I wrote something a few days ago on Twitter after I was considering my apple analogy below. The thinking was, "if they could now just increase energy supplies, this should more or less neutralize a lot of inflation we are... Continue Reading →

I am a HUGE fan of Steve St. Angelo. He might not know it from some of my follow up questions on Twitter on some things. This piece is a discussion about a lot of what he says - and... Continue Reading →

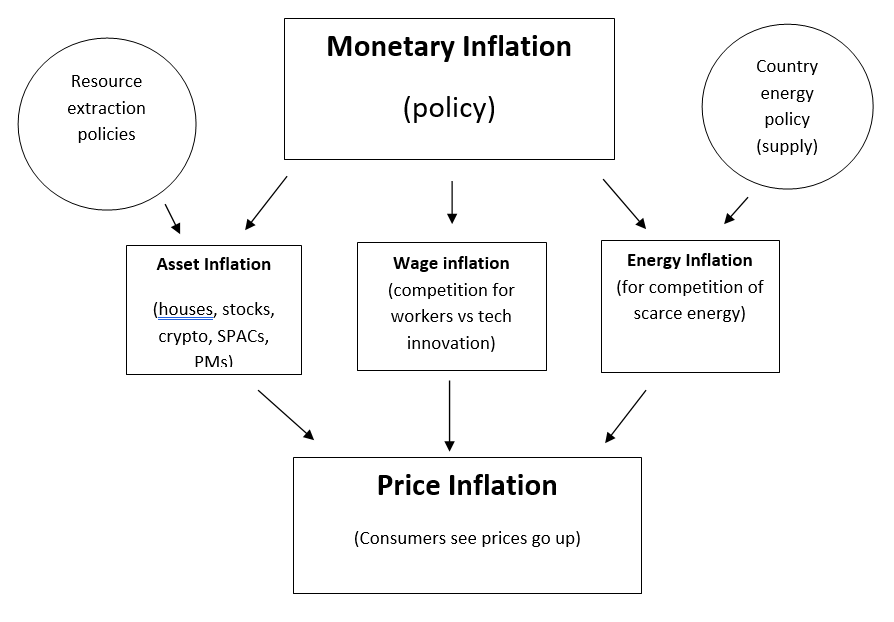

Many months ago - we all heard "the fed is trapped!". I believe it - I still do, to an extent, but I think many people predicated this on the cost of interest on the debt going sky high, leaving... Continue Reading →

I had a conversation with an old friend of mine a few years ago where she continually asked - "but where do I put my money??" This was in response to looking around at the system and evaluating it had... Continue Reading →

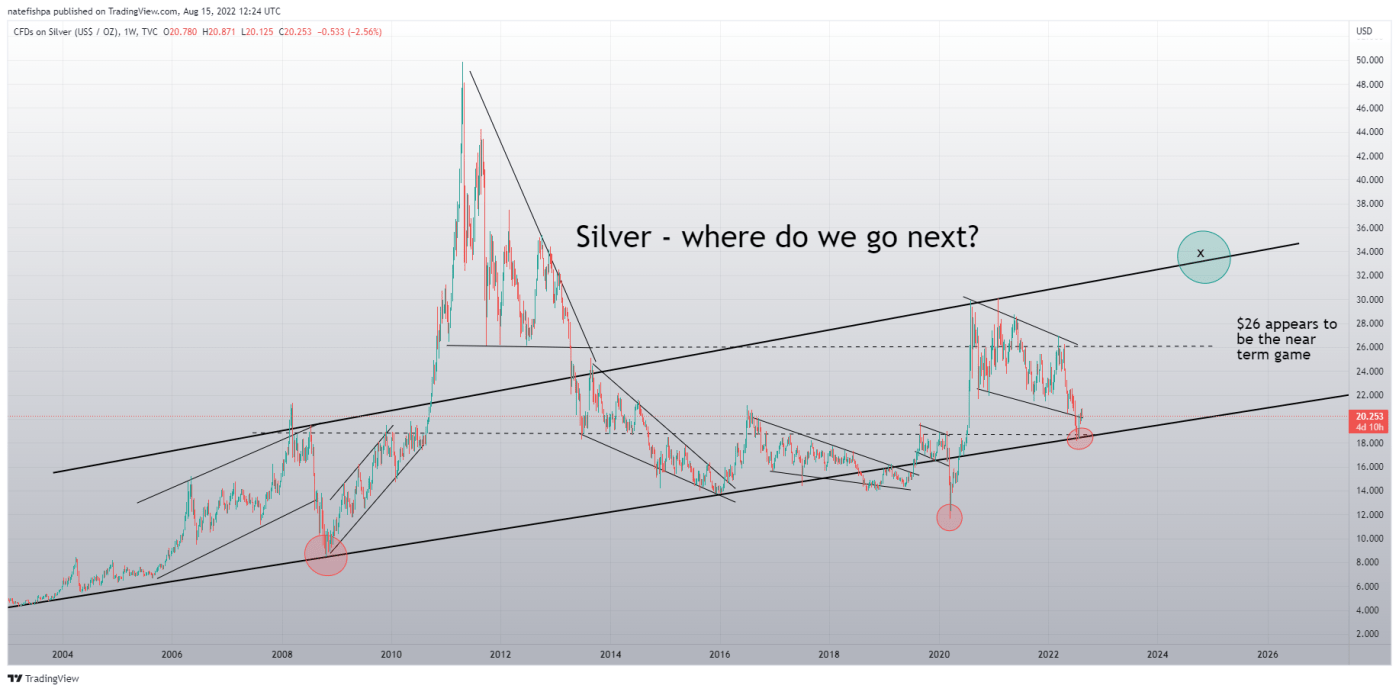

So I had someone ask me about pressure on the metals with the DXY continuing its murder streak, and I decided to take a peak. I know, I know - dollar "strong" bad for metals. You then look back to... Continue Reading →

At this second, you are saying to yourself - "Nate, I know you invest in Fortuna, First Majestic, Pan American - are you telling me they are dead?" No. Not by a longshot. But they aren't silver primary producers, anymore.... Continue Reading →

https://twitter.com/scottsdalemint/status/1549455783301042176?s=20&t=1CDwgGGHASViQMCB1a08vA So I look at Twitter yesterday going nuts on this report from Andy. I have no reason to doubt Andy, as everyone in the industry says great things about him. But I'd like to unpack some of this. At... Continue Reading →

I posted this Tweet early yesterday morning on my way to work and man....I got a ton of comments about gold's 10 year window of investment. Here's the Tweet: It then got a lot of RT and bitcoin guys seems... Continue Reading →

Recent Comments