I wanted to also see how AirBnB might fare in a downturn type of economy? Could a certain TYPE of AirBnB in specific PROXIMITY to things work? I took the dive to find out myself.

First – I need the setup here to understand the evolution of the idea.

The background

Most of you know me from gold and silver blogs. Many don’t know I’ve been involved in real estate since 2005. I am a small scale operation, so no Ferraris in my pics, more like a rented scooter. But over the years, you learn a LOT – from others, but more importantly, from failing yourself. Many of these lessons can be painful at the time, but make you a LOT stronger over the long run. Perhaps it’s how we build wisdom? If you fail in a controlled fail – that is, to have risk parameters to limit the damage, you are there for another round in the fight. Those that fail without risk controls – they might be the ones that get knocked down. Something to think about.

I think Risk Management is something that should be taught in 9th grade, and mastered by the time you are a senior. I believe to understand this could shape the minds of an entire generation differently. Anyway – back to the story.

So I have been active the last year looking for something. It started as one thing and evolved over time to another. My interest in a doomsday place has grown and changed over that time. I did finally buy one, but it will also be a short term rental for half the year when I’m not there. This last year stalking Zillow, and failing on making 4 deals, taught me a ton about the process as well. Most of what I learned with this is, is in “hot” markets with multi-bids – in a really rural area – you can lose out on a bid, even if your offer is higher. Why? These people are typically blue-collar types of people that work with their hands and can fix anything. They see issues they know they can fix. I see issues and need an inspector or contractor. These place contingencies on my offer which in turn makes it weaker. Others have not placed contingencies and they could be really exposed to thousands of dollars of issues. That is a high risk on their end. But it is mitigated if they have the skills to fix it. On my end, the risk is then transferred to a contingency that allows me to bail if bad things are found. “Sellers want easy” is a quote from some I have heard. If you place a ton of contingencies in your bid, and someone else is $10k cheaper with none, they may take them over yours. Hard lesson to learn, but I also cannot absorb a ton of issues that could fail.

My search started with raw land – as it may for many of you. I found that I really couldn’t find what I wanted, anywhere near my price point. Ideally, I was looking for 5+ acres, with some flat spots, a creek, and the ability to shoot on the property. Maybe never build – perhaps just use it for recreation and RVs. You find that many plots would have “deed restrictions” that may limit the types of activities you do on the land.

This makes land a lot harder to find than you would think. My idea was to get something relatively low cost and if things went sideways, get the tent in the truck with the food and get out of Dodge. This starts running into issues with even things like “I have to build an outhouse?” Then you learn about buying raw land, how you may need a special type of loan for it, perhaps 35-40% down, a development plan for the bank, etc. Why? Raw land valuation is an art form. There’s no real comps for what you have. Someone may has $100k, you are willing to borrow the bank’s money to pay for it, and the bank then says…”no, I don’t think so, unless you give us $40k down and tell us how you will develop it”. Why? The bank doesn’t want you dying and then they are stuck with a piece of land on the market for years, which then sells for half the price. Raw land is HIGHLY illiquid, and when you spend months looking through this, you can quickly find how the seller is trying to offload his or her problems to you. If you are a novice at this, you see “5 acres for $10k!!!!”. You then find it is land locked, no means of getting onto the land without trespassing, it might cost $250k to get power there, etc. Or maybe someone dumped on it years ago and there’s a hazard there you don’t know about, then the EPA comes out to fine you $250,000. Yeah. Raw land is a big time gamble. I didn’t know this a year ago. I do now.

I started then considering buying an RV. Maybe put that on the land. But what about power and septic? I then learned all I could about developing raw land, and many of these I liked you realized power might cost you $100k to get it to your site. That is, if you could even put a septic tank and field on it. Too many plots near water are clay, and this means the “stuff” doesn’t absorb into the soil. You may have to spend $25k on expensive systems. Then, I wanted some mountain places – and you may have to consider drilling $25k to get to a well. Suddenly, your dream of a cheap piece of land turns into a nightmare of $150k to try and develop it.

