Real estate investing readers!! Realtors!! Property managers!! Be on the lookout!!

I’m writing this here to collect my thoughts and help any realtor in the region be on the lookout for a specific type of property. I have tried to work with a handful of buying agents recently, and have been disappointed with the results. I’ve been writing this over a few days. I put in a bid on a property that checked most of my boxes in early December, but was outbid. So these properties DO exist. And I AM ready to make a bid. Mostly. The snow right now, today, is going to delay this by a bit.

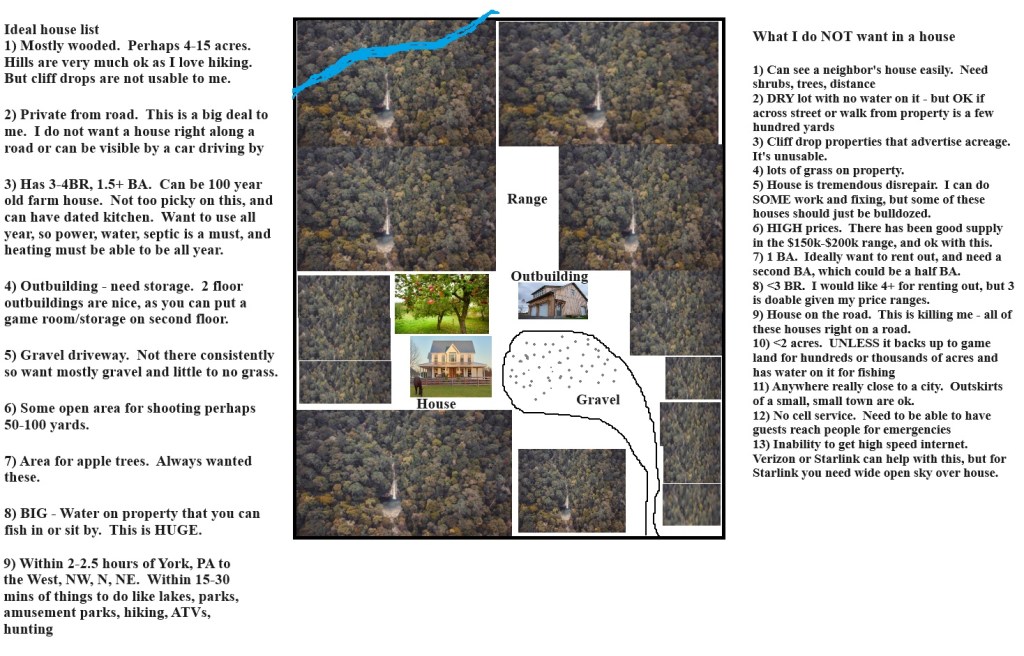

Here is my DREAM scenario – in a picture.

