I have seen a lot of stuff this past week about the CPI predictions. Low 4s today, and low 3s next month.

“The fed MUST pivot!” Errrr…no.

But the stock market is levitating on a belief of a pause and reversal that is imminent. Here, I explain the faulty logic going on with that.

Pain

Back before the fed even thought about thinking about raising rates, there was a relatively big scandal where all of these Fed people sold all of their stocks. Powell has warned “pain is coming”. Yet those in the stock market are waiting for a 2018-like pivot and are front running the big gainz ahead. I think this is a really bad way of looking at it for general equities, but not for gold.

What is the Fed’s mandate?

Last I checked, we had a 3.6% unemployment rate and inflation was over 4%. More importantly, the PPI was over 5%. My belief is the Fed pumped WAY too much money into the markets, and with this, are trying to correct for that by reducing the liquidity in the markets to restore it to a “normal” rate.

What this means is…

I believe that they are trying to get the M2 dialed back to where it should be. While you are seeing the M2 dip for the first time in my life, the Fed is also drawing down its balance sheet by either letting treasuries roll off or not buying new ones. This has a means of “destroying money”.

If the Fed were to “normalize the balance sheet” you are looking at perhaps $3T being removed. At $100 billion a month, that’s nearly 3 years just to get to a “normal” level.

Now, this is also mortgage backed securities, which is telling me we aren’t seeing 2.5% interest rates for homes anytime soon.

What my BELIEF is, is that as long as we aren’t seeing unemployment go higher, the Fed NEEDS to continue QT and sucking dollars out of the system. THEY DON’T CARE ABOUT YOUR STOCKS.

The last part here is what is interesting. “But…Nate. All of the cash on the sidelines!!” Yeah, which is why I subscribe to Michael Oliver’s “arm wrestling down” narrative over a 1931-like drop.

Inflation?

What we saw in a rather rapid time was prices everywhere EXPLODE. First, they were in denial. Now, it’s been a war to get to “2%”. When do they stop tightening? Perhaps tomorrow. But if you think they are lowering anytime soon, I have a bridge to sell you.

With this, look at the stock market. It’s not collapsing.

You can see a “gentle landing” if you will with this. It found a bottom in Sept 2022, but now rallying. How does this appear the economy is bad? If you take the stock market with the 3.5% data, it tells me that the Fed is very comfortable with their path of sucking liquidity out of the economy.

But under what circumstances would you then go long with everything?

If today, the CPI came in lower than expected, you think, “ok. Now the inflation rate is getting there. He HAS to pause now, right?” Then the bots and algos set you up for a rugging by bidding higher, expecting the reversal to follow.

But I ask you, in history, when these reversals came, WHY did they come? Lots of poor economic data and damage to markets. By YOUR measure, you are now in a Bull market for stocks?

And you think Powell is going to reverse rates on that?

Now, if CPI came in a little hotter than expected, the thinking is – Powell will need to keep increasing rates and there should be a sell algo. But no. What we have seen then is more buying. “This just means we are closer to pivot”.

Illusion

By what objective measures is our economy booming to support a bull market in stocks? What I see, and other see, is a handful of companies dragging up the indices with them. Only a portion of the stock market is responsible for all gains this year. Then there’s the “whisper campaign” with “AI” and suddenly every stock analyst says “AI” and stocks rally. Have you really ever look at what Chat GPT gives you? It gives you a 5th grade book report using bad sources on the internet. While there is some promise there down the road, this is painting a turd right now.

What is more likely?

Going to ask you a serious question. Let’s look at what is more likely to happen.

Unemployment at 3.6% and CPI around 4% and Powell armed to continue raising and holding for a long time.

OR

Unemployment at 3.6% and CPI around 4% and Powell capitulating to stop rate raises and indicating a pivot is coming.

For those of you choosing door number 2, you are retail bag holders as the banks today are trying to exit their positions. Congrats, you are being gaslit into investing into this “bull market” as the Fed has sworn to reduce their balance sheet. Congrats, you have been sold “short inventory” to buy a wildly overpriced house at 8% interest rates and when layoffs happen, you will be amongst the first to file for bankruptcy.

