I’m writing this to you new silverbacks on WallStreetSilver and perhaps some of you hedgies out there reading through these posts to see why we are crazy about it.

I’m going to structure this into several sections so you can get an overview of where I’m going with this.

- Silver supply – how much is REALLY out there?

- Silver demand – what is it used for and I hear there are deficits?

- How silver is priced – obviously supply and demand are part of this consideration, right? No. Not at first.

- How a mine is built – how we cannot hope to meet demand

- Refinery and recycling – let’s just take grandmas silver there

- How inflation affects precious metals

- $100 silver in inevitable, but perhaps not imminent – how price will be determined

Silver supply – how much is REALLY out there?

If you listen to Jeffrey Christian on Kitco or some other venue, he is obviously an intelligent human being who has made his customers millions. He also plays circus tamer pretty well, and is adept at putting a confident face forward that there’s 60 billion ounces or so of silver above ground. As humans, we consume about a billion each year, and with mining and recycling, we produce close to that. Over the last 5 years, however, we are running at yearly deficits. This year is projected to be about 250m oz deficits from what I heard. Obviously I would love one of you to fund a book for me so I could spend weeks researching this one item, but alas, I must skip all of these steps and tell you what I hear. So take this as it is.

So if we are at a 250m oz deficit, we just go into the warehouses where there are 60b oz and take from there, right? No. Here’s where the con game breaks down.

I could write about 40 pages on this subject, but want to keep this relatively brief. I wrote a full blog about this previously, so here are the highlights:

- 60b above ground

- 30b is in products like mirrors, band aids, stretchy pants, solar panels, and in dumps. A car may have 1 oz of silver in 50 different parts and it is in a junk yard. At this point in time, it is told that you need $70 silver to make some of these efforts profitable to tap into this vein.

- 25b is in silverware, tea sets, and jewelry. This is worldwide, so places like India who have used precious metals for 30 years are not selling their jewelry when silver runs from $25 to $50. This is generational wealth passed down to only be used in the worst of times.

- Of this, there’s about 5 billion left

- 2.5b estimated to be in 1,000 oz bars in vaults around the world.

- 2.5b in coins, bars, rounds, official coinage (junk silver)

For all intents and purposes, we focus on the 5 billion “available” supply. However, if you are an industrial user, you are typically looking for 1,000 oz bars. A refinery can then turn them into shot, coil, rounds, etc. However, if you are Tesla, you aren’t buying my junk silver. You are buying 1,000 oz bars.

So of that, lets assume there’s 2.5b oz in this form.

Of this, about 1.2b oz are at the LBMA in the UK. A report in February showed that with the silver squeeze, it had taken them down to dangerous levels due to ETF usage. It stated, essentially, that ETFs were using 85% of the bars. The rest you can suggest there were some free float, but most were owned by banks – possibly by wealthy individuals.

Then you have Shanghai and COMEX and other exchanges. The COMEX states it has 350m oz, but 110m in “registered”. David Morgan states essentially that this is the “showroom floor” silver. I am suggesting in MY hypothesis that they CANNOT let THIS silver go down – as my PERSONAL opinion is that they are using this like a fractional reserve in that banks may allow futures trading at 2x or 3x of what is owned. If you take the physical out that you own, it reduces the amount you can short on futures. I’ll get into that in a bit, but I am assuming this 110m CAN be sold.

With the LBMA and COMEX registered, you are perhaps looking at 200m oz in 1,000 oz bars.

You then have Rick Rule and others stating for MONTHS how hard it was to get bars in size for the PSLV ETF. Jim Hunter suggests him and others can buy from the COMEX warehouses “eligible” category, which is 250m oz. However, the reports are, “the bars aren’t there” and Rule says PSLV “cleaned out North America of all 1,000 oz bars”.

Remember, you DO have the 250m in eligible, but available AT THIS PRICE.

This is something a Christian glosses over. If I’m a wealthy guy with a silver doomsday account, perhaps I have 1m oz of silver held in these vaults, but I don’t want to sell at any cost. This is not AVAILABLE inventory. It is SUPPLY, but not AVAILABLE INVENTORY.

However, as price rises past $30, you may see some of this supply be converted to AVAILABLE INVENTORY.

What Rule suggests is, at $28 silver, the AVAILABLE INVENTORY of 1,000 oz bars for the PSLV is relatively non-existent. So why did price go to $25? More on that later, but I don’t want you thinking that you bought at $28 and then all other apes suddenly ran to the coin shop and sold.

So the SUPPLY may be 60 billion ounces, however, this is much different from AVAILABLE SUPPLY.

