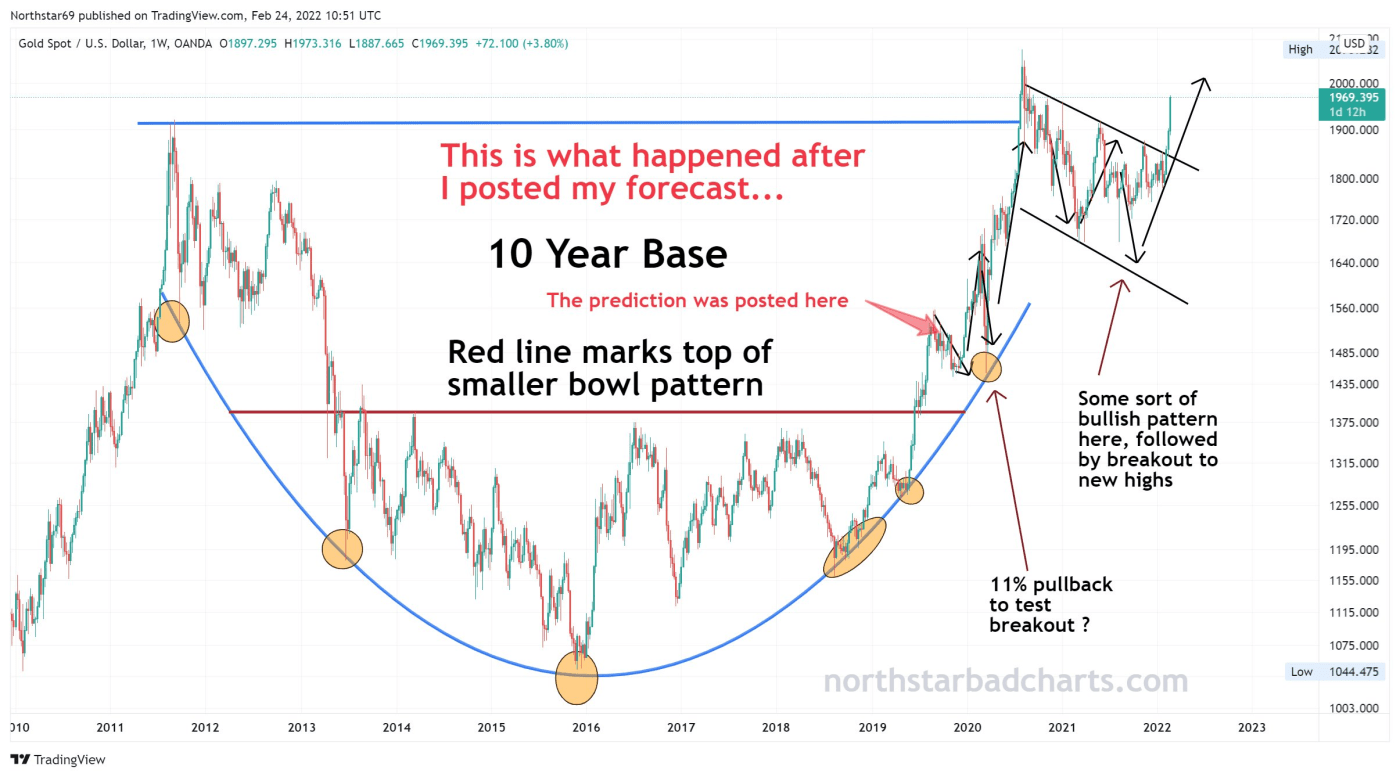

Bottom Line, Up Front - I think anyone holding gold and silver/mining stocks is about to have money reflate that trade quickly. I think lots of shorts are getting decimated as we speak and with that, rocket fuel is happening... Continue Reading →

For security reasons, I don't plan on sharing pictures of my house here, but I will let you know that 3 weeks ago, they came and installed the 2 Tesla powerwalls inside of my garage. About a week ago, they... Continue Reading →

None of us are spiking the football yet with gold. We broke above the triangle, and so far, have held.... We have a few things going on here... We had a nice strong move above the triangle and are back... Continue Reading →

I have used the Silver Institute as a reference for a lot of my work. It's the best PUBLIC information out there, and I had figured these figures were rather close. Upon further review of the most recent report I... Continue Reading →