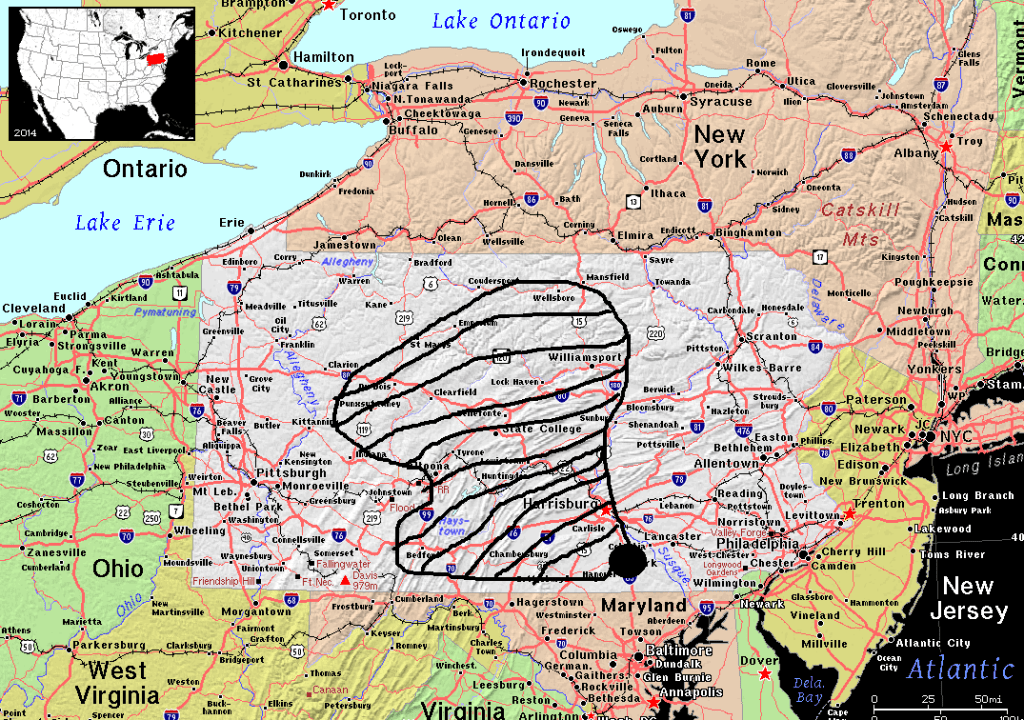

Location, location, location!!

Let’s first start with the APPROXIMATE of WHERE I’m looking. This will help many look at 2 seconds and click off if they aren’t in this party.

If you overlay this with counties, you have about…

The black area is mostly what I’m preferring due to the remoteness, lower costs, more acreage, access to lakes, creeks/streams, and distance from major cities. The place I put a bid on was Irvona, PA (I lost) – a small town I never heard of, about 2.5 hours NW of me in Clearfield county. Pictures on that place below.

A LOT of properties ARE available, but many are in cities/towns. I don’t want that. Think rural and remote.

A BIG attraction in PA is the Poconos region – to the east of where I have selected. The problems with the Poconos are mostly that:

- Much higher costs. Lots of people from NY/NYC vacation there and the amount of cash there is silly that has driven up these property values.

- Most of the properties I have seen are 1 acre lots as part of shared communities. Too many people. Too dense. I want more land than that.

- Too close to NYC/Philly and decent sized minor cities like Reading, Scranton, and Allentown.

How much???

I was pre-approved for $175k for a vacation house, which doesn’t sound like a ton, but in that area, your dollar stretches a lot more than you know. While this might get you a shack in CA, this is the property I lost out on with my bid. 6.2 acres, 5BR/1BA farmhouse with 2 story outbuilding with a stream next to it.

Above is the “outbuilding” with a 2 car garage on the bottom where the tractor was, but on the second floor – 700sq ft for a potential game room.

And check out this stream!!

So – they do exist, it’s just there’s not a ton of them.

To buy a second home, it’s slightly different than an investment property. Anyone who has followed me knows I’ve been involved with rentals since 2005, but sort of backed into that part time endeavor. I’d like to expand my real estate investments into a second home (part time rental) and perhaps a destination rental in Florida that is a condo that is rented through a service – I will look at this later as prices on destination stuff crash. Real estate is where my primary investments are. More on that in a bit. But I bought a home to live in that was practical. I didn’t buy a mega mansion or anything crazy. I wanted to pay it off and have no debt with rentals. I have been able to afford a much bigger house for a decade, but refuse to do it as I want to leave a legacy of properties to my children that will have paid for their education. I always wanted to have borrowing room for properties and other investments.

When you buy a second home here, you need 10% down. So for this, I would have needed $17,500 down. However, there are closing costs and the like which would have taken this over $30k. It is typical to have a “6% seller assist” when buying, so a good portion of the closing costs then are financed and you do not need the cash down. I store a LOT of my cash in PMs and metals miners, and the bank will not let me sell PMs to then use for down money. Why? They see it as money laundering. So I need to stack cash for the next few months OR sell stocks. Not selling PM stocks at a potential cusp of a breakout.

