Preface: I am not your enemy. I’m trying to wake you up from the Saylor grift he has over all of you. If you understand this is a REALLY good speculation, you can play this to your advantage and GROW your BTC rather than riding it down 90% every couple of years, simply by playing an arbitrage to other asset classes.

I wrote an article yesterday discussing why Bitcoin and cryptos are a speculation as opposed to money or a store of wealth. I think many of them are hung up on a definition rather than understanding the properties of what they are. To them, if it IS money or it IS a store of wealth, it validates them. If it is NOT, then it invalidates them. What I’m trying to say over and over is that I believe this mis-classification can cost them a LOT of money if they don’t understand the properties. I went through some examples yesterday, but I was rushed and didn’t have a ton of time.

Below, I want you to see how I am visualizing this, and WHY the hell this is so important to you. All of this deals with my understanding of financial energy, and this is an extension of that. For the book down the road, if it’s ever made, I swear I’ll have better graphics. For now, here’s the bigger picture.

Let’s assume you have 100g of gold, or 100 jewels of energy. For this thought experiment, I call financial energy jewels, as a play on “joules” of electricity. Right now, your jewels are LOCKED as money in gold. We will then sell this gold into the market to get $6000 dollars in currency.

What do you do this with currency? It is on a time decay clock, if you will. Over the last 100 years, the fiat fed note has lost 97% of its purchasing power, very similar to you sending current over a copper wire and losing heat with resistance and ohm’s law. Meaning, distance of TIME decays the power of these fiat fed notes, so you don’t want to HOLD them a long time. These are EXTREMELY LIQUID and used as currency to exchange for goods and services in these 3 categories.

Money – consuming versus storage

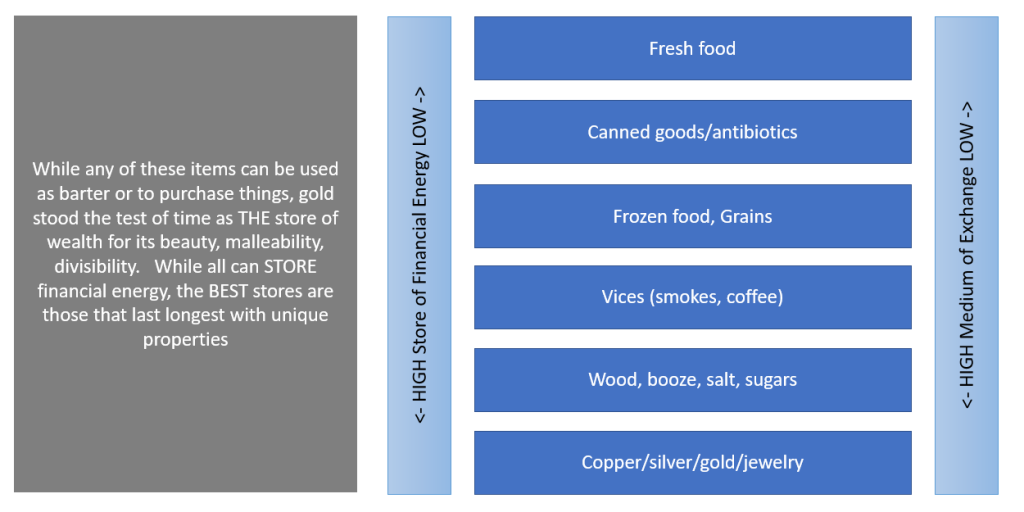

In the money category, if you look around your house for things of relative liquid value, you might see a variety of things. I put them in two broad categores

- Barter goods (food, diapers, emergency supplies, vices) – these can easily be used to “purchase” things in absence of currency.

- Raw materials (wood, copper, silver, gold) – these are things used to build things

With this category, you have a scale of how long something is good for which can determine it’s store of financial energy. This is why if SHTF, they say “you can’t eat gold”. Why?