I would put worldwide AVAILABLE INVENTORY TO BUY somewhere around 20m-100m oz of float at any time – in 1,000 oz bars – AT $25-$28 PRICE. I’m significantly discounting the “registered” on the COMEX due to the many, many stories you see of how hard it is for people to pull off the bars, and perhaps delays of 6-12 weeks to get it to you. This could indicate it’s legit not there, and they are running some sort of ponzi to deliver to you. I’m NOT in that camp, but I cannot discount the tin foil hat guys either when it takes you months to get a single bar. That isn’t legit, and thus it casts aspersions on the true nature of this “availably inventory”.

This is ALSO different from the industrial users that have contracts with banks to get those 1,000 oz bars. These guys are at the top of the heap. What I’m talking about is if you are a wealthy person and wanted to buy 1m oz in silver, there’s not a lot on this planet to get in 1,000 oz bars.

It would then be most prudent to go to the COMEX, buy a futures contract today for July, and get it “delivered” in a few days, then work over the next few weeks to extract it.

Bottom line is many talking heads completely confuse the 60b oz above ground with the 20-100m in AVAILABLE INVENTORY TO BUY, and thus look like idiots to anyone who understands the real game behind the scenes.

Silver demand

This also can be a separate book, and I’d point any of you hedgies or CNBC muppets to get David Morgan on to speak to the demand of silver. This guy could be the face of silver on news programs in the upcoming years when silver cracks $100, so get to him soon.

Below, you see how the production of silver has been declining for the past few years, as demand has risen.

Take a look at Steve St. Angelo at the SRS Rocco report. When I started in this journey, I found a lot of his videos and charts helped me understand the macros. I disagree with him on his energy thesis, due to potential help of batteries coming, but I agree with him on 95% of everything else. Love the charts.

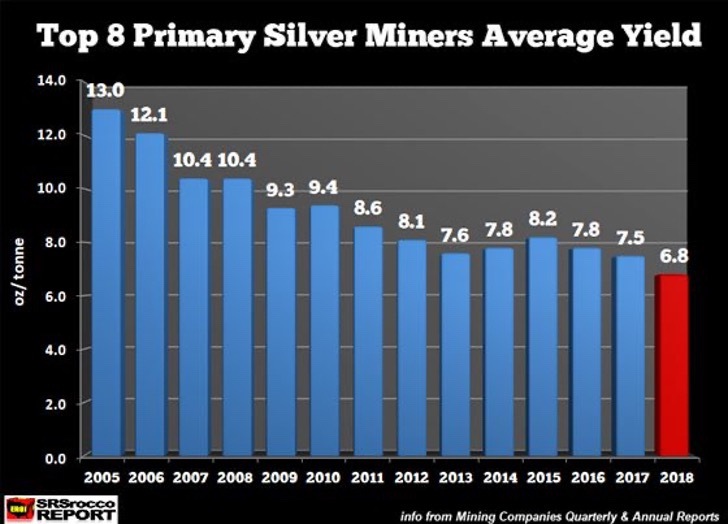

So with this production of silver, you are also seeing grades that are lower. Here’s another chart I remembered seeing from SRS Rocco burned into my brain.

What this is telling you is that the mine supply we have is getting worse and worse grades, making it more expensive to produce. While this is indeed the supply side, let’s dig into the demand side.