I pivoted in October to trying to find a place that was remote and already had the land. I quickly found that the prices of these properties were highly dependent on the areas. While you understand the concept of location, location, location – you might not realize how much inflation hit certain areas until you are digging through literally hundreds of Zillow postings every evening. The kid is watching CoCoMelon on a marathon, and you are becoming a PhD in how to use Zillow over months.

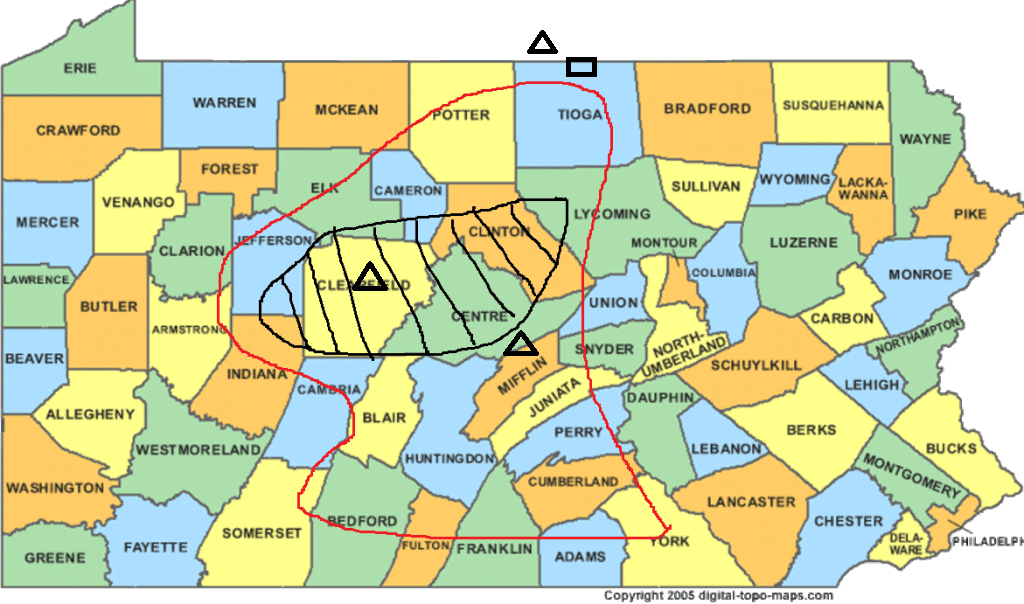

For my specific area, I made this crude map below….

I added to this map the black rectangle, where I bought. But I also added three black triangles, where I failed to win a house I wanted to bid on. I have the RED area as the “boundary” of what I was looking for, which was a specific driving distance from my house, but the BLACK area was my area of highest interest due to location to Penn State, mountains, and things to do. Turns out my black rectangle has PROXIMITY to the Finger Lakes. Oh my….

Proximity. Here’s a word I wanted to use for this piece. It’s not downtown Watkins Glen – which might fetch a hefty price. It’s not downtown Orlando next to Disney World – which might fetch a hefty price. It’s in the PROXIMITY of the area. That is, not the ease of a local location, but close enough to access the region during the day. But have much more affordable accommodations within the proximity of things to do. A value way of doing an AirBnB, of sorts.

Many wondered why I chose this area as well. Let me first state that areas EAST of the red have been bid up, tremendously, over the last few years. Like, by a LOT. The EAST part of this in the central to north is the traditional Poconos region. What you do not see on this map, is that it borders NYC, White Plains, and North Jersey. With the COVID situation, a lot of people went fully remote, and moved out of the city. ALL of these areas are super overstretched. AirBnB in the Poconos also ramped up, with people chasing this trade in 2021. Since then, many Poconos communities have then restricted short term rentals or banned it entirely.

How many of you have read how towns and cities are trying to ban it or restrict it? When you buy places in the sticks – there are no towns or deed restrictions to tell you that you cannot do it. In fact, the local areas may NEED the people to visit and welcome the commerce.

Moving on – to the southern part of this is the Philly region. Again – same as NYC in that there’s a LOT of money there, and a lot of it moved from the city west and north to the suburbs. This abundance of capital simply outbid everyone. These prices are insane.

To the SOUTH of the red line, you have Baltimore and DC money that has driven the West Virginia properties – and MD properties – also to insane heights.