Truth

The truth hurts. The truth is that our economy is slowly, wildly, and quickly. Oil prices are declining not because we just found a 100 billion barrel field, but because macro economists see slowing worldwide economies, and that means less oil used – even with Saudi supply cuts.

The truth is, commercial real estate is a mess, as companies are breaking leases. Unemployment will start to tick higher as sales are dropping off everywhere. As unemployment rises, wages start to go lower as companies have more leverage with negotiation. Less people will buy houses and new cars as they understand we are in a declining economy.

Layoffs are starting.

But until we see a 5% number, or even 4.5%, you cannot expect the Fed to even entertain the idea of a pivot. Remember, the fools changed the definition of a recession to gaslight all of you into continuing to buy houses and cars. This only hit the snooze button. A recession SHOULD have been recognized, but it wasn’t, thus inflating the balloon more and more.

What most MSM is NOT covering, is we have had more banking failures (dollars) in the first 4 months of this year than 2008-9 combined. We now have more bankruptcies this year than any year since 2010, and we are so early in this year we will shatter that number.

But yet unemployment is 3.6%.

I stopped believing these numbers awhile back. As long as they were low, they have a cover for continuing to raise rates.

CPI is not the item to look at right now. It’s unemployment. As long as you see a low unemployment number, the rates will continue to rise. The noose gets tighter. But all of you are looking at “but they told me it was a bull market, so I should go long”.

IF you see unemployment going higher, and they are allowed to report it is higher, that is telling me:

- The Fed is starting to get cover to slow rate hikes and even pivot when this number gets too high

- The economy is in recession, and the risk off algos should rug all of you.

So – CPI this morning will be of interest to me. But what’s even more of interest is that the rate hikes they have done 12 months ago will only now start to show up. It’s a pin pulled from the grenade thing. And rates raised last month will only show up May 2024. Meaning – I believe we are at the beginning of many months of unemployment going higher.

The timing of this is also coinciding with the treasury needing to issue another trillion in treasuries. As defensive algos kick in, the “bulls” are becoming bag holders for the pros who are buying bonds at 5% while the pain happens.

Good luck. May the odds be ever in your favor.

For those of you interested – here is my bear list right now. There’s been a few things I have seen the last few days I have not added yet. Suffice it to say I’m looking at about 40 points right now that are pointing severely bearish. Yet the gaslighting today is all about telling you we are in a bull so you BELIEVE we are in a bull. Funny how they can change the definition of a recession, but the definition of a bull with the gain you are most certain is accurate.

Rugging I tell you. Rugging.

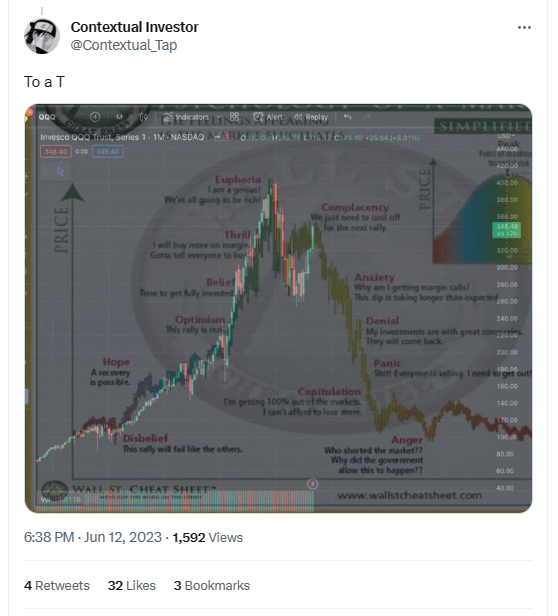

Just saw this and needed to add…

Then in the comments….

Rugging could be imminent. Could be an interesting rest of June.

