I am seeing more and more posts on how a BRICS commodity-backed currency isn't possible. I mean, I don't think anyone really gives it 10 seconds of thought. It's like, "can't be done", and on they go with their day.... Continue Reading →

About 4 years ago, I wrote a post about how my mom was diagnosed with stage 4 pancreatic cancer. On December 5th, 2019, she lost that battle after 15 months. I wrote that post with tears of sorrow. This post... Continue Reading →

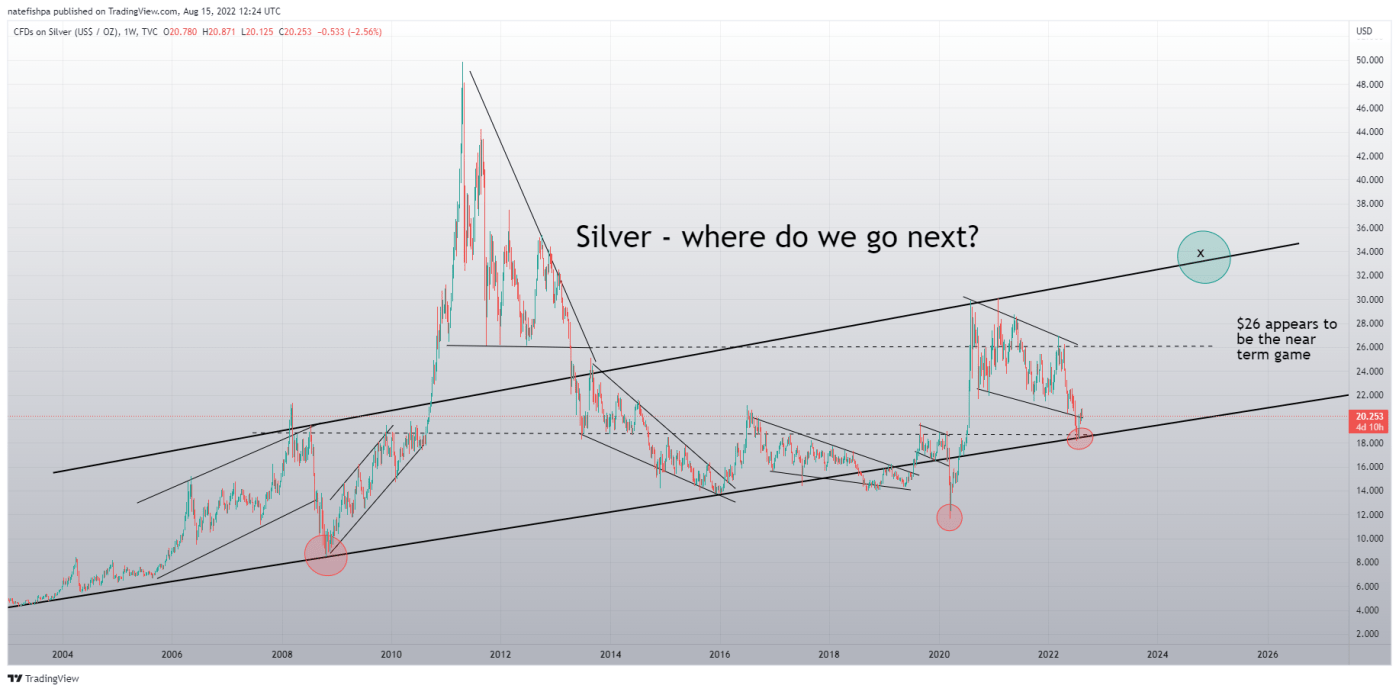

At this second, you are saying to yourself - "Nate, I know you invest in Fortuna, First Majestic, Pan American - are you telling me they are dead?" No. Not by a longshot. But they aren't silver primary producers, anymore.... Continue Reading →

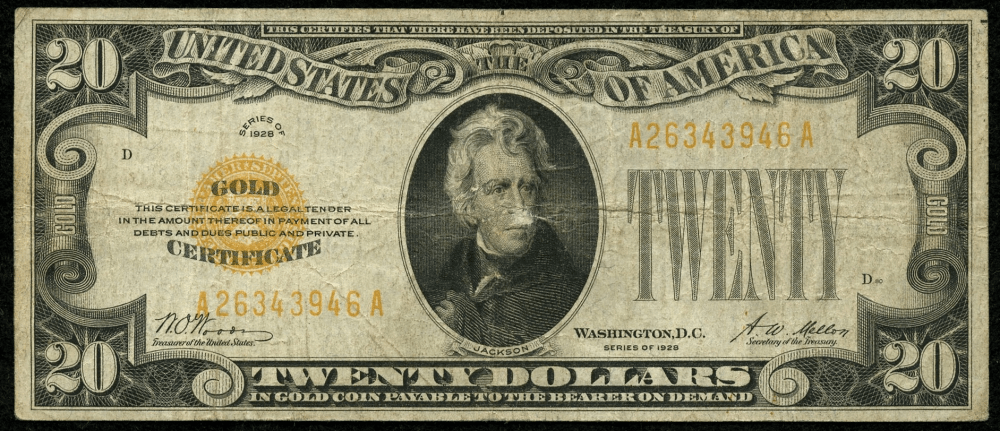

I need to preface any of the below with this is NOT financial advice - this is research on what I have observed over the last few years and have drawn conclusions in this paper that lead me to this... Continue Reading →