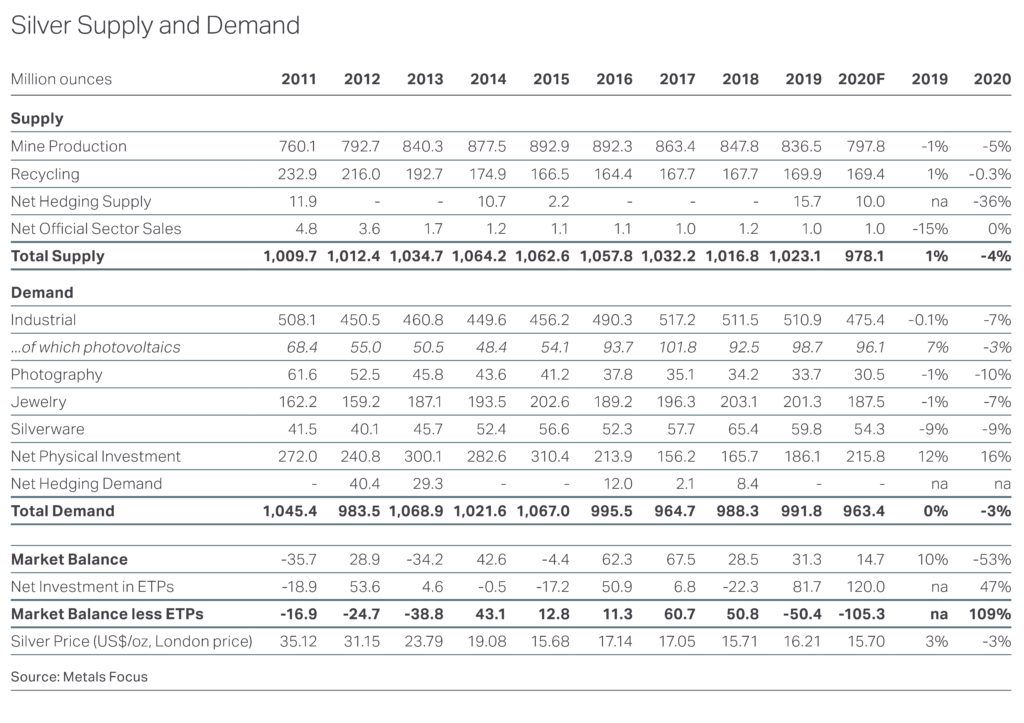

The silver institute put out this document which show a net 105m oz deficit in 2020, and projected to be much higher for 2021. The mine supply was off in 2020, but this can not only be attributed to lower grades – but COVID reduced mine supply. With the higher prices though, you BET many were trying to capitalize on it, so I think given the supply trends, the 797 seems in-line with what I would have expected.

With higher prices is the promise more mine supply would come online as well, so these numbers of supply could increase significantly for 2021. You see industrial usage at about half of the entire supply. But what jumps off of the page is the increase in ETP investments as well as the net physical investment. This only promises to get higher over time as the price goes up.

With that industrial demand though, what does that encounter? If you look at First Majestic’s page, it has a great graphic to show you where this demand is.

Next to petroleum, silver is the second most useful commodity on the planet. It also has properties which make it this desirable, of which there is no substitute:

- Best conductor of electricity on the planet, period

- Most reflective

- Antibacterial

While the second and third are important, it’s the first one here that any of you hedgies need to pay careful attention to.

There’s this whole concept of “going green”. Think about the trillions needed for green energy. With this, you are looking at mostly:

- Solar panels

- EVs

- Battery tech

Solar Panels

With solar panels, you see demand above at about 100m oz. From what I recall, each solar panel uses about 22g of silver, or roughly 3/4th of a troy oz. Estimate. Each year, they try and drive down the amount of silver these things use, but the last I heard, they are near peak efficiency for what they can do with these.

I then want you to consider that I had read that all new houses in California need to have solar panels. There might be some sort of caveat with that, but many states like to look at California for a general direction on things.

I want you to consider most of the industrial world now looking to California to then mandate all new houses have solar panels.

Could this double the yearly requirements? Triple? Quadruple?

Assume there is a “green” way forward, it would mean there could be an extraordinary explosion in silver required for solar panels.

EV’s

While this can be tied to the battery stuff below, I want to separate to show two distinct types of batteries – EV and other. When looking at EV usage, you are looking at replacing existing ICE vehicles.

From what I have seen above on similar charts, the auto industry used about 100m oz. I then found worldwide there were 77m autos produced last year. I came up with roughly 40g of silver used per ICE vehicle, and I have seen estimates at 25-50g of silver per auto.

I have also seen where it is estimated that EVs use 3x the silver of ICE vehicles. That could put us at perhaps 75-150g (or up to 5oz) silver for each EV.

IF we are to produce 100m EVs by 2030 to replace the ICE fleets out there, you are looking at up to 500m oz of silver needed, per year, to produce EVs. Let’s dial that back to 300m for a conservative estimate. In an ICE vehicle, you are dealing with perhaps 50 different parts that might use a gram each. Remember that “best conductor of electricity” thing?

Batteries

I believe that battery tech as a whole COULD be in the most important inventions in history. Obviously the printing press is huge. So is atomic energy. So is the microchip. I’d contest that modern battery tech could make this list. From what I read, the most recent breakthroughs are using silver.

Why is this important? I disagree with St. Angelo on the energy cliff for this reason. I worked in the hydro industry for over 4 years and one hang up with hydro was that they had to shut turbines off at times due to lack of demand. Think overnight. It was real-time generated energy. Where nuclear produces a stable energy source – wind, solar, and hydro are variable. When too MUCH electricity is being generated, you have to turn things off. Mostly seen with hydro. However, IF you were able to have massive batteries capture this extra power produced and feed it back into the grid the next day, you are looking at tremendous amounts of energy we can then capture and release.

Think of this also with the home tech. All of these people with solar may also not capture excess energy, but others now have battery packs at home. With new generation batteries, you might be able to store weeks or months of excess energy in these batteries. Think of your local power grid then able to store months or years of excess energy generation.

Likewise, then consider “green” mining. Steve St. Angelo put out another stat yesterday that I loved. He wrote that for each ounce of gold, a miner uses 43 gallons of diesel fuel.