To the SOUTHWEST of the red line, is the Pittsburgh area. What money is in Pittsburgh then bid up the surrounding suburbs. Not by as much as the other regions, but you can see towards the left part of my red bubble prices rise for what you get.

My red area there was my comfort with distance as well as price. As you can see, I lost a triangle space in southern NY. Story there was that I saw a place with TWENTY acres, a mobile home, and several outbuildings. Had a creek through it. I contacted an agent Sun morning to see it, and she told me she needed 48 hours. I get it. But there weren’t a ton of agents there in the region. So later that evening I got antsy and directly contacted the listing agent, who told me THIRTY MINUTES prior to that, that they agreed on a deal with someone. I lost it. But then there was hope, 3 more times over the next week. Lost it again all 3 times. From that experience, after my initial issues with an agent, I found a tiger up there, who was also licensed in PA. That woman eventually helped me land where I bought. More on her below.

But my experience with all of those triangles were multi-bid situations. Same with the rectangle. Was the market on fire? At damn near 8% mortgage rates for me? Note – buying a second home requires 10% down and the mortgage for this type is usually 100 basis points over regular rates. This a place I plan to be able to live in a LOT on weekends, but when not there, rent out to family and friends. So – in this case I was ok with “dating the rate” because I felt the VALUE of the house was accurate, and any lower rates will reduce the mortgage payments – but also increase the value of the house in equity.

What you then understand quickly is there wasn’t a ton of supply. Yes – there may be listings – but not what I was looking for. Over the course of 4 months, I failed on 4 properties. The rectangle area I won, I had lost that previously, but buyer financing fell through. Each time I failed, the next property was better than the previous one. But I had to eliminate so many terrible, terrible properties. It was a process that took me many, many hours. Realtors for the most part can send you MLS listings for kind of what you are looking for – but you get that quicker with Zillow searches. Also, trying to look in such a vast region, a buying agent wasn’t useful – I needed to work with several.

The supply that was there appeared to be estate sales (2 of those 4 were), distressed sellers, perhaps going through divorce, or even those just downsizing and seeing what they could get for it and list crazy high prices. These weren’t competing against a lot of like properties.

I had seen quite a bit of properties on the market for a VERY long time.

What I then saw was that there were buyers – perhaps not a ton – but those laser-focused on what they wanted, and were all competing for the same houses. This led to specific types of properties catching a quick bid, and everything else sitting forever.

But here’s also something I did. I started looking up the records of the realtors involved with a lot of this. You are seeing a few realtors just mop the floor with everyone, and the rest are starving. Those making a killing have been talented with marketing, or tenacious and extremely knowledgeable about the processes. Those who have not been making a killing came into the market post COVID and may have been eaten alive by the tigers. In this process, I have worked with two extremely talented real estate professionals that I wanted to talk about below – and what you should be looking for in realtors to buy these sorts of things. I want to name them here to help get them some business, but also to recognize the outstanding knowledge and efforts they put into this.

Tyler Noel – he was the LISTING agent of my first triangle in Clearfield County. My buying agent kept pushing me to talk to the listing agent because I had questions. I thought that was extremely odd, and so did everyone else I consulted on this. Tyler spent 30 minutes of his time telling me about the property – as he grew up next door to it and knew everything about it. When I drove to see it, this guy’s face was plastered on signs everywhere on the way up. The marketing of the listing was genius, and absolutely stunning. It got me there to see it. Granted, I went on a rainy Sunday in December – and the trees didn’t have leaves anymore, but this picture was marketing genius.

He then helped me on a place I lost – but not for a lack of effort or trying. I needed to recruit this guy to my team!! Another triangle. When I contacted him to see it, the seller already had an offer in hand, and I rushed to see the place late on a Saturday. Before we could get a bid in, the seller accepted. Turns out, the seller accepted an offer perhaps $40,000 less than I was willing to go. However, you find an offer in hand here is extremely valuable – and there’s risk in putting that person off. Tyler then tried to make it up to me and was getting people listing more with him that were the types that I was looking for. You see this guy’s track record, and he had like 22 listings under his name, with like 18 under contract. I don’t know the numbers now, but the dude is killing it.