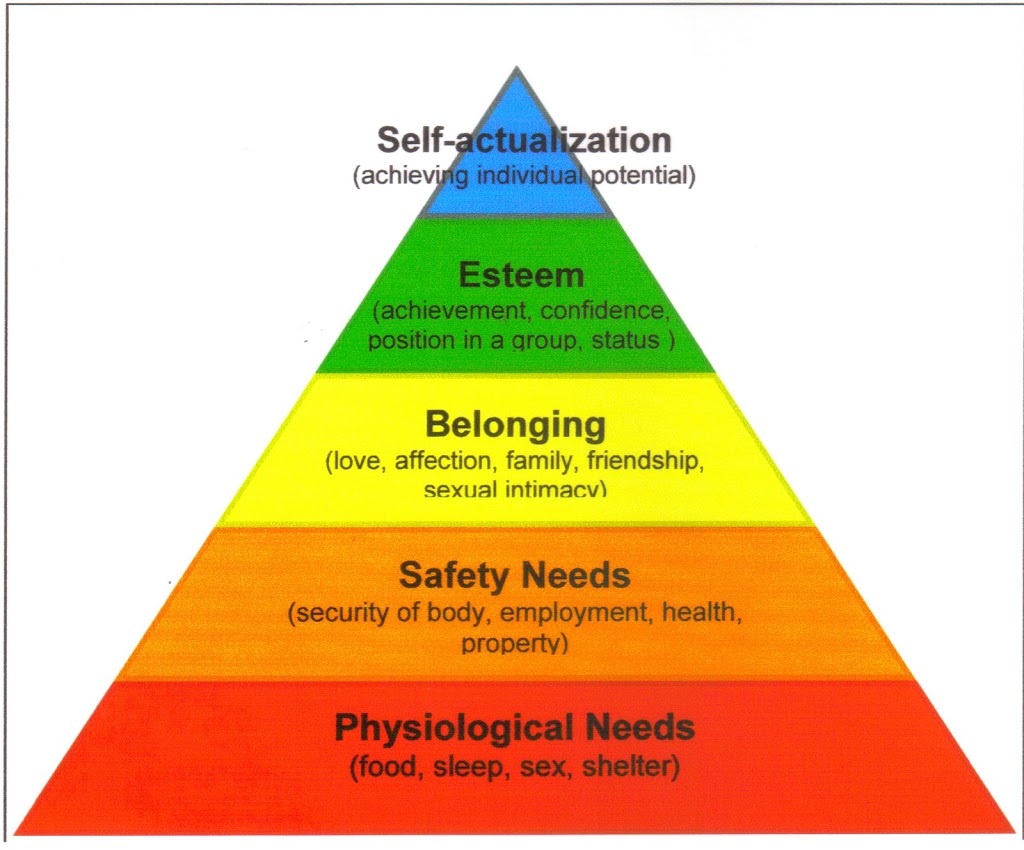

If you look at Maslow’s hierarchy of needs, when SHTF, we need those items FIRST at the bottom of the pyramid.

Now, if you look at these needs, they seem to be an inverse of the money above. At first in SHTF, those items at the top are very liquid. The items below aren’t CONSUMED, so they are a good proxy to use as a MEDIUM OF EXHANGE.

Meaning, your immediate physiological needs of food and water are most pressing. If you cannot get it yourself, you need to exchange things to get it. Perhaps you have extra eggs and want to buy fresh water. You get the idea.

But next on the hierarchy is security of body/employment/health. This is where you start to get into the “what is my labor worth to earn those eggs”. Perhaps you exchange one hour of labor for 2 eggs. Perhaps the “oldest profession” has something to do with this, as well. In old times, you hear about so much silver paid for a day’s wages, which you can then go use the silver to buy whatever food you wanted.

We then have belonging. Love. Affection. Intimacy. Ancient rituals have you giving jewelry and tokens of affection to people. Wedding rings. Jewels. What about dowries? You want to have a family and belong, you perhaps need gold for a wedding ring.

Then we start looking at esteem – perhaps you want to demonstrate to others how successful you are to attract mates. This could be where you have displays of excess wealth with kings and gold.

In all of these situations, you see gold as the tie and anchor of RELATIVE VALUE. And this is KEY to everything here.

