Bonus lesson – learn to say “no” and understand concepts of investment and finance with ROI, carrying costs, etc.

I wanted to show you the amazing transformation of a pool that I had a team renovate. But first, I have to provide the setup. This is a good story, I promise.

It all started with me wanting land going back 3-4 years. I wanted a large tract of land. I didn’t want to build a “dream house”, I was more or less looking for a place to play, be with one in nature, maybe buy an RV to have on it. I looked for years, and everything had some sort of glaring flaw. When you buy raw land, you have to worry about septic, well drilling, easements, oil and gas rights, timber rights, power to the location. It starts to get overwhelming, quickly.

At the same time I was looking for raw land, my wife wanted to start really developing our back yard. We live in suburban hell, and have zero tree cover in the back. It’s a sauna in summer time. It’s also a wind tunnel – so I have had those canopies ripped apart – I had a glass table shatter. Umbrellas destroyed, and the latest was my gas grill that was 200 pounds or so getting flung around the back patio.

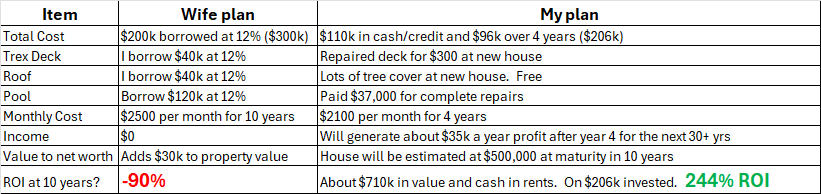

I got people in, and the roof and trex deck was estimated at $80k. The pool was estimated at $115k, but there would need to be more landscaping. Give or take, it’s $200k to make a nice backyard to her desire. I tried alternatives that we far less expensive. I wasn’t sitting on $200k. So everyone wants you to finance today. Pool finance and the construction finance were both somewhere around 12%. To make matters worse, anyone knows that if you put money into your house, you only get a percentage of that back. My house is probably the second most valuable in our development – and my wife never wants to move. So it’s borrowing money to use this stuff for utility, doesn’t get an ROI, and if times get rough, that $200k may only add $20-$30k to the house. And for the last gut punch, if you finance that $200k at 12%, you are probably paying close to $300k if you add in all of the interest. I have one child going to college in a few years and another that is going to kindergarten. I want to retire before I’m 80.

It is not a responsible usage of money to do what my wife wants. She has good taste. I just don’t have $200k laying around and don’t want to make $2500 per month payments for 10 years. That is $2500 a month I could have put into a yield bearing asset. Or invested in the stock market at 8% return?

The path became clear

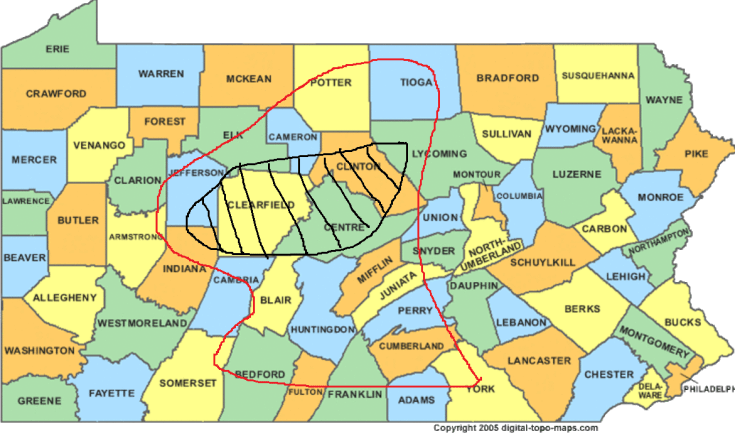

Suddenly, I started to pivot from the RV and land to just buying a house that already had land? I have been doing rentals since 2005, so my idea was to get a big house to rent out when I’m not there. Cool. But why would anyone come to my house? I found on AirBnB the top amenity was a pool. OK – now to look for a house with a pool in the woods. Where? This is the area I decided I wanted to look at.

I looked at some houses, made some offers, and lost. Each time – the next house was better, more features, and more upside. What happened next I think may be my best deal of my life. Thanks to Nichol Clark for tirelessly working with me on this!!

These pictures came up for a house that was a few miles above my red area on the map. The black line was much closer, but the red line was further away – but very affordable. This place was 2:45 from me.