Nichol Clark – of Howard Hanna in Horseheads, NY. She came in late on the triangle in NY, and was not part of the triangle in Mifflin where I was working with Tyler above. These areas are pretty far apart, so I needed people in different areas. When I had lost the rectangle place I eventually bought, she had spent nearly three hours over the course of a day educating me about the sellers in the region. The types of buyers there. What will win bids there, what won’t. Hand shake deals. The local Amish guy to fix things. She has been absolutely amazing during this. A few days later, I was Zillow stalking and saw the property went back onto the market and contacted her. Quickly, I went to see the rectangle place, and she was extremely knowledgeable about everything to look for. My previous experience with my realtors (no names) was not really saying much, and just shadowing me as I looked. No real input. One ghosted me as I was asking him questions. I could not believe how the level of professionalism dropped in the industry.

Nichol was able to get me into this place in a short time frame and get the deal done even more quickly. What amazed me about the two above is that it seems they have a unique ability to multitask many listings/buyers and also somehow navigate family life and work 28 hours a day. They are truly gifted in their fields, and they will last as long as they want in the industry. IF you are looking for your own type of place in that area – I highly encourage you to talk to Tyler/Nichol.

OK – where are we today?

But I wanted to then discuss the state of this. All of the above was priming you for what is going on. I bought the rectangle place for 14% higher than it last sold for in 2006. In 2006, values were somewhat inflated. The house hasn’t had really any changes to it, which then has me spending money to fix up. Meaning, I feel I got a tremendous discount – as long as I can make the numbers work with fixing up. I’m not planning on flipping, but if a situation requires it, I want to be able to make money on the deal. I got the appraisal reports, and with minimal efforts, I should be able to increase the value of this place 25% within 2 months. This is using the appraiser’s tools and methods to then find the best means of improving it for the least amount of cost. So if I have to somehow flip it, I can make perhaps a 75% profit (after selling costs) based on money down, improvements, etc.

With short term rentals, it’s a tricky market. And in trouble. I have been a huge fan of following Amy Nixon’s analysis following her “AirBnBust” original ideas maybe 15 months ago now. She puts out a ton now, and it is original insight that is pretty valuable in my eyes. In that – many areas were selling properties, with others buying them to make them short term rentals. This then had a ton of supply of STR (Short term rentals) for an area. This was coming out of COVID lock downs, and everyone wanted to travel. Hot spots then had prices go vertical in perhaps 2 years. Supply of these houses were all snapped up. This led to…a housing shortage, of sorts. Houses that would be for a family of 4 at $300,000 were bid up to $600,000 with the intentions of renting it out for $6,000 a week. As long as the rents came in and the nut was paid, everyone was ok.

But the rents stopped. The supply glut of high rent places became real. Those who had pricey mortgages on a typical $300k house now (which they bought for $600k) faced reality that their $5,000 per week rents were dropping off the face of the earth. This was also causing home builders to crank out more houses – at elevated prices. Eventually, she pontificated, that these STR would have to either drop in price a lot, become LTRs (long term rentals), or hit the market and perhaps drive DOWN the prices of houses as houses are priced at the margin. One STR sells at fire sale prices can bring down an entire neighborhood’s value. Meaning, the first one to pull the rip cord fares best, and those others who didn’t are left underwater on a house they cannot afford, cannot make rents to pay it, and they cannot refinance it while underwater – and cannot sell it, unless they do a short sale. This may put a LOT of pressure on banks who made these loans. Why? Many of these people lied and put 3-5% down and said it would be their primary residence. With this, the bank doesn’t have enough meat on the bone here. If they had put down 20% or so, and the property drops in value by 25%, the homeowner is out, not the bank. But putting 5% down and the value drops by 40% could put the banks in some trouble as well as get the PMI policies to pay out a lot.

When you speak of hot zones with overpriced housing, I feel this is spot on to think there are problems ahead. There are few families out there to rent a house for $5k a week. In the spec bubbles we are in, it’s possible now a lot of people did those fancy trips, and now need to tighten the belt. Less travel – but perhaps more AFFORDABLE travel. Maybe instead of flying to places and renting in town, they drive to REGIONAL areas in PROXIMITY of the towns. There’s that word again.