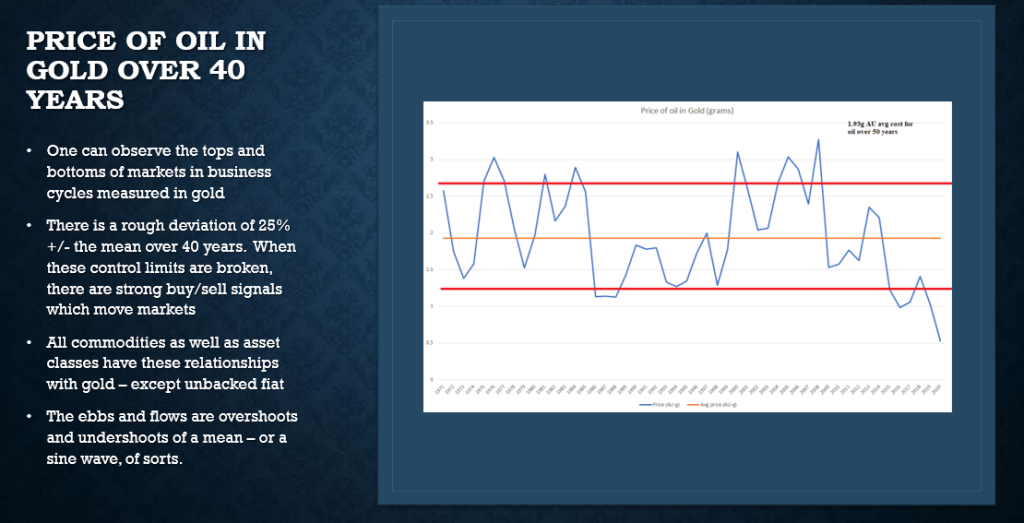

This is how you can see gold’s RELATIVE VALUE to oil over time. With this, you saw how oil went to stupid low levels last year versus gold, which was a great opportunity to trade gold for oil.

There’s an oscillation, it’s not a straight line. When things are overvalued or under-valued they correct to the mean over time.

This is EXPLOSIVE because all of the shit in this category is what is USED in the business category to make ALL GOODS AND SERVICES – meaning, as the value of these things goes up in currency units, it has ripple effects in input costs to business processes – which thus expands and contracts the production of these goods and services.

And what is MOST important is gold is the ANCHOR of VALUE to everything things are made of. Not the USD.

Business – growth versus contraction

This is how you take things from money and make things that go into all asset classes. How things are measured here is the risk against the reward. Meaning, low risk things may grow slowly. Higher risk things may grow much more quickly – but there’s a risk of loss here, and you are rewarded more when higher risk items hit – but you are penalized more when they fail.

The big idea here is that the age of someone may determine the risk profile for growth. If you are 23, you might be all invested in high tech and biotech stocks, SPACS, and IPOs. Maybe you start your own business at 22 living at home and not take a paycheck for 2 years. Maybe you are 75 and retired and want low amounts of growth due to low amounts of risk. You want growth, but perhaps just enough to keep pace with low levels of inflation.

Property – utility versus speculation

The last class here can range from a baseball glove to a giant mansion to bitcoin. This is a wide array of items here, but consider you put financial energy into furniture to sit on, a baseball glove to use in leisure activities, a house to live in, or perhaps vacant land to perhaps build on some day. With the lower end items, you may just buy and put in a closet, but the more higher end items you may have this associated with deeds to show you have claim to a car, dwelling, or space of land.

The items like a baseball glove you put in a closet you paid $100 for you might lose 95% of its value on and can sell at a yard sale for $5. So the speculative value here is EXTREMELY negative, which is a trade off for the utility of what the item is. Next, you have things like appliances and furniture. Maybe you buy a bed for $3000, but 5 years later you maybe can sell it for $100? Perhaps these have less of a daily utility, but hold their value a little better than daily items for utility.

Perhaps the next item up is a broader category where you start with your deeded items like cars, houses, RVs. While you can easily see your car depreciate in value when you drive it off the lot, it has a high utility value as it gets you to your job every day. So while the ASSET may depreciate in value, it allows you to make money daily by getting to work. An RV has utility like a hotel room and has similar depreciation to a car. A house is also deeded here and has the greatest utility of shelter and safety – and while it is supposed to appreciate, you have yearly upkeep costs. Assume you buy a house at 30 and never sell and die at 80, the house may have appreciated over time (rather, the currency has faded in purchasing power) but you had an upkeep cost and mortgage cost. So this is not really a reward for the investment.

The next stage here is vacant land. Maybe y6u buy vacant swamp land in Florida for $1,000 expecting 20 years from now the swamp would be drained and they would build condos. You have a decent probability that may never happen, but it if does, you might make 10x your money, or maybe even 100x.

The next layer here is your numismatic coins, art, comic book collections. These have less utility, but have a much higher speculative upside. You are betting here on rarity and how someone else, over time, may pay you a lot more than what you paid for it.

