I do NOT work in the silver bullion industry. I’m writing about this as a rabid silver enthusiast who has purchased silver now in probably 5 different forms – from bars/coins to PSLV to Kinesis to mining stocks to OneGold.

Below, you will see your blueprint to get to $50 silver, and soon. And perhaps go Palladium and hit $100-$200 silver beyond that.

If you look at the spot price of silver at this moment, it’s somewhere around $28. Yet Apmex is selling a silver eagle at $38?

That’s roughly a 35% premium. A few weeks ago, I saw price at $27 and the price of eagles at $41. That’s a 50% premium.

You are getting gouged. Or are you?

If you talk to some people who sell 1,000 oz bars – there’s no shortage of them. They tell you, “come to my site and I’ll get you 1,000 oz bars all day long”. And when you look at the price they are selling for, you are still looking at a $31 an ounce, or about a 14% premium. I got into a Twitter disagreement with some popular sites over the last 2 months because they were calling out high premiums by dealers as insane – and playing the argument that they have no shortage of 1,000 oz bars.

When you look under the hood, and do they math, those sites were charting between $1.25 and $1.65 premium per ounce for those 1,000 oz bars.

What is “normal”? In times of “normal” conditions, I’ve heard experts state that you can get a 1,000 oz bar from the COMEX at $.10 to $.20 over spot. But if you go into these markets and listen to the people who are telling you bullion dealers are gouging you due to “fake shortage” are selling you a product they perhaps marked up 5-16x on premiums.

Why?

You are sort of seeing narratives out there by the evil dark lord sith Jeffrey Christian and the like talking about “there is no shortage”. I made a point yesterday to call out a popular bullion site because they also claimed no shortage.

What I said was….

“If you sell sausage, and there’s a shortage of sausage from the suppliers, it doesn’t matter if there are 23 billion pigs on the planet, it’s still a shortage”. Because this is the internet, of course someone called bullshit on me.

Immediately, please stop reading. Go down to a community college. Enroll in economics 101. Sit through the first lecture. Then come back and talk to me here.

There’s this misnomer that because there’s 25b ounces of silver in jewelry, tea sets, and grandma’s silverware, that talk of a shortage is silly. The problems are twofold with this statement:

- That the price point will then unlock supply, bringing this supply to market

- That the refining capability exists to then process raw materials into finished products

When I have been doing my metrics guides up, you look for refiners being backed up months. Mints paying 5x premium to skip the line at the refineries. These types of things tell me there’s a lack of supply at the finished goods segment of this – but price point is also something you need to take into consideration.

At $28, no one is likely to run to the coin shop with grandma’s silver. and Jeffrey Christian is a smart guy and he knows this, and his smug and condescending tones to you is to convince you that this supply is available at any price point. It’s not.

How much of grandma’s silverware and constitutional coinage was melted down in 1980 and 2011? What I had heard from 2011 was that they had to stop taking things like constitutional and silverware because refineries were backed up for 2 months. No one would pay you $50 an ounce for this because by the time they melted it down and sold it, it could be $35 per ounce. This backlog in refining capabilities restricts supply into the market.

Let me repeat. If you have constricted supply and massive demand, on a product that will increase in price and demand as price increases. When price is low, you’d think people would scoop this up. Silver and gold are the types of things that as price rises, people pile into it.

Here’s the problem with that. Refining capability. So assume silver runs up to $50 and you run to the coin shop with silverware. They may deny you. Refinery may be backed up. Meanwhile, there’s a line a block long in line to buy. The supply cannot keep up with demand due to refining constraints.

This is why they need “tampy tamp”. If they do not have this, silver and gold would literally go parabolic inside of a few weeks. And – we might be getting to that point anyway due to the governor switch possibly going the way of Palladium soon. When Palladium broke the “tampy tamp”, then it went nuts. This potentially is what is in store for gold and silver soon.

But lets’ get back to premiums. Let’s look at dealers. If you listen to the dealers, they tell you the supplies they get from the mints to sell Eagles and Kangaroos is very constrained.

