However, the AFFORDABLE HOUSING solution only comes by first DESTROYING DEMAND and LOWERING ASSET PRICES. This is starting.

- High interest rates creates risk off. With STOCK ASSET prices also extremely overcooked with high P/E ratios, 2% dividend stocks and lower forecasted earnings is not as attractive as 5-6% treasuries. This starts to suck cash out of risk and into safety. This includes now bank deposits, that are seeing 5% inflation reduce the purchasing power of the cash being left for money markets and treasuries. This reduces the liquidity for banks for lending. Remember how we are just now seeing the effects of 1 year ago? Well, we perhaps have another year of carnage getting much worse. This DESIGN has the rotation of cash out of risk into safety.

To me, it is pretty clear that for the first time since the GFC that the planners are intent on bringing asset prices down. While they want SOME inflation to keep growth, too MUCH inflation (yes, caused by the massive increase in borrowing and creating $6T) has a runaway Weimar effect they appear to be intent on crushing. I believe, strongly, that even when a pause does happen (I’m not convinced June will see a pause) that they will try to hold rates they as long as they can to bring down asset prices.

For those of you not keeping score, our government now likes to run $1.5-2T deficits yearly. We are spending, spending, spending! And, up until recently, we got massive buying of our debt from the Chinese, Saudis, and Japanese. Those days – are over.

To me, it is clear that the government is fully intent on SPENDING until things break. With this, they need cash to fund it. How better to fund the economy than offer 6-7% treasuries? Would not that suck cash out of a stock market? 8% treasuries? What number can you fantasize about? “But Nate – that would mean they would need to spend $1T just on interest!!” DO. YOU. THINK. THEY. CARE. They just borrow more to fund the deficits.

Yellen sat in front of congress and did not blink at a $50T debt. Not for a second. Why? In MMT land, the debt doesn’t matter, as long as the governments beaks continue to get wet. In this environment, you are continuously juicing the economy because – higher asset prices is they higher taxes you collect. Higher profits from sales means higher capital gains taxes collected.

The CBDC is to ensure EVERY transaction, the government beaks get wet. This, is part I feel why they are trying to de-criminalize drugs. Even if you are buying an 8 ball from your coke dealer – that transaction using CBDCs had a tax on it. Vice transactions get taxed. Selling Clue at your yard sale for $3? Government beak still gets wet. No cash? No problem. Use the CBDCs.

So – I do see the party in power wanting much higher asset prices – down the road. However, today, they need to deflate these assets a bit to pay for their orgy of programs.

Demand destruction is real. Supply is only half of the equation. And, when you see 5-6% unemployment, many more houses will come to the market at fire sale prices.

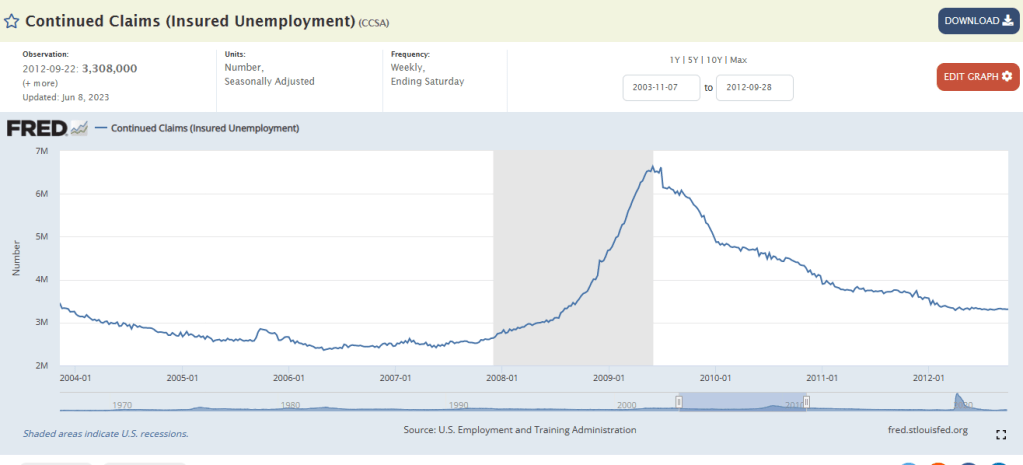

The above is the GFC in 2008. Look at how the rate soared! You can see rates starting to pick up Jan 2008?

If you look at Fed Funds rates, you can see the gradual incline of rates peaked at 2007 and held at 5%. Meaning, there was a lag time where the unemployment bomb hit 6-12 months after peak.

Look at the next hump, and you see “end of QE”. Yes, we had COVID, but many people aren’t tracking right before COVID, MANY of us were predicting a lot of carnage coming. COVID is what everyone blames, but essentially, we were heading towards doom well before the Wuhan reports came out.