Lastly, I have crypto currency. It is like beach front property, swamp property, and art wrapped all into one. This is a speculation on DIGITAL REAL ESTATE (the blockchain) that someone, for some reason, might pay you more for your spot on the blockchain, someday. This speculation could be tremendous IF wide adoption happens with whatever coin you back. Within this speculation is the argument of “finite” space within a crypto currency (bitcoin) versus a crypto that can print “at will” as needed, like a Tether. There are vastly different traits amongst these, but overall, the idea and big picture here is the investor is looking for massively outsized gains with some future implementation of your DIGITAL REAL ESTATE.

Now that I have laid out the asset classes, this now goes back to a friend of mine for 20 years. She said to me, about a year ago, “what am I supposed to do with my money?” Meaning, in all areas you were looking down the barrel of a gun. Gold tanking, real estate bubble to pop, stock market going to pop, debt bubble problems – meanwhile, cash depreciates in spending power by the day – and the higher the inflation rate, the quicker degree of the loss of spending power.

She has a legit question. What do you DO with your cash?

Risk profiles

Now we get to the portion of this episode where you have to identify YOUR needs. If you have $100,000 in assets, it may not be practical to have $75,000 of it in gold if you are 23 years old with a rising stock market and crypto trade. Likewise, it wouldn’t be smart for the 60 year old to have $90,000 of it in bitcoin.

This is why I think this man in the most irresponsible person on the entire internet right now, financially speaking.

To be clear, this guy might be the nicest person on the planet, volunteer at a soup kitchen, rescue dogs, and have 5 beautiful children while being a killer dude to play a round of golf with. I’d like to separate these two things out there – the person who is leading people to financial ruin to benefit him and his company versus the person outside of work. Clear on this? Good.

I say this because the Saylor academy leads people down this path of thinking that bitcoin is something it is not, and with this, the best thing you can do is sell everything you own and buy bitcoin. Please see exhibit A where he tells you to sell everything and also borrow as much as you can to buy bitcoin.

What this video does not take into account is the individual’s risk profile, which is why it is really shitty and dangerous advice. You then see tweets about how Elon and others are in on bitcoin. OK. Let me ask you something. What percent of their entire portfolio do you think they are deep in bitcoin or crypto?

IF you look at the items above, in the three asset classes, Musk probably has a vast amount of his financial energy in Tesla stock, solar panels, Space X, etc – and then have a good amount in houses, cars, etc. He may have 1% at most in some form of gold – and that is probably stupid high of a percentage. It might surprise you to hear that wealth people hedge against doom with gold, but that’s later.

What if Musk’s fortune is $250b? For him to even have 1/10th of 1 percent in BTC you are looking at $250m in BTC. Now, let’s assume you make $75,000 a year, inherited $100,000, and live an ordinary life trying to pay bills, have a mortgage, etc. You are 40 years old. How much would you put in BTC?

Now, If you look at your cars, house, investment account, cash, etc – and used perhaps 1% of your wealth, you are looking at maybe $5,000 in BTC as a SPECULATIVE investment. If you did Elon’s ratio, you’d perhaps have $500 in BTC.

What those people Tweet about with famous and rich people buying BTC are leaving out, is that it’s a tremendously small percentage of their wealth. They sort of leave it out. Why?

Elon could lose $250m in BTC if it goes to zero and still have 99.9% of his wealth. However, if BTC goes up 100x, his entire wealth grows by 10%. Meaning – there’s a risk/reward there for speculating a SMALL PORTION of your wealth.

Now, ask yourself how much it’s going to hurt if your $50,000-$100,000 in BTC goes to zero? That’s what the difference is between Elon buying BTC and you. He’s buying BTC with “fuck you” money. You are using Junior’s college fund.

How to play the speculation

I wrote about this more yesterday, but I have higher risk investments (rentals) and speculate in a small coin collection and miner stocks and call options on miners. With these speculations, I have rules I use. Why? Very volatile and high risk investments can come crashing down as fast as they launched into orbit.

What I might do is perhaps on a double, take half off of the table. What do you do with that? Well, I sold half of the speculation, and if you look at the first chart above, I converted it into fiat currency notes. What do I do with it? What do YOU do with it?

I cannot advise you, I’m not a licensed financial advisor, and this should not be construed as financial advice. I’m telling you how I play some of these things based on geopolitics around me.

About me:

- 45 years old, wife and 2 kids

- Mortgage on my house, own two rental houses with a total of 3 rental units.