Housing rates have come down a bit, but not enough to shake loose a lot of people with sub 3% mortgages. Additionally, because prices got bid so high, there needs to be pain to shake down the values of these. Real estate is valued on comps in the area, and I can tell you – when those $600k houses that were worth $300k prior to COVID start to sell off, this will be a downward pressure. Perhaps rents now can be $3,000 a week, and with this, the magic number is $450,000. No STR person will buy that for $600k if they cannot make the numbers work. So price must come down.

And it will.

BOOM!!!

I feel there is a deflationary shock coming, to everything. I wrote about it a few days ago on Twitter, where I felt March will be the month for it.

I am mostly out of stocks at the moment – but still have my sizable FSM holdings. I rotated a lot of this into the downpayment for the new STR. Is it risky? Yes. Did I minimize the risk the best I could? Yes. But I feel there’s a shock coming, and I’d rather have bought a house in the middle of nowhere that has great access (and proximity) to the finger lakes, a pool, 8 acres, and a creek for my doomsday place rather than hold in the stock market the next few months. While I could be VERY wrong, there’s a lot of risk there in holding in the markets.

I believe this deflationary shock will then take down the stock market at least 20%, but the layoffs and the credit situation is about to get worse. CRE to implode this year and next unless rates drop significantly for them to be able to refinance it. But the regional banks with BTFP – many of these could fail. Many others we didn’t know about might fail.

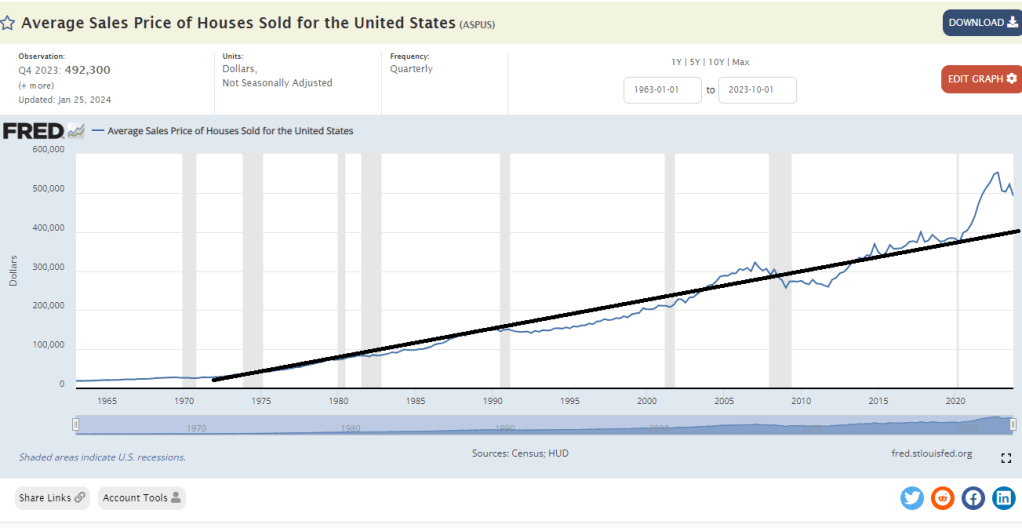

When you look at how these houses have been bid up, it’s severely overstretched. I added a black line here for a “trend” since 1975. However, of the major asset classes, this appears to be the LEAST stretched, on average. While those Miami places and Austin places may have doubled in 5 years – the place I bought went up 14% or so in 18 years. So on AVERAGE, you can see that the big markets stretched this higher. A correction here with the BIG markets – and AirBnB corrects this line. For a vast majority of homes not near a major metro area or hot AirBnB zone, I feel the correction, if any, will be limited.