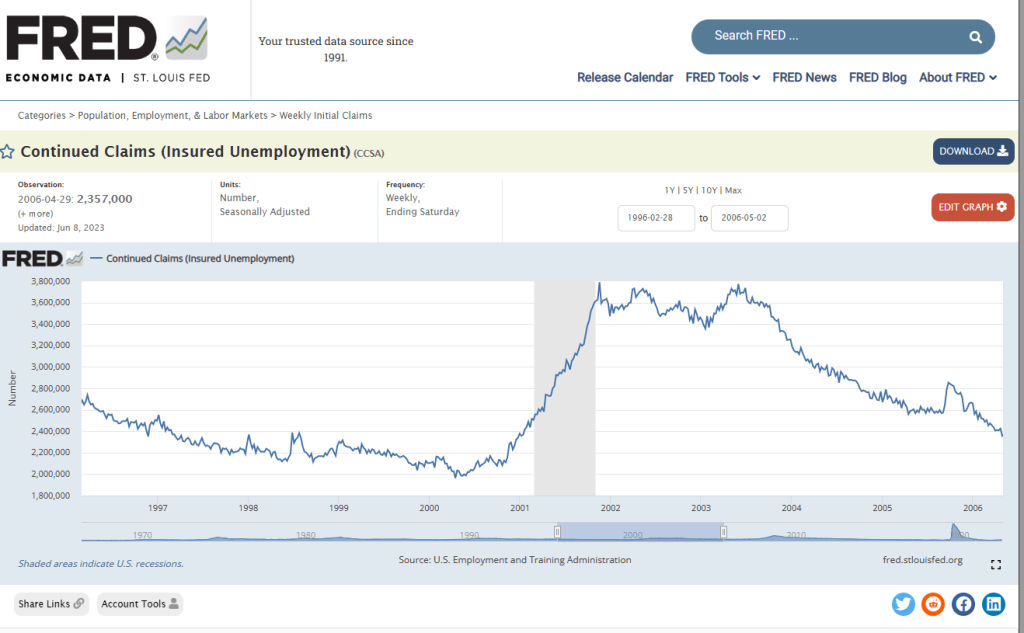

Let’s look at the dot com bust. Look at the rates rising to 7%. Short hold, then massive unemployment hitting. Yes people – I lost my job during the dotcom bust as well, having worked for EDS. This forced me to sell my house. I was out of work here for 15 months.

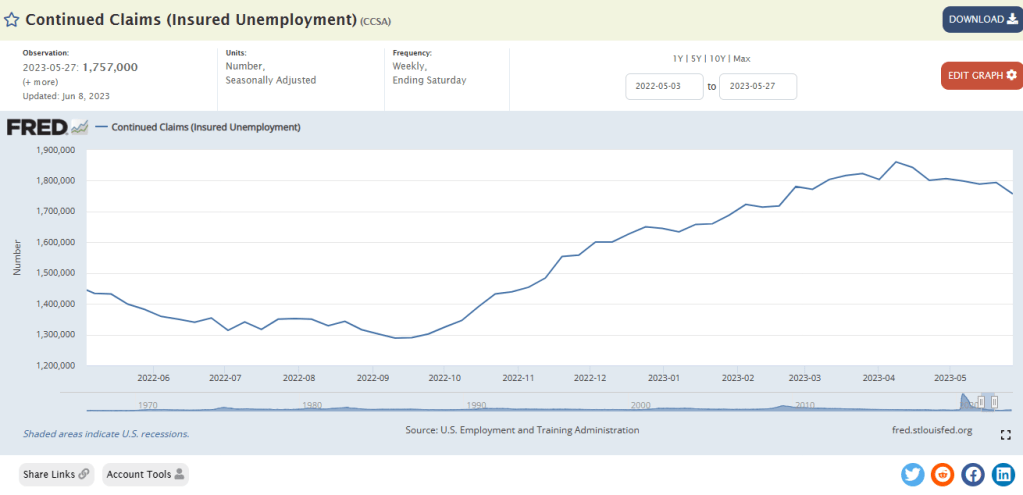

Now – we have to look at the indicators today.

Rates rose at the steepest rate, ever, from 0 to 5% in a year. This essentially says peak unemployment is 6-12 months away. However, the issue doesn’t begin at peak unemployment. The issue starts when those who manage money start to see unemployment rates run higher. This is what we have started to see from November 2022.

While the raw number looks low compared to the GFC, remember, this is coming on the heels of a massive liquidity bomb hitting. One can see the punch bowl being removed. With this, it is easy to envision PEAK unemployment sometime mid to late 2024. IF housing prices are starting to recede today, how much can you see them going down with 12-18 months of bad unemployment reports?

I’m perplexed by anyone with a bull case in anything today other than defensive positions. This “bull market” that people are hyping? You are all about to get rugged. All of you.

I say this partly because of this post, which I outline a ton of bearish positions. Namely, we have had more banking failures, by dollars, than in 2008-2009 combined – and we are only 5 months completed into the year.

I hope I’m very wrong. But every indicator here is a great rotation to bonds/defensive positions is inevitable. Those long anything else are up for a good rugging. I lost my job in the dotcom and GFC (I work in tech) and the amount of tech layoffs this year is staggering. The FEAR trade is coming. This is not being a permabear. It’s math considering the DEMAND side.

Perhaps I will be in the carnage of wreckage in the annals of history of the HH quote train. 200 years from now, the Library of Congress may even recognize HH’s tweet chain as the record of history why this time it was different. However, my plan is for a piece like this to bring sanity to the supply argument by gently reminding there’s a demand side of this as well.

I believe the air brakes of the economy are being fully deployed.

Cheers! P.S. this could be an interesting panel discussion someday!

Leave a comment