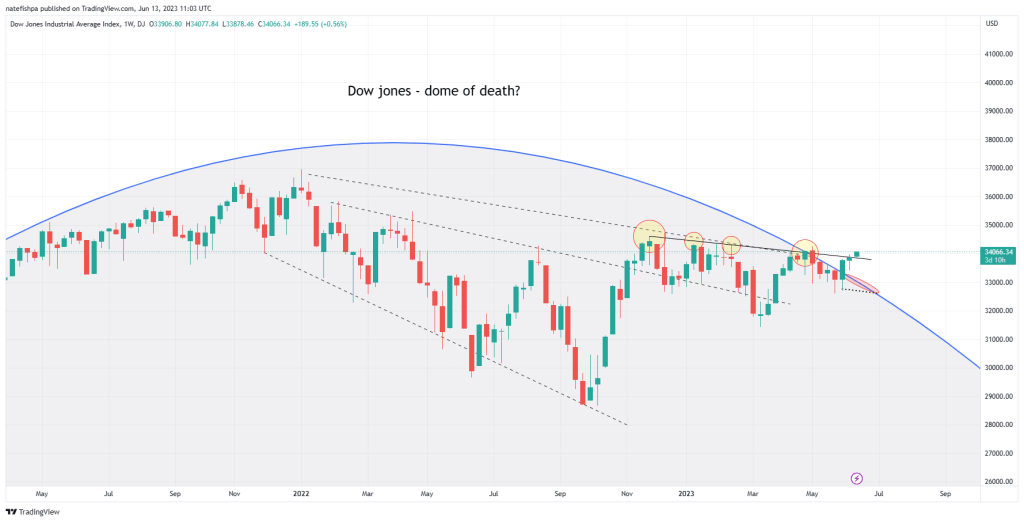

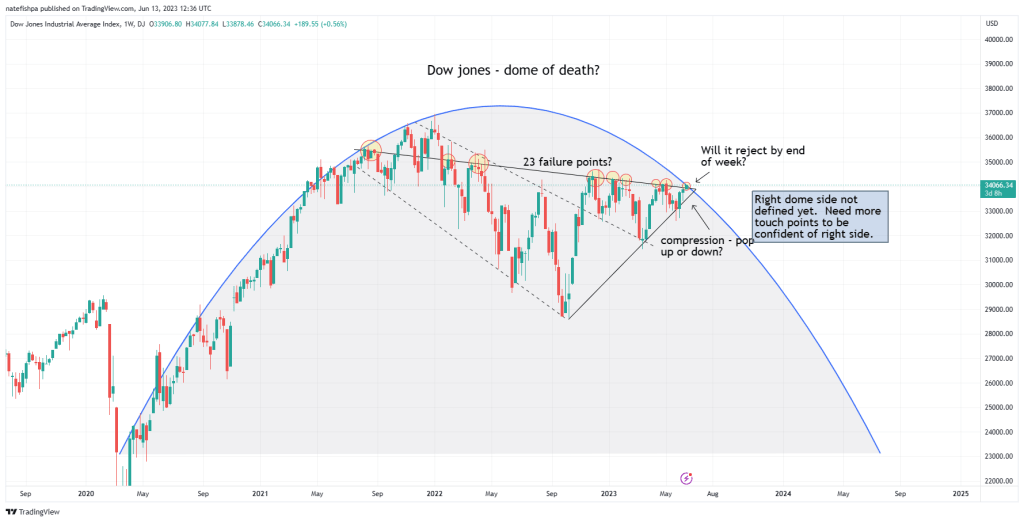

One other addition here. It’s Tuesday, but this bar has popped up over a pretend line I drew. Making fun of TA for a second, but if you look at this line, there were 23 touch points of being rejected.

Now, it COULD mean the below:

- By the end of the week, it will go below this line because of magic and be rejected a 24th time.

- By the end of this week, it could break above the line.

Yeah, rocket science.

But you can see the triangle compression. This is bulls fighting bears. The “dome” has the left side defined, but the right side is not defined yet, as you need more touch points. IF it were to fail here by the end of the week, the dome of death will have started.

My NARRATIVE here is supported by the bear data points. NO ONE can predict the future. Can the bulls take this and run? Sure. I think it is MORE LIKELY this breaks down as economic data starts rolling in that supports we are in a contraction. Until that time – there will not be a break down. But with labor numbers later this week, it could be the start.

Leave a comment