With a second home, you need to live there 10% of the time, or perhaps 5 weeks a year. You are permitted to rent it out to people when you are not using it, but within the first year or so you cannot have a property management firm put in a long term tenant. You also can get the rent tax free – but you cannot use expenses from the place to deduct from your income taxes.

My intentions are to be able to work from there at times, vacation there, and rent out to family/friends. So I check that box. HOWEVER – I probably want to put 25% down, depending on how move-in ready the place is. At 20%, it removes the need for PMI, and with the higher rates today, 25% down and no PMI keeps a relatively low monthly payment. However – this is a trade off. Let’s do math here on a $150k home. 10% down is $15k, and 20% down is $30k.

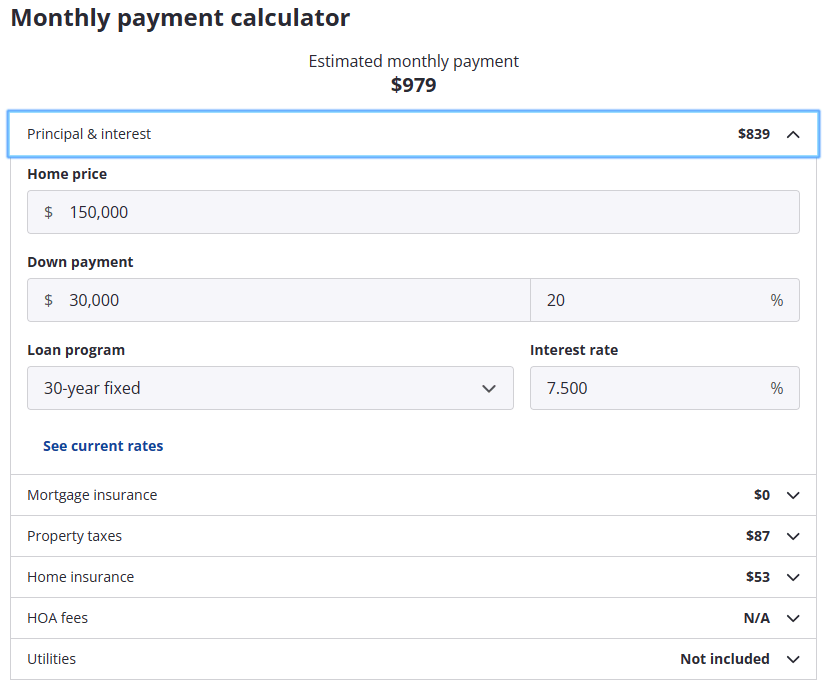

Rates right now for a second home come in about 100 basis points higher than a typical primary mortgage. I’m guessing below at 7.5%.

At $150k for 10% down, you get a payment of $1150. This adds PMI, which is Private Mortgage Insurance, and is needed on any loans under 20% down.

Now if you put 20% down with the same parameters, you get $979 per month as you have less to borrow and no PMI.

How I look at this is:

- I want to preserve cash for repairs, move in expenses, furnishings, things that break in the first few months, etc. Some houses are “move in ready” but you need to paint the rooms or re-do some flooring.

- If you can save $15,000 out of pocket, that means you pay $171 more out of pocket. That is 87 months (7.25 years) it takes to get that $15,000 back.