Now I want you to consider a type of mining where your power is generated by a local hydro dam that can bank tons of extra power generation, and then your fleet of trucks are run on giant batteries.

First Majestic San Dimas mine has a hydro dam powering it….

So IF this battery breakthrough is legit, we could see excess power generation by hydro dams being captured. This would require less power derived from oil plants. Coal is the leading power generation now, so a higher cost in oil would not affect that much.

IF we have a situation where demand for oil collapses due to 2 billion cars on the planet running on batteries, produced by clean mining with battery powered trucks, and the power generated by hydro excesses and nuclear could be captured in batteries, I’d posit that this could have oil not reaching the cliff for another few hundred years.

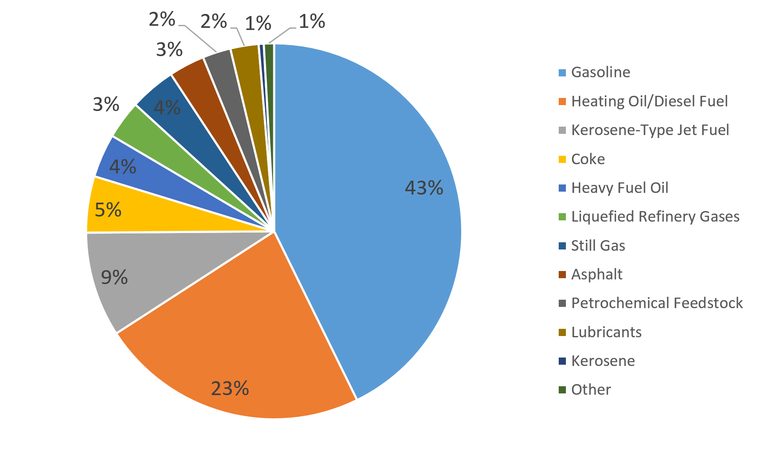

In a 5 second review, I found a pie chart that shows the below. This may be a terrible, terrible source, but I’d ask those writing books to look for definitive scholarly resources. This comes from here at energyeducation.ca:

IF 66% of the petroleum demand for gasoline/diesel could be significantly reduced due to battery tech, the demand would crater price and perhaps really push off that cliff.

The question is, how quickly can we get these batteries produced? How much silver is needed? Copper? Nickel?

This is where natural resource investing could be very interesting over the next decade.

Either we:

- Run so low on oil we are looking at $200-$300 per barrel, which could destroy markets and decimate global travel OR

- We prevail with battery tech and save the world

To me, I believe those now in power want nothing more than to get off of oil and into green. What this is telling me is billions or TRILLIONS could go into research, development, and getting these needed resources.

Remember how I was talking about 20-100m oz of available float AT THIS PRICE?

Well, what yearly numbers do you think you will need of silver in excess of what is being produced today? Between battery tech to stave off oil production cliff, EVs, and solar panels – my bet is by 2030 we might need to see 500-800m more silver oz than are being produced today.

This then has hockey stick moves in silver written all over it.

Oh, and in case you didn’t know, silver has also been money for longer than gold. In the current environment, you are now looking at people getting gold and silver into their personal possession in case of some event like a currency collapse. To those hedgies who didn’t learn this at Wharton, every fiat currency in the history of man has failed. Thousands of currencies. And we are 40 years past the expected demise of this one.

So not only do you have the green people who need this, but you are also growing a massive worldwide population who are understanding sound money who want to get their hands on this. As inflation will grow and the case for industrial usage of silver grows, more and more people will pile in to buy silver for its monetary usage.

Meaning, if the world gets more scary, expect silver demand for investment and ETP to continue to escalate. This makes your hockey stick have a hockey stick within it.

I want to leave you with this. One day in February, #silversqueeze became popular on Twitter. In a weekend, a FEW THOUSAND PEOPLE took silver over $30 and cleaned out literally all retail, WORLDWIDE.

Now, picture just a few million people in the world getting skittish. And there are 8 billion souls now. What if just 1 percent got skittish and went to silver? That’s 80 million people running to silver.

How silver is priced

Surely, supply and demand has fairly priced this unique substance, right? I mean, if there was so much demand, obviously the price would rise to reflect this?

Yeah…..no.

The price of silver that you are seeing today is a ticking time bomb that is created by a “fake” silver “paper” game called the COMEX. It uses something called “silver futures” to then derive the price of spot from that, along with a “fix” price.

Let me break down what this means.

- A futures market in commodities is ultimately set up to “hedge” production. The prices then for these tend to go down over time as efficiencies with production happen. Meaning, you tend to see price of these things just above the cost to produce

- Many “silver primary” miners have been driven out of the business due to the rising costs of production, along with lower grades.

