NOTE: DO NOT read this and say, "Nate is calling for $3000 gold, let me take my kid's college fund and put it into GDX. This article is that by observing the latest banking issues, it appears that the Fed... Continue Reading →

Note - this is MOST CERTAINLY not trading advice. It is IMPORTANT to note I use PMs to hedge my real estate positions. I have vaulted physical, lots of miners, and use the paper game recently to play moves up... Continue Reading →

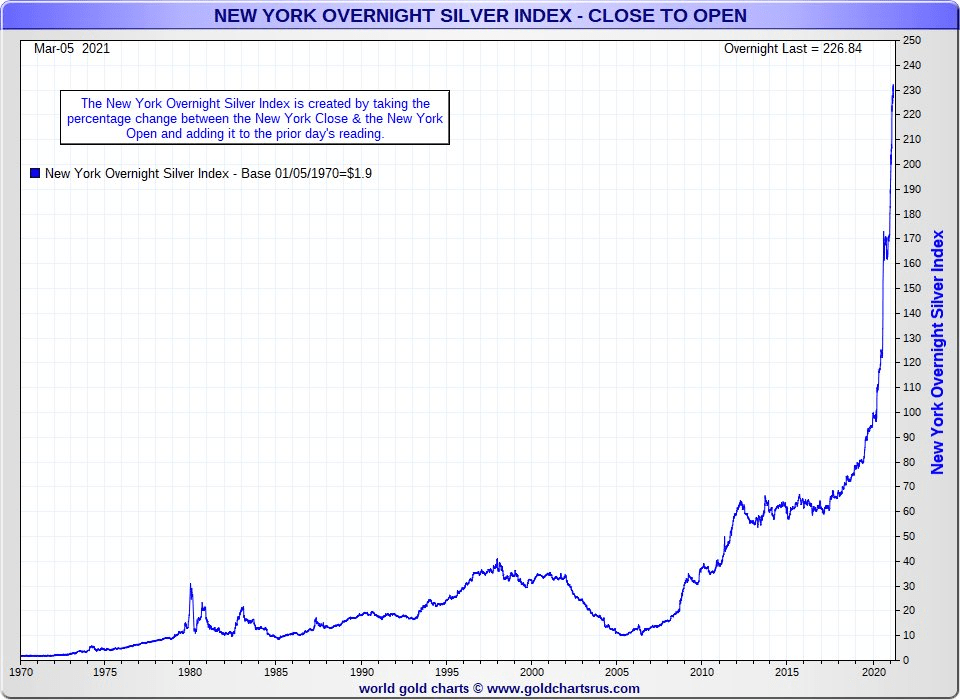

The setup "Silver is HALF of what it was in 1980!" Well, given the recent smashes, it's actually closer to 40%. The last time I checked, silver was the only commodity to hold this distinction. Yet, we saw a $50... Continue Reading →

I had recently seen a post relating to Steve St Angelo's talks in the past about gold storing energy. He got me thinking about this a few years ago. Like, deep thinking stuff. I tried working it out in my... Continue Reading →