- Invest in “business” with mining stocks, energy, uranium, battery metals

- Speculate with mining stock call options and resource exploration companies

- Small PM holdings to “hedge” in Kinesis in vaults

- Chooses not to speculate in unbacked crypto currencies, as seen as too risky for MY portfolio with my responsibilities

For me, my PREFERENCE to use the blockchain is Kinesis Money. This allows me to own PMs in a vault – and immediately liquidate them for currency, then convert to USD, BTC, ETH, gold, silver, etc. I can send these to anyone. To me, this is MONEY. YOU prefer a crypto currency SPECULATION – which is great! Love it! But you need to ask yourself how that asset class acts different than a monetary asset class.

Furthermore, you have to understand the psychology of speculations, and where you might be in the speculative bubble. 98% of you reading this don’t have a clue what the dotcom bubble was from 2001, but on the other end of that was a recession and I had the toughest 15 months of my life, which took me years to dig out of.

With the dotcom bubble, this was more or less the beginning of the corporate internet you know and love now. Everything with a dotcom at the end of it raised tons of cash. Stock market inflated to crazy numbers, and then they realized, “shit, how do we make money from this” and 90+% of them crashed and burned to nothing. One of those that burned to nothing is how Mark Cuban got rich (broadcasting.com). Then there was pets.com. My high school friend later invented YouTube, but that was after the carnage of all of that settled. YouTube even struggled with how to make money, if you can believe that.

This is like the crypto craze right now, and all of you don’t realize that there’s so much money going into these, with the bubbles getting blown up – with the moment of…”hey, everyone that is going to buy this has, now what”. That’s the moment when you are holding an asset that isn’t doing a 5x every week, and starts slowly draining in value. Those who invested see the charts where the price is on a slide down. Some white knuckle it all the way to the bottom (Bitcoin HODLers), but others bail at some point because no one is coming in new. Why? There’s no real application for the dog meme coin of the week. You cannot buy a pizza with it.

Where there IS speculative value is in the backend development of some of this stuff. Whether it is theta and Sony, or DeFi and international settlements, or ETH for contracts and escrow, one has to envision an application of the tech that could continue to fuel the speculative bubble. There are some of you who may be visionaries who understand the precise manner in which Hashgraph can be used, and you understand this so well you invest a LOT into the speculation – and when this pays off, you are a millionaire. However, the sad truth is 98% of you are following others to slaughter based on hype, momentum, buzz, or attention and hope to get a 100x by the time you wake up tomorrow. In a sense, you are playing a lottery ticket.

The question you have to ask yourself with any speculation, is, “is this gonna hurt if I lose this”. If the answer is, “yes”, then you have too much in your speculation. IF you are the crazy nerd guy above who does the hashgraph research and has intel that a Fortune 100 company is about to announce something big, maybe have an over-weighted speculation.

But – we ultimately get to how we play the speculation play….

- How much of your financial energy are you comfortable with going to zero? Meaning, look at your family size and financial responsibilities. A 23 year old living at home with his parents is in a different zip code than me with many obligations. This helps you understand the risk you are willing to take.

- What is your expected upside? Do you reasonably see a 2x or 100x ahead? How objective is your reasoning?

- With my mining explorers, I look for some for 3-5x, some that are 10x, and some that are 20x plus – the 3-5x might be more near term, a 10x might take 1-2 years to develop, and a 20+x might take 3-5 years to play out. How comfortable am I holding things for a long period of time that are high risk?

- Some portion of your speculation may not move for months or years, are you comfortable holding this as an opportunity cost to miss other things?

- At what point would you cut your losses to the downside? 5%? 20%? Riding to zero?

- What research have you done on this yourself?

- What do you know? What do you not know? Is this a hunch someone gave you, or does your professional background give you unique perspective on the speculation?

- What research have you paid professionals for? (This is my mining stock explorer speculations, I pay highly skilled professionals for their research ideas)

- What is your plan to “take profits”? At what point are you greedy and stupid? Would you take half out on a double? One third out on a triple? Would you maybe trim a little each month?

- What is your plan to buy tranches in and sell tranches out?

- What would you do with your speculative gains? Would you lock it into a form of money, perhaps put it in a low risk business venture, do repairs to your high risk rental unit to increase its value and rents, or pay off your car to reduce monthly expenses?

- Do you take a portion of your speculations and seed other speculations? Sometimes with profits I may seed other opportunities which are low cost at the time

- Is the overall market in an uptrend or down trend? Should I be in some cash to be nimble between the asset classes?

- How is my retirement looking? Should I stick some away in an index fund to grow with compounding interest over time?

Those 14 questions above would get a different answer from literally every person on the planet, which is another reason why the dumbest guy who ever graduated from MIT should not be your financial planner.