- Most silver is produced as a byproduct of other metals. Therefore, the idea here of trying to price this commodity completely ignores the primary silver production cost and focuses on what a miner would take as a “side metal”. Meaning, a gold, lead, or zinc producer gets silver as a secondary metal and are happy to get good money, but it is irrespective of the primary metal they are mining

- This dynamic has starved exploration of silver mining and thus led to the decay you saw above of the grades of silver declining.

- There is a lack of silver mines coming online, and these can take 10-15 years to actually go into production, IF a discovery is found.

- There essentially is a crisis for primary silver producers, AT THIS PRICE.

The futures market doesn’t care about silver primary producers. Let me boil this down. On May 26th, there were 905m oz in “open interest” on the COMEX, but 112m oz in the registered. To many futures traders, this means nothing. To a risk department at a bullion bank, you may see your people selling 8x more product than they have to sell. Still – futures people are wheeling and dealing in CONTRACTS, not SILVER.

What?

Let my try to put this another way that hedgies might understand.

- People who may or may not have silver are selling paper contracts to people who may not want the silver. Neither party actually cares if silver exists, at all, in the COMEX. Why? Because IF a long DEMANDED silver at the onset of a delivery month, the short can just settle in cash and move on with his life.

Oh.

This video sums up what most of us think about this scenario WHEN the switch flips in peoples’ minds and they realize what on god’s earth is going on.

Take a look at Kyle Bass below.

So you are a futures trader, and price is $25 today. You sell 1,000 contracts. You need $15,000 or so in margin for each of these contracts. So you put up $15m to sell these contracts.

A news report on CNBC comes up the next day, detailing everything I discuss here. They talk to David Morgan.

There’s a collective “WTF” moment in their office.

They run the story.

The bank that just sold those 1000 contracts now sees silver at $30 the next day. A freight train is about to hit them. They get margin called for $25m. They get out. Open Interest (OI) drops by 1,000 contracts. This happens across to the board to those current 775m oz now in OI. Many who have zero intention of delivering silver GTFO immediately. OI in silver would collapse, as the newscasters completely understand this asymmetric play.

Other talking heads see this and pick up on it.

Hedgies start opening positions going long. Price is now $35.

Those who HAVE the metal to sell, like a BB, may be simply selling the product on behalf of a miner. But the price action and macro picture now have no speculative people wanting to short the market. Some may short into the price rise if they have the metals. So be it. Remember, you may be unlocking some eligible at the moment and legit selling of metals may be taking place.

Right now, what is missing for this first hockey stick move is simply awareness of how precarious the situation is on the price mechanism. Shorts are getting away with pushing price down, as long as no one really knows the game afoot. Now, there are 125k WallStreetSilver apes that are trying to get this word out.

I have to tell you, shorting for speculative purposes, at this price, today, is a very, very, very dumb move. It’s your money. Do what you want. But damn dude. Think of that piece that is coming out…someday. Remember, as the dollar declines, you will also see price gains in gold and silver.

In the SHORT term, there’s lot of price manipulation going on. Daily. Take a look in your google search for “silver price manipulation” and read through the first 20 or 30 articles. Let me give you a cliff’s notes version. They do this to make billions, to pay fines in the millions. Let that sink in. It’s the same line item for them as a stapler budget.

Palladium

These same types of games happened with palladium, until the supply/demand fundamentals broke the pricing mechanism. Take a look at what happened to palladium.

Palladium went from $442 to $3000, or about a 7x move, when the supply/demand fundamentals overtook the “paper price”. These guys all got hit by semis.

The point is that the paper price works to suppress, for awhile, and then such extremes happen that push the imbalance so far that paper shorts get decimated.

Cheaper than all other commodities relative to 1980s highs

You can see this chart below

This shows that relative to 1980s highs, silver is 43% off of its high, whereas every other commodity seems to be much higher than its 1980s highs. Remember the above. Declining mining supplies, lower grades, and a supply/demand fundamental that could take this thing on a moonshot. Lack of “available supply, at this price”. Green deal. EVs. Solar panels.

Are you betting this is going to remain here for long?

In all likelihood, silver has a much, much higher price ahead. And that’s how you get a short squeeze, of sorts. Fundamentals will overtake specs and they will get the hell out of the way.

When that CNBC piece runs, man I’d love to see how shorts perform that day. Wow.

How a mine is built

We need more silver. Turn up the dial on production.

If only it were that simple.

When silver was $35 or so an ounce, you did have mines in production that are not now. Many of these went on “care and maintenance” because it cost more to produce than the revenue they were getting for it. So if price goes back up to $35, and stays there, some miners MAY put some of these mines back into production. This might add SOME production.