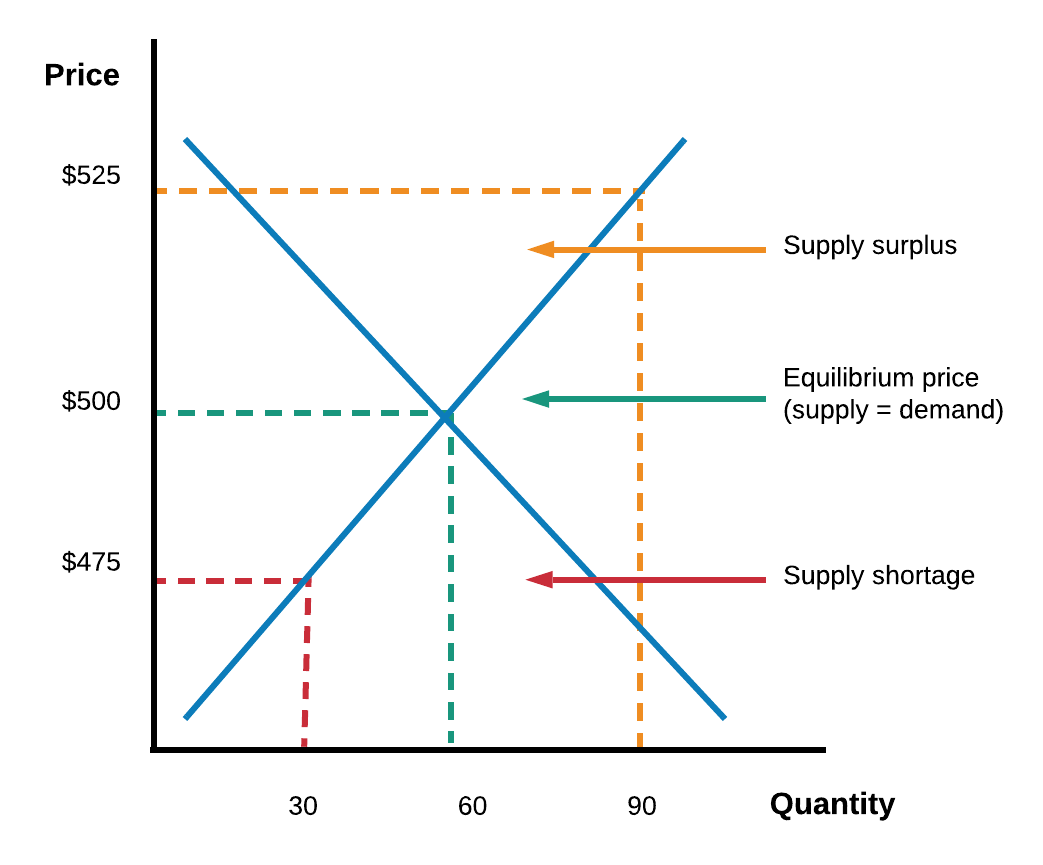

Assume there’s 900m ounces sold of silver per year. What you find from these dealers is that the US mint only makes so many eagles. The US mint then slaps like a $2-3 premium on from THEM. This then goes to distributors who have a mark up, then get to the end dealer to sell. And they may have 10,000 available but 100,000 want them at $5 over. This moves price higher to meet that 10,000 available and find the equilibrium. Otherwise, they sell to you too cheap and they are out of products and out of business soon thereafter.

So what is given to the dealers from the distributor is very little supply, and a RAGING demand. The market essentially has the governor switch at the retail front end. Interesting – huh? We have a cheat code for that, by the way.

Let me tell you another part of this, which you do not want to hear. If they sell to you at their exact same premium when times are normal, you and I would literally clean them out in a day. And then they have to wait weeks or months in order to get more product from the distributors.

They HAVE to raise prices to:

- slow you down from cleaning them out

- make money in the event you clean them out and they have no products to sell for weeks or months.

See, if you took that micro economics class, the first sentence of the first day is:

“A businesses are in business to make money”.

They are NOT in the business of running a charity. And, it is NOT their duty to give you a price that makes YOU happy, but one that sustains their continued operations.

The BIG problem which you are not grasping is that the underlying silver market is NOT going to move price points by you clearing out retail. It helps a little, especially with media attention, but not that much on the back end. Because the idea is that they only provide so much to retail from the mints so they cannot move the markets enough to affect underlying price.