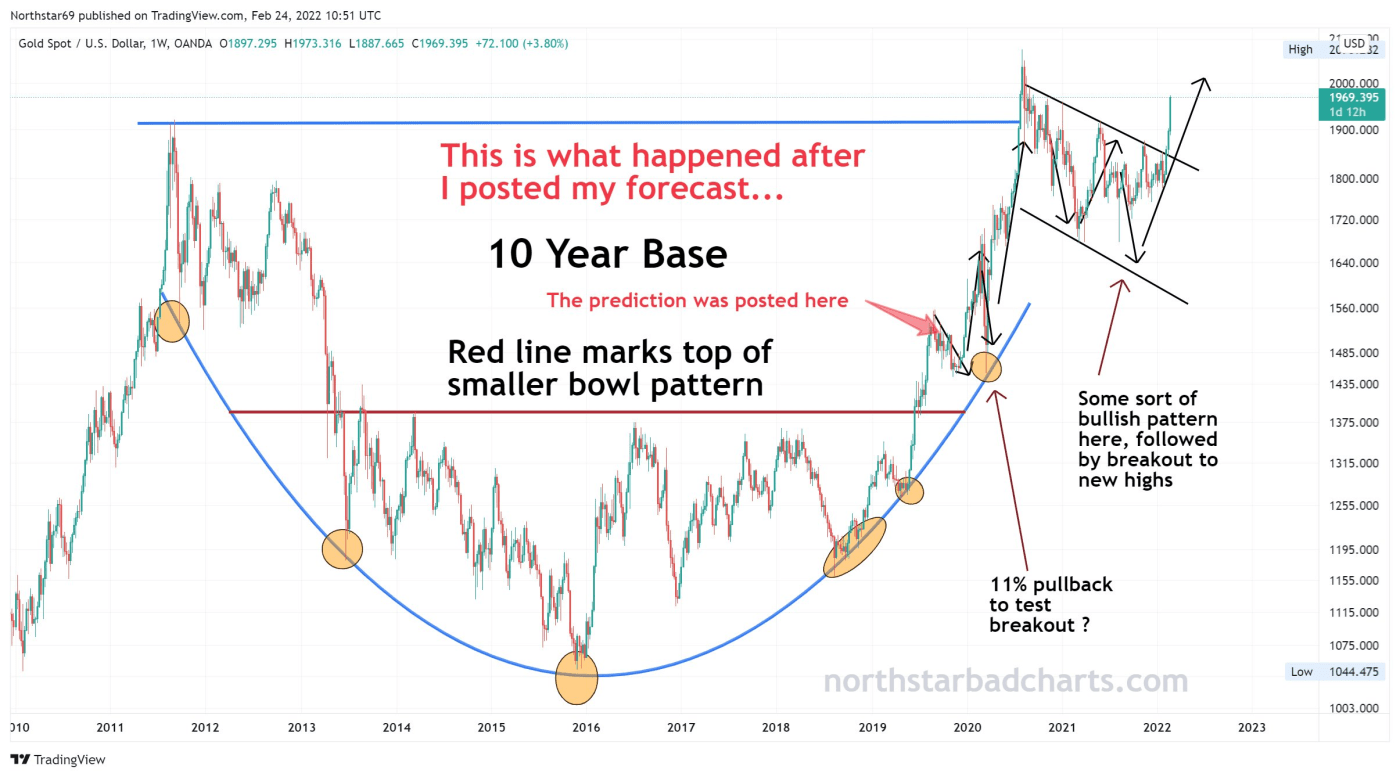

Bottom Line, Up Front - I think anyone holding gold and silver/mining stocks is about to have money reflate that trade quickly. I think lots of shorts are getting decimated as we speak and with that, rocket fuel is happening... Continue Reading →

I was recently asked by a friend for a project to analyze snapchat and Fortuna for how I might play these in the short term. Meaning, this is NOT financial advice. I am NOT a professional trader as I have... Continue Reading →

Review of Ted’s 800m silver short claim by BoA – new evidence from OCC sheds light on the discussion

Summary: The OCC report does NOT contain gold, as Ted and Bix have claimed all along. Derivative contracts appear like they could be double counted if one of these 4 banks is the lessee and the other is the lessor.... Continue Reading →

Recent Comments