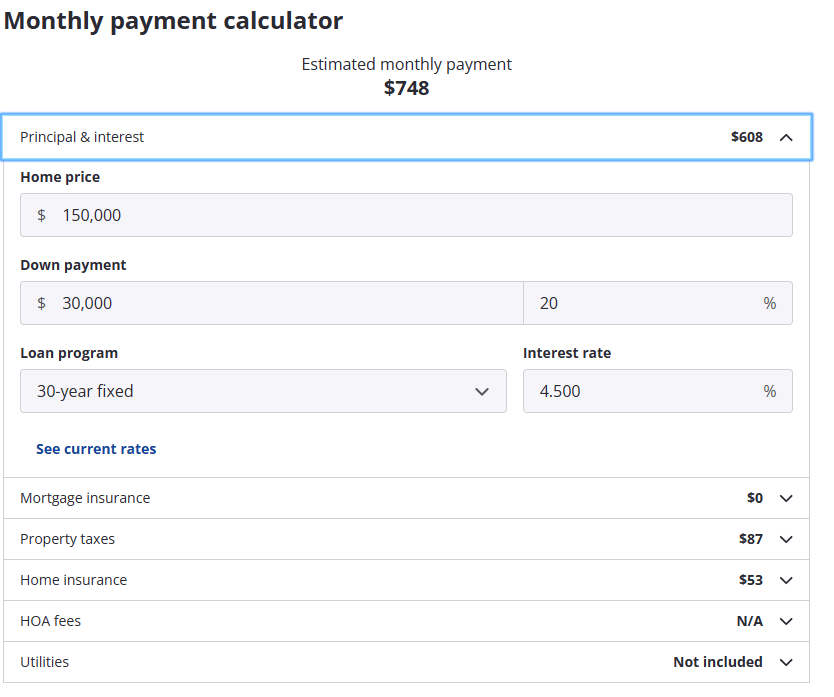

- With rates as high as they are, I feel this can be a refi several years down the road at perhaps 4.5%. I also plan on doing improvements to a house, and “hope” values go up. I can save cash for 1-3 years while I wait for rates to come down. So at THAT time, perhaps I then have the $15k to do a refi. This could take my payments from $1150 down to $748, saving me $402 per month. For the 24 months I paid the extra $171 per month, that cost is $4,104. With $400 per month savings, I then recover that in 10 months. So at potentially 3 years out, I have a 30 year mortgage at $748 a month on a $150k place. Maybe rates don’t come down that quickly? OK. Your “carrying costs” are higher – but remember, for a second home here, you might be able to rent it out once a month to friends or family for $500 a week. If you only rent this out 6 times in a year, it takes your $1150 payment down to $900. Then when you DO refinance, perhaps by this time you are renting out 12 times a year. This takes your $748 monthly payment down to $248.

Maybe you consider 25% down on a move-in ready house to keep monthly payments down. Perhaps on a rehab you want 10% down to preserve cash for repairs. Depends on the situation.

This is slightly different than an investment property. This is 20% down, and with this, you can then have a property management firm put in a long term tenant. This market is pretty saturated right now and the sheer number of people in this game ensures that there’s virtually no profits to be made in this field – perhaps anymore. Many people would need to exit this, but most likely crashing rents and/or crashing home prices might thin the herd here. Now is not a great time to buy investment properties.

The AirBNB properties might be of interest to buy on liquidation – as this market is highly saturated and as vacation rents drop off, prices for rents need to significantly drop to attract guests. Many who bought in 2021-22 are going to get their asses handed to them, as they would be collecting rents far less than their mortgages. Maybe some tucked money away and are weathering the storm, but those who were overextended who lost their primary source of income and cannot afford to carry this – will sell soon. The speed at which these need to sell may see lots of price reductions, and these are then used for comps on the market.

So – now isn’t a great time to buy a vacation rental, either, unless you find the right seller at the right time. Those who have poured over Zillow like I have for 6 months are seeing trends of houses being listed, they sit for a month or two, a 5-10% price reduction then gets the house under contract. Many of these today are intentionally listed 5-10% higher – with the hope that the low amount of supply will force a buyer to overpay by 5-10%. IF you plan on keeping the house for 30 years, you might not care. IF you are using it as an investment of any kind, you have to be cognizant of the price in case you have to sell in 1-2 years. The Irvona place I lost out on, I estimate was about $25k-$30k over the normal market price. My bid was overpaying on that number by about 10%. I whiffed. The market outbid me. And that person may keep it for 40 years and not care. Or, they didn’t use the same contingencies as me, and when they find they need a $25k new septic system, may then need to put the house back on the market. That is the risk they took by having a lot less contingencies than me. They are risking $30k in well/septic costs I wasn’t willing to risk.