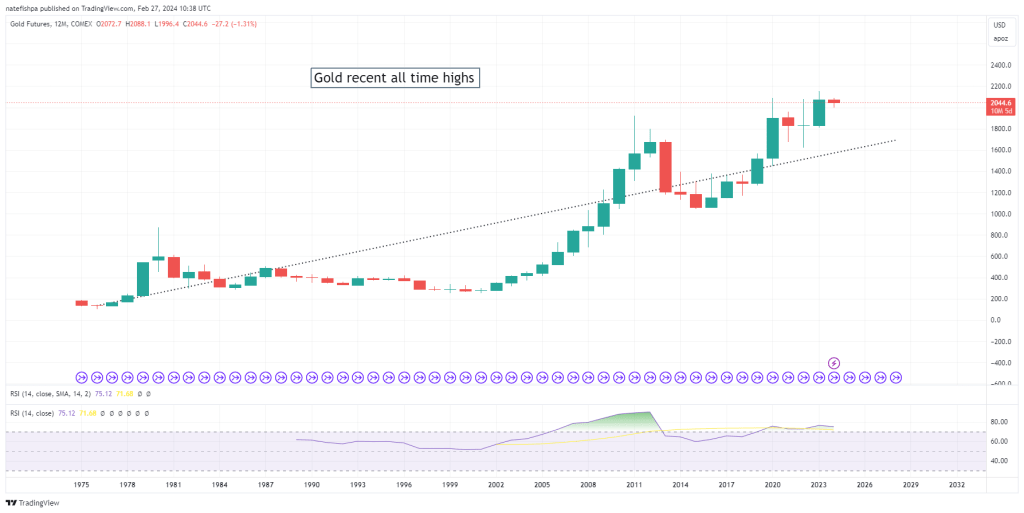

What about gold? While I’m a huge gold bug – this line is a little troubling.

What about the Dow? Ouch.

But let’s then also look at M2. Why? Because as this money is “borrowed” into existence, it then tries to find the most efficient place to go. It may find an undervalued asset and rotate to it.

I’m drawing arbitrary lines for a mean, but you get the idea. This might reflect a LT moving average. IF inflation is like 2%…or 3% – this is first reflected in the money creation – OR destruction. I was born in 1975. And with that, every year M2 has gone up, we then see that borrowed money going to the most efficient place. But…it contracted. AFTER it puffed up everything way above its mean.

What this means, in my humble opinion, is that a lot of the slosh is about to leave the sectors above. ALL of them are due for a major correction, and SOON. I believe this is why my gold miners have been shit on. And will continue to be so. But it seems to me, that the LEAST AFFECTED of all would be the real estate in the middle of nowhere that didn’t puff up. THAT is my safe haven, and the upside here is I can potentially get some rents from it as yield-bearing.

IF you can find real estate today that makes the numbers work for you, it’s usually a rehab of sorts. I think there is a massive, massive correction coming for a lot of things. But what is interesting here is that real estate is overstretched only in SOME areas. Those AirBnB spec places, as well as major metro areas that had big money leave the cities and bid up the suburbs.

What I bought was a place first and foremost to be MY vacation home. I had spent $6000 on a Disney Cruise last year. Crushed my soul to spend that. While my son will not really remember it 10 years from now, the smiles of him meeting Mickey and Minnie were priceless. But….we live in a time of gross excess. This type of thing is perhaps the norm when you look at your Facebook friends. This is NOT how I was raised. For me, I want to find VALUE with vacations.

For me – I can then take that $500 and use it towards a vacation home, and perhaps get some rents from others to break even. Over time, the rents pay off the mortgage.

But the place I have is a regional type of thing. Go for a long weekend with two families, split the $1400 rent in a big house. This is not Miami with 2BR 1BA for $6000 for a week. What I am looking at now, on my end, is skating to where the puck is going. If you have a lot of people not flying to Miami and spending $6000 for a week for one of these AirBnBs – but they still want to vacation and find value, what do they do?

Regional destinations. The big deal here is that you need to be able to offer VALUE. A hotel room has 2 beds, and maybe you put a family of 4 in there. But when you rent a big home, you have a lot of space to lounge, can have a second or third family, cook meals, enjoy the actual property, and do regional activities on a budget. Instead of $230 a night for 4 in a hotel room, it can be $200 a night for 2 families to sleep in, cook, swim, enjoy the fire pits, the creek, the fishing. You need VALUE.