But most people don’t understand how complex and long it is to get a resource into production. You have private enterprises putting hundreds of millions, or BILLIONS into a mine and the needed mills, equipment, and personnel to produce this.

For example, you are a rich person like Musk. You realize your EV and solar panel companies are going to need a LOT of silver over the next few decades. Why not just buy all you can now? Well, they might. There’s another hockey stick. Most people don’t realize that at today’s price, Apple can buy all silver on the earth 20 times over with just their cash on hand. That is how SMALL this market is. So, VERY large orders can move the dial, rapidly, and quickly.

But you are Musk and want to get a lot of silver. You say, “I’ll just go mine it”. Sure. Have at it.

- You have to look for it. Where is it? Get out your geologists and put holes in the ground.

- Assume you find silver, it’s probably near existing silver. How much do you have? This takes years of drilling

- Now, you think you have a lot of silver. Is it economical to mine? Is the grade too low? You might need to get a prefeasibility study (PFS) or Preliminary Economic Assessment (PEA).

- Now, the numbers look ok. Now I need to get the permits in place to build everything out. We’re talking roads, power lines, mills, all that fund stuff.

- What about the water, you might have to re-direct a river

- Don’t forget about the indigenous tribes locally, you have to ensure they are on-board or else they might not let you build.

- Ahhh – almost forgot about the 1-2 years for the ecological studies

- Did I mention all of this now has you costing hundreds of millions?

- Now, let’s take 18 months to build the mine! Time to cough up another $50-$200 million

- Great! I can now produce silver, assuming the gangs in the area don’t kill us.

- Hey! We are your local government. We are planning to seize your mine under our new laws.

This is what a new miner has to look forward to. Meaning, if you are a Musk, you might have to look for a mine possibly coming into production in the next few years. Given you might be looking to build 10m cars a year and have lots of solar panels, you might need about 20m ounces a year for the next 20-30 years. Let me introduce you to Discovery Metals.

This is a 600m oz asset and plans to come online in 2023. Before that, if you want, perhaps you can buy MAG silver. Any which way you slice it, you will now have to be in the mining industry. Your costs to produce will go up yearly, as your grades get worse and fuel prices go up.

So, let’s plan on $1-3billion over the next 5 years. Oh, and your car company at any time could go to zero.

What this means is a Musk will realize he’s not a miner and probably let other people deal with that risk and he will simply buy the product. As costs go up, he simply passes that cost on to you, the consumer.

Now, there are over 1,000 unique products that use silver. And with the whole GREEN thing above, imagine the fire hose of demand then coming in. Imagine how everyone has been led to believe that silver is just sitting on shelves waiting for people to buy it. And, imagine their dismay when they realize the shelves are stocked, but with silver not for sale to them, at this price.

Refinery and recycling

Now, remember that 60b oz that Jeff Curry and Jeff Christian hint at? Yeah, that is all time ever mined, and as you’ve seen above, a lot of this is industrial and goes into products that ends up in the dump.

Then there’s silver candlesticks that have been in your family for generations. It’s Sterling Silver, and at 92%, Tesla cannot buy your candle sticks. You have to sell this to a coin shop or directly to a refinery. But these things have sentimental value. The price of silver goes up $2. Are you running to the coin shop to part with this? Not likely, unless you are a soul-less, heartless bastard.

In all likelihood, there will come a tipping point where you consider it. Your kid is about to go to college, and some extra scratch would be nice, and you hear of $50 silver on the news. You do the math, and think another $1000 in your pocket would be nice.

As price rises, YES, more of this locked up supply becomes available. It will first start in the “eligible” 1,000 oz bars and quickly run through a lot of that. But when we hit $50, there’s not going to be a lot of 1,000 oz bars left. What you will see happen is a lot of people then trying to sell jewelry or candlesticks. The problem is, the refineries only have so much capacity. Right now, you can see above, they already do recycling of 170m or so oz per year. This is a lot of junk silver, silverware, etc.

Let me ask you something. What is the HIGHEST number on that chart? 239? 2011? Yeah, so silver hit $50 in 2011, and it seems the max they recycled was about 70m more oz than last year. This means of all of the people on the planet, only 70m wanted to turn in their candlesticks? Why not 1 billion oz?

From what I heard, people stopped taking grandmas silver due to backlogs. Refineries only have a limited capacity. Why would they build structures to do 10x their max capacity?

Meaning, if there’s a rapid rise in silver price, the refineries could not keep up with demand.

So you just want to flood the refineries with hundreds of millions of ounces of grandma’s silver? Yeah, right.

The suggestion here is we might be able to add 70-100m of supply with recycling. Perhaps a sustained higher price might then entice more refineries to come online, but this is not a quick thing.