The doomsday scenario

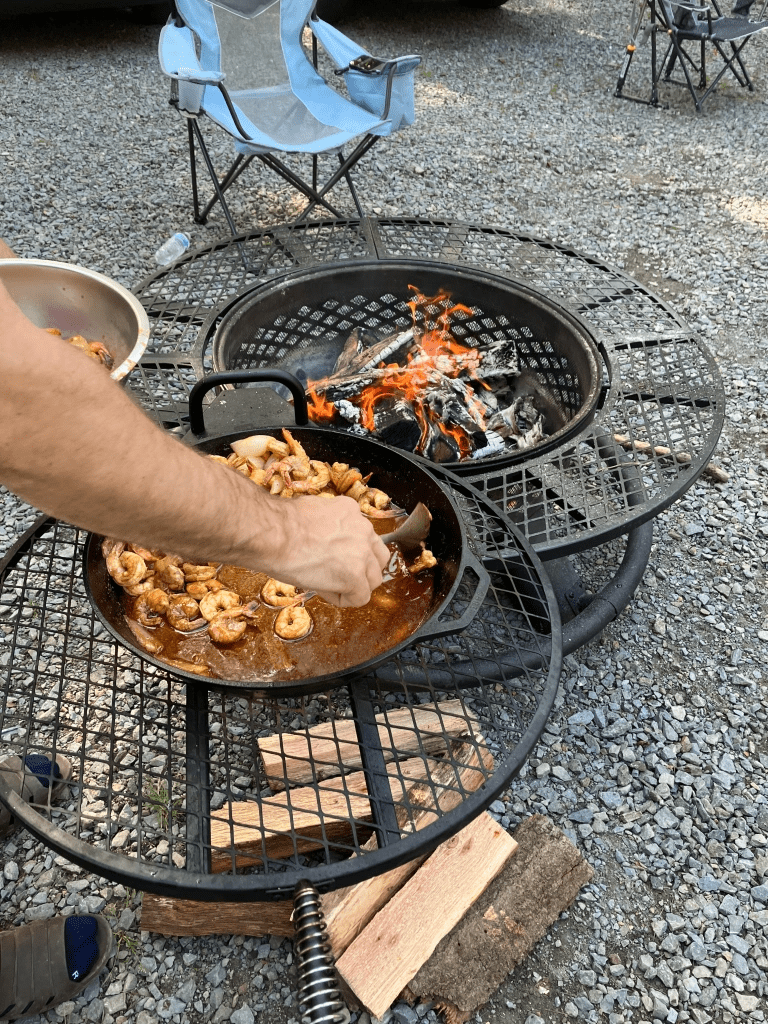

The purchase of this property seems to make a ton of sense for me. My wife thinks I’m sort of crazy. However, I have never been a suburbs kinda guy and documented why I think the prepper side in everyone sort of needs to come out. My wife is a beach town person, and I’m a mountain man who wanted to live rural with jeans, flannel shirts, boots, and chop trees down. So we settled on the suburbs, and all vacation time for a decade has been visiting her parents in a beach town in NY. Now that a lot of IT jobs can be remote, I want to capitalize on that by being able to perhaps work a few days a month from the cabin, then after work go out and fix the fence, chop a tree down, pick some apples, and make a steak or buttered shrimp over the fire pit while I drink a six pack.

You live your life for others, and at some point you have to stand up for what you want to do, or else you are living your life through the lens of someone else.