The place was listed at $220k. 1920 sq ft. 3 bedrooms. 8 acres. OK. Nothing about a pool listed in the advertisement. Snow everywhere. The inside pictures were missing a lot and weren’t flattering. I was in love. I went to see the place because I needed to confirm it had a pool and what I thought was a creek and waterfall. It did, indeed. My rationale with this was:

- Selling during winter. Why not wait until Spring?

- No mention of the pool or creek in the advertisement.

- I asked for the seller disclosure and got N/A on it. This indicates the person selling it knows nothing about the house.

All of the above indicated it was an estate sale. In this case, they were anxious to move it. It was in rough shape, but “had good bones”. I went walking through the place, picturing how a renovation would go. I did a pretty big project in 2021, so I knew the drill now.

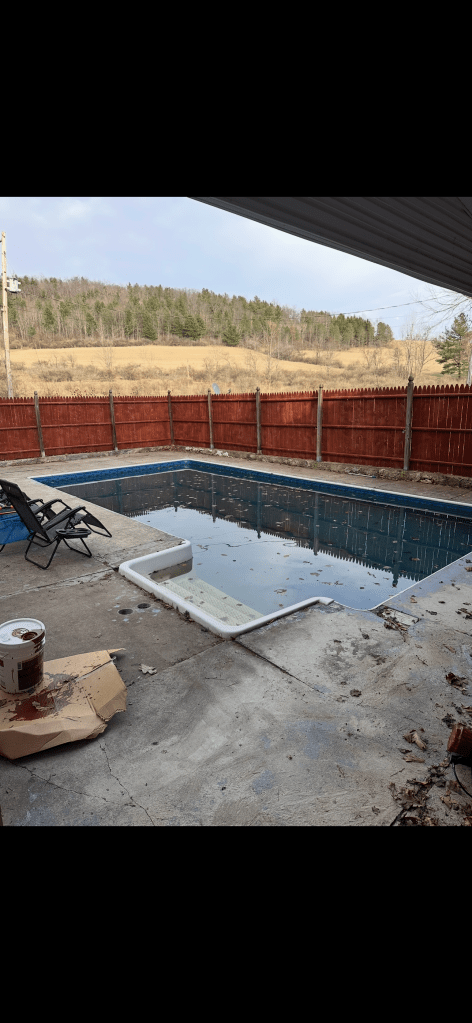

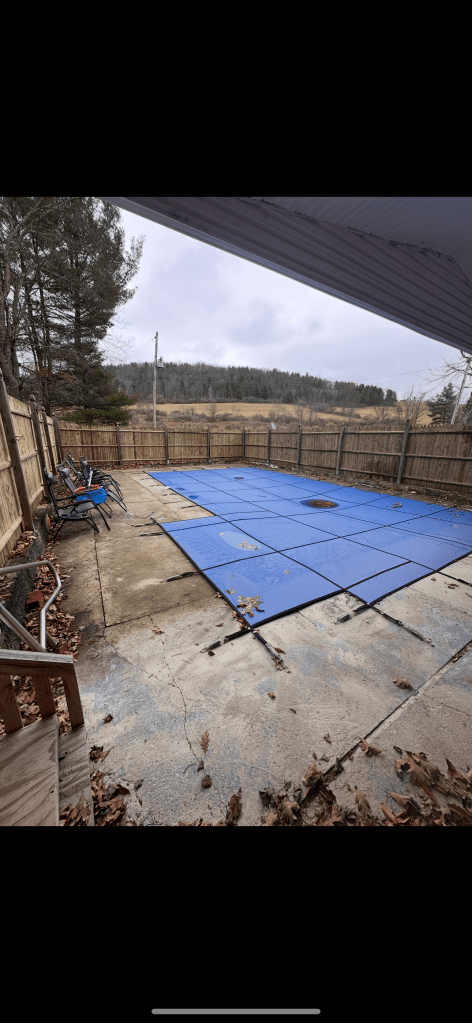

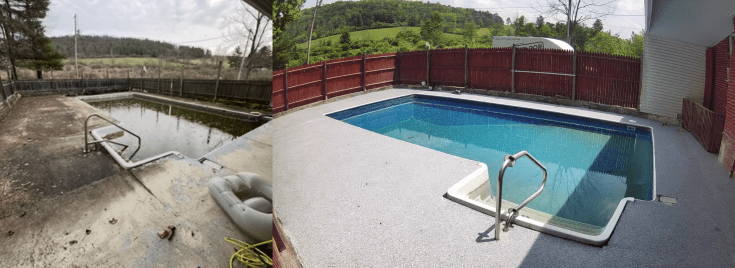

One problem I had was I didn’t estimate some things correctly. For example, this was the pool. I figured $5000 for rehab. Take a look. Yeah. Pool owners everywhere are laughing at me at the moment.