Clearing out retail helps, in a way, but is not what drives the price of the silver market. THAT is in 1,000 oz bars. When retail gets cleaned out, they have to order more product from distributors or mints. And these can be delayed for a long time. So now their shelves are empty – what are they supposed to sell you?

Remember – at the same time those who deal with 1,000 oz bars are telling you “there’s no shortage, come here” and they have 5-16x higher premiums than normal. Anyone buying silver for 5 minutes knows that the larger the quantity, the lower the premium per ounce. But why would THEY have such high premiums?

They use the word “tightness”.

Let me translate. “At this price point, there is a lower than usual supply so I am being charged more.” This is exactly the same story the retail guys have, dude.

So as an investor, what are you to do about this?

We have had the “silver raid days”, which help clear out retail. But in advance of these, you see premiums go sky high. This is anticipating people wiping out their stocks. I can’t blame them.

If you WANT to wipe out silver supply clearing out retail isn’t exactly the most efficient way of doing it. If you want product in your hands for the “if you don’t hold it, you don’t own it” crowd, buy now. Don’t buy on a raid day unless you absolutely love the idea of paying stupid high premiums.

Let me also be clear. These retail companies have a business to run. They LOVE their product. YOU love their product. Support them. Get your shiny. But if you, the consumer, feel costs + premium are too high, then look to other avenues to buy. I think it is asinine to call out bullion dealers as bad people or crooks because YOU are about to wipe them out of inventory and THEY need to protect their business.

As DEMAND rises, PRICE must move up in order to adjust to limited supply. See above.

What are other options to drain the COMEX, so to speak?

- Buy PSLV or another ETF that you trust. PSLV is indeed draining 1,000 oz bars from the market.

- Buy OneGold – that says that it is allocated and a Sprott product. I recently used them and there was a steep $1.25 or so premium for an allocated vault product. The price was WAY higher than I had bought at previously. Supposedly, this is matched to silver in their vaults. If you want your silver, they cash you out to dollars, then you can buy at the best premiums on Apmex. You are then running into premiums twice. It is highly liquid though and you can get metal on the other end- provided Apmex is not out.

- Kinesis – I have several articles about them, but you can buy KAG and mint silver there – which has them going out and draining silver from the market and putting into their vaults. You can take delivery of 100 oz bars, minimum of 200 oz. This is the best solution if you want to put some serious money into silver, yet down the road have the optionality to take delivery of your silver if you aren’t a 6 figure investor in silver.

The latest silver reports show investment silver at 500m oz, to include ETFs, yet price hasn’t moved since the summer?

The reason I’m writing this is because there’s a lot of noobs out there that want to:

- Get metals into their possession

- Take down the sith lord empire

So, if you want shiny in your hands, go to your local coin shop. Buy some. Go to your favorite online dealer. Buy some.

If you want to take down Darth Vader, you’re going to need a bigger boat. And for that, please take a look at the three options I mention above.

The above is showing you what the deal is and why your favorite dealer may be “gouging” you. The truth is not that at all. The truth is they have a spigot providing them small amounts than cannot keep up with demand. This forces THEIR prices higher.

Edit: I’m aware 1,000 oz bars are not going through your local coin shops – I just wanted to show a point of sale before things go to the refineries to then be turned into finished products. I also didn’t mention how this supply could be going to making industrial finished silver supplies like shot, coils, or specialized parts that have nothing to do with coins.

How does this REALLY end in higher silver prices?

“Nate, I want $50 silver, but how do I do this with $41 silver Eagles”?

See below.

Ideally, what I’d like to see is this:

- Bullion dealers not charging 50% premium. This is based on demand to slow you down to keep them from going out of business. In order to lower premiums, you have to spend elsewhere to allow them to reduce buying pressures and normalize inventory and operations.

- Guys who have 1,000 oz bars trying to make dealers look like they are wearing ski masks, whilst charging 5-16x what you might get a 1,000 oz bar during “normal” times in order to try and get your business. And then trying to lecture me that there’s no shortage. There’s a LOT of money to go around. Show an investor the value they are getting by buying your product at a lower premium and how buying these bars takes them out of big banks. Stop trying to make dealers look like they are ripping people off, it then makes you look shady. You would do the exact same thing if you had 240 1,000 oz bars and 30,000 people instantly trying to buy them. Just stop already.