Connecting the dots

I expound on Mike Maloney’s Wealth Cycles and Financial energy concepts here.

Most seem to mistake financial energy as a proxy for physical energy, and they are quite different. What engaged me most was Mike’s “Wealth Cycles” video, which is a must watch. What you see in this is these three asset classes, in a sense, can get stretched from each other. He shows things like Dow to gold ratio, gold to real estate, etc. If you think of BTC as property like real estate, you can play this to add a hell of a lot more BTC to your wallet.

What I more or less do is show that gold is the anchor of everything – which is WHY it is money, and Bitcoin is not anchored to anything which is why it is a speculation. This is important to understand because I feel gold is a RISK OFF asset where BTC (and crypto) are RISK ON assets.

Let me explain here. IF BTC was a true store of wealth, it would not have lost 90% 3 times in 12 years. Now, IF there’s a stock market rollover into an 18 month recession or so, this moves from a RISK ON phase to a RISK OFF phase. How this begins to happen is stock market values are sky high. Real estate, sky high. Coin collections, comic books, art, wild speculation (crypto) all sky high. This is lots of liquidity in the system trying to find the most rapid growth possible. This is more or less permitted by cheap debt with low interest rates.

Because interest rates have been artificially held down (2018 they tried to raise them and almost took down the whole system), it put a “snooze” on the recession. Because others saw this, they then more or less proclaimed we’d never have recessions again. They can juke interest rates down with QE and simply allow expansion forever.

But this runs into a wall of growth, at some point. Prices get so high, that even with cheap interest rates – demand starts to wane. Look at the housing market now. 24% YoY increase – now has a cooling starting. Everyone that was going to sell and refi, did. New homeowners priced out.

Risk off starts.

Insiders in companies start selling (Elon, hello). You start to see “profit taking” as sales start to go down. This profit taking, is then being stored in RISK OFF assets. These are things like cash (to be nimble, but has a clock on it), bonds, and gold/silver. In THIS highly inflationary environment, you will see a lot of that money going after lower risk and higher security – like gold. Bonds will be problematic because who is buying a 10 year at 1.6% when inflation is 6.2%?

Where people THEORIZE that bitcoin is a hedge, it’s just a theory. Most crypto is bought on leverage, and when things start to go south, leverage starts to get de-levered. My guess is a lot of cryptos are the first things that sell off, along with high risk tech startups. This is where the gold/bitcoin people should talk. They aren’t in the same asset class, and they do two separate things.

In a RISK ON environment, cryptos can really be a speculation that tech will find uses for all of these – but as tech budgets and plans contract, so does the use case for a lot of these cryptos. They may not collapse – but these use-cases may have a snooze button themselves. The BEST that have the best use case will survive until the next risk on event.

Overall, the wealth cycles is important to understand because gold and bitcoin are in 2 different asset classes – meaning, you can play that back and forth. If BTC is $65,000 now and gold is $1850, then you can get 35 oz of gold for one BTC. What if you paid $30,000 for that 1 BTC? Why not sell 1/2 BTC for $32,500 and buy 17.5oz of gold? The thinking here is BTC has drawn back 90% 3 times. Gold is perhaps on its way to $3,000. Maybe BTC drops to $6,500 and you have 1/2 BTC worth $3,250. But gold went to $3,000 and your 17.5oz gold are now worth $52,000. Meaning – you DID have 1 BTC for $65,000 and instead of riding it down 90% to $6,500, you banked your profits and now have a total of $56,000. You then see BTC cheap for $6,000 and buy 7 for $42,000. Because you BANKED your speculative proceeds in gold, you then weathered the 90% storm. When bitcoin then starts its next cycle to perhaps $100,000, you then have 7.5 BTC and not one.

I know this was a little math above, but the idea here is that IF you see BTC as being in a different asset class than gold, you can play this arb opportunity to make a HELL of a lot of money.

Consider BTC is now at $65,000 and is at a double top, and possibly heading to $20,000. What if you bought at $20,000? Want to ride it all the way back down to $20,000 or do you want to sell 1/3rd, get your $20,000 back, and when it goes back down to $20,000 buy another BTC or two with your gold proceeds.

This man’s business model relies on you never selling any BTC, while he is a millionaire living comfortably. Consider that HIS wealth depends on YOU not taking profits.

November 15, 2021 at 6:11 am

Brilliant Nate, thanks for articulating so much so well!

LikeLike