While I am SPECULATING that my rents will be steady and fortuitous, I also don’t care if I rent it, at all. I have other properties which will cover this cost. But what I WANT to do, is build this thing up over years. I can add another bedroom and bathroom. An outbuilding, a wood shop. You provide VALUE with the STR. I believe this is the NEXT GENERATION of STRs. While the Miami market for $6000 weekly rentals may dry up with a bad economy, this will drive a lot of those properties down in price as STR owners need to then sell.

However, I feel regional STRs not in high end areas will pick up in value. Those in PROXIMITY to interesting regional destinations for 3 and 4 day trips may pick up.

I feel the high-end housing market is doomed for 5 years. A lot of these Miami types of homes will hit the market, driving values into the dirt. All of this high-end housing is priced at the top. Inventory will – and has – been sitting.

I can tell you my observation of where I THINK this is going. We all know “location, location, location” in respect to Miami hot spots all over the country. I feel the next gen is “proximity, proximity, proximity“. My place I bought is 20 mins SW of the southern finger lakes. A group can drive 40 minutes NE to hike Watkins Glen. Drive around the area and see the vineyards. Drive 25 mins south to see the PA Grand Canyon and hike. Drive a mile south and fish. Hunt on the property. Perfect for a family, multiple families, guys weekend, girls weekend, or hunting/fishing trips in October/November.

Those people who are then able to cater to a lot of different market segments can also have the highest rental rates. My property has significant acreage, a pool, lots of trees – a creek, a lake really close. It has everything, for a LOT of the types of people that will look to vacation trying to do a nice vacation on a budget, to get a lot of value.

This is the word to think about with a possible recession. Value. There are still markets, but they want to get the best bang for their buck.

Since the younger generation has never seen a recession, this is what it is about to look like. Your tech stocks will be ground to dust, and companies that sell toilet paper will still sell toilet paper during a recession and be strong companies to rotate to for dividend stocks. Your speculative stock market is going down. Your high-end properties? Going down. Precious metals? Possibly down – but I feel this might catch the safety net bid. It is very possible a lot of gold’s move has caught up to markets.

But like the dotcom bust – you then perhaps see gold lead into the next 10 years up as the DXY declines. Don’t know, but I feel my entire country is feeling all is well and they do not understand the rot at the foundation that could erode everything we know, in a hurry.

IF I am wrong? My real estate value soars, and I get stupid high rents. It’s a good place to be, honestly.

But the real estate market? I feel the Tylers and Nichols will do well in any market. They hustle. They listen. They are tenacious. They take the time to learn their craft and the markets around them. That mindset survives and thrives. And if the market doesn’t die out – they will continue to outperform their peers.

The question then is – how long will it take to play out? While I have called for March for massive corrections, I could be very wrong, yet again, on timing. What I never am able to take into account is how good they are at kicking the can down the road. The new programs they create to rescue their friends that I don’t know about. The amount of rescue dollars to prop stuff up. With inflation being sticky – do we actually see Powell have a Volcker moment and let things die? I’d argue they NEED things to break before they justify lowering rates. They do NOTHING preventatively, everything is reactionary.

So then the question is – what kind of corrections would we get with the real estate market? I feel like a place I just bought, I bought wayyyyyy under market, and it needed some TLC. I do not see that value going down, at all, as it is soooo far away from major metros. But the same is not true for the Miami places. If people KNOW there is a recession, this then begets more recession as people stop spending on luxury. Would they spend on value? Yes. This, to me, leaves higher end luxury STR in a pickle.

The LAST question here is – have these operators been smart with their money to weather storms, or did they go out and lease a Lambo and blow their cash? If they pocketed massive cash in 2021 and 2022 and invested in the stock market, they’d be well capable of absorbing a lot of down moves ahead. But what if the stock market eats their tech stocks for breakfast and then devours their bitcoin?

I feel this is the painful lesson many are about to face. No one understands that recessions are natural, and with this – one MAY be coming. Did they squirrel away cash? Part of investing today is the need to understand risk management. Did they? Or will some of them be doing fire sales, soon, which brings everyone’s property values down in that area.

I feel many are unprepared for ANY downturn, and simply refuse to accept there is a risk of one. THOSE are the most in danger.

Leave a comment