How inflation affect previous metals

We are currently seeing inflation everywhere around us. Many academics like to try and tell us we are in deflation. While that may be true at an academic level on the macros, I have argued that the every day Joe Six Pack has seen steady high inflation since 1980. To argue against this means you never were part of the lower classes and dealt with price rises while your wages never kept up. I would take that Pepsi challenge with any Rickards, any day.

What we are seeing now is the fact that the inflation can no longer be hidden by the artificially juked CPI. I have gone into great detail on this, but it is my contention that we are about to see massive inflation through this next decade. I also believe we will have a great bust or smash as interest rates creep up to keep pace with inflation, before the Fed steps in with full Yield Curve Control. At that moment, you are seeing interest rates at 1.5% or so and inflation at 6+%. Meaning, the REAL YIELDS are highly negative. They are now, but the Fed hints at raising rates at some point – and everyone knows they can’t.

The point is, metals are a really good inflation hedge. In the 1970s, gold went up 24x and silver went up 29x. This was 40-50 years ago, so most of the boomers who are retired don’t care so much, but the younger people out there will start to discover this.

Our debt is now 30x more than it was in 1980, so it’s not like they can just increase the interest rates to 20% to stop inflation. My expectation is this is going to run hot, for years. When this DOES really catch fire with the inflation narrative, gold catches a real bid. It kicks in the door, then silver goes and clears the room. This is ASIDE from all supply/demand I spoke of above. This could then take gold to $2500 and silver to $50 on only a 50:1 GSR. At a 25:1 GSR, it’s $100 silver. What if gold reaches $3000 with a 25:1 GSR? Remember, in 1980, it hit 12:1. You are looking at $120. This is NOT COUNTING SUPPLY/DEMAND YET.

Additionally, central banks all over the world are moving out of the dollar and have been accumulating gold for years. If gold was a pet rock, why is everyone moving to it? Why have countries began to move their gold out of countries and re-patriate it? There are global forces at work here well beyond our pay grades.

Do NOT listen to them. Watch what they are doing.

The printing of money is one thing, to create liquidity in the system to prevent another Great Depression liquidity crisis. But what this has done is create cheap money to leverage on, which then has driven the bubble higher in all derivatives and margin usage. This creates asset inflation in houses, too, because everyone is rushing to get out of cash and into assets – using cheap money. This inflationary impulse is melting up.

As Ray Dalio said, “Cash is trash”. With inflation, cash is indeed trash, because every day you hold it, it is devalued. This rapidly increases the velocity of money and “looks” like a GDP recovery. It’s not. It’s fake.

With inflation, something to consider. When people realize their cash is losing purchasing power every day, and the potential cost of their needs will be significantly higher months down the road, they tend to not only buy what they need today, but buy what they might need further out. I believe with the extremely small “float” in the silver 1,000 oz bar market, this could cause industry to then collectively run for this float to ensure they have a supply further down the road. While a large company like Samsung might not sweat a $5 price move in 6 months, plenty of smaller producers could get decimated. They have contracts to supply retail with items for $50, but their costs could go up massively and wipe out margins. So you could see a lot of small to medium sized manufacturers increasing their normal purchases – even by 10% more. Where is that coming from, with 500m per year? The float. Which Rule says is already virtually non-existent.

This inflation side effect of consumer purchasing could be a self-fulfilling prophecy – with more manufacturers buying supply further out, this actually DOES lead to shortages, which then play an according and suddenly shock price higher to shake out immediate supply. This is not factored into many peoples’ thinking right now with the inflation play. With Just In Time (JIT) delivery, most manufacturers do not have stockpiles of millions of ounces laying around. Perhaps they buy SLV shares and hope to extract through one of the BB? Remember, JPM changed the prospectus to state it all might not be there!! So, now you are adding counterparty risk to your company’s supply chain? No. They will be taking possession of what they need. And this means extracting it from exchanges to reduce that risk.

And as I’ve said, when that interest rate goes up, pop goes the bubble. That being said – there will be a period of reckoning, and metals will perform amongst the best by losing the least – and then hyper inflate as the decade goes on and REAL money is hard to find.

The question is, if this freight train can run to $100 before the pop, or will this be delayed until the other side of the pop?

$100 silver inevitable, but not imminent

This is more or less a conclusion section here. With the massive demand forces that are here, and are inbound, coupled with the small amount of silver available, AT THIS PRICE, coupled with the inability to rapidly dial up supply without significant price increases to:

- knock 1,000 oz bars available

- entice retail holders to sell

- entice mines that were online to come back online

- entice more supply via recylcing

- entice more supply via new mines coming online

The thinking is the snowball is rolling down the hill at 40 mph gaining mass and inertia into an avalanche.

Why do I see prices rise?