I was recently asked by a friend for a project to analyze snapchat and Fortuna for how I might play these in the short term. Meaning, this is NOT financial advice. I am NOT a professional trader as I have... Continue Reading →

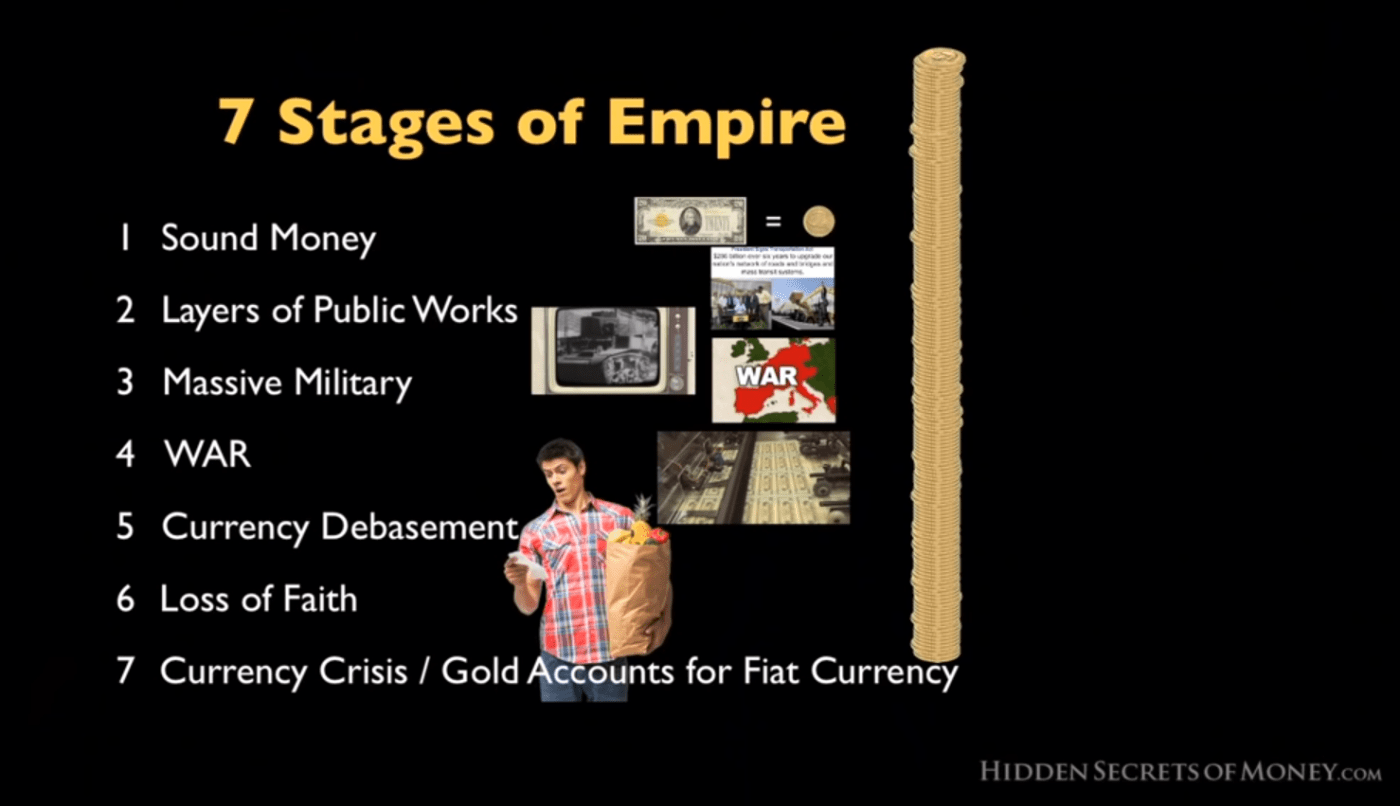

Note for the squirrels: We are at the very end of stage 6, and it's a matter of time before we enter stage 7, and this is possibly due to current global conflict that triggers a situation where the USD... Continue Reading →

Really - it depends on your time frame. Why? Consider your "2% inflation" yearly compounding over 100 years where gold was $20 a hundred years ago, now it is touching on 100x that. In another 100 years, could gold be... Continue Reading →

Recent Comments