Additionally, a lot of other work in the house I was going to do over 6-8 months going up a few times a month. After the first full weekend, it was absolutely clear it would take me 5 years to get this the way I wanted myself. I brought in plumbers, HVAC, electrical, repair walls, paint, trim, baseboards, light fixtures – then I had to furnish. Because of this cost, I wanted to get the renting going.

Funding

Last summer I sold most of my mining stock and maybe half of my silver? I took those profits and used for downpayment (10%) and a staggering amount to furnish and fix up. I started renting it out, but I needed the below…

- Liner – $7500

- Dolphin – $800

- New Hayward Omni Logic remote equipment and salt cell – $3000

- Electrical – $2000

- Pool Cover – $2500

- New fence I installed and stain – $1500

That total takes me to about $17000.

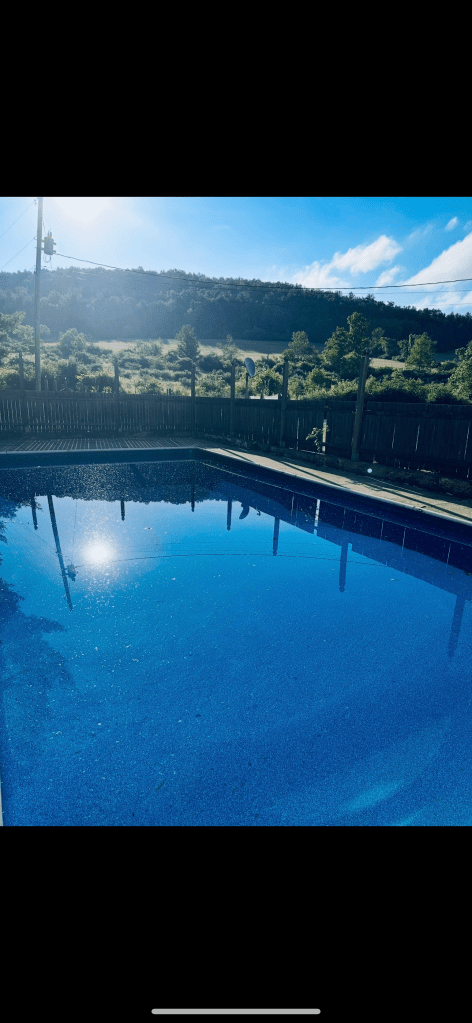

This is what it then looked like before the fence was replaced. My pool guy did a great job!

I then ripped out the fence and put in a new one myself and stained it. This was like a 4 hour job to replace the fence. I used the existing posts, cut a few lengths shorter, built a new gate, etc.

There are two items I wanted yet. I wanted to improve the pool decking area, get new furniture, and get a pool heater so I can use it earlier in the season and later in the season for personal usage and rents.

Enter the garage floor guys my pool person recommended to me. They had a model of what I could make it look like online. Then, the nice cost of $13,000. Ouch. But if my pool decking was really good AND I had a heater, could that drive interest in my unit and not only increase the amount of stays each year, but the competition may drive up the cost per day. My place is booked most of the summer already, so things are going good.

The pool furniture was about $1200, but a massive upgrade from last year’s cheapies I got in a hurry. Last year I was tapped, so this year I was able to invest a little. The pool heater will be about $5k, but that’s about one month of rent. If I can rent 3-4 months more a year because of the heater, it pays for itself in 30 days.