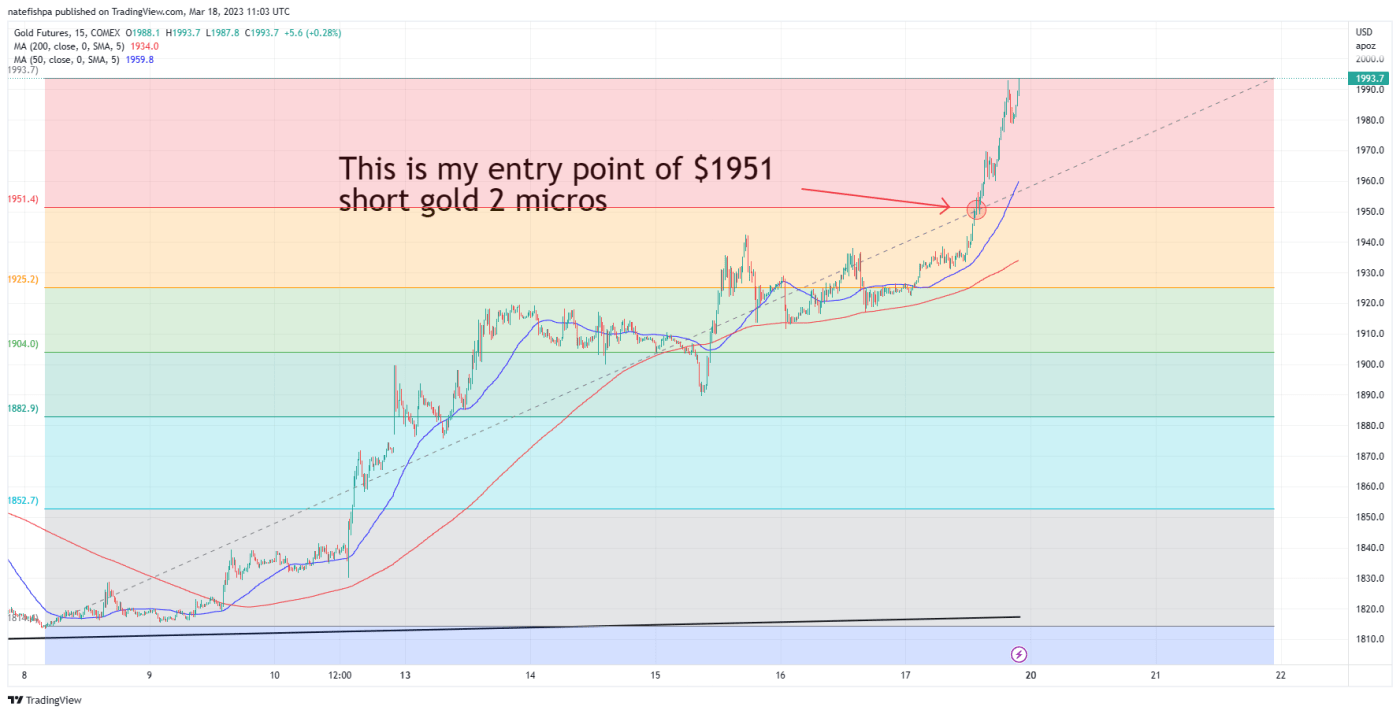

So I wrote a note about an experiment I was doing based off of this chart... I wanted to put this out there QUICKLY before people just blindly follow me - despite me begging you not to. I'm running an... Continue Reading →

My my brokerage that I have my long term in investments with, I was able to request permission for a futures account. I already have a margin account, and options ability - so I think these places need you to... Continue Reading →

The first attempt at creating metrics for this was interesting. However, the failure with this mostly was that a specific entity did not buy the 100m+ oz it was supposed it - but rather changed their prospectus. This took a... Continue Reading →

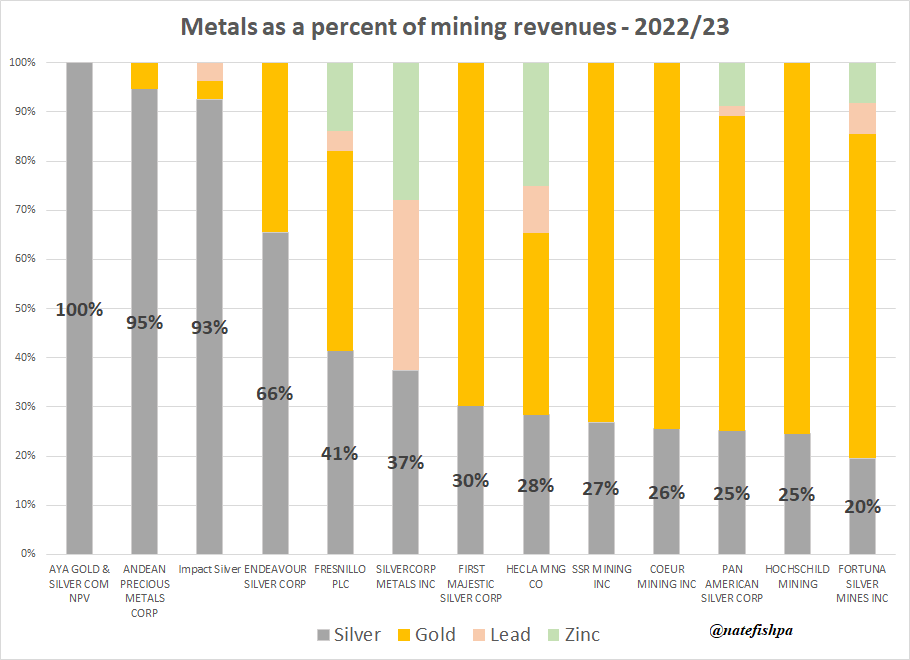

TLDR for the squirrels and goldfish. It appears as if there are only perhaps 5 (updated 2/1 to add GoGold) silver primary miners left in the world with a market cap over $100m. I could have missed a handful -... Continue Reading →

Recent Comments