- The talking heads of the world stop talking like 25B oz is “available”. They are really smart people who are saying really dumb things to talk down to the uneducated and drive a dishonest media narrative. “Available supply” is not the same as “supply”. And they know it. To anyone with a business education, it makes them look disgusting as they are manipulating facts.

- Anyone with a brain realizing that FINISHED PRODUCTS for sale are not the same as RAW MATERIALS. Refining is a delay, whether it’s COVID or an oil refinery caught fire and reduces available gasoline for sale. Anyone take a look at “timber” versus “lumber”. There are no shortage at the timber level, but refining it into lumber is the bottleneck. If we see $50 silver, refineries are about to be crushed with grandma’s tea sets. Problem is, the rabid demand will outstrip available product coming in that can be sent to retail. THIS WILL MAKE RETAIL PREMIUMS JACKED. If you WANT to keep the pressure on, let the common Joe buy silver at $50 silver retail where you continue your pressure with PSLV, OneGold, Kinesis, and vaulting services buying 1,000 oz bars. You should by now already have a decent physical stash. Now time to light the fuse of the powderkeg.

So, in the next few months and years, silver price will increase. Get your metals now.

If you want $100 and $200 silver, look at the chart above. Continue to drain on the right side, and when premiums come down on the left side, get some more shiny here and there. Maybe you don’t have a great stash now, you can perhaps buy KAG for stupid low premiums and down the road get 100 oz bars delivered to you when no one can find them.

The common mistake is just trying to go after retail. Look at the drip above that is going to dealers. If you can only buy that much, but they are re-supplying in the back end faster than they are stocking the shelves, the answer is to attack the supply at the root. And that’s 1,000 oz bars.

100,000 crazy, deranged, silver apes from WallStreetSilver can really do a LOT of damage by focusing on the right hand side above. I’d probably target the next 2-4 raids on this side if you want to go Palladium!!

If you are new, buy a little on the left side when premiums drop.

Concluding thoughts…

I’m also aware as supply is unlocked, it’s possible the refineries and others are hedging what they just bought to protect from downside price moves. That hedging in itself is potentially shorting on the COMEX and creating the downward price pressure they are trying to protect against.

What 1980 and 2011 did NOT have was PSLV, Kinesis Money, and OneGold. Meaning – as retailers see a flood of interested people over $30, high retail premiums would be the norm to slow the interest in buying. But now, we can filter a lot of those people towards other instruments, bypassing the “air brakes” of the trickle of the retail front end supply. If we continue to pound PSLV and those types of instruments, we blow through $50 silver like a hot knife through butter and continued pressure may make Palladium jealous of the results that come from this.

I believe gold kicks in the door, but silver moves faster and further. The silver squeeze will then be the blueprint for the gold squeeze. Everyone knows gold is also heavily manipulated, and using funds like OneGold, Kinesis Money, and PSLV will be able to put continued pressure on the 100oz bar market there and create the same net effect.

July 19, 2021 at 1:26 am

So I read the whole article and what I made of it is that it was written by someone that deals in silver explaining why they are ripping the public off since as said there is no shortage of silver.

The silver market and the premiums are a scam and have been for years.

LikeLike

February 7, 2022 at 3:34 pm

Great article, so many short sighted folks who can’t see the forest for the trees will sit on the sidelines and whine about premiums. I think they’ll get to buy at <10% premiums once the suppressed spot prices and the actual real world market value equalize. Will they feel better when silver is at $75/oz and the premiums are back to "normal"? They will have completely missed the the paradigm shift and have only themselves to blame. To each their own. I added good amount of physical silver after the Covid outbreak and offset premiums by adding an additional 50% through OneGold. You need to study and advance your position while you are able, getting tunnel vision and staying put while whining about gouging while likely only be to your own peril.

LikeLike

April 30, 2022 at 8:20 am

Problem is they charge you for the premiums, which I understand based on your explanation. But they do not give you much of the premium when you sell it back to them. Then they just give you spot.

LikeLike