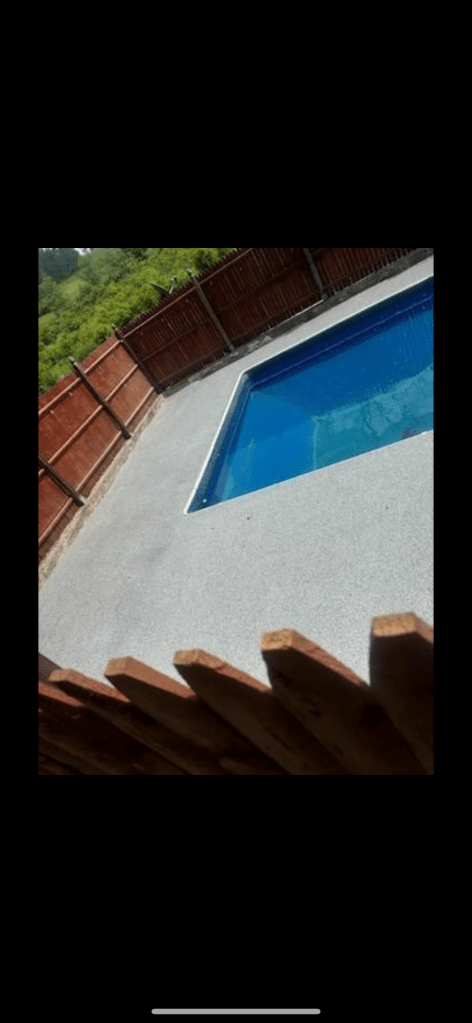

This is what it now looks like with the new decking. This weekend I’m going up there with my kids and I want to put out the new pool furniture and take lots of new pictures!

Don’t mind the pool water color, a lot of the cement they ground went into a dust and got in the pool. I will be cleaning the hell out of it this weekend. It’s not algae. The dolphin has a lot of work to do!

So let’s look at the before and after.

Here are some more pics the guys on the job just sent me. I will add in final pics with furniture below in a few days.

Here are the final pics!!

The goal

My carrying costs for everything are about $2100 a month including mortgage, taxes, insurance, utilities, etc. Right now – before the deck/heater, I was operating just under break even. I didn’t care about breaking even. I bought this also because 20 months ago, I did a Disney Cruise for $6000 for 4 days and decided I had a better usage for that capital. Instead of a single 4-day vacation, I have an entire home that costs me about $300 a month and I can go up a ton.

What’s more interesting is that I’m going to absorb that $2100 as a carrying cost. An “investment”. The cash coming in from all rents are first going to go to paying down debt I incurred. Remember how I said the pool was a bit over the $5000?

Overall – it looks like I’m out $37,000. Seems like a lot? It is 16×32. With the decking, fence, and equipment I have, is probably close to $120,000-$130,000 here.

If I had taken everything I have spent up to now on the house in stocks I cashed and credit – I could have afforded a pool here. But I would still then not have the roof and Trex deck? And then of course you have to get the $17,000 outdoor kitchen.

What I want to do with the mountain house and my other rentals, is pay down all of the principal with the rents. This will be paid off in 4 years.

Let’s compare where we are in 10 years?

This might be slightly exaggerated – maybe the wife’s plan actually adds $50k in value? That is still a loss of $250k in value over 10 years. Or rather, you are pissing away $2500 a month of net worth. My ROI may only be 200%? Who knows. But the idea is that rents from my rentals will pay for all of this and then some. If you take this out over 30 years, and then add the cost to maintain the pool and trex deck and roof – and add home values going up due to depreciating currency – maybe that $30k value is $100k? But that was still $300k spent in 10 years. If you look at a 30 year number with increasing rents and property values – the purchase of the mountain home and repairs could have the house worth $1m and 26 years of avg of $4,000 per month rent (higher in years 15-30) gives you a value of $1.2 million in rents as well. So my $200k investment could make an 11x over 30 years?

After those 4 years, I have free rental homes, paid down 100% and can supplement my income. In another 2 years after that, my primary residence is hopefully also paid off. By rents. In 6 years, it then means I will have about $1.5m in property paid for outright by rents. With my other units, with this STR, I am looking at about $6,000 per month income – which is going to help me pay my kids’ college debts. But furthermore, if you have $6k per month and no debt, this is when you SAVE to buy a deck. Then the roof. Then the pool. In 3 years then, you could have all three of them.

With MY plan

- in 6 years all of my property is paid down using rents from these houses to pay principal off. Paying off highest interest debt first, and keep working down.

- I get a FREE vacation rental, that will have at least a 300% ROI in 10 years. I spend a lot of time up there, and my kids and friends love it.

- Over a 10 year span, the pool plan here lost 90% of the value of the currency invested where the house made 244% on the investment.

- In 10 years, instead of paying $300k for a roof, deck, and pool to use that has a low residual value and tied up capital for 10 years – and forever if we never sell. I got a free pool, deck, tree cover – as well as throwing in a house and 8 acres – and then they decided to give me another $210k in cash on top of it.

Learn math. Use logic. Take calculated risks. Learn to say “no”. Do what is best for your family in 10 years, not today.

Leave a comment