Rick Rule made a fortune in the uranium sector. He was seeing they were producing uranium for less than what they were getting for it. He said, they were trying to make up the difference in volume, making a joke essentially that it was a terrible way of doing business. Because it sometimes costs millions to shut down, it’s not unusual for companies to continue production at a loss for a short time. But this is not sustainable.

His bet was that either the price of uranium goes up, or the lights go off. Therefore, he suggested that the solution to low prices…is low prices.

With silver, you look at all of the demand coming with the lack of available supply, and either the price goes up, or someone’s production line stops. Simple as that.

Where I’m getting $100 silver is based on the palladium example above. I feel the supply and demand forces here will turn this into a palladium situation, eventually. Let’s just say it’s a 7x. From when? If you go back to the same date as the low with palladium, you get $13.57 silver times 7, and you get $95 silver. That doesn’t mean next week, but over a 3-5 year run up like palladium, it can really get moving – and I’d suggest the run started when it broke from $19 to $30 in short time. This would suggest a $100 silver price perhaps in as little as 2 years.

If you look at the moves to $50 previously, could see in 2011 it ran from $19 to $50 in like 6 months…

In 1980, it went from $10 to $50 in the better part of FOUR MONTHS.

So…we bounced off of $30 twice in the last year, and you are telling me $50 is not possible, given the insane demand?

What I would tell anyone who doubts that is to look at the violence at which this moved up. Would you like to be short 775m ounces into THAT?

I’ll pause while the reality is now hitting you.

So while a move to $50 is almost certainly possible, and soon, you then look at structurally, how much COULD you increase supply in the first year?

- refineries can only add 70m of supply, at best, if 2011 is an indicator. Doesn’t matter if price is $200, refineries will NOT give you that if they are backed up for weeks.

- mines can perhaps only dial up maybe 50m oz with taking some off of care and maintenance. Since most supply is a BYPRODUCT of other metals, the primary silver miners would need SUSTAINED prices over $30 to take some of these off of care and maintenance.

- Maybe 100m of eligible comes free over $50

- Maybe 100m of retail comes back at $50

This tells me that perhaps we can increase the supply by 400m oz over $50, but this needs to be sustained. This available supply COULD take it back down to $40 or so, but I believe this is breaking the paper game and now leads to more free market discovery. Why? More demand is now being satisfied but even more demand is coming online than can be addressed. This scares the spec shorts out. Only legit selling and legit hedging remain.

The PROBLEM you run into, is silver is one of those assets that people buy into as it goes up. I was buying the hell out of silver at $16, but what you will find is that when silver goes over $30, the FOMO will go nuts.

Let me also explain one last wrinkle in this.

In 1980 and 2011, you could potentially have seen retail sell out. And then what happens is retail premiums go sky high and then they are waiting weeks for more metals. In TODAY’S case, you have PSLV and even Kinesis where, if you cannot find physical, buy into those vehicles and THEY will take 1,000 oz bars off of the market. So the industry wants to allow a trickle into retail, but the workaround is now there are ETFS and other things that if you cannot buy retail, you can continue to put pressure on silver. This is VASTLY different than 1980 and 2011.

Meaning, once that CNBC piece runs that connects all of these dots, there goes the avalanche.

I’ve talked about the silver move upcoming as a glacier smashing into the ocean. I’ve discussed it as Krakatoa. But what I like the best is Yellowstone. Have fun with this….

And then think of the morons that are short silver at the moment.

Think of this upcoming event just like a volcano.

Think of the pressure building. The rumbles are the moves to $30. It may LOOK dormant, but it is dangerous. You see those moves to $50 above? That was releasing the pressure built up.

The difference before was that in 1970s it was inflation. In 2011, it was inflation fears and debt fears. In 2021, it’s inflation, $30T in debt, and a REAL physical shortage – AT THIS PRICE. My money is on an overshoot when it does run, as short will be covering and getting the hell out.

So….

Friends don’t let Friends drive short on silver on the COMEX right now. In the SHORT term, it’s maddening to see the smash downs. In the long term, I think there’s only a small group of people on the planet that can comprehend what is about to happen to the COMEX shorts in silver.

Look at the above. The whole world is “moving green” with solar and EVs. Where the absolute hell are you getting that supply? Paper? Hahahahahahha.

Price moves up or assembly lines stop. I’m betting lines don’t stop.

Let’s dance.

July 23, 2021 at 9:12 pm

Nate – I have been an avid reader of yours since your 4D Chess article. This one is even more brilliant. I am big believer in your overall thesis. Let’s hope it plays out.

LikeLike

August 13, 2021 at 8:14 pm

Fantastic article, a mine of information on silver (forgive the pun). Keep up the great content. Thanks ZM.

LikeLike