Thanks to the hive mind, I bought a book called “Strategic Location” by Joel and Andrew Skouson and this more or less confirmed my heat map of PA is the ideal place for me. While PA isn’t the best state, there are pockets of it that I think would match up with a lot of others. The problem with books like that, to an extent, is that even if Wyoming is amazing, in a SHTF scenario, I’d never be able to get there. Meaning, I would have to change my PRIMARY residence to then have a secondary residence within driving distance. One good nugget I saw was that the second place should be within a gas tank of a drive.

Land

One thing that I have also dipped my toes into is raw land. But there’s a problem with this. Why are they selling it? Many of these people bought the land, then once they had it, realized they would need to spend $150k to get power to it, $20k to drill a well down through the mountain, or either cannot put a septic on the property or find it may be $25k.

With this, I also determined I might try and find an area of land, then put an RV on it. But sometimes these land deeds have restrictions. Additionally, the RV would have limits unless there were water, power, and septic hookups. So to me – unless a property has decent assurances I can get water, power, and septic – it’s almost a goose chase at this point. Many of these tracts of land, I just then wonder – “how far away is the nearest power pole?”

But the home building trade is also overcooked. Part of me wanted to talk to a builder about a parcel of land, and then build a reasonable house. Problems here are a lot – but primarily I’ve seen a lot of these homebuilders are booked way out and charge extremely high fees. They aren’t building smaller, practical houses. They are building $400k houses with a good profit margin.

I even looked into log home kits. You pay $75k for this kit, but you need the land first. Again – you run into power, septic, and water. From there, you most likely need to hire professionals to do a decent amount of work.

Projects and analysis

One area I have found a talent in is research and due diligence. With the house I lost the bid on, the person who bought exposed themselves to a lot more risk than I did. Am I sad I lost the place? You bet! However, I was doing things like looking up the flood zones, checking the location of the closest oil rigs, and even went through maps of permits in the area to ensure an oil rig wouldn’t pop up on the property next to mine. I found the outbuilding was in a flood zone, but the house was not. My lender wanted to try and force me to get flood insurance on everything, not just the outbuilding – which added monthly costs that the buyer may not have had to endure with their lender. Why??? Makes no sense. But the owner of that place is potentially now dealing with flood zone costs that I discounted with my bid. Or not – depending on their lender or if they paid cash. For MY situation, I had to make that monthly cost discount, which perhaps cost me the property.

I felt that perhaps if I bought the 5BR house with 1 BA, I could convert one of the bedrooms into a bathroom. Maybe spend $15-20k doing that. I hired a realtor with 12 years of construction experience and he was like, “you can’t do it”. The only bathroom had a door that slides, and it was right next to the living room. If it was just you, no biggie, but if you rented this to a friend (see once a month rentals above) and they brought a bunch of people, this had very negative side effects. It was not ideal for a part time rental without modifications.

But this brings me to a house I’m looking at now near Lock Haven, PA. It has no power to it. It is priced to perfection, as if it had power. It’s a bit of a disaster to be honest, but has 16 acres and access to a creek. I had one realtor essentially tell me to pound sand about the electric. I was trying to determine how much it would cost to get public power, and tried to have a realtor get this answer for me – by calling the listing agent to see if the owners would tell them what the quote was. He refused, and instead went on OnX to then try and tell me that none of the other houses near there had the same tax address as the address, so they are all hunting camps and most likely don’t have power. I asked him to call, he did not.

90% of the houses I look up do not have a matching tax address – because they are all second homes. I got infuriated, so I called PP&L who does service in the area. I spent time talking to someone, and they told me there is service in that area, but it’s through West Penn. I called them and got Met-Ed. I’m waiting for a call back. If this is like $10k, maybe I liquidate some silver and pay for it with that. But the house is priced as if it has power. It does not. So these are the kinds of things I want to be able to use to then come up with the perfect price, then discount from there to get my offer. My offer may be low. But it’s been on the market for 3 months and price has barely changed. It started listing at 3.33x the price they paid for it 5 years earlier, and the only upgrade was a metal roof installed – and with that size of house, maybe it was $10k. So the current owners can ASK whatever the hell they want. The problem is, the market will decide what it is worth with BIDS. So far, the property appears to me to be wildly overpriced, and the market agrees.

So I do not mind buying a place at a legit price, then having a contractor come in to do work. Some things I can do myself. But I enjoy the research with this stuff and understanding it at the bit and byte level, if you will.

Some of these places just need to be torn down, however. The one I’m referring to is rough. I do not need an updated kitchen. I need “barely above hunting camp”. The problem I’m seeing is many of these places are “priced to perfection” using comps in the area for costs per sq ft, but not taking 2 seconds to realize that a house with power is tremendously more valuable than a house without power and running water. But if you can discount it to the right price, you can then do the legwork to get it up to the perfect value – perhaps at a slight discount for the work and effort that went into it.

I feel that listing agents need to do some deep dive analysis for their clients and get them not only just comps, but the listing agent needs to understand the warts and discount for them, partially, to come up with the ASK price. The BUYING agent needs to be able to quickly understand the warts (risks) and with this, present these to their client with a high level range of what they feel the property is worth. They list the risks, and provide about how much they think it might cost to mitigate.

My horror stories today with buying agents are endless. So much so that last week in the evenings I started taking the PA realtor license training. I’d like to be able to get in a car, and see these places myself. Instead, I have to coordinate with a realtor who may not be free and may know less about analysis than me. If I want to go walk a 5 acre property on a Saturday, and my realtor tells me he’s not available, why can’t I just go and get the punch code and look at it? I have 18 years of real estate investor experience. Why not? Maybe only involve a realtor locally if I go and see it and like it – THEN use their time up. Instead, many of these places I cannot even look at unless a licensed realtor goes with me. I guess it’s for liability purposes, but it’s still silly.

OK – let’s wrap it up

So I do not want to throw realtors under the bus. God no. I’ve worked with some amazing ones over the years, and I want to commend them for it. I even have commended the listing agent on the place I lost out on, publicly, due to his marketing ability of the place, and his spot on price which it sold for. Had I had a different agent, the guy may have been like “hey – I think this is priced right. If you do not make a competitive offer, you may be outbid.” My offer went in, and heard NOTHING for days. The offer is good for 24 hours. I’m like, “did they accept?” If not – why not. Should I raise the bid $5k? No. Nothing. Hard to get in touch with him.

Anyway, I looked up the listing agent and he’s got a TON of properties listed – and almost all have contracts on them. Dude is going to do very well in this industry. Had this guy looked at this listing agent and seen 20 or so recent properties all sold at ask, maybe he might consider the listing agent was targeting the proper market price for the place? Don’t know. But I just felt like the lack of participating from him helped me lose that place.

But the industry is now saturated with everyone that came out of the woodworks for cheap and easy money. A listing comes on the market, and all you had to do as a buying agent was unlock the door and let someone in to look around, then draw up the contract as they rushed to put in an offer before they were outbid. Buying agents were getting fast money. Listing agents threw shit against a wall, and it was selling within a week for over ask at ludicrous prices. My brother sold his house a few years ago in a bidding war – but the top bid could not get it financed by their lender because the appraisal came back much lower than what he bid.

For a guy like me who has been camping on zillow over 6 months, I cannot believe the number of listings that have dirty dishes in the sink, clutter everywhere, and just a shit show of terrible marketing.

Maybe someday down the road I get my license so I can buy these places directly. Who knows. At the very least, I want the education and the test so I know more about this stuff than I do now.

Until then – I continue to look.

January 20, 2024 at 3:37 pm

great article. consider rural Maine. stunningly beautiful. low population. remote.

possibly near Moosehead Lake.

LikeLike

January 20, 2024 at 4:35 pm

Been to a 10BR cabin in lake rangely, Maine twice. Issue is at 10 hours plus away, I can never get there. What I’m looking for is about 2-2.5 hours from me. Loved Maine!!!

LikeLike